The Verkhovna Rada on Thursday, with 252 votes out of the required 226, adopted the law (No. 5270) “On Amendments to the Tax Code of Ukraine and Certain Other Legislative Acts of Ukraine on the Peculiarities of Taxation of Entrepreneurial Activities of Electronic Residents” (E-residency), the information says on the parliament website.

“By the second reading, we have expanded the list of professions for e-residents from IT specialists to all other service exporters,” MP Yaroslav Zheleznyak, co-author of the law, commented on the decision of the Rada.

According to him, E-residency is an opportunity for foreigners to “transport” their business to Ukraine in a couple of clicks without having to physically move. “This is a great option for specialists in countries with a difficult political and economic situation to work with developed civilized markets and protect their income,” he said.

The deputy specified that in order to become an E-resident – an electronic single tax payer in the third group of the simplified taxation system without VAT at a rate of 5% within the limit, a specialist must register with Die and pass a financial and security check. After that, he receives an electronic digital signature and opens a bank account. In this case, it is the bank that will be the tax agent for the E-resident.

All documents of the E-resident are stored in electronic form, all calculations and correspondence with the state tax service are also made online, Zheleznyak added.

According to the explanatory note, it was originally envisaged that an E-resident entrepreneur could only carry out such types of business activities: publishing computer games, publishing other software, computer programming, other activities in the field of information technology and computer systems, data processing, posting information on the web. nodes and related activities.

At the same time, citizens of the aggressor country of the Russian Federation, persons included in the “black list” of the FATF (countries that finance terrorism) and persons with any type of income in Ukraine, except passive, cannot be an E-resident.

The list of countries whose citizens are allowed to become E-residents of Ukraine is determined by the government.

The Ministry of Digital Transformation of Ukraine has received 1,300 preliminary applications for e-resident status from different countries.

“Two weeks ago, we launched a project landing to an international audience. And we have already received 1,300 preliminary applications for e-resident status from different countries,” Deputy Prime Minister for Digital Transformation Mykhailo Fedorov wrote in his telegram channel.

According to him, the first country and the most successful example of launching an e-residency was Estonia, which in six years received more than 80,000 e-residents and plus EUR 54 million to the state budget.

“Inspired by the experience of foreign partners, we are creating a new product, thanks to which Ukraine has the potential to become the largest IT hub in Eastern and Central Europe. By the end of 2022, we expect 3,000 e-residents in Ukraine,” he said.

According to Fedorov, the project will annually replenish the Ukrainian state budget by $1.5 million.

As reported, the Verkhovna Rada of Ukraine at an extraordinary meeting on Tuesday adopted at the first reading Bill No. 5270 of March 18, 2021, introducing temporary (until December 31, 2022) features and rules of taxation of business activities of electronic resident entrepreneurs (e-residency).

286 MPs voted in favor of the bill.

The bill will allow foreigners and stateless persons who have received e-resident status to register as a person-entrepreneur, conduct business activities and pay taxes in Ukraine without the need to stay in Ukraine.

A group of MPs has registered bill No. 4245 with amendments to the Budget Code on the electronic residency mechanism, which implies a preferential income tax rate of 5%, in the Verkhovna Rada.

According to the information on the parliamentary website, the bill was registered on October 21 by MPs from the Holos faction Yaroslav Zhelezniak, Volodymyr Tsabal, Kira Rudik and Halyna Vasylchenko, as well as MP from the Servant of the People Danylo Hetmantsev.

“The idea is simple. If you are an IT specialist from India, China, Pakistan, Germany, or even Belarus, then, being in your country, you can become an electronic resident, that is, an electronic taxpayer. And for this you will pay only one simple tax – 5%, which our sole proprietors pay from turnover,” Zhelezniak said.

According to him, this mechanism may be of interest, in particular, to citizens of Asian countries. On the other hand, this will allow attracting additional funds to the national budget, he said.

“This proposal may not be so interesting to the United States or the EU, but it will definitely be interesting to other countries, especially Asia, the East, which have not a better reputation and more complex tax legislation compared to the Ukrainian one,” Zhelezniak said.

The Cabinet of Ministers of Ukraine at a meeting on Thursday approved the launch of electronic residency in Ukraine.

“This is one of the unique projects of the Ministry of Digital Transformation, which can make Ukraine a powerful East European IT hub. Thanks to e-residency, in the near future, our country will become attractive for foreigners to do business, primarily IT specialists,” Deputy Prime Minister, Minister of Digital Transformation Mykhailo Fedorov said, commenting on the decision on his Facebook page.

According to him, online, without the need to visit Ukraine, foreigners will receive a Ukrainian qualified electronic signature, registration number of a tax payer’s account card, the ability to open an online account with a Ukrainian bank, and simplified access to administrative services in Ukraine.

“We see foreign IT specialists working for Ukrainian companies, as well as specialists from countries of the Asia-Pacific region and neighboring countries, for whom the status of Ukraine’s e-resident will help to effectively cooperate in the European market, as the first e-residents. Of course, all e-residents will pass a thorough check in Ukraine by law enforcement, financial authorities and the Ministry of Digital Transformation,” he said.

According to Fedorov, in the near future, the Ministry of Digital Transformation and other government agencies will develop a regulatory framework for the launch of the project. It is planned to launch an e-residency portal by the end of the year.

Citizens of Ukraine have registered the most companies in Estonia using the e-residency system – 423 companies, the head of the Tallin office of Ilyashev and Partners Vitaliy Halytskykh has said. “Ukrainians top registrations – 423 companies, while 2,131 Ukrainian citizens have received e-residency cards. Next comes Finland – 315, Germany – 311. Demand is growing,” he said in an interview to the Kyiv-based Interfax-Ukraine news agency.

Some 3,444 companies have been registered using the e-residency card, while in November 2017 the number was 3,000.

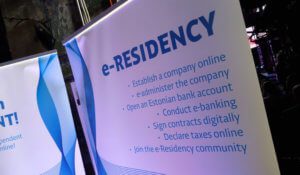

“The e-residency card does not offer tax residency or the right to visit Estonia, but allows the use of all government services, including registering companies online, online banking, signing contracts electronically, serving motions online, et cetera – about 99% of all state services can be used online, and e-Residency in Estonia makes them internationally available. This has attracted Ukrainian business,” Halytskykh said.