During the Black Friday-2024 promotion (November 25 to December 2), Foxtrot’s turnover tripled compared to the three regular weeks of the month, the company’s press service told Interfax-Ukraine.

“These productive eight days have shown that customers’ interest in Black Friday remains at the pre-war level, but with adjustments to our realities. Among the sales drivers are products that primarily provide energy independence, mobility and comfort at the same time: such as a TV and charging station combo. Mobile gadgets and home appliances that Ukrainians prepare for each other for the upcoming holidays are also popular among the leaders,” said Oleksiy Zozulya, CEO of Foxtrot.

He said that the average check during the campaign added 10% to the previous year and amounted to almost UAH 9 thousand. At the same time, the longest receipt contained 112 items and broke last year’s record (there were 72 items in one receipt). Sales peaked on Saturday, November 30.

In general, compared to the previous three weeks, the company noted an increase in purchases of charging stations (+900%), TVs (+489%), accessories (+315%), large household appliances (+309%), small household appliances (+302%), IT and laptops (+271%), smartphones, tablets (+222%), and the category of non-core products increased by +270%.

The company also noted the top sellers by product group. Coffee makers were bought 4.5 times more, multicookers 3.5 times more, laptops almost three times more, refrigerators and washing machines three times more, smartphones and tablets more than twice as much.

Foxtrot added that all 124 of its retail stores operated smoothly during the blackout. In addition, on the eve of Black Friday, a mobile application was launched for sellers, which significantly accelerated the service and checkout process. As a result, half of the sales in retail stores were made using this mobile application, and 14% of payments for goods were made without the participation of a cashier – from the workplace of a sales assistant. The online service “Barrier-Free Foxtrot”, a service that provides sign language services to customers who cannot hear, was in high demand, including when purchasing equipment on credit.

As for online orders, their number on Foxtrot.ua increased by 40%, and 12% of new users registered on the resource (year-on-year). During the most active hours of Black Friday, up to 20 thousand customers were simultaneously on the site, and the number of daily orders more than doubled. An AI contact center consultant was also connected. During the Black Friday period, it processed 30% of the total number of requests for discounts, available bonuses, order statuses, delivery, store hours, etc.

As in the previous year, the distribution of traffic between mobile and desktop devices did not change significantly: mobile – 80%, desktop – 20%.

As for the regional component, the largest increase in sales was demonstrated by the Western and Central regions, where people buy gifts for St. Nicholas Day and Christmas and New Year holidays on Black Friday.

“Foxtrot is one of Ukraine’s largest omnichannel retailers in terms of the number of stores and sales of electronics and home appliances. The company operates 124 stores in 66 cities, all of which are energy-independent, an online platform Foxtrot.ua and a mobile application of the same name. In the first nine months of 2024, Foxtrot paid UAH 700.5 million in revenue.

The Foxtrot brand is developed by the Foxtrot group of companies. The co-founders are Valery Makovetsky and Gennady Vykhodtsev.

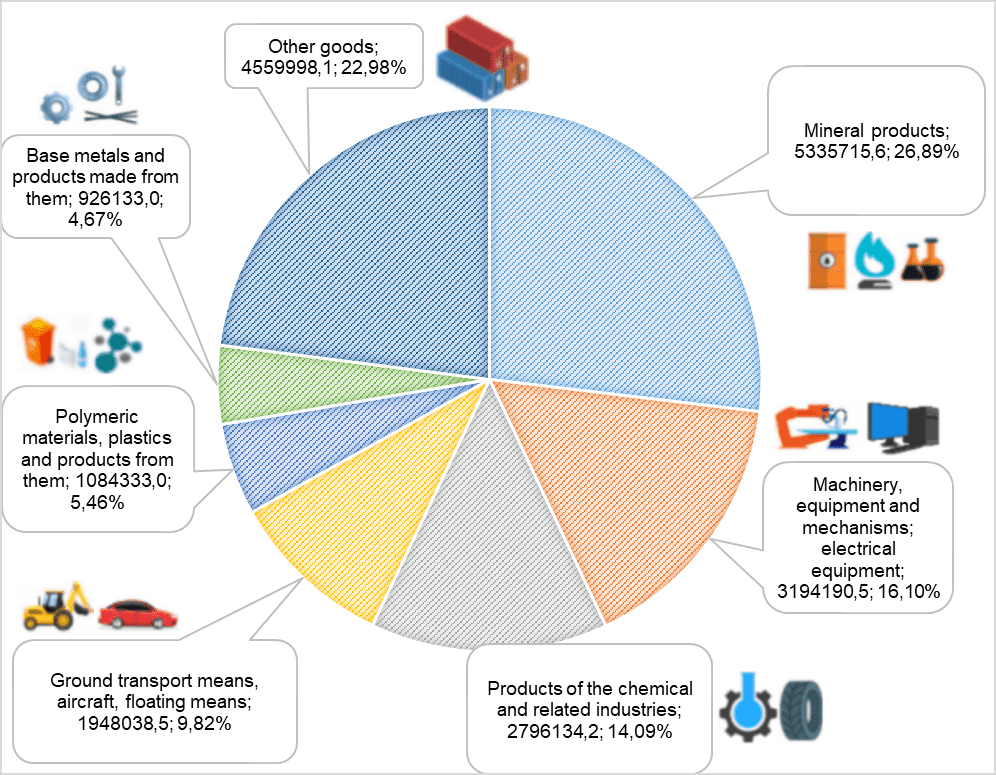

Foreign trade turnover by the most important positions Jan-May 2022 (import)

SSC of Ukraine

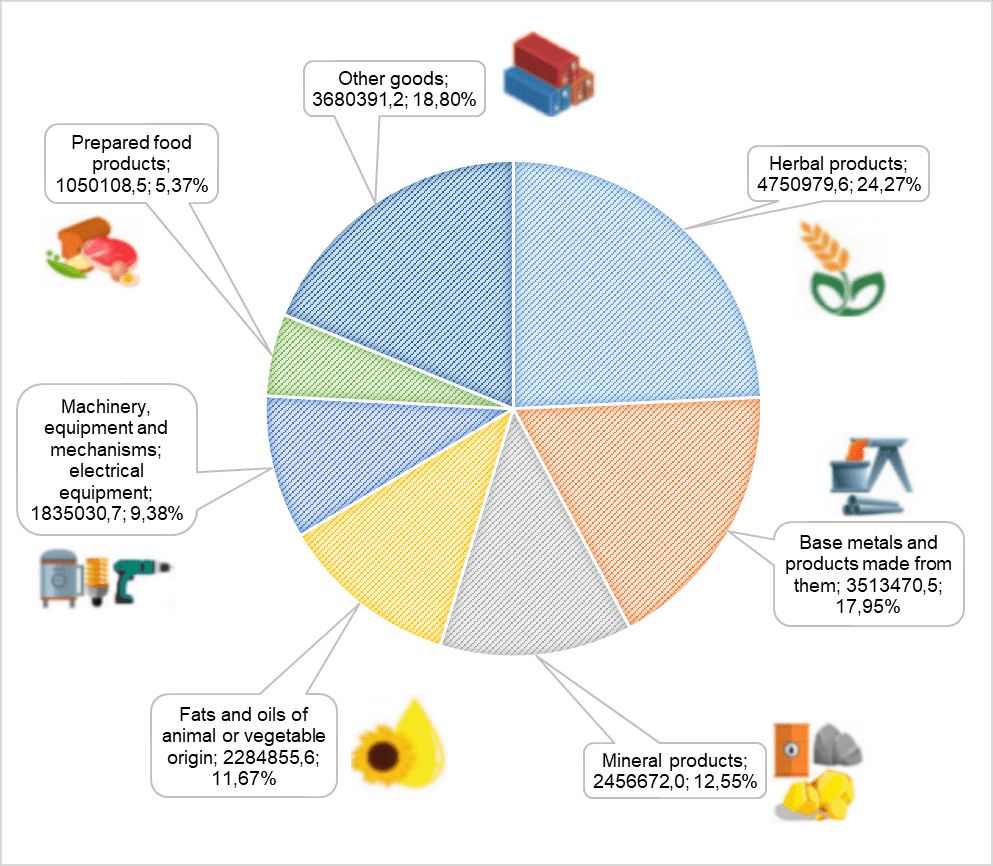

Foreign trade turnover by the most important positions in Jan-May 2022 (export)

SSC of Ukraine

The Ukrainian government has agreed on draft decisions to support the Ukrainian economy in an effort to maintain the operation of businesses and employment in places where security permits that, President of Ukraine Volodymyr Zelensky said.

“First, we are starting tax reform: instead of VAT and the income tax, we are giving a rate of 2% of turnover and simplified accounting. For small businesses – it is the first and second groups of individual entrepreneurs – we are introducing voluntary payments of the unified tax. In other words, pay if you can, but if you cannot, there are no questions,” Zelensky said in a message published in the early hours of Tuesday.

The second main point is maximum deregulation of business, he said.

“We are cancelling all checks for all businesses in order to allow everyone to work normally, in order to enable cities to return to life, in order to allow life to continue in all places where there is no fighting. There is only one condition – you must ensure the normal operation of your business within the framework of Ukrainian legislation,” Zelensky said.

These are just the first two steps of Ukraine’s tax reform, he said. “It will be continued,” Zelensky said.

SIMPLIFIED ACCOUNTING, TAX REFORM, TURNOVER, VOLUNTARY SINGLE TAX