The State Tax Service of Ukraine (STS) warns of probable restrictions in work from December 31, 2025 to January 2, 2026 due to routine and technical works. According to information in its Telegram channel, the works are related to the end of the budget year 2025 and the beginning of the budget year 2026.

“During this period there may be restrictions in the work of electronic services of the State Tax Service. December 31, 2025 – the last operational day of 2025 for the reception and processing of tax invoices and calculations of the adjustment to tax invoices to the Unified register of tax invoices, which will continue until 3 pm,” – explained STS.

At the same time, January 2, 2026 is defined as the first operational day of 2026 to accept for processing of tax invoices and adjustment calculations, information and communication systems of STS will work in normal mode.

The results of processing electronic documents, except for tax invoices and adjustment calculations, which will be received from 15:00 on December 31, 2025 to 15:00 on January 2, 2026, will be sent after the completion of routine and technical work.

Also in the STS emphasized that the fiscal server of the supervisory authority works in normal mode with possible restrictions at night.

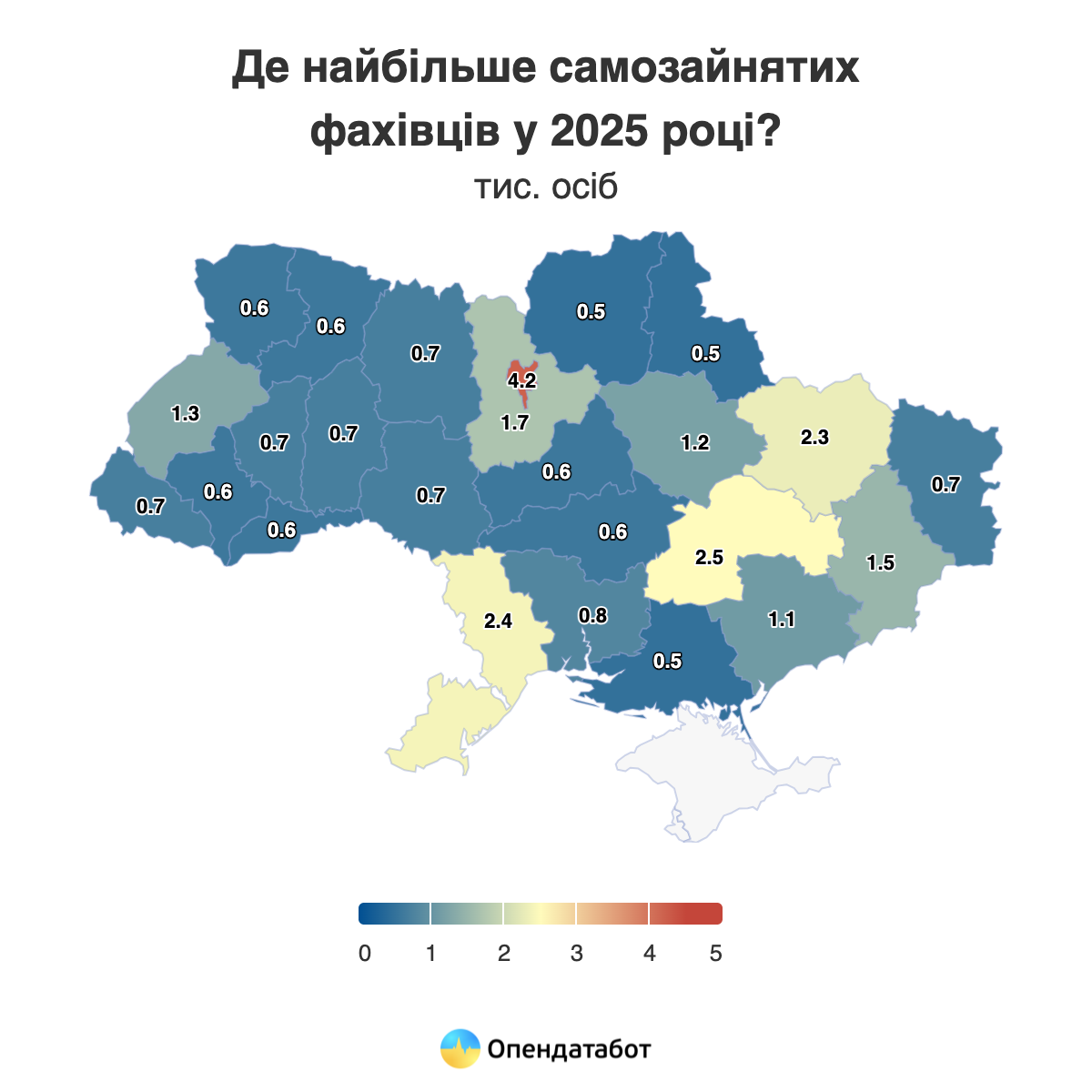

More than 28 thousand self-employed people are currently registered in Ukraine, according to the State Tax Service. This is a record figure for the last 5 years. The number of self-employed has increased by 1.1 thousand since the beginning of the full-scale reform. Over UAH 292 million of tax has already been paid by professionals engaged in independent professional activities in the first five months of 2025. The largest number of such professionals is in Kyiv, Dnipro and Odesa regions.

As of the beginning of June 2025, 28.3 thousand professionals engaged in independent professional activities – i.e. self-employed – were registered in Ukraine. These are lawyers, private teachers, translators, architects, notaries, psychologists, artists, scientists, doctors, and other professionals who do not have the status of a sole proprietor but work independently.

This is a record figure for the last five years. The peak number of such specialists was previously recorded in November 2021 – 27.9 thousand. However, in December, their number decreased by 700 people, after which the figure began to grow again, albeit with a pause in the first months of the full-scale invasion. Since the beginning of the full-scale invasion, the number of self-employed professionals has increased by 1,100, or about 4%.

It is worth noting that the Unified Register of Lawyers alone currently contains more than 71 thousand professionals. However, not all of them are registered as self-employed, but, for example, they can work in law firms or associations, or work as private individuals.

The largest number of such specialists works in Kyiv – 4.2 thousand people. This is followed by Dnipropetrovs’k region – 2.5 thousand and Odesa region – 2.4 thousand.

The self-employed paid UAH 292.29 million in taxes to the budget in the first five months of 2025. This is 33% more than in the same period last year. It is worth noting that the amount of taxes paid in Kherson, Volyn, and Kyiv regions almost doubled. In total, such specialists paid UAH 603.16 million in taxes in 2024. This is 1.6 times more than in 2023 and 1.2 times more than before the full-scale campaign.

The leaders in terms of taxes paid are Kyiv – UAH 140.5 million (23% of the total amount), Lviv region – UAH 49.8 million (8%), and Dnipropetrovs’k region – UAH 49.6 million (8%). However, while in Lviv region this amount was paid by 1.3 thousand people, in Dnipropetrovs’k region 2.5 thousand self-employed people paid almost the same amount.

On average, one self-employed person in Lviv region paid UAH 38 thousand in taxes in 2024. In Kyiv – UAH 33 thousand, in Vinnytsia region – UAH 31 thousand. The lowest average amounts were in Luhansk, Donetsk, and Kherson regions.

However, these calculations are conditional – it is impossible to give an accurate estimate, because it is not known how many of the people who are certified as self-employed actually work and earn income.

It is worth noting that independent professionals account for only 1.4% of all self-employed persons in Ukraine (together with sole proprietors). Their share of tax revenues is only 0.6% of the total amount paid by the self-employed.

Banks regularly check the self-employment status of their clients, which is important for assessing their financial profile, taxation, and regulatory compliance.

Opendatabot offers a service that allows you to check whether a person is an entrepreneur or self-employed, as well as to receive a corresponding statement.

Context

In April, the Cabinet of Ministers approved a draft law on the introduction of an international automatic exchange of information on income received through digital platforms. It provides for the taxation of self-employed people’s income received from activities on digital platforms such as Uklon, Bolt, OLX, Prom, Rozetka, etc.

https://opendatabot.ua/analytics/self-employed

Who is under the attention of the Tax Service?

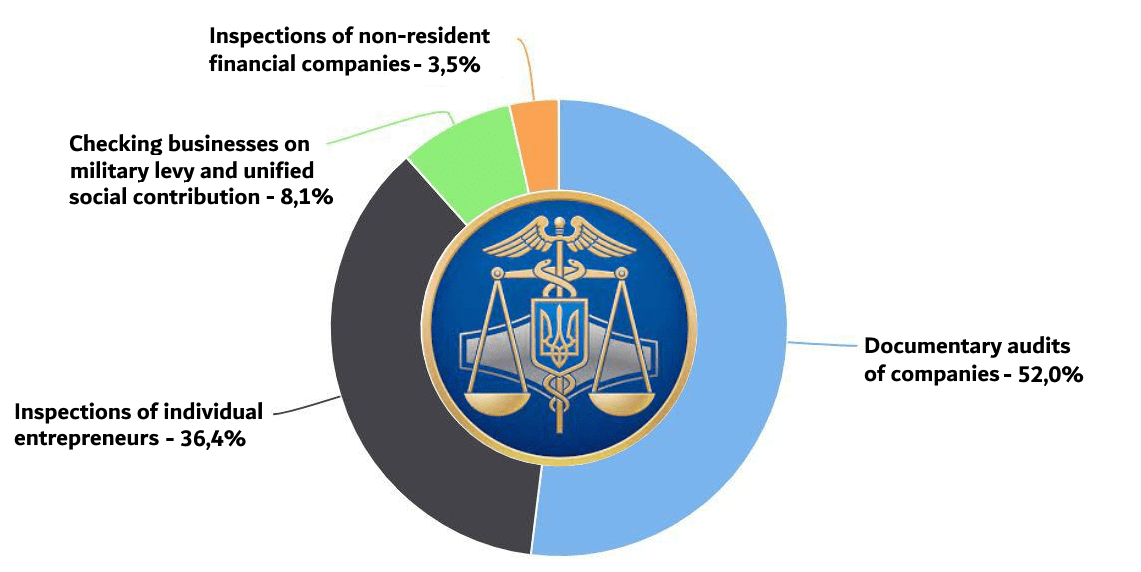

The State Tax Service has planned 4.7 thousand business inspections for 2025. The State Tax Service will pay most attention to companies from Kyiv, Odesa and Dnipro regions. About 400 businesses will be inspected every month, with the most visits scheduled for October.

Of the 4.7 thousand inspections, about 3.7 thousand are for companies, and the rest are for individual entrepreneurs. Financial institutions and non-residents will also be inspected. The State Tax Service will also visit 266 businesses that have questions about personal income tax, military duty, and unified social tax.

The State Tax Service will pay most attention to companies from Kyiv – 18% of the total number of inspections. Odesa region will be in second place, and Dnipropetrovs’k region will be in third place: 12% and 10% respectively.

Wholesale companies will face the most inspections – 20.7%. Agriculture and hunting will account for another 15% of inspections. Food production rounds out the top three with 6.2%.

In January, 287 companies will be inspected, and in February another 371. In total, the State Tax Service will visit about 400 businesses every month, with 423 companies being inspected in October.

20 companies from the list were included in the Opendatabot 2024 index:

– D. Trading – UAH 165.6 billion in revenue;

– Okko Express – UAH 61.8 billion;

– Vinnytsia Poultry Farm – UAH 39.2 billion;

– Nova Poshta – UAH 36.4 billion;

– Ukrainian armored vehicles – UAH 32.4 billion;

– SpaceX – UAH 27.9 billion.

– Myronivska Poultry Farm – UAH 21.4 billion;

– Pumb – UAH 16 billion;

– Ukrsibbank – UAH 15.4 billion;

– Poltava Mining and Processing Plant – UAH 15 billion;

– Concorde Consulting – UAH 8.5 billion;

– Enselco Agro – UAH 7.2 billion;

– Institute of Information Technologies Intelias – UAH 4.3 billion;

– Berehove Grain Receiving Enterprise – UAH 4.3 billion;

– ONUR CONSTRUCTION INTERNATIONAL – UAH 2.9 billion;

– Testi Food – UAH 1 billion;

– Three O – UAH 906 million;

– Triumph Media Group – UAH 562 million;

– SC Dnipro-1 – UAH 437 million;

– Star Bukovel – UAH 421 million.

You can find out whether your business or partners are scheduled for inspections for free in the Opportunity Bot. To do this, send the bot the company code. If the business is on the tax plan, the relevant information will appear in the company card.

Instructions.

How to find out if the Tax Service is planning to inspect your business?

https://opendatabot.ua/analytics/dps-audits-2025

According to the State Tax Service, more than 3.3 thousand inspections of companies and individual entrepreneurs are planned for this year. Almost 73% of them will be for companies, and the rest will be for private entrepreneurs. In June, the number of companies “under supervision” increased by 42.

Therefore, 2,450 companies and 915 individual entrepreneurs should expect inspections this year. In June, 42 more businesses were added to the list, which will be inspected in the second half of the year.

Most inspections will be conducted in Kyiv – 26%. It will also be carried out in Dnipropetrovska and Lvivska oblasts – 8.1% and 6.9% respectively. Kherson region attracted the least interest from tax authorities – only 2 companies.

What businesses are on the updated list?

Among the new companies is SENS BANK with a revenue of UAH 12.9 billion, which took the 7th position in the Opendatabot Index among banking activities.

The tax authorities will also inspect AGROPROINVEST 08 LLC with almost UAH 2 billion and ALMA VIN LLC with UAH 1.6 billion. Instead, TRADING PRODUCT COMPANY LLC with a revenue of more than UAH 326 million closes the top ten.

Top 10 new companies to be inspected by the tax authorities

You can find out if your business or partners are scheduled for an audit for free in the Opportunity Bot. To do this, send the bot the company code. If the business is on the State Tax Service’s plan, the relevant information will appear in the company card.

https://opendatabot.ua/analytics/dps-audits-update-2024-7

The Tax Service has imposed UAH 1.65 billion in fines for violations in the use of payment transaction registers (PTRs) in the first half of 2023. This is already three times more than in all of 2021. The number of “cash registers in a smartphone” increased 4 times by 2021, while the number of traditional cash registers decreased by 5%.

The State Tax Service (STS) imposed 29,753 fines for violations in the use of PTRs totaling UAH 1.65 billion on entrepreneurs in the first half of 2023. This is already three times more than for the whole of 2021.

Entrepreneurs were fined for more than half of this amount – UAH 988.15 million – in August. It was during this month that the smallest number of inspections in 2023 was conducted – only 1640, but the largest number of fines was issued – 3336.

287.4 thousand cash registers and 554.6 thousand cash registers are in operation in Ukraine as of the beginning of December 2023. The surge in the installation of cash registers in 2023 occurred in September – +15% per month. We believe that this is due to the lifting of the moratorium on cash register checks in October, which was introduced at the beginning of the full-scale invasion.

The Ukrainian restaurant automation company Poster notes that most entrepreneurs were not ready for the return of inspections until the last minute.

“Many entrepreneurs waited until the last minute, explaining that this is not the first time the moratorium has been frozen or postponed. The demand for Poster’s PTR in chats and calls increased rapidly in the last week of September – 1.5-2 times more than usual.

Given that some entrepreneurs use physical cash registers and third-party integrations, we can assume that about a third of businesses were still not ready for the October 1 deadline,” said Rodion Yeroshek, CEO and co-owner of Poster.

Currently, the number of “cash registers in a smartphone” is almost twice as high as the number of regular ones. Compared to November 2021, the number of PTRs has increased 4 times, while the number of cash registers has decreased by 5%.

Despite this rapid growth, PTRs currently account for only 29% of the total number of checks. However, their number is increasing from year to year: for comparison, in 2021, the share of PTR checks was only 2.7%.

In total, 6.62 billion checks totaling UAH 2.3 trillion were issued in 11 months of this year. The total amount of PTR checks increased 1.5 times by 2021.

Scheduled business audits by state tax service in 2023

Source: Open4Business.com.ua and experts.news