The European Bank for Reconstruction and Development (EBRD) will provide a EUR 10 million two-year committed local currency-denominated working capital loan to the Ukrainian electricity and gas supplier ERU Trading LLC.

As stated in a report of the bank, the decision was made by the board of directors on June 9.

“EBRD funds will be used to support growing gas trading operations of ERU Trading in order to secure low cost gas from EU during summer season and store it in Ukrainian gas storages with further sale in Ukraine,” the EBRD said.

According to EBRD, the proposed project supports a private, independent trader in competing with the dominant player, Naftogaz, in an increasingly liberalised market, and facilitates increased liquidity and competition on the private energy exchange UEEX following the MoU signed by the EBRD in July 2020.

The EBRD will become the first international financial institution in the existing loan portfolio of ERU Trading.

ERU Trading LLC, established in 2016, belongs to Yaroslav Mudry and Dale Perry. According to the information on the company’s website, gas supplies to the population are an important part of its strategy. In February of this year, the company received the license from the energy regulator.

EBRD, ELECTRICITY, GAS, LOAN

The European Bank for Reconstruction and Development (EBRD) will provide a EUR 20 million senior secured loan to Winner Imports Ukraine LLC, Ukrainian importer and retailer of several well-known international vehicle brands. The money will be invested in sustainable dealerships for Renault and Volvo.

As reported on the bank’s website on Tuesday, the loan was approved by the EBRD’s board of directors on May 18. Financing will focus on green economy transition and circular economy through investments in dealerships, expansion of client’s logistic capacities, distribution and service infrastructure for vehicles, including electric.

“All building financed by the Bank will obtain BREEAM or EDGE sustainable certification. Project contributes to the adoption of advanced green practices in a country where such standards and practices are still uncommon, for instance, according to the latest data, only 12 BREEAM certificates have been issued in Ukraine to date with only one certificate issued in the retail category,” the EBRD said.

The total cost of the project is EUR 43 million, but the sources of co-financing are not given.

Winner Imports Ukraine LLC, part of Winner Group, is the official importer of Ford, Volvo, Jaguar, Land Rover, Porsche and Bentley, SAIC Motor vehicles in Ukraine.

In addition, in 2020, the company became an official dealer of the Renault auto brand, since the spring of the same year it began to provide services for cars of this brand in its multi-brand center Winner Automotive, and has planned to open a Renault concept dealership this year.

Winner Group Ukraine has been operating in the Ukrainian market for over 28 years, during this time more than 140,000 cars have been sold and more than 50 dealer centers have been opened in Ukraine.

The Cabinet of Ministers at an extraordinary meeting on April 19 approved a project to attract a $ 100 million loan from the International Bank for Reconstruction and Development (IBRD) for export-oriented small and medium-sized enterprises (SME), the Ministry of Finance said.

“Today, on April 19, 2021, the has government adopted a resolution on some issues of the implementation of the joint investment project with the IBRD on additional financing to counter COVID-19 within the framework of access to long-term financing, the Finance Ministry’s website said.

The additional financing project provides for a loan from the IBRD in the amount of $ 100 million to provide export-oriented SMEs with access to long-term financing, the ministry explained.

The Ministry of Finance notes an increase in demand from potential financial institutions participating in the project amid the coronavirus crisis.

At the same time, the government supported the draft presidential decree on the creation of a Ukrainian delegation to participate in negotiations with the IBRD and authorized the chairman of the board of Ukreximbank to sign the guarantee agreement between Ukraine and the IBRD, the Ministry of Finance said.

Earlier this week, Ukraine repaid early a short-term loan from Deutsche Bank AG London in the amount of about $350 million, attracted at the end of last year, a source in the market has told Interfax-Ukraine.

According to the source, taking into account interest, the payment reached some $354 million.

Interfax-Ukraine could not immediately reach the Ministry of Finance for confirmation of the information.

As reported, according to government resolution No. 1291 dated December 23, 2020, this is a bridge loan taken for up to six months at a rate of up to three-month LIBOR + 5.75%, which can be repaid ahead of schedule in the event of a change in the market price of Ukraine’s eurobonds or new issue on the terms determined by the loan agreement.

Early 2021, the Ministry of Finance said that in the last days of 2020 it attracted a short-term $340.7 million loan from Deutsche Bank. According to the ministry’s statistics, in December 2020, Ukraine’s debt to this creditor increased by $372.6 million, to $1.313 billion, and by the end of February 2021 it decreased to $1.272 billion.

The Cabinet of Ministers approved raising of a $200 million loan from the International Bank for Reconstruction and Development (IBRD) to improve the higher education system in Ukraine.

“The government adopted an order of the Cabinet of Ministers of Ukraine on attracting a loan from the International Bank for Reconstruction and Development for the implementation of the project Improving Higher Education for Results in the amount of $200 million,” the press service of the Ministry of Education and Science said.

It is noted that the purpose of the investment project is to create conditions for increasing the efficiency, quality and transparency of higher education in Ukraine, and to support systemic reforms in the social sphere.

The project consists of four interconnected components, and its implementation will take place over five years.

In particular, the first component involves improving approaches to management, financing, quality and transparency in higher education, namely: creating incentives for the implementation of structural reforms, in particular, through the introduction of digital solutions.

The second component involves the formation of partner alliances of higher education institutions to improve efficiency and quality.

The third component provides for the development of ability and improvement of the educational environment. It is planned to finance the procurement of computer and multimedia equipment and software for the organization of distance learning and teaching, modern telecommunications, the development of modern digital infrastructure, the development and launch of electronic learning management systems, and the purchase of laboratory equipment for modern educational and research laboratories.

“The project also includes the implementation of certain educational policies. We are talking about the development of financial autonomy of higher educational institutions, the expansion of the implementation of the formula approach to financing, and the improvement of universities,” the ministry said.

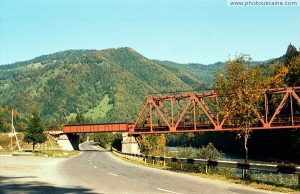

The State Agency of Automobile Roads of Ukraine (Ukravtodor) intends to implement three priority projects in Zakarpattia region under a Hungarian loan, the allocation of which was confirmed by Minister of Foreign Economy and Foreign Affairs of Hungary Peter Szijjarto during his working visit to Ukraine on Wednesday.

As the press service of Ukravtodor told Interfax-Ukraine, among these facilities, in particular, is the construction of a new 10-kilometer road of the first technical category from the Hungarian border to the M-24 highway, and then to the highway M-06 Kyiv-Chop.

“This will be a continuation of the Hungarian M3 motorway from Budapest to Vásárosnamény, which, in turn, is part of the Fifth Pan-European Transport Corridor that passes through the territory of Ukraine,” the agency said.

The expected traffic intensity on the site is 12,000 vehicles. The construction of three interchanges is envisaged. Another checkpoint on the Hungarian-Ukrainian border is envisaged as well.

According to Ukravtodor, the designed-estimated documentation for this project is being examined. The estimated cost of construction is UAH 3.8 billion.

Another priority object is the construction of a bypass road around the town of Berehove and further to the Luzhanka checkpoint on the border with Hungary. The estimated cost of construction is UAH 1.5 billion. The designed-estimated documentation is at the final stage.

In addition, the modernization of the bridge across the river Tysa at the checkpoint Tysa-Záhony is a priority.

According to Ukravtodor, the start of the implementation of these projects is scheduled for 2021.

In general, in 2020, some 282 km of roads were repaired under the Big Construction program in Zakarpattia region.

As reported, Minister of Foreign Economy and Foreign Affairs of Hungary Peter Szijjarto confirmed the allocation of EU50 million to Ukraine for the development of road infrastructure in Zakarpattia region.