NEQSOL Holding, the owner of Ukraine’s second largest mobile operator VF Ukraine (Vodafone Ukraine), has paid UAH 3.94 billion to the state budget of Ukraine in full for the purchase of United Mining and Chemical Company (UMCC, Kyiv) at a privatization tender.

“The winner of the auction paid in full for the state-owned stake in the country’s largest producer of titanium raw materials. The new owner has also undertaken important investment commitments: to invest at least UAH 400 million in the modernization of production, which will ensure the further development of the enterprise,” the SPF said in a statement on Monday.

For his part, NEQSOL Holding’s Regional Director Volodymyr Lavrenchuk noted that the international group of companies, which does business in 11 countries, is taking the steps required by law to complete the privatization process.

“As a strategic investor, we have already started negotiations with a number of specialized companies from the US, Australia, the UK and Canada to attract the best international experience to develop a new strategy for UMCC. This strategy provides for the fulfillment of privatization obligations, deep modernization and expansion in global markets,” he stressed.

The State Property Fund noted that the process of large-scale privatization continues, and on December 19, 2024, 100% of the state-owned share of the nationalized building materials producer Aerok LLC will be put up for sale at an online auction in the Prozorro.Sale electronic trading system with a starting price of UAH 965.3 million.

The SPF reminded that, including the sale of the Ukraina Hotel earlier this fall, the total amount of proceeds from large-scale privatization this year has already exceeded UAH 6.4 billion.

As reported, Cemin Ukraine LLC, controlled by NEQSOL Holding, was the only bidder for the purchase of the UMCC at the auction scheduled for October 9: it offered UAH 3 billion 938 million 351,581 thousand at the initial price of UAH 3 billion 899,358 million.

NEQSOL Holding is founded and owned by Azerbaijani citizen Nasib Hasanov. According to the holding’s website, in the 1990s, during the collapse of the Soviet Union, he started providing brokerage services, initially engaged in the supply of chemicals, developed business in Kazakhstan, Uzbekistan, Azerbaijan, Turkmenistan and other countries of the former USSR, and then in the supply of equipment for the oil and gas industry in the region.

After that, Hasanov used the accumulated capital to invest in the oil and gas industry of Azerbaijan, establishing his own company in this field. The holding’s enterprises in the energy sector are consolidated into two groups: Nobel Oil E&P (UK) Limited (trading name Nobel Upstream), which is engaged in exploration and production in the UK, the US and Azerbaijan, and Nobel Energy, which provides diversified integrated services to international oil and gas operators in the Caspian region and beyond.

The holding entered the telecommunications industry in 2005 by acquiring Bakcell, the first Azerbaijani telecommunications company, and in 2019 NEQSOL Holding bought Vodafone Ukraine. The holding also invests in various startups.

In the late 2000s, the group expanded its business portfolio by making a name for itself in the construction services and materials market, producing cement and related materials. Norm, founded in 2013, is the largest cement producer in the South Caucasus. Before the war, NEQSOL Holding was close to buying Ivano-Frankivskcement, Ukraine’s largest cement producer, but later abandoned the deal.

Currently, the group employs over 12,000 people in 11 countries, including the UK, USA, Turkey, Azerbaijan, Ukraine, the Netherlands, Georgia, Kazakhstan, and the UAE. The company’s headquarters are located in Amsterdam, Baku and Kyiv.

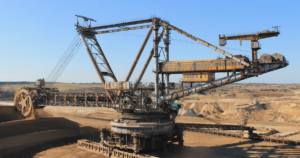

UMCC started its actual operations in August 2014, when the Ukrainian government decided to transfer the property complexes of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipropetrovska oblast) and Irshansk Mining and Processing Plant (IGOK, Zhytomyrska oblast) to its management. Previously, these plants were leased from Dmitry Firtash’s structures.

In August 2016, the government included UMCC in the list of companies to be privatized in 2017. The privatization was postponed several times, most recently due to Covid and quarantine.

Before the war, in the second half of 2021, the SPF put UMCC up for auction three times with a starting price of UAH 3.7 billion. The last auction, scheduled for December 20, did not take place as only two bids were submitted, one of which was rejected due to non-compliance with the law. At that time, one bidder was not enough for the sale. This was preceded by a statement by the privatization adviser BDO Corporate Finance that international companies were not ready to participate in the auction due to the lack of guarantees of protection of large investments by the Cabinet of Ministers. At that time, the SPF and the advisor appealed to the government to provide such guarantees, but to no avail.

In 2023, UMCC’s revenue decreased by 15.4% to UAH 1 billion 946.68 million, and its net loss amounted to UAH 481.35 million against a net profit of UAH 13.37 million a year earlier. According to YouControl, in January-September this year, the company increased its revenue by 88.8% to UAH 2 billion 295.5 million, receiving UAH 89.1 million in net profit against UAH 274.2 million in net loss for the same period last year.

The state-owned stake of 100% of the authorized capital of United Mining and Chemical Company JSC was offered to be paid UAH 39 million more than the starting price of the privatization auction of the State Property Fund of Ukraine.

NADRA.INFO reports with reference to the data of the UBIZ.ua platform, accredited by Prozorro.Sale JSC.

The price offer of UAH 3,938,351,581 was received from Cemin Ukraine LLC, a member of the NEQSOL Holding group of Nasib Hasanov (Azerbaijan) (YouControl).

NEQSOL Holding in Ukraine is headed by Volodymyr Lavrenchuk. The group is a member of the EBA Subsoil Committee.

Cemin Ukraine was the only bidder to buy UMCC (Minutes).

“NEQSOL Holding has taken this step as a potential strategic investor, which, if recognized as the winner, plans to implement plans for modernization, development of new products using deep processing of raw materials and expansion in global markets along with fulfilling all privatization obligations covering social, environmental and technical aspects. Currently, NEQSOL Holding is waiting for the privatization process to be completed and its official results to be announced in accordance with the applicable procedures,” Volodymyr Lavrenchuk, Regional Director of NEQSOL Holding in Ukraine, told NADRA.INFO.

THE NEWS HAS BEEN UPDATED:

At 22:41 on Tuesday, 08.10.2024, the State Property Fund of Ukraine published an announcement on the redemption of UMCC shares on its Facebook page:

“The team of the State Property Fund of Ukraine held an online privatization auction for the sale of a state-owned stake of 100% of the authorized capital of United Mining and Chemical Company JSC. The purchase took place in the electronic system Prozorro.Sale.

…

the buyer is obliged to maintain the main activities of the enterprise, invest at least UAH 400 million in technical re-equipment and modernization. It is also obliged to pay off wage and budget arrears and repay overdue accounts payable.

The privatization of this enterprise opens up new opportunities for the development of Ukraine’s titanium industry. Attracting private capital will help improve the technological level of production, expand export opportunities and create new jobs. This will be an important step towards increasing the competitiveness of the Ukrainian industry on the global stage.

We have witnessed an important event for the economic development of the country, as all proceeds from the sale will go to the state budget of Ukraine, thereby strengthening our defense capabilities in the fight against the aggressor,” the SPFU said in a statement.

If a decision is made to privatize the facility through a buyout, VAT will be charged on the price offered by the bidder (sale price) in accordance with the Tax Code of Ukraine.

As a reminder, the Government has approved the starting price of the company at UAH 3.9 billion with the buyer’s investment obligations of at least UAH 0.4 billion.

PrJSC United Mining and Chemical Company (UMCC), which has taken over management of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipro region) and Irshansk Mining and Processing Plant (IGOK, Zhytomyr region), is expected to increase its sales by 68% year-on-year to 221,847 thousand tons in January-September this year.

In particular, sales of ilmenite by IGOK in the first nine months of 2014 will amount to 60.961 thousand tons (a twofold increase), by VMMC – 51.755 thousand tons (a 1.66-fold increase), rutile – 6.767 thousand tons (minus 19%), and zircon – 7.436 thousand tons (a twofold increase).

As UMCC’s acting CEO Yegor Perelygin told LIGA.net in an interview, both branches of the company are currently operating steadily, although there are nuances with electricity, lack of working capital – liquidity of working capital, and staff shortages.

“At VMMC, we were able to reach healthy stripping rates in the summer, ranging from 800,000 to one million cubic meters per month. These are optimal parameters in the context of the ratio of stripping to production in the warmer months of the year. The plant itself operates at a stripping ratio of about 4.5. That is, if we want to produce 200 thousand cubic meters of ore steadily every month, we need to continue stripping according to these parameters,” explained the head of UMCC.

In July, IGOK restarted stripping and mining operations to fulfill the US contract. Two open pits are now in operation, one for stripping and one for mining.

Currently, the company has no debts for electricity, gas, reagents, etc., and its equipment is working steadily.

The CEO clarified that 90% of production is exported, almost all ilmenite is supplied to the US and Mexico to the end user, Chemours.

“Taking into account September, we have already started all the planned shipments. There is an accumulated warehouse in the port of Constanta in Romania. There is ilmenite in Pivdenne, some of it is going to Izmail and Chornomorsk. And there is already accumulated ilmenite at the plants, which we will sell and ship in the near future,” stated Perelygin.

Over the past nine months, VGMK sold more than 50 thousand tons of ilmenite and IGOK sold more than 60 thousand tons of ilmenite. In total, we sold 110 thousand tons of ilmenite during this period, which is a significant dynamic that we could not even imagine at the beginning of 2023, the acting Chairman of the Board noted.

“If we take rutile and zircon together, we have sold 15 thousand tons since the beginning of the year. The situation with zircon is better than last year. Rutile is another matter. There is a lot of low-TiO2 rutile from Africa and China on the global market. China buys collective HMC (Heavy Mineral Concentrate) from Africa and Asia. They don’t even expect it to be used as a final product; they process it at home. Then they put it on the market at dumping prices. This is a problem for all of us. We will never be able to compete with the notional Sierra Leone or Mozambique, where mining is done by an open-pit method and at low cost. We also have an open-pit mining method, but we are dealing with low beta and rather high production costs,” the top manager explained.

He added that one of our main problems is the high cost of electricity: currently, the share of electricity is 33-35% of production costs.

Regarding ilmenite, UMCC has a very limited geography where it can sell. Ilmenite is considered a dual-use commodity in Ukraine, as it is the raw material for a very difficult and intensive processing process that can produce a titanium sponge. If you go through several very intensive processing stages in terms of energy consumption and capital investment – from ilmenite concentrate to titanium slag, then to titanium tetrachloride and then to titanium sponge – then it becomes possible to melt down titanium sponge into ingots.

But even an ingot is a semi-finished product that still needs to be processed into the final form and product. And then it can be used to make an aircraft part, a medical implant, etc. However, most ilmenite is processed into TiO2 pigment.

“Today, the export of ilmenite is strictly regulated by the State Export Control Service (SECS). We have now reached an understanding with this authority and implemented all the necessary procedures and regulations for exporting to the US market and other markets as well. There are not many companies in the US that could buy ilmenite. Therefore, there are no problems with America. There is full support from us and from the State Energy and Environmental Protection Agency. But we cannot work only on the US market, concentration is a risk for us,” the CEO said.

The US buys ilmenite concentrate from Ukraine to produce TiO2 pigments. The US is currently building a new complex for processing cast metal billets, which means they will buy sponge from somewhere else and process it into the final product.

He added that UMCC is also working with a large European company in the Czech Republic.

“It is important for me that our ilmenite gets to the Asian market. For example, to Japan. And that we gradually look for an opportunity to discover China, the largest titanium market in the world. But as for China, we need to make sure that our products are processed into pigment. Relatively speaking, white paint,” said Perelygin.

Regarding the resource base of UMCC, he explained that the nominal capacity of IGOK is 180-200 thousand tons of finished products per year, or 2.5 million tons of ore production per year. Reserves are 35-40 million cubic meters, for 15 years of production. However, the company has a Selyshchansky area near Irshansk, where a full geological study is underway. According to estimates, the reserves could be more than 30 million cubic meters. In total, in Zhytomyr region, the company can optimally operate for at least 25-27 years on the existing reserves.

IGOK was built with a focus on sulfate processing, with a focus on processing into pigment. This is the main raw material for the Czech Republic, Poland, Slovenia, Ukraine, and China, and the issue of expanding sales is currently being addressed.

“If there are opportunities for systemic investment in the future, we can produce titanium slag. But then the question of production costs and competitiveness will arise. In particular, with regard to global players such as China. To work with the US market on a large scale, we need desulphurization. To enter the Saudi market with our ilmenite, we need to reduce phosphorus, magnesium and SiO2. We will look for options to make a cleaner product,” the CEO said.

As for VGMK, the North and South areas are currently being developed at the end of the open pit with reserves of 20 million cubic meters. The North site will be completed soon, then the focus will be on the South site starting in mid-2025. At the same time, there are so-called Blocks 7-10, which are planned to be developed after the documentation and calculations are completed – most of the reserves are there, but there are questions about the development technology. If we develop 2 to 3 million cubic meters annually, we will have enough reserves for six years.

“Does it make sense to expand the possibilities of connecting other assets to UMCC? Of course it does, because expanding the resource base is always a plus. Of course, the merger of Matronovskiy GOK with VGMK would be a big plus. However, I cannot provide a legal assessment of what is happening around this idea. As a 100% state-owned company, it is very difficult for us to take individual steps. We can’t just buy out the debt of this company,” Perelygin said.

At the same time, he pointed to the search for investments. It is also necessary to deal with the license, which is now in court, and hold an auction at an open tender. UMCC is ready to participate in auctions for special permits that interest the company.

As for Demurinsky GOK, Perelygin assured that he could make Demurinsky GOK profitable. However, the maximum production capacity of Demurinsky GOK is 400-500 thousand cubic meters of ore per year, which is a small volume. Therefore, we need to focus on more tactical and short-term actions. If we merge DGOK with UMCC, it would make sense to transport DGOK’s collective concentrate to VMMC and mix it during the production cycle.

As for the loan from Ukreximbank, it was successfully restructured in early summer and relations with the bank have been normalized. This year, we have repaid more than UAH 50 million of the principal debt, and over the year, the debt has decreased from UAH 276 million to UAH 207 million. This loan is no longer critical for the company’s operations.

“UMCC really needs optimization and automation. Firstly, it has a Soviet legacy in the form of various sanatoriums, homes and boarding houses. These are so-called non-core assets that burden the company financially. The second is the large number of labor, sometimes duplicated. The third problem is the automation of decision-making and accounting systems. The fourth is the launch of new energy-efficient equipment and programs to optimize electricity consumption,” said the CEO.

UMCC started its actual operations in August 2014 after the property complexes of Vilnohirsk Mining and Metallurgical Plant and Irshansk Mining and Processing Plant were transferred to its management by the Cabinet of Ministers. On December 8, 2016, the state-owned enterprise was reorganized into UMCC, and on December 26, 2018, it was transformed from a PJSC into a PrJSC.

UMCC used to sell its products to more than 30 countries. The main sales markets were the EU, China, Turkey, as well as the USA and African countries.

Ukraine has scheduled the auction of a 100 percent stake in UMCC for October 9, 2024, via Prozorro.Sale. The starting sale price is UAH 3 billion 899.358 million.

PrJSC United Mining and Chemical Company (UMCC), which manages Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipro region) and Irshansk Mining and Processing Plant (IGOK, Zhytomyr region), posted a net profit of UAH 61.6 million in January-June 2024.

According to Yegor Perelygin, interim chairman of the board of UMCC, on Facebook, EBITDA in this period amounted to UAH 139.8 million.

At the same time, sales of finished products in monetary terms increased by 39.1%. The Group sold nearly 70 thousand tons of main concentrates, which is 20 thousand tons more than in the same period last year. The Group paid UAH 211 million in taxes.

“We started the second half of the year very actively and energetically. I can say that, despite all the problems, Vilnohirsk Mining has a normal operating perspective until 2030. We have enough reserves for the economically viable operation of the plant,” said the CEO.

There are several options and scenarios for further developments after 2030, and UMCC is working on them, he added. He clarified that mining operations at Irshansky GOK were fully resumed in the second half of 2024, and two open pits are operating steadily. SOE also said that the nameplate capacity of Irshansk GOK is 2.5 million cubic meters of production.

“Having an understanding of our balance sheet reserves, we see at least 15 years of prospects at a capacity of 180-200 thousand tons per year (after all the reconstructions, this is the real passport capacity of ‘finishing’, i.e., final products). Also, don’t forget that we still have the Selyshchanska area and off-balance sheet resources,” explained the acting Chairman of the Board.

“I’ll be blunt: we have a good understanding of the future development of the entire Irshansk resource base within a time horizon of 27 years at Irshansk GOK (and even more!!!). We are calmly moving forward,” the CEO summarized.

As reported, in the first quarter of 2024, UMCC received UAH 30 million of net profit, while in the same period last year there was a loss.

UMCC started its actual operations in August 2014 after the property complexes of Vilnohirsk Mining and Metallurgical Plant and Irshansk Mining and Processing Plant were transferred to its management by the Cabinet of Ministers. On December 8, 2016, the state-owned enterprise was transformed into PJSC UMCC, and on December 26, 2018, it was transformed from PJSC to PrJSC.

UMCC used to sell its products to more than 30 countries. The main sales markets were the EU, China, Turkey, as well as the USA and African countries.

Ukraine has scheduled the auction of a 100% stake in UMCC for October 9, 2024, via Prozorro.Sale. The starting sale price is UAH 3 billion 899.358 million.

On Friday, the Ukrainian government approved the terms of privatization of United Mining and Chemical Company (UMCC), which has been given control of Vilnohirsk Mining and Metallurgical Plant (VMMC, Dnipropetrovs’k region) and Irshansk Mining and Processing Plant (IGOK, Zhytomyr region), setting the starting price at UAH 3 billion 899.358 million.

“To take note of the starting price of the stake set by the advisor BDO Corporate Finance LLC in the amount of UAH 3,899,358,000 (three billion eight hundred and ninety-nine million three hundred and fifty-eight thousand),” the Cabinet of Ministers said in its resolution No. 643 of July 12 on its website.

It is specified that all 1 billion 944 million shares, which is 100% of the authorized capital, will be put up for sale.

Earlier, the State Property Fund pointed out that the sale of UMCC belongs to large-scale privatization, as it is the sale of state assets with a book value of more than UAH 250 million. Earlier, the SPF has already held auction commissions for the sale of the Ukraina Hotel, UMCC and the state share in the authorized capital of Lybid Investment Union LLC (Ocean Plaza shopping center). Auctions for the sale of these assets will be announced after the Cabinet of Ministers approves the starting prices and terms of sale. All auctions will be held in the state electronic system Prozorro.Sale. The proceeds from the privatization of state-owned enterprises will go to the state budget of Ukraine, and the proceeds from the privatization of nationalized assets will go to the fund for liquidation of the consequences of armed aggression.

The United Mining and Chemical Company began its actual operations in August 2014, when the Ukrainian government decided to transfer the property complexes of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipropetrovska oblast) and Irshansk Mining and Processing Plant (IGOK, Zhytomyrska oblast) to its management. On December 8, 2016, the state-owned enterprise was transformed into PJSC UMCC, and on December 26, 2018, it was transformed from PJSC to PrJSC.

UMCC used to sell its products to more than 30 countries. The main sales markets were the EU, China, Turkey, as well as the USA and African countries.

PrJSC United Mining and Chemical Company (UMCC), which has taken over management of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipro region) and Irshansk Mining and Processing Plant (IGOK, Zhytomyr region), has resumed mining titanium raw materials and the full operation of the open pits at Irshansk Mining and Processing Plant.

According to the company’s press release on Thursday, this branch was shut down in October 2022. This decision was made due to the lack of contracts for the sale of ilmenite concentrate and, at the same time, significant stocks of finished products in warehouses.

Currently, the management of UMCC has signed a large contract to sell the branch’s products to a strategic North American customer. Accordingly, there is a need to restore the plant’s full capacity.

“Back in April, we gradually started preparing for the full resumption of the branch’s operations, including the full resumption of production. We made all the necessary purchases and carried out as many repairs as possible. Now we have an active contract with an American end user for 70 thousand tons of ilmenite concentrate from Irshansk GOK,” said Yegor Perelygin, acting Chairman of the Board of UMCC.

According to him, another 25-40 thousand tons are currently under discussion. Additionally, the company is preparing to start negotiations for 30 thousand tons for a European end user, with a shipment plan for the fourth quarter of this year.

“Since we have almost sold the old stocks in our warehouses, which is good news, the resumption of quarrying is critical,” said Perelygin.

He specified that the company plans to produce 12 thousand tons of ilmenite concentrate per month by the end of this year.

“We understand that if there is an opportunity to increase production, we will definitely press the gas pedal. But there are several barriers and negative factors that constantly make adjustments to our production program. Everyone is well aware that we are in the active stage of the war and need to prepare for surprises or unplanned problems. In particular, it concerns the stabilization of electricity supplies to the plant,” added the CEO.

He also explained that UMCC has come a long way to qualify IGOK’s ilmenite concentrate for the North American market, and it is strategically important for the company to maintain this momentum until 2025, as then we can talk about long-term contracts and long-term product qualification.

“My personal dream is that 2/3 of IGOK’s products should be exported to the market that is strategic for us as a country and that our cooperation with the American chemical industry should only strengthen and the volumes should grow. This will allow us to move to planning horizons of 1-3 years, even during the war, and will have a good stabilizing effect,” Perelygin explained.

According to him, this will also allow us to move to a broader development of the local resource base, in particular by returning to the implementation of the capital investment program.

“Unfortunately, due to the lack of long-term money and a large number of unpredictable events, the last two years have been practically on hold,” summarized the acting chairman of the board of UMGC.

United Mining and Chemical Company started its actual operations in August 2014, when the Ukrainian government decided to transfer the property complexes of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipropetrovska oblast) and Irshansk Mining and Processing Plant (IGOK, Zhytomyrska oblast) to its management. On December 8, 2016, the state-owned enterprise was transformed into PJSC UMCC, and on December 26, 2018, it was transformed from PJSC to PrJSC.

UMCC used to sell its products to more than 30 countries. The main sales markets were the EU, China, Turkey, as well as the USA and African countries.