In July-September 2022, the mobile operator Lifecell LLC (lifecell) increased its revenue by 9.8% – up to UAH 2 billion 370.9 million compared to UAH 2,159.2 million for the same period in 2021.

According to a statement on the website of its parent company Turkcell, the net profit of Lifecell LLC for the specified period amounted to UAH 381.6 million, which is 2.2 times more than in July-September 2020 (UAH 173.8 million). EBITDA increased by 15.8% to UAH 1 billion 417.6 million, the EBITDA margin was 59.8% (for the same period in 2021, this figure was 56.7%).

The active three-month subscriber base of lifecell in the third quarter decreased by 7.9% – to 8.2 million subscribers. At the same time, the total number of users grew by 2%, to 10.1 million subscribers.

The company’s active three-month ARPU in the third quarter of 2022 increased by 14.9% and amounted to UAH 95.4 compared to last year’s figure of UAH 83.

Lifecell’s capital investments in July-September 2022 decreased by 10.4% – to UAH 639.6 million compared to UAH 713.7 million for the same period in 2021.

According to the report, as of September 30, 2022, the network and other equipment of the company in the regions of Ukraine occupied by Russia due to hostilities and territories controlled by Ukraine, which has not been working for more than 92 days, is out of order. “As of September 30, 2022, the amount of impairment recognized in the condensed consolidated financial statements is TL 231,472 (UAH 458,000 – IF),” Turkcell said in a statement.

As reported, according to the results of 2021, lifecell received a net profit of UAH 610.9 million, which is 4.24 times less than in 2020, while the operator’s income in 2021 increased by 24.1% to UAH 8.483 billion . The total number of subscribers of the operator at the end of 2021 amounted to 10.1 million.

lifecell is the third largest mobile operator in Ukraine. Turkcell (Turkey) owns 100% shares of Lifecell LLC.

A large manufacturer of capping and packaging materials JSC Tekhnologiya (Sumy) in January-September received a net profit of UAH 214.18 million, which is 33.5% less than in the same period of 2021.

According to the company’s non-consolidated financial statements, published on Friday in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), its net income fell by 5% to UAH 1 billion 457 million.

At the same time, the gross profit of Technologiya JSC increased by 22.6% – up to UAH 443.4 million, and UAH 297 million of profit was received from operating activities – 41% more.

According to reports, the company’s expenses under the item “other operating expenses” increased 3.6 times – up to UAH 136.79 million.

According to the company’s statements, in the first half of this year, it reduced its net profit by 6.7 times compared to the same period in 2021, to UAH 16.68 million, while net income decreased by 12.5%, to UAH 824 million.

Thus, in the third quarter of this year, Tekhnologiya’s net profit decreased by 6.5% to UAH 197.5 million, while net income increased by 7% to UAH 632.5 million.

Founded in 1990, Tekhnologiya produces capping and packaging materials, including decorative casings and caps for champagne decoration, label products, packaging for pharmaceuticals, combined material, and polyethylene film. The export geography included more than 60 countries.

The beneficiaries of the company are Vladimir Zayets (70%) and Pole Krzysztof Gzhondzel (30%).

Technologia Group’s global offices are located in the UK (TEO UK Packaging Limited), Poland (MUZEL LTD), Italy (TEO ITALY SRL).

Dneprovagonmash JSC (DVM, Kamianske, Dnipropetrovsk region), a large railcar building company in Ukraine, controlled by the TAS financial and industrial group of businessman Serhiy Tigipko, completed January-September with a net profit of UAH 6.15 million, while in the first nine months of 2021 the loss was UAH 97.7 million.

According to the interim reporting of the company (non-consolidated), published on Friday in the information disclosure system of the National Commission for Securities and Stock Market (NCSMFR), its net income increased by 2.2 times – up to UAH 849.86 million.

The plant received UAH 81.6 million in gross profit (against a loss of UAH 28 million a year earlier), and operating profit amounted to UAH 11.75 million (a loss of UAH 101.4 million).

As reported, DVM in the first half of this year increased its net income by 2.3 times compared to the same period last year – up to UAH 493 million, and reduced the loss by 67%, to UAH 25 million.

Thus, in the third quarter of 2022, it more than doubled its net income to UAH 357 million and received UAH 31.14 million of net profit against a loss of UAH 22 million in July-September 2021.

The report says that in the first nine months of this year, DVM produced 468 railcars, mainly gondola railcars and flatcars for large-tonnage containers.

“Dneprovagonmash” is one of the leading Ukrainian enterprises in the design and manufacture of freight cars.

As reported, in January-September 2021, against the backdrop of a crisis situation in the railcar building of Ukraine, the plant received a net loss of UAH 97.7 million, with a decrease in net income by 38.7% to UAH 384.4 million.

In total, last year DVM reduced the production of freight cars by 39.2% – to 477 units, sales – by 44% to 461 units. In total, 1.9 thousand wagons were produced in Ukraine.

PJSC Interpipe Novomoskovsky Pipe Plant (Interpipe NMTZ, Dnipropetrovsk region) increased its net profit by 2.2 times in 2021 compared to the previous year, to UAH 175.722 million.

According to the company’s annual report published on Monday, Interpipe NMPP increased its net income by 43.6% in 2021, to UAH 3 billion 871.695 million.

Retained earnings at the end of 2021 amounted to UAH 514.575 million.

As reported, Interpipe NMPP increased its net income by 25.1% in 2020 to UAH 3 billion 63.202 million, received a consolidated net profit of UAH 80.919 million, while it ended 2019 with a net loss of UAH 43.743 million.

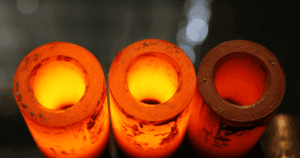

Interpipe is a Ukrainian industrial company, a manufacturer of seamless pipes and railway wheels. The company’s products are supplied to more than 80 countries through a network of sales offices located in the key markets of the CIS, the Middle East, North America and Europe.

The structure of the company includes five industrial assets: Interpipe Nizhnedneprovsk Pipe Rolling Plant (NTZ), Interpipe Novomoskovsky Pipe Plant (NMTZ), Interpipe Niko-Tube, Dnepropetrovsk Vtormet and the Dneprostal electric steel-smelting complex under the Interpipe Steel brand .

The ultimate owner of Interpipe Limited is Ukrainian businessman Viktor Pinchuk and members of his family.

“Interpipe NMTZ” specializes in the production of welded pipes for the oil and gas industry, mechanical engineering, construction and other industries.

According to NDU data for the second quarter of 2021, Interpipe Limited (Cyprus) owns 89.8681% of the shares of the plant, while Lindsell Enterprises Limited (Cyprus) owns 6.2918%.

The authorized capital of PJSC Interpipe NMPP is UAH 50 million, the par value of a share is UAH 0.25.

The international vertically integrated pipe and wheel company Interpipe in January-June of this year reduced its net profit by 33.8% compared to the same period last year – to $19.532 million from $29.431 million.

According to the company’s interim report on operating and financial results for the second quarter and as a whole for the first half of 2022, pretax profit in January-June decreased by 51%, to $24.899 million from $50.766 million for the same period in 2021.

At the same time, operating profit increased by 6%, to $66.567 million from $62.847 million.

Interpipe in the first half of this year received $50.429 million EBITDA, which is 54.7% lower than in the same period last year ($111.209 million). The company’s revenue for this period decreased by 9.9%, to $595.638 million from $661.055 million.

In addition, Interpipe reduced free cash from $206.008 million at the beginning of this year to $156.767 million by the middle of the year.

Interpipe is a Ukrainian industrial company, a manufacturer of seamless pipes and railway wheels. The company’s products are supplied to more than 80 countries through a network of sales offices located in the key markets of the CIS, the Middle East, North America and Europe. In 2021, Interpipe sold 602,000 tonnes of pipe products and 174,000 tonnes of railway products. Railway products are sold under the KLW brand.

The profit of Ukrainian banks in January-August 2022 amounted to UAH 8.4 billion, which is 5.4 times less than in the same period last year (UAH 45.6 billion), the press service of the National Bank of Ukraine (NBU) reported on Thursday.

According to the report, the profit of Ukrainian banks in August amounted to UAH 5.05 billion, which is 37% less than the profit in July (UAH 8.05 billion).

The regulator noted that the income of banks in August increased by 20.3%, and expenses by 17.9%.

According to the regulator, the income of banks for 8 months of this year increased by 32% against the figure for the same period last year – up to UAH 227.5 billion. Including commission income increased by 2.25 times – up to UAH 130.846 billion.

At the same time, the result from the revaluation and from purchase and sale transactions was positive and amounted to UAH 39.617 billion, while for the same period last year it was negative and amounted to UAH 1 billion.

At the same time, the expenses of the banking system in January-August 2022 increased by 72% compared to this indicator in 2021, to UAH 219 billion, including contributions to reserves, by 12.4 times, to UAH 89.4 billion. At the same time, fee and commission expenses increased by 0.8% to UAH 21.93 billion,

As reported, Ukrainian banks doubled their net profit in 2021 to UAH 77.5 billion compared to UAH 41.3 billion in 2020.