In contrast to the summer months, the situation in the foreign exchange market is currently much better, as evidenced by the supply-demand ratio, deputy head of the National Bank of Ukraine Yuriy Geletiy said.

“An important indicator is the volume of interventions: $2 billion in October and $1.6 billion in November, whereas in June it was $4 billion,” he said at a briefing on Thursday.

According to him, exports are growing which together with expectation of international aid makes it possible to expect growth of currency receipts.

Geletiy reminded that international reserves of the NBU at the beginning of December exceeded the prewar level and amounted to about $28 billion, which provides 3.5 months of future import.

The Deputy Chairperson of the National Bank also said that the average daily volume of transactions between the banks had increased, but they were still “objectively small” – $65 million in November against $38 million in September.

According to him, the ability of the currency market to self-balance is one of the conditions for a return to a floating rate, but unfortunately, that’s not on the market at the moment, and the National Bank is out there with interventions.

Geletiy added that the second important precondition for returning to a floating exchange rate is the ability of inflation to be a nominal anchor, but now its level does not allow to anchor expectations, such a function is performed by a fixed hryvnia rate.

He stressed that under such conditions, the National Bank can’t name specific dates when the return to a floating exchange rate may take place.

“So now we live in this environment. Our system is working efficiently. We monitor the situation from our side, adapt our currency issues in the context of regulation and adapt to the current conditions,” he said.

In turn, Head of the National Bank Andriy Pyshnyy noted that with each successive attack Ukrainians only add to the strength of the national currency – its rate strengthens.

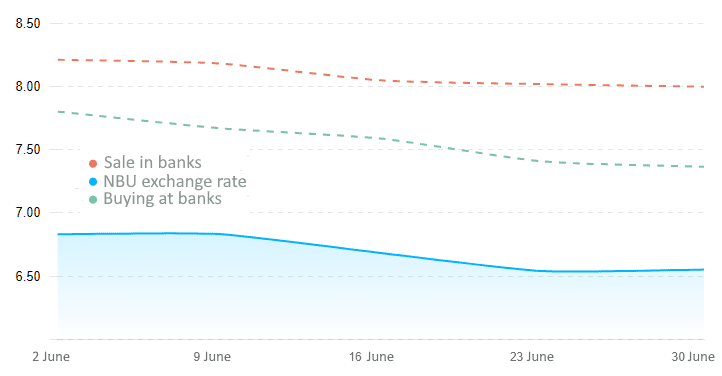

He pointed to the convergence of the official exchange rate of the hryvnya and the exchange rate in the cash market lately.

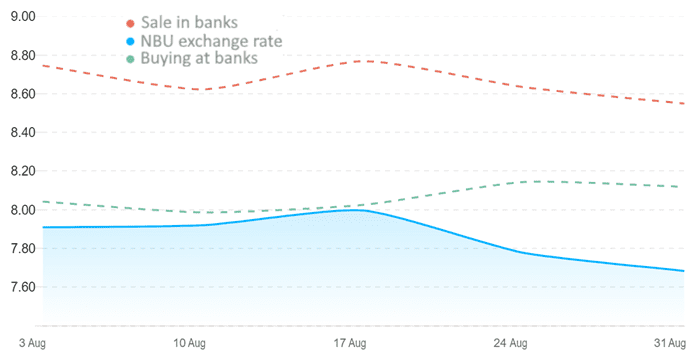

Quotes of interbank currency market of Ukraine (UAH for 1 PLN, IN 01.08.2022-31.08.2022)

graphics of the Club of Experts

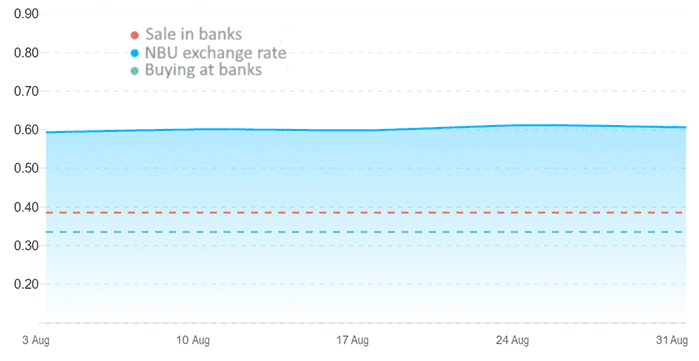

Quotes of interbank currency market of Ukraine (UAH for 1 RUB, IN 01.08.2022-31.08.2022)

graphics of the Club of Experts

Quotes of interbank currency market of Ukraine (UAH for €1, IN 01.08.2022-31.08.2022)

graphics of the Club of Experts

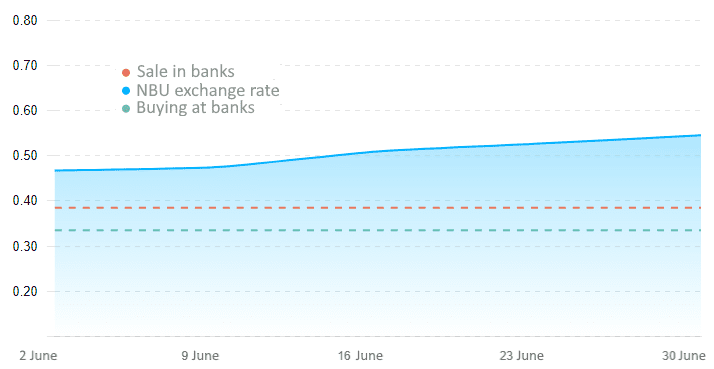

Quotes of interbank currency market of Ukraine (UAH for 1 PLN, in 01.06.2022-30.06.2022)

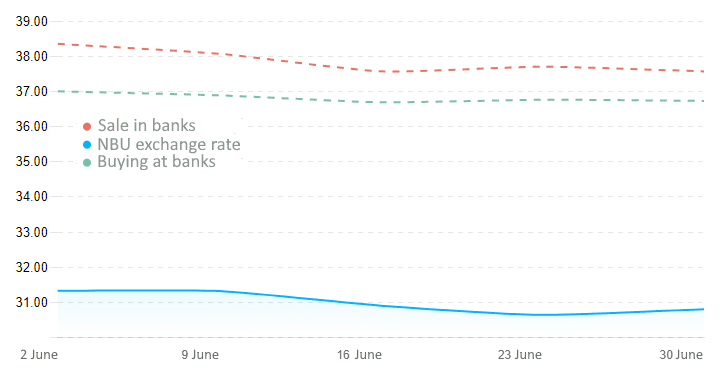

Quotes of interbank currency market of Ukraine (UAH for 1 RUB, in 01.06.2022-30.06.2022)