Amounts to be refunded decreased by almost one and a half times

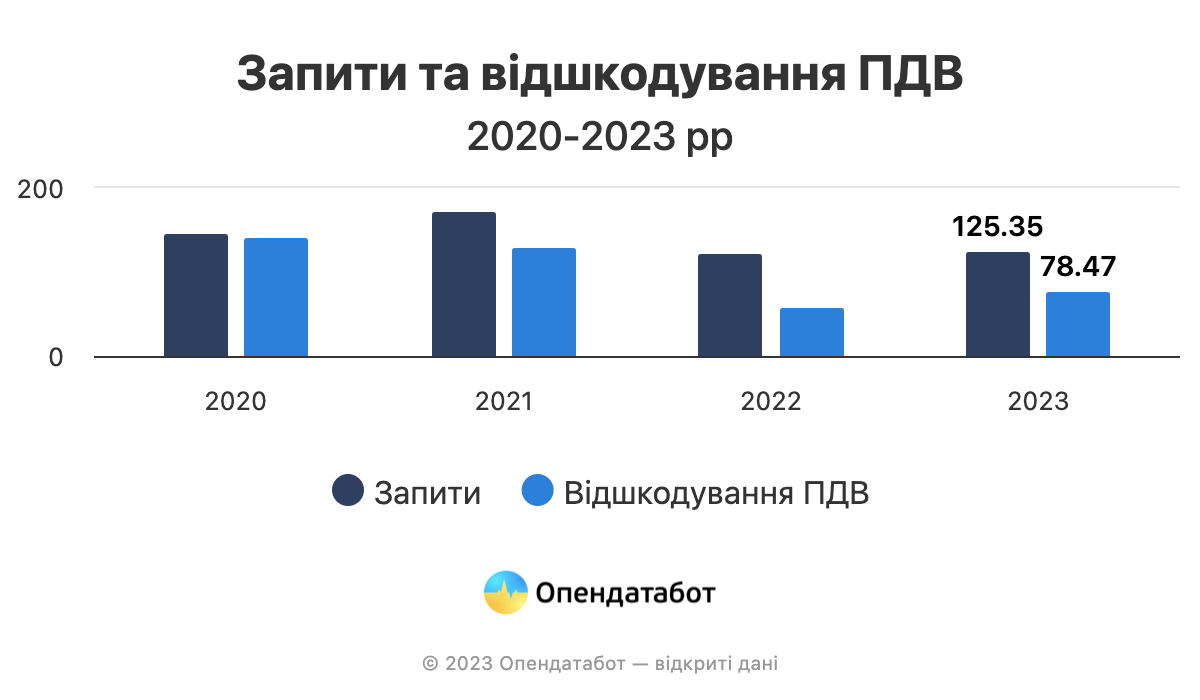

Value added tax (VAT) accounted for one fifth of all state budget revenues in 2023. All VAT payers are entitled to a VAT refund. However, only 63% of the requested VAT refunds were paid by the State Tax Service (STS) in 2023.

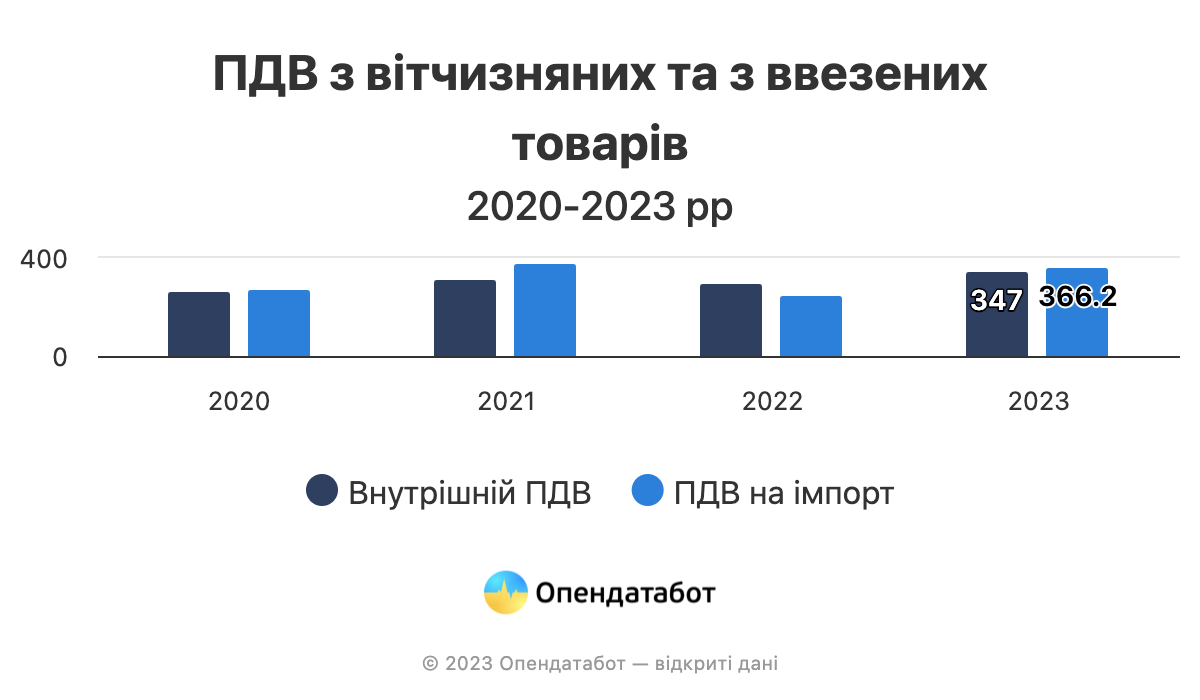

Last year, VAT on imported goods amounted to UAH 366.2 billion, a 1.4-fold increase compared to the first year of the full-scale war. This is almost the same as in 2021 – UAH 380.7 billion.

At the same time, domestic VAT – that is, the tax on goods produced in the country – increased by 10% by 2021.

The situation with VAT refunds in 2023 improved slightly, but still did not reach pre-war levels. Last year, the Tax Service refunded 63% of the amounts claimed for refund, almost UAH 78.5 billion. This is 1.6 times less than in 2021. It is worth noting that the amounts to be refunded decreased by 1.4 times compared to the same pre-war year.

In general, the worst VAT refund rates over the past 4 years were recorded in 2022 – only 48% of the requested amounts, and the best – in the covid 2020: 97% of the requested amount.

Last year, VAT on domestic goods, including refunds, amounted to 8.6% of the budget, and VAT on imported goods – 11.5%. VAT will account for 20% of all state budget revenues in 2023. For comparison, in 2022, VAT brought 25% of the state treasury.