The number of cars subject to luxury tax decreased threefold over the year

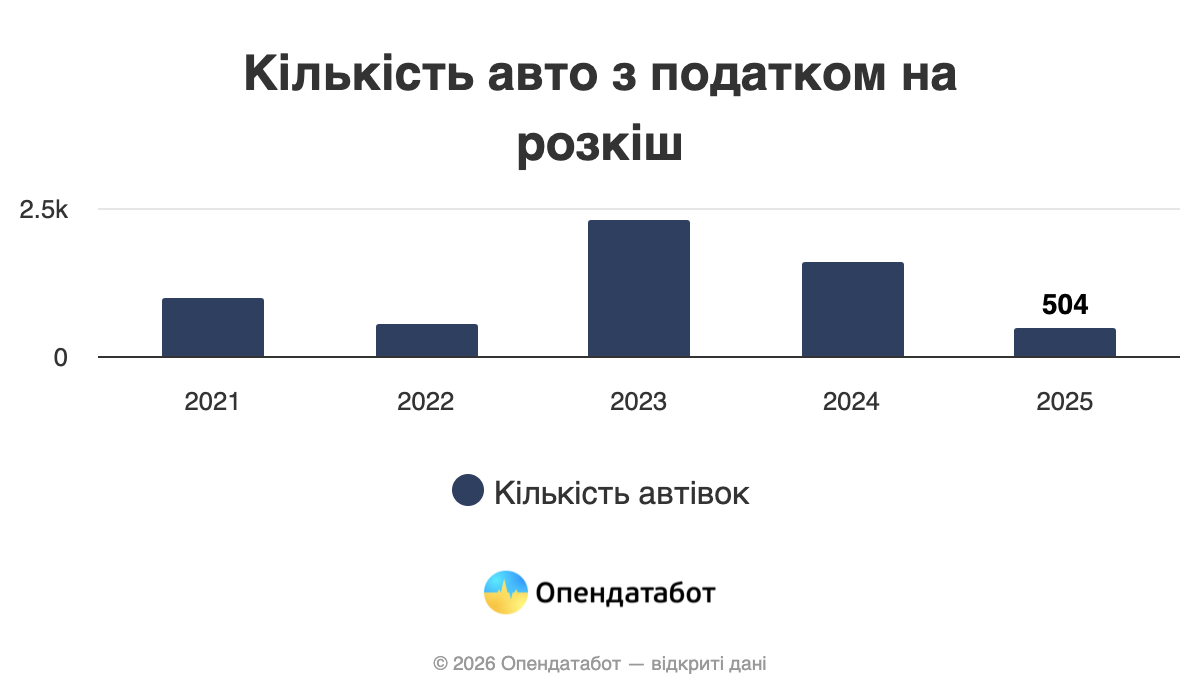

According to the Ministry of Internal Affairs, 504 vehicles subject to luxury tax were imported into the country last year.

This is the lowest figure in the last five years. Porsche and Mercedes-Benz account for 89% of luxury vehicles, and every second such car is a Porsche Taycan. In total, electric cars account for 65% of all cars subject to luxury tax.

504 cars subject to the “luxury tax” were imported into Ukraine in 2025. This is 3.2 times less than in 2024. Overall, this is the lowest figure in the last five years.

Every second car on the “luxury” list is a Porsche Taycan: 232 cars. Overall, Porsche became the leader in the luxury segment with additional taxation: cars of this brand account for 64% of the total volume. Mercedes-Benz took another quarter of the market with 126 cars. The rest of the premium brands together account for 11% of the market: Audi, Rolls-Royce, Aston Martin, Lamborghini, Maserati, etc.

It is worth noting that, in contrast to overall imports, electric cars dominate the premium segment: 65% of imported luxury cars. Another 18% are hybrids that can run on electricity as well as gasoline or diesel. Pure gasoline cars, the leaders in overall imports, are at the bottom of the list with 17%. Diesel accounts for a symbolic 0.4%.

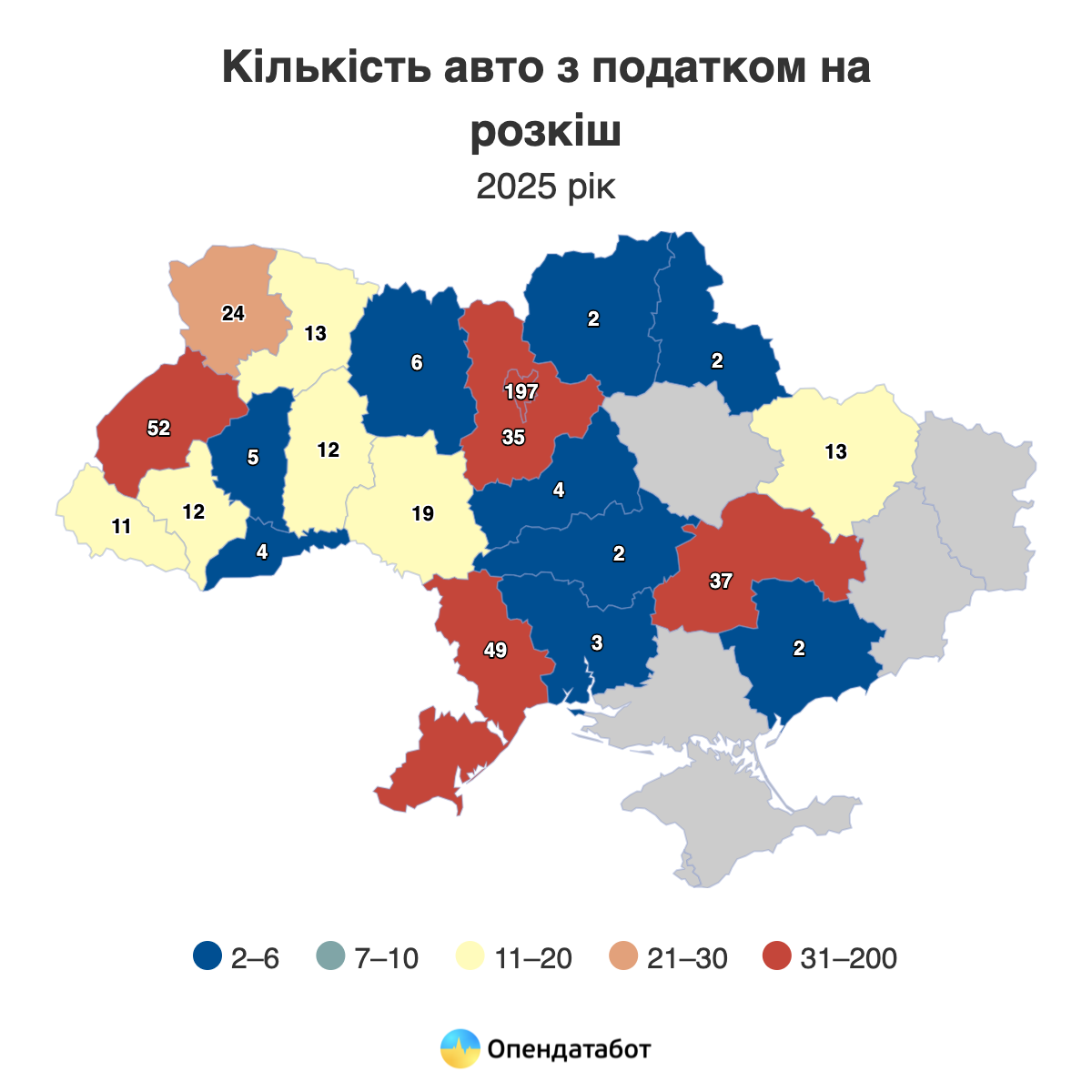

Almost half of all luxury cars are registered in Kyiv and the surrounding region: 236 cars. Another 52 cars are in Lviv region, 49 in Odesa region, and 37 in Dnipropetrovsk region.

Most of the cars in the luxury segment are registered to individuals — 82% or 413 cars. Only 18% of such cars are registered to businesses.

The ultra-premium segment deserves special attention. Last year, 21 Rolls-Royces were imported into Ukraine. Fifteen of them are the electric Spectre model, which costs about $600,000. The registry also includes seven Aston Martins and two Lamborghinis.

It should be noted that the “luxury tax” applies to cars costing more than UAH 3.2 million and less than 5 years old. The tax amount for one such car is UAH 25,000 per year.

https://opendatabot.ua/analytics/luxury-car-fee-2025

CAR, IMPORT, luxury, Porsche Taycan, TAX

The amount of value-added tax (VAT) declared by non-residents who provide electronic services to individuals in the customs territory of Ukraine and are registered as VAT payers reached 14.4 billion hryvnia in 2025, while in 2024, the budget received 29% less – 11.2 billion hryvnia.

The “Google tax” brought over 14.4 billion hryvnia to the budget in 2025. These are funds paid by non-residents who provide electronic services to individuals in the customs territory of Ukraine and are registered as VAT payers,” wrote Lesya Karnaukh, acting head of the State Tax Service of Ukraine (STS), on her Facebook page.

According to her, 150 non-residents already pay this tax: in 2025, 12 new non-residents registered as VAT payers, and at the beginning of 2026, another five companies did so.

The leaders in paying the “Google tax” remain the world’s leading digital companies: Apple, Google, Valve, Meta, Sony, Etsy, and Netflix.

“All the electronic services we use every day contribute to the state budget. These are funds for the protection of the country, social programs, and restoration,” Karnaukh noted.

Revenues to local budgets from transport tax payments amounted to UAH 249.8 million in 2025, which is 13.7% more than in 2024, according to data on the website of the State Tax Service of Ukraine (STS).

In regional terms, the largest amounts were paid in Kyiv (UAH 74.1 million), Dnipropetrovsk (UAH 24.9 million), Odesa (UAH 20.9 million), and Kyiv (UAH 18.5 million) regions.

The STS reminded that transport tax payers are individuals and legal entities, including non-residents, who own passenger cars registered in Ukraine that meet several criteria: no more than five years have passed since their year of manufacture (inclusive), and the average market value of the car is more than 375 times the minimum wage (MW) established as of January 1 of the tax (reporting) year.

In addition, in 2025, revenues to the state budget from the environmental tax increased—35,600 taxpayers paid UAH 5.6 billion, which is UAH 219 million more than the revenues from it in 2024.

Among the regions, the largest amounts were paid in the Dnipropetrovsk region (UAH 1.1 billion) and Kyiv (UAH 1 billion). Significant revenues were also recorded in the Ivano-Frankivsk (UAH 640 million) and Zaporizhzhia (UAH 392 million) regions.

Actual revenues to the general fund of the state budget from taxes and fees controlled by the State Tax Service of Ukraine (STS) amounted to UAH 1 trillion 246 billion in January-December 2025, which is 20.2% or UAH 209.3 billion more than last year, according to a publication on the institution’s website.

According to the STS, despite an increase in planned indicators during the year by more than UAH 100 billion, the annual revenue plan was fulfilled by 97.4%.

According to the acting head of the State Tax Service, Lesya Karnaukh, quoted in the report, the stable over-fulfillment of targets during the first half of the year created the necessary financial reserve, which made it possible to avoid significant shortfalls at the end of the year.

It is noted that in the structure of the main sources of budget revenues for the 12 months of 2025, the largest share was provided by personal income tax and fees, which amounted to UAH 362.9 billion. Value added tax (including budget refunds) brought UAH 306.5 billion to the budget, and corporate income tax brought UAH 284.7 billion. In addition, excise tax revenues amounted to UAH 163.9 billion, while rent payments provided UAH 48.4 billion.

Karnaukh separately highlighted the dynamics of VAT budget refunds, which totaled UAH 179.6 billion for the year. At the same time, the monthly refund rate during the year was not less than UAH 13 billion.

“Today, businesses have to reorient significant financial resources and invest in recovery and relocation. I am grateful to everyone who does not give up,” said the acting head of the State Tax Service.

She also added that the achievement of these indicators in the context of war, shelling, and energy challenges is the result of the responsibility of each taxpayer.

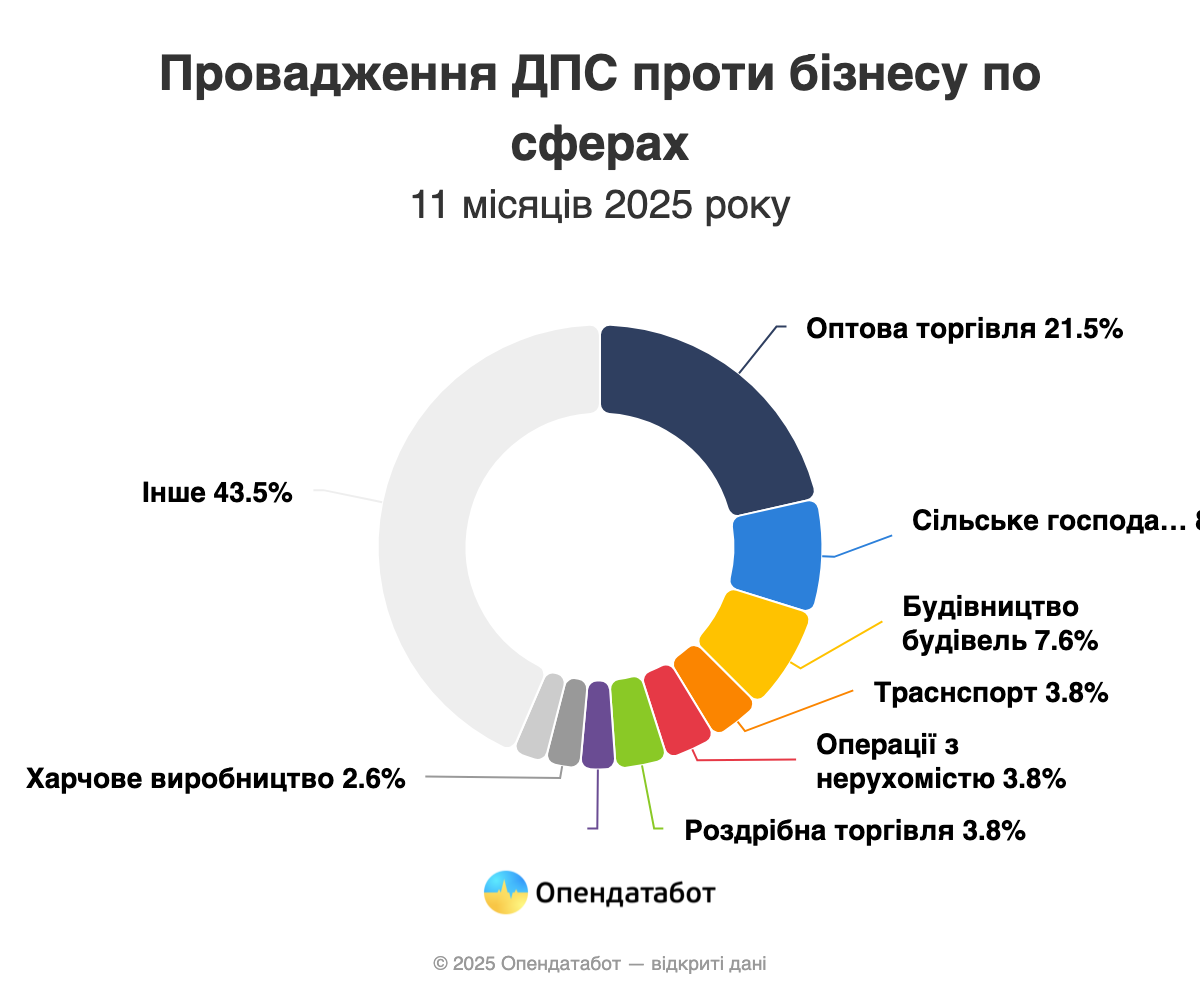

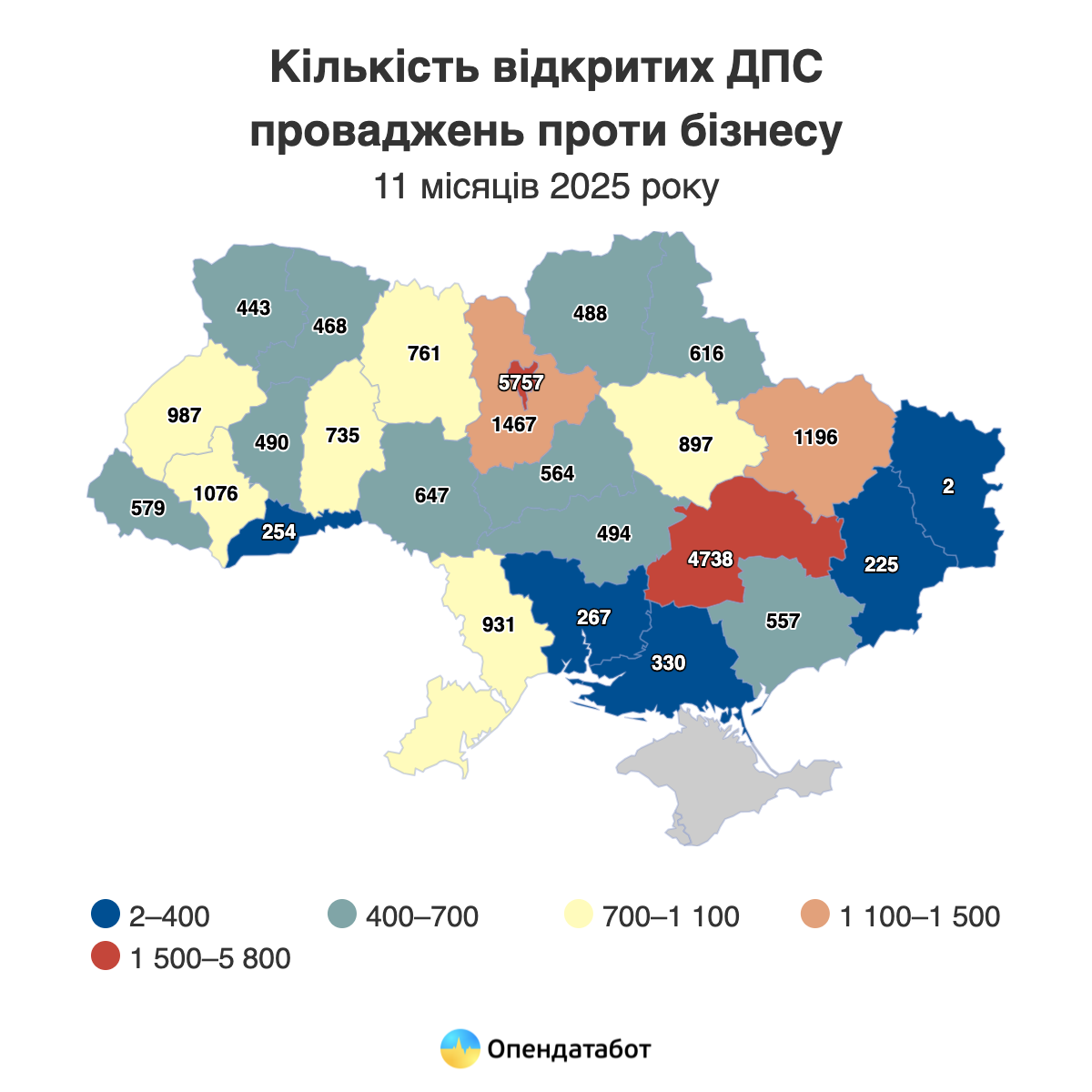

Over 25 thousand proceedings were opened by the State Tax Service against companies in 11 months of 2025. This is 35% more than before the start of the full-scale war. Most of these proceedings were opened in Kyiv, Dnipropetrovs’k and Kyiv regions. Every 5th proceeding this year was opened against businesses in the wholesale trade sector. Among the companies that have received comments from the State Tax Service are Derevtekhservice, Kravbud, the editorial office of the Kreminna city newspaper, and the Kryvbas football club. Myrhorod Bakery Plant No. 1 has accumulated the most proceedings over time.

The Tax Service opened 25,035 proceedings against companies this year. This is 1.7% less than last year, but 35% more than before the full-scale campaign. These are enforcement proceedings to collect fines, taxes and fees from businesses in favor of the State Tax Service.

One in four proceedings against businesses was opened in Kyiv this year – 5,757 cases from the Tax Service. Dnipropetrovs’k region is catching up with the capital: 4,738 proceedings. Kyiv region closes the top three with 1,467 proceedings.

The largest number of proceedings was opened by the Tax Service against businesses in the field of wholesale trade – 5,380 cases. The second place is taken by agriculture and hunting: 2,092 proceedings. The construction sector is next: 1,910 cases.

The leader among the companies against which the Tax Service has opened the most proceedings is the private enterprise Derevtechservice with 29 proceedings. It is followed by Kravbud (22), the editorial office of the city newspaper Kremin (20) and the Kryvbas football club (17).

It should be noted that not all proceedings are visible now – some have already been settled, so they have disappeared from the list. If we look at active proceedings, i.e. those that were opened a long time ago but have not yet been closed, the absolute leader here is Myrhorod Bakery No. 1 with 79 active proceedings. It is followed by Kvarsit (40) and Lers (39).

The highest number of active proceedings is currently in Kyiv (4,157), Dnipropetrovs’k region (3,931) and Kharkiv region (1,418).

Ukrainian banks will pay income tax at a doubled rate of 50% in 2026.

The corresponding law (No. 14097) on amendments to the Tax Code of Ukraine regarding the specifics of income tax for banks in 2026 was adopted by the Verkhovna Rada on Wednesday with 272 votes in favor, with a minimum of 226 votes required, according to a correspondent from the Interfax-Ukraine news agency.

According to Yaroslav Zheleznyak, first deputy chairman of the relevant parliamentary finance committee, banks will pay tax at this rate on a quarterly basis next year and in the first quarter of 2027, which should bring an additional UAH 15-23 billion to the budget in 2026 and about UAH 5 billion in 2027.

This is the third tax increase for banks to 50% since the start of Russia’s full-scale invasion, but the first two times — in 2023 and 2024 — the Rada made this decision retroactively in the fall.

At its meeting on October 30, the Financial Stability Council (FSC) noted the systemic risks that could be created by the introduction of a 50% tax rate on bank profits from 2026.

“Raising the tax rate for banks to 50% creates risks of limiting lending to the economy and weakening financial stability in wartime,” the FSC emphasized.

Council members also noted that the expected fiscal effect of raising the rate to 50% may turn out to be significantly lower than publicly communicated estimates.

Among other risks, the FRS cited possible complications in the privatization of banks with state ownership, failure by some institutions to implement capitalization programs within the specified time frame, difficulties in timely compliance with capital adequacy requirements in accordance with EU standards, the risk of violating the obligations under the Memorandum with the IMF, as well as a reduction in incentives to de-shadow the economy.

The National Bank also noted that banks and financial companies already have a higher level of income taxation compared to other sectors of the economy – 25% versus 18%.

According to the NBU, Ukrainian banks earned UAH 131.7 billion in net profit in the first 10 months of 2025, which is 4.9% more than in the same period of 2024, and paid 2.1% more income tax – UAH 34.7 billion.