OTP Bank (Kyiv) has begun providing online acquiring services for businesses that sell online, the financial institution announced on Tuesday.

“The online acquiring service has been operational since the first days of 2026. Before the launch, the bank studied competitors’ offers and user needs, and the decision to launch was made taking into account customer requests,” said Serhiy Sereda, director of the corporate products and services department at OTP Bank.

According to the bank’s statement, the service features include connection within two days and crediting of funds from sales twice a day: at the beginning and end of the working day.

According to the bank, the service provides customers with various e-commerce tools, including accepting payments via QR codes and payment links, setting up a payment button on the website, including Apple Pay and Google Pay, as well as automated solutions for integrating payment instruments into customers’ mobile applications.

As Sereda noted, the bank is guided by market rates, and the main users of the service are currently existing customers of the bank. The rate for internet acquiring is 1.5% for Ukrainian bank cards and 2.3% for foreign bank cards. There is a possibility of applying individual rates as the volume of transactions increases.

The bank announced plans to scale up its online acquiring business in 2026 and launch merchant acquiring in the second quarter.

“The project’s benchmarks are customer satisfaction with product quality and service profitability, and the bank expects to reach profitability as soon as possible,” Sereda added.

According to the National Bank, OTP Bank ranked 10th among the country’s 60 banks in terms of total assets as of January 1, 2026, with UAH 135.99 billion. Its net profit for 2025 amounted to UAH 5.45 billion.

Supervisory Board of PJSC Vasylkivska Poultry Farm (Kyiv region) On January 26, 2026, approved amendments to the decision on private placement of shares, according to which the company plans to raise additional funds for the development of production, the company reported in the information system of the National Securities and Stock Market Commission (NSSMC).

According to the report, the company will conduct an additional issue of 5,500,000 ordinary uncertificated registered shares. The nominal value of one security is UAH 1.00, thus the total amount of the issue is UAH 5.5 million.

The placement of shares will take place in one stage and will last 16 working days: from March 9 to March 30, 2026, inclusive. A pre-determined group of persons, including businessman Serhiy Velykanov, Ledrua Consult LLC, and Pan Capital LLC, will participate in the share buyback.

The decision to increase the capital was made at an extraordinary general meeting of shareholders on November 17, 2025. On the date of this decision, the company’s authorized capital was UAH 2,700,258. After the completion of the issue and registration of amendments to the charter, it is expected to increase to UAH 8,200,258. The funds raised are planned to be used to purchase equipment, feed, and replenish working capital to expand the poultry farm’s production capacity.

The issuer also reported that it owns 100% of the capital of Vetoline LLC (Kyiv). At the time of the start of the issue procedure, the company had no repurchased own shares.

PJSC Poultry Farm Vasylkivska was founded in 2004 and is based in the Vasylkiv district of the Kyiv region. The company specializes in the industrial production of poultry products, breeding of domestic poultry, and the sale of related goods. The company’s production capacity allows it to simultaneously maintain approximately 600-700 thousand birds (laying hens). The poultry farm produces more than 150-180 million eggs annually, which it sells under its own trademark “Dobre Yajce” and the private labels of the Silpo, Fora, and ATB retail chains.

According to the OpenDataBot service, in 2025, PJSC “Vasylkivska Poultry Farm” increased its revenue by 12% to UAH 428.24 million, and its net profit grew by 52.5% to UAH 18.45 million. The company’s assets at the end of the year amounted to UAH 315.6 million, compared to UAH 294.2 million in 2024, while debt obligations decreased by 8% to UAH 142.4 million.

State-owned Ukrgasbank has signed a new guarantee agreement with the European Investment Bank (EIB) and the European Investment Fund (EIF) under the EU4Business Guarantee Facility Ukraine program, which is expected to provide more than €31 million in financing to Ukrainian businesses, the financial institution said on Thursday.

“By working with strong local partners such as Ukrgasbank, the EIB Group is helping to ensure that Ukrainian businesses have access to vital financing when they need it most,” said EIB Vice President Teresa Czerwinska.

The bank specified that the support extends not only to small and medium-sized businesses, but also to labor-intensive enterprises with up to 500 employees. Priority will be given to companies owned or managed by veterans, internally displaced persons, women, or entrepreneurs under the age of 36, as well as businesses in regions most affected by the war.

According to the announcement, the guarantee mechanism will cover 30-80% of the credit risk for individual transactions and will apply to investment loans, working capital financing, and documentary transactions, including bank guarantees and letters of credit. Financing is provided for a term of 6 to 84 months in hryvnia, euros, or US dollars, in particular with reduced collateral requirements.

The financing was made possible with the support of the European Union under the Ukraine Facility program.

As reported, in terms of the number of loans serviced as of December 1, 2025, under state guarantees on a portfolio basis, Ukrgasbank ranks third with over 1,000 loans worth UAH 10.4 billion, or 69% of the limit of such guarantees provided to the bank.

Ukrgasbank is the fifth largest bank in Ukraine in terms of assets: according to the National Bank, as of December 1, 2025, they amounted to UAH 208.24 billion.

On January 1, 2026, a number of changes came into force in Ukraine that affect companies’ expenses, tax burdens, and foreign trade operations—from new state budget parameters and individual tax innovations to updates to energy tariffs and export licensing rules, according to the Experts Club information and analytical center.

The 2026 state budget has set new social standards that directly affect the wage fund, social security contributions, and the calculation of fines and mandatory payments linked to the minimum wage and subsistence minimum.

In terms of taxation, businesses should take into account the updated indicators for the simplified system and military tax. The tax service’s explanations for 2026 separately note the amounts of payments for individual entrepreneurs in groups 1-2, as well as the introduction/application of the military levy for single tax payers (in particular, a fixed payment for groups 1-2 and a percentage of income for group 3), plus a number of related administrative changes.

A separate section is devoted to labor regulation. Starting in 2026, the requirements for employers regarding the employment of people with disabilities will be updated (a change in the approach to meeting the quota and financial responsibility for non-compliance). This affects personnel policy, budgeting, and internal HR procedures, especially in companies with a large number of employees.

In foreign trade for 2026, the government has maintained zero quotas (a ban through quotas) on exports of natural gas of Ukrainian origin and a number of other items, while canceling quotas on exports of table salt and coking coal, and maintaining the licensing regime for certain agricultural items for export to a number of EU countries.

In the energy sector, the NEURC set the tariff for Ukrenergo’s electricity transmission services for 2026: for January-March – UAH 713.68/MWh (excluding VAT) for most system users and UAH 373.93/MWh (excluding VAT) for green electrometallurgy enterprises; for April-December – UAH 742.91/MWh and UAH 378.49/MWh, respectively (excluding VAT).

Changes in excise and financial matters are also important for certain industries. In particular, the schedule for increasing excise duty on motor fuel, previously introduced by amendments to the Tax Code, continues to apply, and an increased income tax rate has been set for banks for 2026.

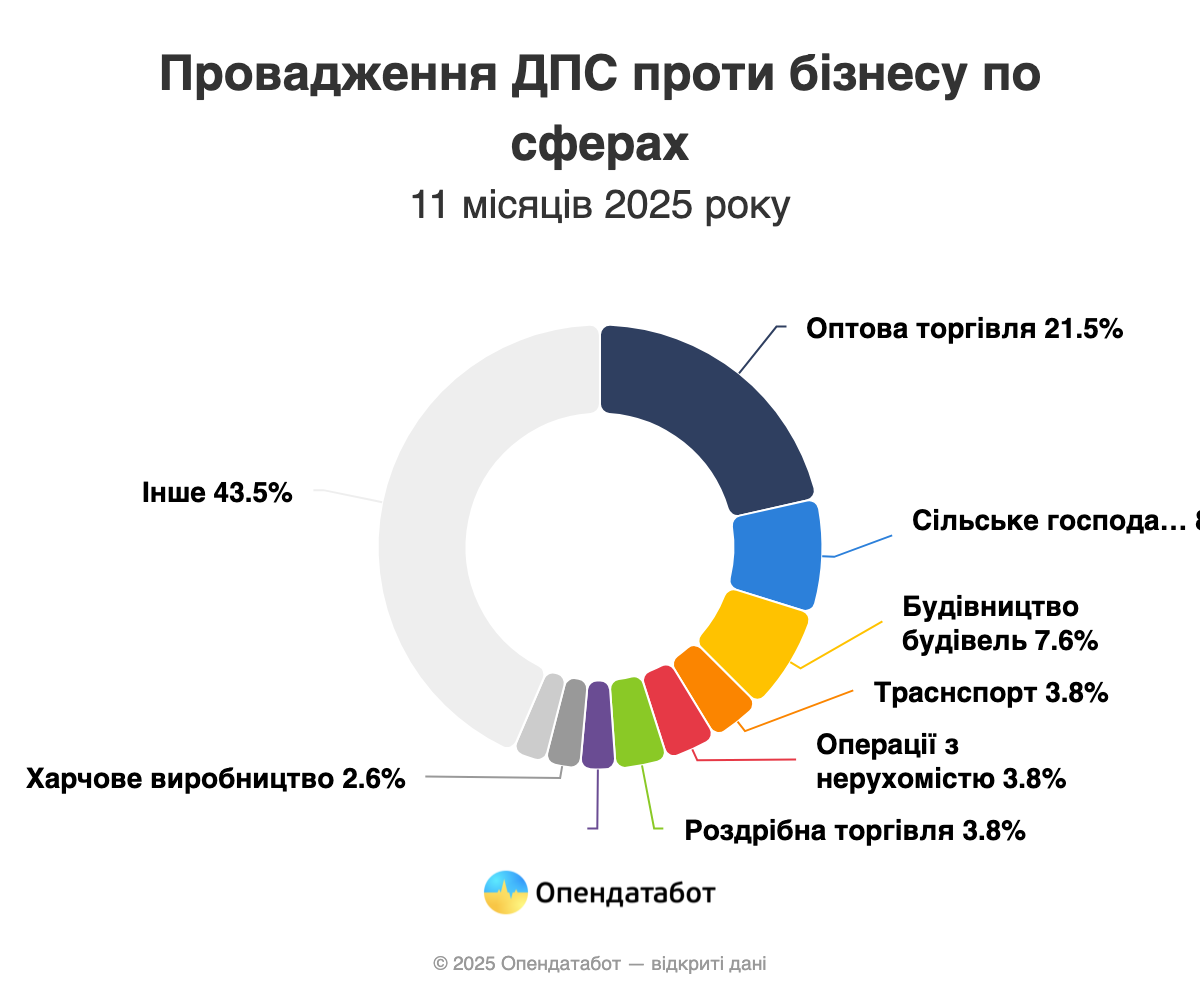

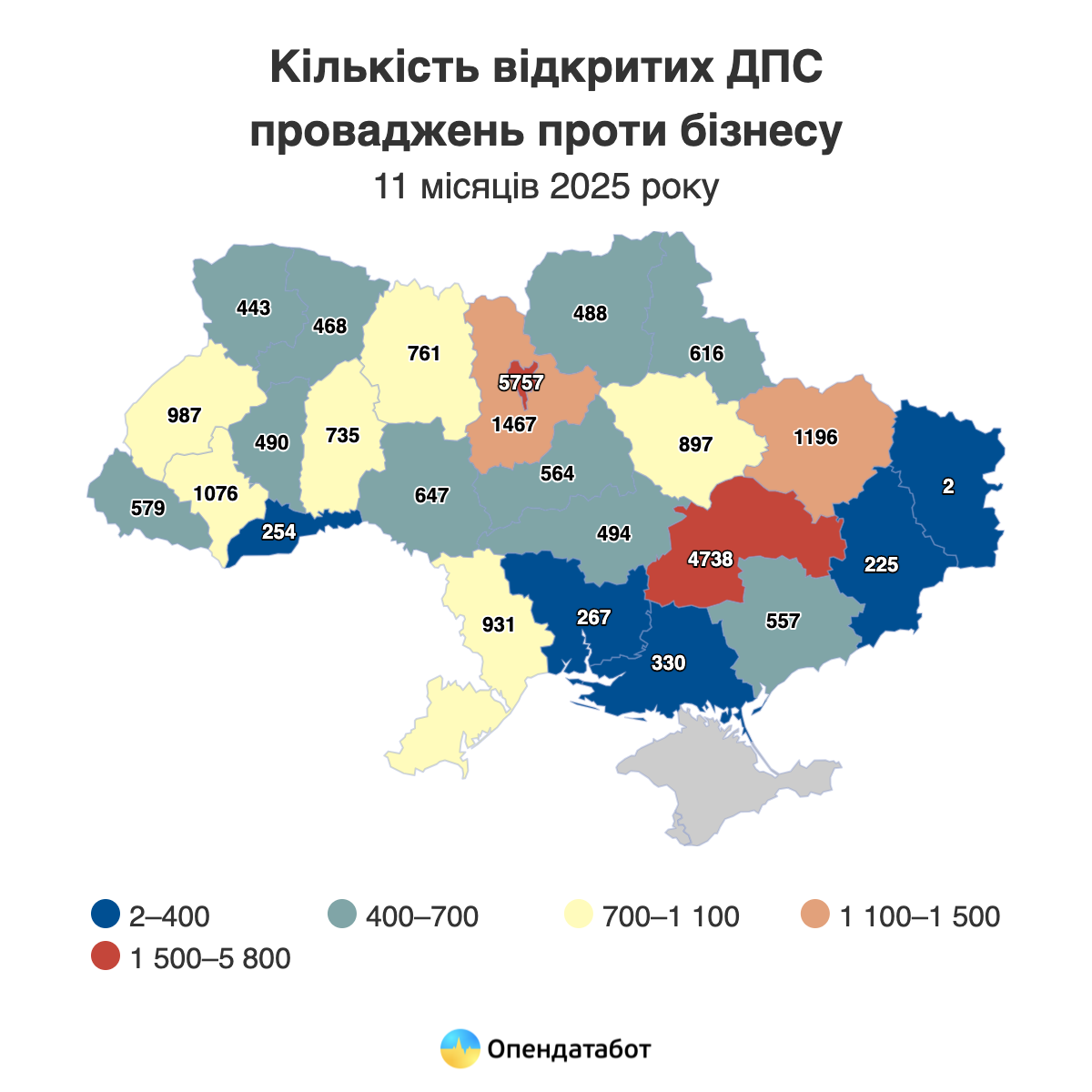

Over 25 thousand proceedings were opened by the State Tax Service against companies in 11 months of 2025. This is 35% more than before the start of the full-scale war. Most of these proceedings were opened in Kyiv, Dnipropetrovs’k and Kyiv regions. Every 5th proceeding this year was opened against businesses in the wholesale trade sector. Among the companies that have received comments from the State Tax Service are Derevtekhservice, Kravbud, the editorial office of the Kreminna city newspaper, and the Kryvbas football club. Myrhorod Bakery Plant No. 1 has accumulated the most proceedings over time.

The Tax Service opened 25,035 proceedings against companies this year. This is 1.7% less than last year, but 35% more than before the full-scale campaign. These are enforcement proceedings to collect fines, taxes and fees from businesses in favor of the State Tax Service.

One in four proceedings against businesses was opened in Kyiv this year – 5,757 cases from the Tax Service. Dnipropetrovs’k region is catching up with the capital: 4,738 proceedings. Kyiv region closes the top three with 1,467 proceedings.

The largest number of proceedings was opened by the Tax Service against businesses in the field of wholesale trade – 5,380 cases. The second place is taken by agriculture and hunting: 2,092 proceedings. The construction sector is next: 1,910 cases.

The leader among the companies against which the Tax Service has opened the most proceedings is the private enterprise Derevtechservice with 29 proceedings. It is followed by Kravbud (22), the editorial office of the city newspaper Kremin (20) and the Kryvbas football club (17).

It should be noted that not all proceedings are visible now – some have already been settled, so they have disappeared from the list. If we look at active proceedings, i.e. those that were opened a long time ago but have not yet been closed, the absolute leader here is Myrhorod Bakery No. 1 with 79 active proceedings. It is followed by Kvarsit (40) and Lers (39).

The highest number of active proceedings is currently in Kyiv (4,157), Dnipropetrovs’k region (3,931) and Kharkiv region (1,418).

The European Investment Bank (EIB) has approved a project to provide ProCredit Bank (Kyiv) with a partial portfolio guarantee of EUR7 million, which will enable the financial institution to issue up to EUR35 million in loans to micro, small, and medium-sized enterprises (MSMEs).

As stated on the EIB website, the guarantee is part of the EU4Business Guarantee Facility II program, which aims to improve lending conditions for businesses, in particular by reducing collateral requirements and lowering interest rates, thereby expanding access to finance for MSMEs in Ukraine.

As reported, EU4Business Guarantee Facility II is a program under which the EIB provides Ukrainian banks with partial portfolio guarantees to expand lending to MSMEs. Its goal is to simplify access to financing for these enterprises by improving loan conditions. The total volume of the program is estimated at EUR 300 million, of which EUR 40 million is EIB guarantees. The project was approved on May 5, 2025.

ProCredit Bank is part of the ProCredit Holding AG (Germany) banking group, which owns 100% of its shares. According to the National Bank, as of October 1 this year, it ranked 16th (UAH 44.68 billion) among 60 banks in Ukraine in terms of total assets.