PJSC Interpipe Novomoskovsky Pipe Plant (Interpipe NMTZ, Dnipropetrovsk region) increased its net profit by 2.2 times in 2021 compared to the previous year, to UAH 175.722 million.

According to the company’s annual report published on Monday, Interpipe NMPP increased its net income by 43.6% in 2021, to UAH 3 billion 871.695 million.

Retained earnings at the end of 2021 amounted to UAH 514.575 million.

As reported, Interpipe NMPP increased its net income by 25.1% in 2020 to UAH 3 billion 63.202 million, received a consolidated net profit of UAH 80.919 million, while it ended 2019 with a net loss of UAH 43.743 million.

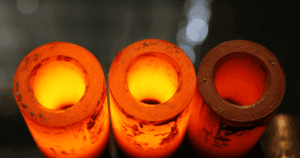

Interpipe is a Ukrainian industrial company, a manufacturer of seamless pipes and railway wheels. The company’s products are supplied to more than 80 countries through a network of sales offices located in the key markets of the CIS, the Middle East, North America and Europe.

The structure of the company includes five industrial assets: Interpipe Nizhnedneprovsk Pipe Rolling Plant (NTZ), Interpipe Novomoskovsky Pipe Plant (NMTZ), Interpipe Niko-Tube, Dnepropetrovsk Vtormet and the Dneprostal electric steel-smelting complex under the Interpipe Steel brand .

The ultimate owner of Interpipe Limited is Ukrainian businessman Viktor Pinchuk and members of his family.

“Interpipe NMTZ” specializes in the production of welded pipes for the oil and gas industry, mechanical engineering, construction and other industries.

According to NDU data for the second quarter of 2021, Interpipe Limited (Cyprus) owns 89.8681% of the shares of the plant, while Lindsell Enterprises Limited (Cyprus) owns 6.2918%.

The authorized capital of PJSC Interpipe NMPP is UAH 50 million, the par value of a share is UAH 0.25.

The international vertically integrated pipe and wheel company Interpipe in January-June of this year reduced its net profit by 33.8% compared to the same period last year – to $19.532 million from $29.431 million.

According to the company’s interim report on operating and financial results for the second quarter and as a whole for the first half of 2022, pretax profit in January-June decreased by 51%, to $24.899 million from $50.766 million for the same period in 2021.

At the same time, operating profit increased by 6%, to $66.567 million from $62.847 million.

Interpipe in the first half of this year received $50.429 million EBITDA, which is 54.7% lower than in the same period last year ($111.209 million). The company’s revenue for this period decreased by 9.9%, to $595.638 million from $661.055 million.

In addition, Interpipe reduced free cash from $206.008 million at the beginning of this year to $156.767 million by the middle of the year.

Interpipe is a Ukrainian industrial company, a manufacturer of seamless pipes and railway wheels. The company’s products are supplied to more than 80 countries through a network of sales offices located in the key markets of the CIS, the Middle East, North America and Europe. In 2021, Interpipe sold 602,000 tonnes of pipe products and 174,000 tonnes of railway products. Railway products are sold under the KLW brand.

The profit of Ukrainian banks in January-August 2022 amounted to UAH 8.4 billion, which is 5.4 times less than in the same period last year (UAH 45.6 billion), the press service of the National Bank of Ukraine (NBU) reported on Thursday.

According to the report, the profit of Ukrainian banks in August amounted to UAH 5.05 billion, which is 37% less than the profit in July (UAH 8.05 billion).

The regulator noted that the income of banks in August increased by 20.3%, and expenses by 17.9%.

According to the regulator, the income of banks for 8 months of this year increased by 32% against the figure for the same period last year – up to UAH 227.5 billion. Including commission income increased by 2.25 times – up to UAH 130.846 billion.

At the same time, the result from the revaluation and from purchase and sale transactions was positive and amounted to UAH 39.617 billion, while for the same period last year it was negative and amounted to UAH 1 billion.

At the same time, the expenses of the banking system in January-August 2022 increased by 72% compared to this indicator in 2021, to UAH 219 billion, including contributions to reserves, by 12.4 times, to UAH 89.4 billion. At the same time, fee and commission expenses increased by 0.8% to UAH 21.93 billion,

As reported, Ukrainian banks doubled their net profit in 2021 to UAH 77.5 billion compared to UAH 41.3 billion in 2020.

Alfa-Bank’s (Ukraine) Supervisory Board offers Alfa-Bank (Ukraine) shareholders to direct 90% of net profit for 2021, or UAH 2 billion 987.21 million, to cover losses of previous years.

According to the agenda of the annual meeting of shareholders, which is scheduled to be held remotely on September 30, it is planned to send the remaining 10% of net profit or UAH 331.91 million to the reserve fund, and not pay dividends.

In addition, the meeting plans to approve the supervisory board of Alfa-Bank, consisting of six people, while before the war, at an extraordinary meeting in January this year, the supervisory board was expanded from 10 to 12 people.

At present, out of the 12 members elected by the then meeting in the Supervisory Board, according to information on the website, exactly half remained, of which three independent directors are Yevhen Davidovich, Volodymyr Zhmak and Viktor Lysenko and three representatives of ABH Ukraine are Roman Shpek (Head of the Supervisory Board), Andrew Baxter and David Mark Brown.

Since January, for various reasons, the Supervisory Board has left the representative of ABH Ukraine Petr Aven, Ilyadr Karimov, Vladimir Voeikov and independent directors Ernest Galiev, Adnan Anachali and Elena Volskaya.

According to the bank, its largest shareholders at the moment indirectly are Andrey Kosogov (40.9614%, after the war he received packages of German Khan and Alexei Kuzmichev, who fell under the sanctions in the amount of 20.9659% and 16.3239%, respectively), Mikhail Fridman (32.8632%), Petr Aven (12.4018%), UniCredit S.p.A. (Italy, 9.9%), Mark Foundation for Cancer Research (3.8736%). Ex-Finance Minister of Bulgaria Simeon Dyankov, who in mid-April, in agreement with the National Bank, was given the right to vote on the majority stake in Alfa-Bank, is a trustee of the NBU on the stakes of Kosogov and those sanctioned by Fridman and Aven.

Alfa-Bank (Ukraine), according to the NBU, as of July 1, 2022, ranked 7th (UAH 104.03 billion) in terms of total assets among 68 banks operating in the country. The bank’s net loss, according to the National Bank, for January-June this year amounted to UAH 2 billion 348.5 million.

Last year, Alfa-Bank (Ukraine) increased its net profit to UAH 3 billion 319.12 million from UAH 1 billion 154.79 million a year earlier.

Agro-industrial holding Astarta, the largest sugar producer in Ukraine, received EUR 27.7 million in net profit in January-June 2022, which is 3.2 times less compared to the same period last year, according to the company’s report on the Warsaw Stock Exchange on Tuesday .

According to it, the company’s EBITDA decreased by 1.8 times – to EUR68.14 million, while revenue increased by 44%, to EUR218.3 million. The agricultural holding’s gross profit for this period decreased by 37.4% and amounted to EUR77.46 million , the gross margin and return on sales (EBITDA margin) fell 2.3 times – to 35% from 82%.

According to the report, as of June 30, 2022, the total assets of the agricultural holding increased by 21.4% compared to the data as of December 31, 2021 – up to EUR787.2 million, current liabilities – by 37.8% – up to EUR136.7 million, long-term liabilities – by 17.6%, up to EUR125.3 million.

“As of the end of the first half of 2022, net debt increased by 8% year-on-year to EUR193 million driven by an increase in working capital, while net financial debt decreased by 30% year-on-year to EUR53 million with higher balances cash at the end of the first half of 2022,” the agro-industrial holding said in a statement.

According to Astarta, 28% of the total revenue was generated by the sugar production segment, 35% by growing crops, 24% by the production of soybean meal and soybean oil, and 10% by dairy cattle breeding.

The sugar segment of the group in January-June 2022 showed an increase in revenue by 5% – up to EUR61.85 million due to an increase in prices for it by 23% – up to EUR613 per ton. During the reporting period, 121 thousand tons of sugar and sugar-containing products were produced, which is 6.2% less than in the first half of last year.

At the same time, the vast majority of sugar produced by Astarta (96%) was sold on the domestic market, and 4 thousand tons were exported (4%), while in the first half of last year all sugar was sold in Ukraine.

“Since Ukraine has removed export restrictions, and the EU has canceled import duties (for one year – IF-U), the total export of sugar from Ukraine reached 14 thousand tons in the first half of 2022. The share of Astarta in total sugar exports amounted to 30% The key buyers were the EU countries neighboring Ukraine and Moldova,” the manufacturer said in an exchange message.

Revenue generated by the agricultural segment of Astarta in January-June 2022 jumped 2.8 times compared to the same period in 2021, to EUR 76.9 million due to significant sales volumes and high prices for crops before the Russian military invasion of Ukraine. During this period, exports accounted for 79% of crop production segment revenue.

In January-June 2022, Agropromholding sold corn for EUR54.5 million (an increase of 2.3 times compared to the first half of 2021), wheat for EUR3.2 million (an increase of 2 times), sunflower for EUR18.1 million (an increase of 14 times) and rapeseed by EUR0.39 mln.

As of the date of this report, Astarta has completed the harvesting of winter crops; in total, 265 thousand tons of wheat and 19 thousand tons of rapeseed have been harvested. Due to less favorable weather conditions compared to the previous year, winter crop yields were lower: wheat – 4.8 tons/ha (17% less), rapeseed – 3.1 tons/ha (4% less).

The agro-industrial holding’s revenue in the soybean processing segment for the six months of this year increased by 18% to EUR52.7 million due to an increase in average prices for soybean meal to EUR480/ton (+7% compared to January-June 2021) and soybean oil to EUR1300/ ton (+38%). In total, Astarta produced 113 thousand tons of soybean meal (+18% compared to January-June 2021), 83 thousand tons of soybean meal (+17%) and 21 thousand tons of soybean oil (+17%).

The mobile operator “Vodafone Ukraine”, which is part of NEQSOL Holding (Azerbaijan), in January-June 2022 reached a revenue figure of UAH 9.916 billion, which is 3% more than in the same period of 2021 (9 .64 billion UAH) .

According to the operator’s financial report, its net profit for the specified period amounted to UAH 663 million (UAH 2.1 billion for the same period last year).

OIBDA exceeded UAH 5.76 billion. OIBDA margin increased by 2.1 p.p. up to 58.1%.

As emphasized in the message of the operator, emergency work on the network and its restoration, assistance to the country and customers, and mass migration of customers abroad have significantly affected the dynamics of key financial indicators.

The growth of part of the financial indicators in the first half of 2022 was achieved due to the successful results of the first two months of the year.

The operator’s capital investments in the first half of the year amounted to UAH 1.276 billion, which is 14% less compared to the same period last year.

“As of today, all elements of the core network are operating normally, Vodafone Ukraine has taken all the necessary steps to quickly switch to a backup scenario. The Vodafone Ukraine team is actively working to restore damage: about 87% of the network is working and this figure is growing “All critical elements of the technical and IT infrastructure have already been diversified. The approximate amount of asset losses is about UAH 806 million,” the company stressed.

Mass migration due to the war also significantly affected the size of the subscriber base – as of the end of July, the operator’s subscriber base amounted to 16.6 million customers, of which 1.76 million were forced to stay outside the country.

In addition, as of the end of July 2022, the company connected free services in the amount of UAH 270 million for 13 million customers in Ukraine. And abroad – in the amount of UAH 596 million for 1.5 million subscribers in 32 countries.

The operator also purchased 10 ambulances for the amount of UAH 23 million.

The volume of humanitarian and direct financial assistance of the company to the country is currently estimated at UAH 250 million.

In 2019, NEQSOL Holding, through Telco Solutions and Investments LLC, controlled by Bakcell, signed an agreement with MTS PJSC on the purchase of its telecommunications business in Ukraine. The deal for the purchase of Vodafone Ukraine was closed at the end of December 2019 with funding from J.P. Morgan and RBI, the price was $734 million, including a deferred payment of about $84 million.

The NEQSOL Holding group of companies, according to the release, has more than 25 years of experience in various industries and countries. Its activities cover oil and gas, telecommunications, construction and other high-tech industries in the UK, USA, Turkey, Azerbaijan, Kazakhstan, UAE, Bangladesh. The group entered the telecommunications industry in the early 2000s. The companies included in it provide mobile communication services, international transit and wholesale Internet sales, leased line services, data center services, etc.

Businessman Nasib Hasanov is the official founder and 100% owner of the NEQSOL Holding group, including Nobel Oil Services (UK) Limited, Nobel Oil E&P (UK) Limited (trade name Nobel Upstream), Bakcell LLC and Norm OJSC.