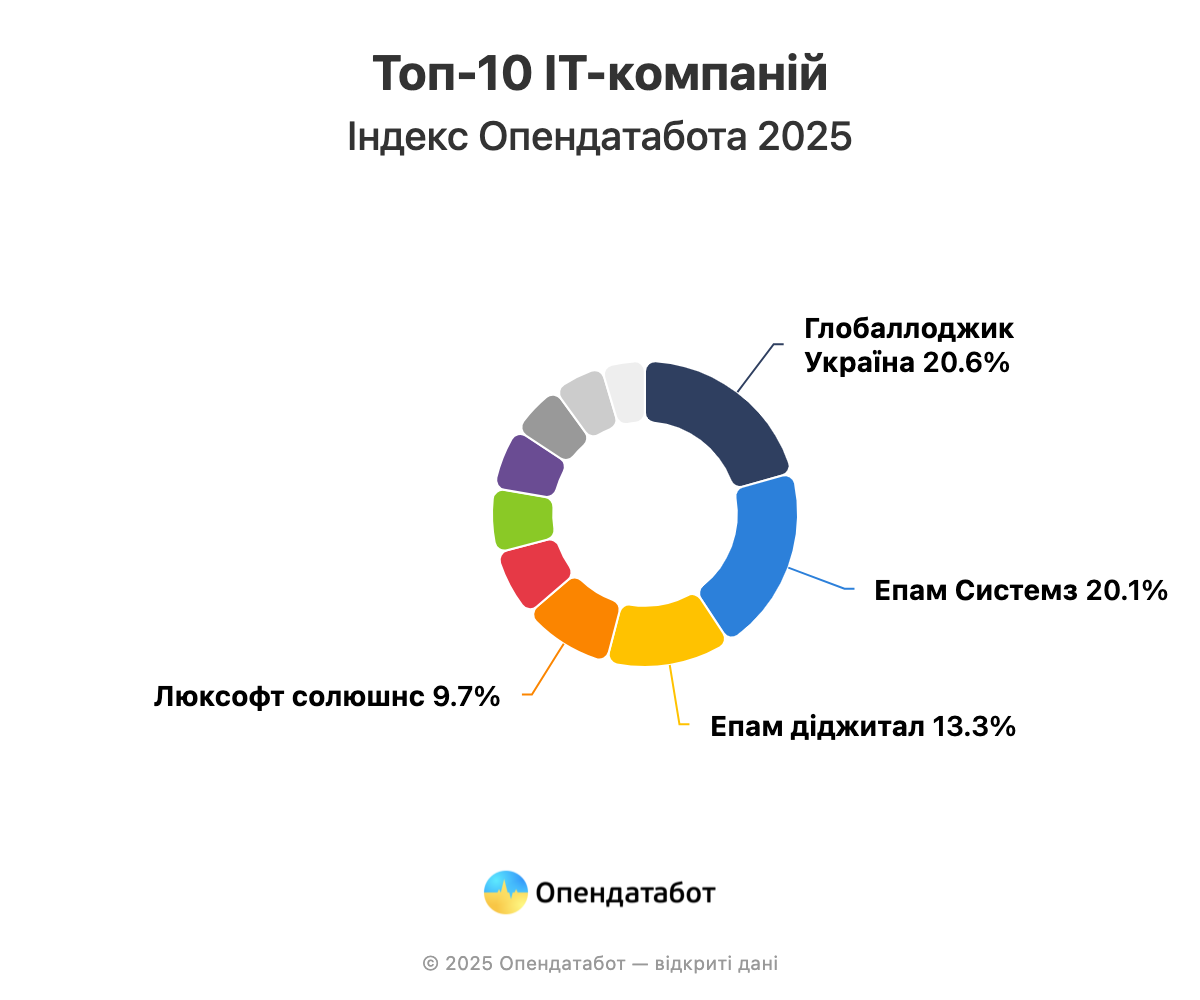

UAH 56.48 billion was the total revenue of the best IT companies in the Opendatabot 2025 Index. The top three leaders belong to American companies, with Globalogic Ukraine taking the first place. Also, 2 companies left the top 10, one of which was included in the Index for 2 years. 7 out of 10 companies in the Index are in the Diia City register

GlobalLogic Ukraine , owned by the American Bonus Technology INC, debuted on the first place in terms of revenue. Revenue for the year changed slightly to UAH 11.66 billion (+2%), while profit decreased by 28% to UAH 653 million. Despite the fact that the company has been in the Index for 3 years, it took the leading position for the first time.

“We are honored to continue and develop our business in Ukraine, as we understand the high price of such an opportunity. GlobalLogic in Ukraine unites thousands of talented engineers. It is their intelligence, education, diligence and high efficiency that helps the company grow in Ukraine and pay taxes to our country’s economy. Our engineering teams in Ukraine create high-tech solutions in the areas of artificial intelligence, automotive, medical, semiconductors, and more. These developments are highly valued by our customers in the US and Europe,” comments Anna Shcherbakova, COO of GlobalLogic Ukraine.

The remaining top 3 positions were shared by two companies of Epam, founded by Arkadiy Dobkin. They account for a third of the top ten earnings. Epam Systems , which previously topped the Index for 2 years in a row, went down a notch with revenue of UAH 11.35 billion. This is 10% less than in 2023. At the same time, its profit increased by 27% to UAH 1.67 billion.

At the same time, Epam Digital ‘s revenues and profits are growing year on year. With revenue of UAH 7.5 billion (+25%) and profit of UAH 838 million (+11%), the company ranked third in the Index. It is worth noting that this legal entity was founded only in December 2021.

“EPAM Ukraine has been a leader in the IT industry for several years in terms of key indicators: the number of specialists, revenue, and the amount of tax payments to the country’s budget. Last year, we paid over UAH 1 billion in taxes, which confirms our position as one of the largest taxpayers in the Ukrainian IT sector. Since the start of the full-scale invasion, the company has committed $100 million to support its Ukrainian team, their families, Ukrainian defenders and the country’s critical needs,” comments Stepan Mitish, Vice President, Head of EPAM Ukraine

For the second year in a row, Luxoft Solutions, a subsidiary of Swiss Luxoft founded by Dmytro Loshchynin, remains fourth in the Index. Its revenue fell by 7% to UAH 5.45 billion, while profit decreased by 12% to UAH 263.6 million.

The Institute of Information Technologies “Intellias” took the 5th place with a revenue of UAH 4.06 billion (-6%). At the same time, the company’s profit increased by 18% to UAH 300.7 million. The business is owned by ITE Limited, whose ultimate owners are Vitaliy Sedler and Mikhail Puzrakov.

SoftServe Technologies, founded by Lviv residents Taras Kitsmey and Yaroslav Lyubynets, moved up two places last year: 6th place. The company’s revenue grew 1.6 times over the year to UAH 3.83 billion, while profit remained the same at UAH 210 million.

Thefintech band, owned by Monobank founders Oleg Gorokhovsky and Mikhail Rogalsky, lost two positions in the Best Index this year. Due to a significant decrease in revenue – by one and a half times – the company was ranked seventh: UAH 3.71 billion. Profits decreased even more significantly: by 2.7 times to UAH 1.15 billion.

Infopulse Ukraine, founded by Oleksiy Sigovyi and Andriy Anisimov, took the ninth place. It is now owned by the Swedish company NUK HOLDING AB. The company’s revenue decreased by 5% to UAH 3.06 billion, while profit decreased by 14% to UAH 332.7 million.

At the same time, this year’s iteration of the Opendatabot Index also includes newcomers that debuted with stunning results. With revenues of UAH 3.22 billion and a record profit of UAH 2.4 billion among the top 10 companies, Highload Solutions (formerly Favbet Tech) by Dmitry Matyukha appeared in the Index. The company, registered in January 2022, accounts for a third of the total profit of the ranked companies.

Another newcomer to the Index rounds out the top ten is the young company Squad Ukraine (SQUAD), established in August 2022. The business is owned by the Cypriot company Squad IT Limited, owned by Ukrainians Lyubomyr Vasyliev and Yuriy Katkov. Last year, Squad’s revenue grew 2.8 times year-on-year to UAH 2.6 billion, and its profit grew 3.4 times to UAH 80.6 million.

It is worth noting that 7 of the top companies chose the Diia City legal regime, except for Epam Systems, Luxoft Solutions, and the Institute of Information Technologies “Intellias”. This means that these companies do not enjoy special tax benefits, a simplified administrative process, and other tools for the development of the IT sector from the state.

At the same time, this year the IT Companies Index was dropped:

https://opendatabot.ua/analytics/index-it-2025

More than 236 thousand tech workers in the world have lost their jobs since the beginning of 2023, according to a study by Layoffs.fyi.

The data indicate that the number of layoffs in the tech sector in 2023 will significantly exceed the figure for the previous year. Thus, since the beginning of this year, 1,019 thousand tech companies have laid off 236,495 thousand people. Last year, 1,024 thousand companies laid off 154.34 thousand employees, according to Layoffs.fyi.

In particular, last week, telecommunications equipment manufacturer Cisco Systems Inc. announced the dismissal of 350 employees, and in early September, streaming company Roku Inc. announced a 10% reduction in staff.

Among the tech companies that announced layoffs this year are the American Amazon.com Inc., Electronic Arts, Palantir Technologies, Twilio Inc., DocuSign Inc., Salesforce Inc., Zoom Video Communications, eBay, Dell Technologies, PayPal Holdings, International Business Machines, Intel Corp., Microsoft Corp., Alphabet Inc. as well as German SAP and Swedish Spotify Technology.

More than 216,000 workers in the technology industry worldwide have lost their jobs since the beginning of 2023, a study by Layoffs.fyi shows.

At the same time, the number of people laid off has increased more than eightfold since mid-January, MarketWatch notes.

The data suggest that the number of layoffs in the tech sector at the end of 2023 will be significantly higher than last year. For example, since the beginning of this year, 837 tech companies have laid off 216,328,000 people. Last year, 1,024,000 companies laid off 154,34,000 employees, according to Layoffs.fyi.

That included Niantic Inc. last week, creator of the popular game Pokemon Go, announcing 230 layoffs, and in late June, trading platform Robinhood Markets announced 150 job cuts.

Tech companies announcing layoffs this year include U.S. Amazon.com Inc., Electronic Arts, Roku Inc., Palantir Technologies, Twilio Inc., DocuSign Inc., Salesforce Inc., Zoom Video Communications, eBay, Dell Technologies, PayPal Holdings, International Business Machines, Intel Corp., Microsoft Corp., Alphabet Inc. as well as Germany’s SAP and Sweden’s Spotify Technology.

Asia-Pacific stock indexes are mostly rising on Friday, the exception is the South Korean indicator.

Traders are assessing the statistical data and the results of the Bank of Japan meeting.

The Japanese Central Bank left unchanged the main parameters of the monetary policy (MP) on the results of the two-day meeting that ended on Friday, which became the first for the new head of the Central Bank Kazuo Ueda.

The short-term interest rate on commercial bank deposits at the Central Bank remained at minus 0.1% per annum, the target yield on ten-year government bonds – about zero, according to a statement from the Japanese Central Bank.

Bank of Japan also retained the range within which the yield of ten-year government bonds may fluctuate – plus/minus 0.5%.

At the same time, the phrase about the Central Bank’s intention to keep the rate at the current level or lower was missing from the text of the statement on the results of the meeting. This is a phrase the Bank of Japan has been repeating since October 2019.

At the same time, the central bank reiterated that it is ready to keep its stimulative policy until inflation stabilizes at the 2% target level.

In addition, the Bank of Japan announced its intention to revise its monetary policy, the results of which will be published in 12-18 months.

Statistics released Friday showed a 13th straight month of improvement in the country’s retail sales, as well as an increase in industrial production and an unexpected jump in unemployment.

Japan’s Nikkei 225 stock index gained 1% in trading. Toyota Motor gained 1.3 percent, SoftBank Group gained 2.3 percent and Denso Corp. – Denso Corp. by 4.3%, Daikin Industries by 2.8% and Ana Holdings by 2.2%.

China’s Shanghai Composite stock index added 0.7 percent in trading Friday, while Hong Kong’s Hang Seng gained 0.6 percent.

The leaders of the growth both in mainland China and Hong Kong are shares of technology companies, rising due to strong quarterly reports of U.S. IT-giants.

Kunlun Tech soared almost 20% in trading in Shenzhen. Shares of BlueFocus Intelligent gained 17%, Dawning Information Industry gained 5.2%, and 360 Security Technology gained 4.8%.

In Hong Kong, shares of BYD Electronic (+6.7%), Haier Smart Home (+5.9%), Semiconductor Manufacturing International (+2%), NetEase Inc. (SPB: NTES) (+3.2%) gained.

The value of China Tourism Duty Free Corp. securities fell 0.15% during trading. The company’s net income fell 10% in the first quarter as its expenses grew faster than revenue.

Australia’s S&P/ASX 200 is adding 0.24% and South Korea’s KOSPI is losing 0.02%.

South Korean industrial production fell 7.6% in March compared to the same month last year. In February the index decreased by 8%.

More than 139,000 technology workers around the world have lost their jobs since the beginning of 2023, according to data compiled by Layoffs.fyi.

The figure has more than tripled since mid-January.

The data suggest that the number of tech-sector layoffs at the end of this year will far exceed the figure for 2022. So, since the beginning of the year, 498 tech companies have cut 139,033 thousand people. Last year, 1,024,000 companies laid off 154,34,000 employees, Layoffs.fyi reports.

Including this week, Meta Platforms Inc. (said it intends to lay off another 10,000 people as part of a cost-cutting program. The company has already cut more than 11,000 employees in November.

Tech companies that have announced layoffs this year include U.S. Palantir Technologies, Twilio Inc., DocuSign Inc., Salesforce Inc., Zoom Video Communications, eBay, Dell Technologies, PayPal Holdings, International Business Machines, Intel Corp., Microsoft Corp., Alphabet Inc. as well as Germany’s SAP and Sweden’s Spotify Technology.

Ukrainian IT companies attracted about $1 billion in venture capital investments in 2022, mainly these were investments by foreign companies, while the activity of most Ukrainian companies from other sectors that invested in IT development before the war has dropped to zero, said Deputy Minister of Digital Transformation on IT Development Alexander Boryakov.

“I will not give a clear figure. I can guess up to $1 billion last year (the number of venture capital investments in IT) even in conditions of a full-scale war,” he said in an interview with Interfax-Ukraine.

According to him, since the beginning of the war, the interest of venture capitalists in the sector has declined sharply, but activity resumed in the summer. In particular, Blue&Yellow Heritage Fund (the first venture fund of the American company Venture Capital to work with Ukrainian IT-projects – IFU) was founded for $50 million. Also several foreign funds ready to invest over $10 million each are known, added the deputy minister.

“I do not see people in Ukraine today who would allocate funds for this. Just imagine, before the war, the same DTEK, Metinvest had groups that were engaged in innovations and investments. However, I don’t think that against the background of how many facilities suffered because of the full-scale Russian invasion, these groups have funding. Kyivstar, Vodafone, Pinchuk’s group had similar projects. Now the majority of the projects are winding down”, – Mr. Boryakov said.

He added that about $15 million have been attracted as grants and donations. Approximately $0.5 million in grant support has been provided by partners from USAID CEP, WNISEF, GIST, EIT Raw materials and YEP. About $40 million from the beginning of full-scale war is estimated by Google, grants were also provided by Microsoft and Amazon.

The top three areas of interest to investors, according to Boryakov, include web3, mil-tech, and artificial intelligence.

The deputy minister did not make predictions about possible investments that could be allocated to the IT-sphere in Ukraine in 2023, noting that “much will depend on the situation with military action.”

“However, with the initiative that we launch (mil-tech startups), if done right, it is possible to attract even more funds (than in 2022),” he said.