Naftogaz Group companies paid UAH 90.2 billion in taxes in 2023.

“Last year, our group of companies transferred: UAH 83.4 billion to the state budget, UAH 6.8 billion to local budgets,” Naftogaz said on its Telegram channel on Monday.

It is specified that, in particular, in December 2023, the group’s companies transferred UAH 6 billion to the state budget and UAH 0.5 billion to local budgets.

“The energy security of our country is one of the key tasks of the Naftogaz Group. However, contributing to Ukraine’s economic development is equally important. We continue to be one of the largest taxpayers for the state,” Naftogaz CEO Oleksiy Chernyshov said as quoted on the company’s website.

At present, Gas Supply Company Naftogaz of Ukraine LLC continues to supply gas to 12.3 million consumers. It has signed 1,242 contracts with 449 district heating companies and 793 condominiums.

In addition, it is noted that 7 CHP plants managed by the group continue to provide heat to thousands of Ukrainians in Kamianske, Kryvyi Rih, Novoyavorivsk, Novyi Rozdil, Mykolaiv, Odesa and Kherson.

“Gas reserves in Ukrainian storage facilities are sufficient for the successful completion of the heating season,” Naftogaz said.

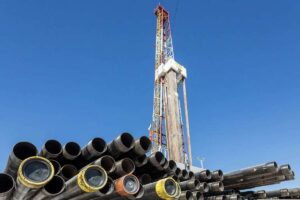

Naftogaz Group has increased gas production by more than 400 thousand cubic meters by launching three wells in November, its CEO Oleksiy Chernyshov said.

“We continue to increase Ukrainian gas production! In November alone, three high-rate wells were put into operation (…). In total, in November we have an additional 400 thousand cubic meters of gas per day!” he wrote on his Facebook page on Friday.

Chernyshov clarified that two of the mentioned wells are new. Their launch was the result of the implementation of the largest 3D seismic survey program in the history of modern Ukraine and the high professionalism of Naftogaz specialists. The third well is a rehabilitated well that had been in the liquidation fund for 35 years.

As reported, in 2023, Ukrgasvydobuvannya set a goal to increase natural gas production by 1 billion cubic meters to 13.5 billion cubic meters. In 2022, the company produced 12.5 bcm of natural gas (commercial), which is 3% less than in 2021.

NJSC Naftogaz of Ukraine owns 100% of Ukrgasvydobuvannya shares.

In January-October 2023, Naftogaz Group paid UAH 75.4 billion in taxes to the state and local budgets.

According to the Group’s press service, the state budget received UAH 69.8 billion, which is 11.5% of the payments controlled by the State Tax Service of Ukraine, and almost UAH 6 billion went to local budgets.

“Our work is not only about the country’s energy sustainability, it is also about economic sustainability. In October, our companies paid UAH 4.7 billion to the state budget. We are constantly working to increase our profits, which in turn affects the growth of contributions to the country’s budget,” commented Oleksiy Chernyshov, Chairman of the Group, as quoted in the release.

As reported, in 2022, Naftogaz Group transferred almost UAH 100 billion to the budgets, and in 2021 – UAH 116 billion.

“Chernihivgaz” JSC has come under the management of “Naftogaz” Group, the company’s press service said on Tuesday.

“Chernihivgaz” became the 18th enterprise to come under state control.

The company delivers gas to almost 360,000 homes, regulates its distribution to budgetary and religious organizations, industrial facilities and municipal heating enterprises,

“Chernihivgaz” joined the “Naftogaz” Group as part of the transfer of gas distribution companies to state control. At present, personal accounts of customers, as well as tariffs for distribution services, remain unchanged”, the statement said.

As reported, at the end of May 2022, at the request of the State Bureau of Investigation (SBI), the court transferred the seized private corporate rights to 26 regional and city gas distribution system operators to the management of the ARMA.

In September 2022, “Naftogaz” of Ukraine registered Gas Distribution Networks of Ukraine LLC (“Gazomerezhi”), whose main activity is gas distribution through local pipelines.

By Resolution No. 1335 dated November 25, 2022, the Cabinet of Ministers transferred state-owned gas distribution networks to “Gazomerezhy” for operation.

Volynhaz JSC has come under state control and joined the Naftogaz group,” the company said on Friday.

“This is the 17th regional gas distribution company that has come under state control since the beginning of the year. The changes were necessitated by the need to address strategic energy tasks concerning the reliable protection of critical facilities, as well as the speedy restoration of infrastructure in the event of enemy attacks,” the group said.

“Volynhaz” provides gas distribution to budget organizations and more than 250 thousand homes in the region.

“Tariffs for distribution services and personal accounts for residents of the region remain unchanged. On the change of requisites we will inform additionally”, – informed in “Naftogaz”

Earlier in the NJSC “Naftogaz of Ukraine” included JSC “Vinnytsiagaz”, JSC “Dniprogaz”, JSC “Dnipropetrovskgaz”, JSC “Donetskoblgaz”, JSC “Ivano-Frankivskgaz”, JSC “Zhytomyrgaz”, JSC “Kievoblgaz”, Krivorozhgaz, Kirovogradgaz, Lvovgaz, Mykolaivgaz, Sumygaz, Kharkovgorgaz, Kharkovgaz, Khmelnitskgaz and Cherkasygaz.

Ukraine is entering the autumn-winter season with a sufficient amount of gas in underground storage facilities, while maintaining a stable pricing policy, said Oleksiy Chernyshov, CEO of Naftogaz of Ukraine, during the United News telethon.

“Gas prices for households and district heating companies remain stable. They will not change until the end of winter. Therefore, I have to reassure the population in this regard, as well as cities and district heating companies,” he emphasized.

The Head of Naftogaz Group also noted that the preparations for the heating season were at the proper level.

“We have to move forward, get through this winter and be absolutely confident of victory and further actions,” Chernyshov said.

Earlier on Tuesday, Energy Minister Herman Halushchenko said that electricity prices for household consumers would remain stable until the end of this heating season.

“As for resources, we will be provided with everything we need, both coal and gas. Due to high temperatures in the last two months of summer, coal stocks in warehouses have fallen slightly, but we have already signed relevant contracts, including imports, and we will be fully provided with coal in the required volume,” the minister said.

According to him, almost 15 billion cubic meters of gas have been accumulated in storage facilities so far, which is even more than planned for the beginning of the heating season.