Zaporozhkoks, one of Ukraine’s largest coke and chemical producers, earned a net profit of UAH 399.840 million in 2023, which it retained as undistributed.

According to the minutes of the general meeting of shareholders held on April 30, a copy of which is available to Interfax-Ukraine, the meeting was attended by both shareholders – Metinvest B. V. (the Netherlands), which owns 57.2347% of the company’s shares, and Zaporizhstal, which owns 42.7653% of the shares.

The meeting approved the report of the Supervisory Board for 2023, recognizing its work as satisfactory. The shareholders also recognized the work of the company’s executive body as satisfactory, took note of the audit results and approved the results of the plant’s financial and economic activities for the past year, determined the procedure for distributing profits and gave preliminary consent to enter into significant transactions.

In addition, they amended the employment contract with the executive director.

According to the minutes of the other general meeting of shareholders of the company held on June 13 this year, a copy of which is also available to the agency, the meeting was attended by both shareholders – Metinvest B. V. (Netherlands) and “Zaporizhstal” Steel Works.

In January-March 2024, the company received a net profit of UAH 289 million 834,763 thousand, which it was decided to allocate to pay dividends for 2024. At the same time, almost UAH 2.43 of dividends are paid per ordinary share.

The Board of Directors of the company (Minutes No. 3 dated June 14, 2024) decided to establish the date of compiling the list of persons entitled to receive dividends, the procedure and term for their payment. The start date of dividend payment is July 1, 2024, and the end date of dividend payment is December 13, 2024 inclusive.

As reported, Zaporozhkoks earned a net profit of UAH 163.576 million in January-September 2023, while the same period in 2022 ended with a net loss of UAH 385.255 million. Retained earnings as of the end of September 2023 amounted to UAH 3 billion 131.849 million.

The plant ended 2022 with a net loss of UAH 249.382 million, while in 2021 it made a net profit of UAH 2 billion 997.541 million. In 2020, the plant increased its net profit by 72.2% year-on-year to UAH 166.436 million.

The company ships its products to the domestic market, Europe, Turkey, and Canada. The structure of chemical sales in 2022 was as follows: 50.4% – domestic market, 49.6% – exports.

“Zaporizhkoks has a full technological cycle of coke and chemical products processing.

Metinvest B. V. (the Netherlands) owns 57.2347% of the company’s shares, while Zaporizhstal owns 42.7653%.

The company’s authorized capital is UAH 1.193 million, with a share price of UAH 0.01.

“Metinvest is a vertically integrated mining group of companies. Its major shareholders are SCM Group (71.24%) and Smart Holding (23.76%), which jointly manage the company.

Metinvest Holding LLC is the management company of Metinvest Group.

In the first quarter of 2024, KSG Agro agricultural holding reduced its net profit by 37% to $0.96 million, while revenue decreased by 2% to $5.02 million, according to the company’s report on the Warsaw Stock Exchange.

“As in the previous year, the Group used more of its own grain for feed production rather than purchasing it (to reduce dependence on external suppliers of feed components in wartime). In 2024, the Group continues to export grain,” the document says.

According to it, due to a 10-fold increase in the benefits of biological transformation this year (up to $1.06 million), gross profit increased by 10% to $2.26 million, operating profit by 5% to $1.61 million, while EBITDA decreased by 2% to $1.83 million.

It is specified that the higher profit last year was due to the sale of a subsidiary for $0.76 million.

According to the report, KSG Agro managed to slightly reduce its net debt in the first quarter of this year to $15.06 million from $15.63 million due to a reduction in bank loans to $15.17 million from $15.84 million. The agricultural holding’s free cash flows at the end of March amounted to $0.11 million compared to $0.21 million at the beginning of the year.

During January-March 2024, the key operating subsidiary KSG Dnipro issued $5 million of C and D series bonds with a coupon rate of 7% per annum and maturity in August and October 2025, respectively, of which it placed $1.35 million of C series bonds.

As noted, the sowing campaign is proceeding according to plan, without significant interruptions due to military operations. As of the date of the report, the group sowed sunflower on an area of 7.7 thousand hectares, wheat on 2.2 thousand hectares and rapeseed on 1.43 thousand hectares.

According to the report, KSG Agro, a vertically integrated holding company, is one of the top 5 pork producers in Ukraine. It is also engaged in the production, storage, processing, and sale of grains and oilseeds. Its land bank is about 21 thousand hectares in the Dnipro and Kherson regions.

In 2023, KSG Agro reduced its net loss by 30.9% to $1.16 million, while revenue increased by 13.8% to $18.79 million.

In January-March 2024, lifecell mobile operator’s revenue increased by 16.1% compared to the same period in 2023, to UAH 3.12 billion.

According to the report of the parent company Turkcell, lifecell’s net profit for the first quarter increased by 13% to UAH 582.7 million.

Lifecell’s EBITDA for the period increased by 5.7% to UAH 1.69 billion. At the same time, the EBITDA margin decreased by 5.3 percentage points to 54.4%.

The company’s capital investments in the first quarter increased by 58% to UAH 1.008 billion.

“Three years ago, we developed our medium-term strategy. The name of the strategy was 20-24! It meant 20% market share in 2024! The great lifecell team has done it! The best team in history has increased our market share by 5 percentage points in terms of revenue; from 15.5% to 20.2% for a long time!” Ismet Yazici, CEO of lifecell, commented on the results on Facebook.

He reminded that the company had to work with the challenges of the COVID pandemic, a full-scale war in Ukraine, and unfair regulatory conditions.

Yazidi said that in the first quarter of 2024, lifecell’s subscriber base grew by 12.8%, without specifying the absolute figure.

Turkcell’s report says that the Ukrainian assets of Lifecell LLC, Global Bilgi LLC and Ukrtower LLC, which the Turkish company has owned since July 10, 2015, have been allocated to the disposal group in connection with the agreement to transfer all shares, as well as all rights and debts of these companies to French NJJ. The agreement with the company of French billionaire Xavier Niel was signed on December 29, 2023.

Turkcell CEO Ali Taha Koç, answering investors’ questions at a conference on the first quarter results, said that the deal to sell Ukrainian assets to DVL Telecom, a member of French billionaire Xavier Niel’s NJJ group, would be closed by the end of 2024. According to him, after the Ukrainian court lifted the seizure of some of the assets, the company is awaiting approval from the Antimonopoly Committee, which is the last step to close the deal.

The net profit of OTP Bank (Kyiv) in January-March this year amounted to UAH 1.56 billion, which is 7.8% better than the result for the same period in 2023, according to the quarterly consolidated financial statements of the financial institution.

According to them, the bank’s net interest income decreased slightly by 0.6% to UAH 2.14 billion, while net commission income decreased by 23.2% to UAH 247.3 million.

Since the end of 2023, OTP Bank’s assets have increased by 2.2%, or by UAH 2.2 billion, and reached UAH 104.2 billion as of March 31. This increase was primarily due to an increase in loans and advances to banks by 21.5% to UAH 26.1 billion and to customers by 2.7% to UAH 25.5 billion.

The portfolio of loans to legal entities and individual entrepreneurs decreased by 0.3% to UAH 26.2 billion, consumer loans to households – by 5.4% to UAH 4.76 billion, while loans under repurchase agreements increased by 69% to UAH 1.79 billion.

It is indicated that balances on accounts with the National Bank of Ukraine (NBU) decreased by 9.5% to UAH 9.05 billion, while cash on hand increased by 41.6% to UAH 1.18 billion.

According to the report, OTP reduced its investments in securities by 7.2% to UAH 40.24 billion.

Since the beginning of this year, the financial institution has managed to increase its customer accounts from UAH 81.16 billion to UAH 83.63 billion, and the bank’s total liabilities have increased from UAH 85.5 billion to UAH 86.3 billion.

It is noted that the bank’s capital increased by 9.2% to UAH 17.9 billion, including retained earnings by 19.4% to UAH 9.6 billion.

The financial report indicates that the remuneration of key management personnel for the first three months of this year included short-term payments of UAH 12.9 million, which is 40% less than in the same period last year.

Since June 1, 2006, OTP Bank has been a 100% subsidiary of the Hungarian OTP Bank Plc. According to the National Bank of Ukraine, as of April 1, 2024, OTP ranked 11th in terms of assets (UAH 112.26 billion) among 63 banks operating in the country. The financial institution’s net profit for 2023 amounted to UAH 3.71 billion.

Who are the top 10 banks by profit?

Ukrainian banks earned UAH 40.5 billion in 2024. Despite the increase in taxation, banks managed to earn 19% more than in the same period last year. Only 8 banks out of 63 suffered losses in Q1 2024.

Ukrainian banks earned UAH 40.5 billion in profit after tax in Q1 2024. Despite the fact that the tax rate increased from 18% to 25%, banks managed to earn 19% more than in the same period last year.

There are currently 63 banks operating in Ukraine, including 6 state-owned, 14 with foreign capital, and 43 with private capital. Only 8 banks out of the total number suffered losses this year – UAH 111 million.

The top 10 banks in Ukraine earned UAH 34.22 billion in the first quarter. This is 84% of the total profit of all banks in the country.

During this period, Ukrainian banks paid UAH 10.34 billion in income tax, which is one and a half times more than last year. Privatbank paid almost half of this amount – UAH 4.84 billion.

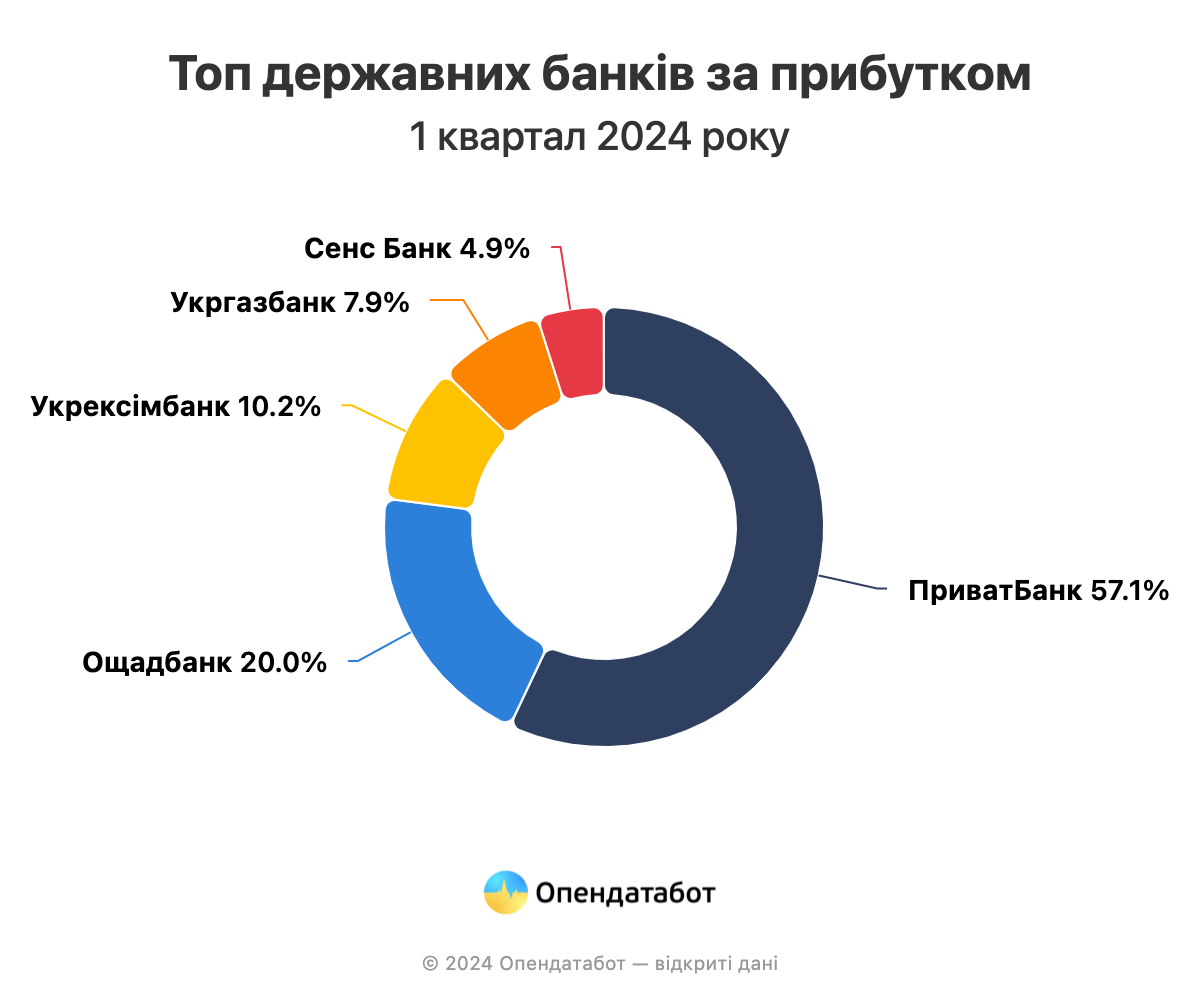

State-owned banks

Privatbank became the leader of the top, earning UAH 13.86 billion in Q1 2024. This is a third of the profit of all banks. However, this is 14% less than in the same period last year – UAH 16.04 billion.

In total, 6 state-owned banks account for 60% of the total profit of all institutions – UAH 24.28 billion. Currently, only the First Investment Bank, which has recently come under state control, suffered a loss of UAH 7.6 million in Q1.

Foreign banks

Raiffeisen Bank remains the leader among banks with foreign capital, having earned UAH 2.53 billion this year. This is 23% more than in the same period of 2023.

Another bank of this group, Credit Agricole Bank, saw its profits for this period increase 20 times compared to the same period last year. This year, the bank earned UAH 2.02 billion compared to UAH 102.9 million in Q1 of last year. This is the largest increase among all Ukrainian banks.

In total, foreign banks earned UAH 10.2 billion, which is a quarter of the total profit. Only one bank, Pravex Bank, suffered a loss of UAH 76.7 million in Q1.

Private capital

FUIB remains the leader of the group of banks with private capital: UAH 2.13 billion of profit for the quarter. This is 38% more than in the same period last year. Together with Universal Bank (Monobank), they received half of the total profit of the banks in this group.

MTB Bank showed the largest increase in profit among private banks: up to 13 times by the first quarter of 2023.

https://opendatabot.ua/analytics/banks-2024-4

In January-March 2024, FUIB (Kyiv) received UAH 2.13 billion in net profit, which is 38.1% higher than in the same period of 2023 (UAH 1.55 billion), according to the bank’s quarterly report.

According to the report, the bank’s net interest income increased significantly in the first three months of 2024: by 41% year-on-year to UAH 3.56 billion, while net fee and commission income decreased by 9.2% to UAH 0.52 billion.

Since the end of 2023, the bank’s assets have increased by 2.5%, or by UAH 3.8 billion, and reached UAH 157.1 billion as of March 31. This increase was primarily due to an increase in investments in securities by 15%, or UAH 8.7 billion, to UAH 66.9 billion, as well as an increase in loans and advances to banks by 70% to UAH 7.1 billion and to customers by 3.4% to UAH 53.8 billion, of which UAH 43.2 billion to corporate clients (including expected credit losses), UAH 10.6 billion to individuals.

It is noted that the positive impact on the increase in FUIB’s assets is also associated with an increase in the item “other financial assets” by 39% to UAH 3.6 billion, primarily due to an increase in the purchase of foreign currency from UAH 0.06 billion to UAH 1.3 billion.

The amount of cash on hand and in transit decreased by 6% to UAH 2.7 billion, while FUIB’s funds on the current account with the National Bank increased by 23% to UAH 12.3 billion.

Between January and March, the financial institution managed to increase its customer accounts from UAH 126.5 billion to UAH 129.4 billion, while the banks’ accounts increased from UAH 2.7 billion to UAH 3.4 billion.

According to the report, at the same time, FUIB’s liabilities increased from UAH 135.9 billion to UAH 137.6 billion during this period.

It is noted that the bank’s capital increased by 12.5% in the first quarter and reached UAH 19.6 billion, including retained earnings by 27% to UAH 9.9 billion.

Remuneration to the members of the bank’s Management Board increased by 24.6% year-on-year to UAH 36.9 million in the first quarter, while remuneration to the Supervisory Board increased by 43.3% to UAH 8.1 million.

JSC First Ukrainian International Bank was founded on November 20, 1991 and started its operations in April 1992. As of March 31, 2024, the bank’s shareholders were SCM Finance (92.3%) and SCM Holdings Limited (7.7%, Cyprus). The actual control over FUIB is exercised by the citizen of Ukraine Rinat Akhmetov.

According to the National Bank of Ukraine, as of March 1, 2024, FUIB ranked 6th in terms of assets (UAH 163 billion) among 63 banks operating in the country. The financial institution’s net profit for 2023 amounted to UAH 3.95 billion.