Who is under the attention of the Tax Service?

The State Tax Service has planned 4.7 thousand business inspections for 2025. The State Tax Service will pay most attention to companies from Kyiv, Odesa and Dnipro regions. About 400 businesses will be inspected every month, with the most visits scheduled for October.

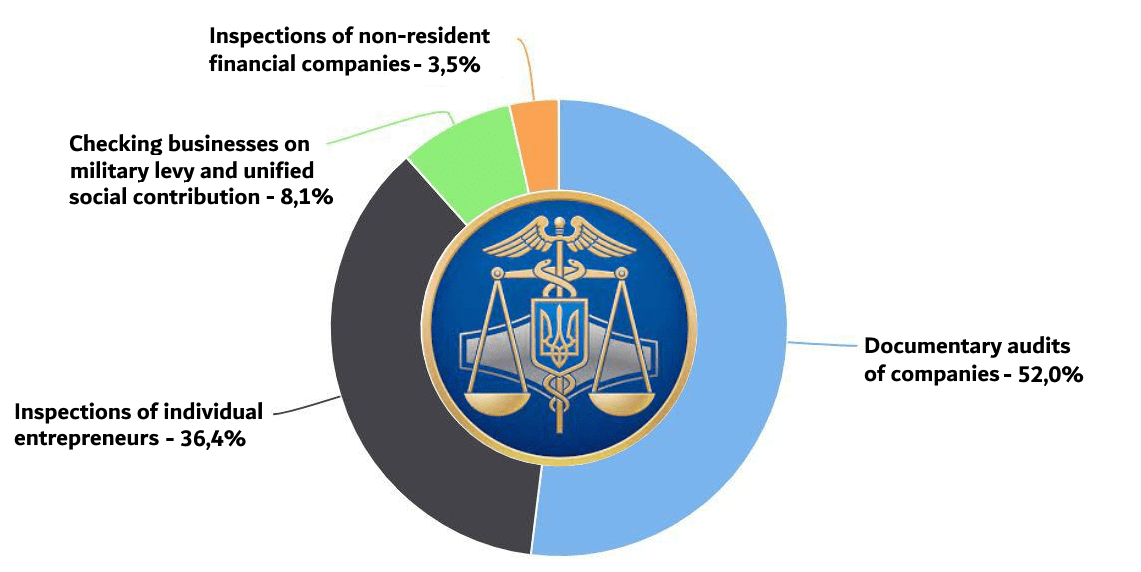

Of the 4.7 thousand inspections, about 3.7 thousand are for companies, and the rest are for individual entrepreneurs. Financial institutions and non-residents will also be inspected. The State Tax Service will also visit 266 businesses that have questions about personal income tax, military duty, and unified social tax.

The State Tax Service will pay most attention to companies from Kyiv – 18% of the total number of inspections. Odesa region will be in second place, and Dnipropetrovs’k region will be in third place: 12% and 10% respectively.

Wholesale companies will face the most inspections – 20.7%. Agriculture and hunting will account for another 15% of inspections. Food production rounds out the top three with 6.2%.

In January, 287 companies will be inspected, and in February another 371. In total, the State Tax Service will visit about 400 businesses every month, with 423 companies being inspected in October.

20 companies from the list were included in the Opendatabot 2024 index:

– D. Trading – UAH 165.6 billion in revenue;

– Okko Express – UAH 61.8 billion;

– Vinnytsia Poultry Farm – UAH 39.2 billion;

– Nova Poshta – UAH 36.4 billion;

– Ukrainian armored vehicles – UAH 32.4 billion;

– SpaceX – UAH 27.9 billion.

– Myronivska Poultry Farm – UAH 21.4 billion;

– Pumb – UAH 16 billion;

– Ukrsibbank – UAH 15.4 billion;

– Poltava Mining and Processing Plant – UAH 15 billion;

– Concorde Consulting – UAH 8.5 billion;

– Enselco Agro – UAH 7.2 billion;

– Institute of Information Technologies Intelias – UAH 4.3 billion;

– Berehove Grain Receiving Enterprise – UAH 4.3 billion;

– ONUR CONSTRUCTION INTERNATIONAL – UAH 2.9 billion;

– Testi Food – UAH 1 billion;

– Three O – UAH 906 million;

– Triumph Media Group – UAH 562 million;

– SC Dnipro-1 – UAH 437 million;

– Star Bukovel – UAH 421 million.

You can find out whether your business or partners are scheduled for inspections for free in the Opportunity Bot. To do this, send the bot the company code. If the business is on the tax plan, the relevant information will appear in the company card.

Instructions.

How to find out if the Tax Service is planning to inspect your business?

https://opendatabot.ua/analytics/dps-audits-2025

According to the State Tax Service, more than 3.3 thousand inspections of companies and individual entrepreneurs are planned for this year. Almost 73% of them will be for companies, and the rest will be for private entrepreneurs. In June, the number of companies “under supervision” increased by 42.

Therefore, 2,450 companies and 915 individual entrepreneurs should expect inspections this year. In June, 42 more businesses were added to the list, which will be inspected in the second half of the year.

Most inspections will be conducted in Kyiv – 26%. It will also be carried out in Dnipropetrovska and Lvivska oblasts – 8.1% and 6.9% respectively. Kherson region attracted the least interest from tax authorities – only 2 companies.

What businesses are on the updated list?

Among the new companies is SENS BANK with a revenue of UAH 12.9 billion, which took the 7th position in the Opendatabot Index among banking activities.

The tax authorities will also inspect AGROPROINVEST 08 LLC with almost UAH 2 billion and ALMA VIN LLC with UAH 1.6 billion. Instead, TRADING PRODUCT COMPANY LLC with a revenue of more than UAH 326 million closes the top ten.

Top 10 new companies to be inspected by the tax authorities

You can find out if your business or partners are scheduled for an audit for free in the Opportunity Bot. To do this, send the bot the company code. If the business is on the State Tax Service’s plan, the relevant information will appear in the company card.

https://opendatabot.ua/analytics/dps-audits-update-2024-7

The Tax Service has imposed UAH 1.65 billion in fines for violations in the use of payment transaction registers (PTRs) in the first half of 2023. This is already three times more than in all of 2021. The number of “cash registers in a smartphone” increased 4 times by 2021, while the number of traditional cash registers decreased by 5%.

The State Tax Service (STS) imposed 29,753 fines for violations in the use of PTRs totaling UAH 1.65 billion on entrepreneurs in the first half of 2023. This is already three times more than for the whole of 2021.

Entrepreneurs were fined for more than half of this amount – UAH 988.15 million – in August. It was during this month that the smallest number of inspections in 2023 was conducted – only 1640, but the largest number of fines was issued – 3336.

287.4 thousand cash registers and 554.6 thousand cash registers are in operation in Ukraine as of the beginning of December 2023. The surge in the installation of cash registers in 2023 occurred in September – +15% per month. We believe that this is due to the lifting of the moratorium on cash register checks in October, which was introduced at the beginning of the full-scale invasion.

The Ukrainian restaurant automation company Poster notes that most entrepreneurs were not ready for the return of inspections until the last minute.

“Many entrepreneurs waited until the last minute, explaining that this is not the first time the moratorium has been frozen or postponed. The demand for Poster’s PTR in chats and calls increased rapidly in the last week of September – 1.5-2 times more than usual.

Given that some entrepreneurs use physical cash registers and third-party integrations, we can assume that about a third of businesses were still not ready for the October 1 deadline,” said Rodion Yeroshek, CEO and co-owner of Poster.

Currently, the number of “cash registers in a smartphone” is almost twice as high as the number of regular ones. Compared to November 2021, the number of PTRs has increased 4 times, while the number of cash registers has decreased by 5%.

Despite this rapid growth, PTRs currently account for only 29% of the total number of checks. However, their number is increasing from year to year: for comparison, in 2021, the share of PTR checks was only 2.7%.

In total, 6.62 billion checks totaling UAH 2.3 trillion were issued in 11 months of this year. The total amount of PTR checks increased 1.5 times by 2021.

Scheduled business audits by state tax service in 2023

Source: Open4Business.com.ua and experts.news

In connection with the launch of the land market in Ukraine, which will start working on July 1, the Ministry of Agrarian Policy and Food, the Ministry of Justice and the State Tax Service will publish clarifications on a number of important issues related to the sale of land, Prime Minister of Ukraine Denys Shmyhal said.

“Next week, the land market will start working in Ukraine. From July 1, Ukrainians will be able to exercise their legal right and independently dispose of land plots. In this regard, this week I instructed the Ministry of Agrarian Policy and Food, the Ministry of Justice and the State Tax Service to issue clarifications on the launch of the land market, the work of notaries and maximally assist in resolving issues that Ukrainians may have,” Shmyhal wrote on Facebook on Sunday.

He noted that the government has also made changes to the procedure for maintaining the State Register of Rights to Real Estate, which will ensure the correct sale procedure and the correct disclosure of all information in the register.

AGRARIAN MINISTRY, JUSTICE MINISTRY, LAND MARKET, TAX SERVICE

The State Tax Service carried out 186 actual inspections of filling stations, following which it imposed fines for UAH 83.4 million.

“In March this year, 186 actual inspections of filling stations were carried out, as a result of which UAH 83.4 million of fines were imposed. Also, 237,300 liters of fuel from illegal turnover for a total of UAH 5.4 million were seized,” the service said on its website.

As a result of the inspections, the tax office stopped the operation of ten filling stations and seized 40 units of equipment for UAH 4.8 million.

According to the service, among the main violations are trade in unaccounted excisable goods, transitions without the use of payment transactions recorders and sale of excisable goods without licenses. The tax authority also points to such violations regarding fuel storage as the lack of registration in the Unified State Register of flow meters and level meters of fuel in a place for which a license for storing fuel for the own needs or industrial processing has not been obtained.