The National Bank of Ukraine (NBU) has included 13 insurance companies in the list of insurers with the right to conduct transactions with non-resident reinsurers, the regulator’s website says.

According to its data, on March 6, 2023 the list included IC “TAS”, IC “Universalna”; on March 13 – IC “Unica”, IC “Arsenal Insurance”, IC “ARKS”, IC “PZU Ukraine”, IC “TAS”; on March 20 – IC “INGO”; on March 29 – IC “Insurance Guarantees of Ukraine”; on April 4 – IC “Busin”; on April 17 – IC “Guardian”, IC “Ukrainian fire insurance company”, IC “European insurance alliance”.

As reported, on February, 13, the NBU reported that it expanded the possibilities of insurance companies on payment of insurance payments under reinsurance contracts with non-resident reinsurers, and specified the requirements for such operations.

Thus, starting from February 14 insurers, insurance and reinsurance brokers could make payments under respective contracts without restrictions as to the date of conclusion of such contracts under condition of fulfillment of a number of conditions.

In order to simplify the procedure for cross-border reinsurance payments, the National Bank has created a list of insurers and established the procedure for deciding on the inclusion and exclusion of an insurer from the relevant list, as well as the grounds for leaving applications without consideration.

In order to be included to the specified list a respective application should be submitted to the NBU. Inclusion of insurers in the list takes place if the insurer complies with a number of requirements, namely, absence of enforcement actions taken against the insurer for violation of legislation requirements in the sphere of financial monitoring (except written clauses) in realization of special economic and other sanctions, compliance with transparency requirements as to ownership structure, compliance with solvency, capital adequacy and risk ratios within the year prior to application submission and within the period of being in the list of insurers.

In addition, the financial strength (stability) rating of the non-resident reinsurer, with which the reinsurance transaction is performed, should correspond to the level not lower than “A3” (Moody’s Investors Service), “A-” (Standard & Poor’s), “A-” (Fitch Ratings), “A-” (A.M. Best).

Romanian authorities are introducing new rules for housing and food subsidies for Ukrainian refugees starting from May: now the money will be received only by those who have found a job, the EFE news agency reported.

In addition, those citizens of Ukraine whose children go to school in Romania will be able to count on the subsidies.

Under the new rules, the state will no longer pay housing costs to landlords who house refugees, and tenants will receive subsidies directly. Refugee camps will receive subsidies from the state as before. Details of these rules will be made public at a later date, the agency notes.

EFE explains that Bucharest has taken such measures against the background of a significant labor shortage in Romania. More than 3.8 million Ukrainians arrived in the country since February 2022, but the vast majority went to other European countries. According to Romanian authorities, about 110,000 Ukrainian refugees currently remain in the country, but less than 10 percent of them have a work contract.

ALC Insurance Company ARX Life (ARX Life, Kyiv) has collected UAH 266.3 mln of insurance premiums in 2022, which is 17.02% less than a year earlier, according to Standard-Rating RA website updated credit rating/rating of financial stability (reliability) of the insurer at the level uaAAA on the national scale. Credit-Rating notes that decrease of gross business of the company has been caused by Russian aggression, introduction of martial law, fall of business activity level in the country and is the general tendency in the insurance market of Ukraine.

The volume of payouts and indemnities, performed by the insurer in 2022, has grown by 2,57% in comparison with 2021 – up to UAH 50,294 mln. Therefore, the level of payments of the insurer has grown by 3,61 p.p. – up to 18,89%.

Acquisition expenses of the insurer have decreased by 19,42% down to UAH 151,264 mln in 2022.

According to the results of work for the year “IC “ARKS Life” has received a net profit of UAH 21,594 mln that is by 2,24% more than in the same period of 2021.

As of January 1, 2023 assets of the company have increased by 17.61% up to UAH 232,882 mln, shareholders’ equity – by 22.01% up to UAH 119,692 mln, liabilities – by 13.30% up to UAH 113,19 mln, cash and cash equivalents – in 2.58 times, up to UAH 66,205 mln.

Thus, as of the beginning of 2023, the company had a high level of capitalization (105,74%) and high level of liabilities coverage by monetary assets and their equivalents (58,49%).

At the same time, RA notes that as of January 1, 2023, the insurer carried out financial investments in the amount of UAH 144,893 mln consisting of government bonds (96,55%) and deposits in banks (3,45%).

ARX Life, like ARX, is a part of the international insurance holding Fairfax Financial Holdings Ltd. ARX Life is among the top 10 companies in the life insurance market in Ukraine.

IC “Brokbusiness” (Kyiv) collected UAH 258.9 mln of gross premiums in 2022, which is 1.76% less than during the same period a year earlier, Expert-Rating said in its information about confirmation of insurer financial strength rating at the level uaAA+ on national scale.

According to the agency, the part of insurance premiums, which belongs to reinsurers, for the mentioned mentioned period decreased by 37,47%, and their share in the structure of gross premiums of the company decreased by 1,98 p.p. and made 3,46%.

The company carried out 63,967 mln UAH of insurance payments and indemnities in 2022, which is 29,42% less than in 2021, while the level of payments has reduced by 9,69 p.p. and has amounted to 24,71% following the results of 2022.

In 2022 the shareholders’ equity of the company has grown by 74.32% up to UAH 164,53 million, and its gross liabilities have reduced by 1,69% down to UAH 155,54 million. The Agency notes that an essential growth of the insurer’s shareholders’ equity in the analyzed period has occurred due to the increase in retained profit (by UAH 64,1 mln) in its structure, which has become possible due to the profitable activity of the company in 2022. In this regard, there was an increase in the level of shareholders’ equity coverage of the insurer’s liabilities on 46,12 p.p. – to 105,78 %. Consequently, at the beginning of 2023 shareholders’ equity exceeded the volume of the company’s liabilities by 5,78%.

The volume of cash and cash equivalents as of December, 31st, 2022 has grown in 1,55 times and has amounted to UAH 167,73 mln that has resulted in the increase of the level of liabilities coverage by cash means: by 39,33 p.p. up to – up to 107,84 %.

In the analyzed period the activity of PrJSC IC “Brokbusiness” has been characterized by a high efficiency. In particular, according to the results of 2022 the operating profit of the insurer has grown up to UAH 70,37 mln, and its net profit has increased up to UAH 66,98 mln, while following the results of 2021 the company has received net and operating losses.

IC Brokbusiness works in the Ukrainian insurance market for more than 25 years and is presented in all regions of Ukraine. The insurer has 39 licenses for voluntary and obligatory types of insurance.

TAS Insurance Group (Kyiv) paid UAH 73.95 mln in compensation under insurance contracts in November 2022, which is 31.1% less than during the same period a year earlier.

As it is stated on the web-site of the company, payments on CASCO contracts amounted to UAH 21,58 mln, which is 29,18% of total payments of the company per month, on MTPL – UAH 27,82 mln or 37,62% of total payments.

In turn, the share of “Green Card” in the payments portfolio of the company for the month was 16,24% or UAH 12,01 mln.

At the same time the indemnities of “TAS” Insurance Group based on voluntary medical insurance contracts in November amounted to UAH 9,45 mln, which is 12,78% of the total indemnities for the month.

Under other insurance contracts in the last month of autumn 2022 TAS IG has paid UAH 3,09 mln.

TAS IG was registered in 1998. It is a universal company, offering customers more than 80 types of insurance products for various types of voluntary and compulsory insurance. It has an extensive regional network: 28 regional directorates and branches and 450 sales offices throughout Ukraine.

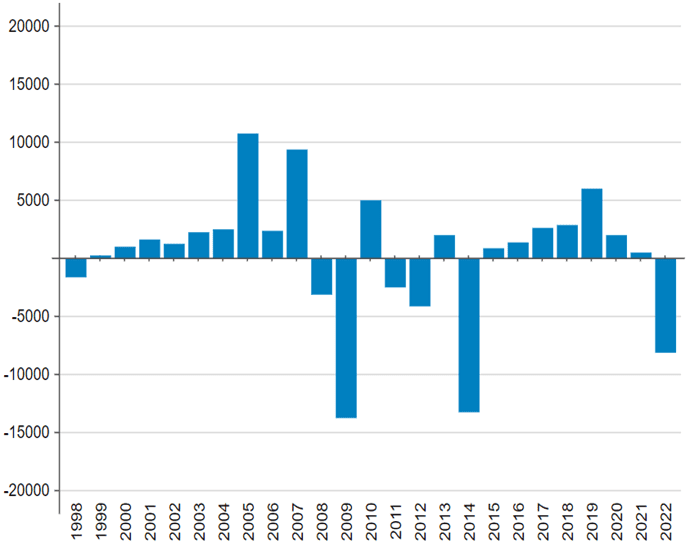

Dynamics of balance of payments of Ukraine in 1998-2022 (USD mln)

http://www.minfin.gov.ua