Last week, trading in August 2025, September 2025 and subsequent months continued. In total, 4 companies formed positions for the purchase and sale of natural gas: LTC Electrum, GTS Operator of Ukraine, D.Trading, and Ukrzaliznytsia.

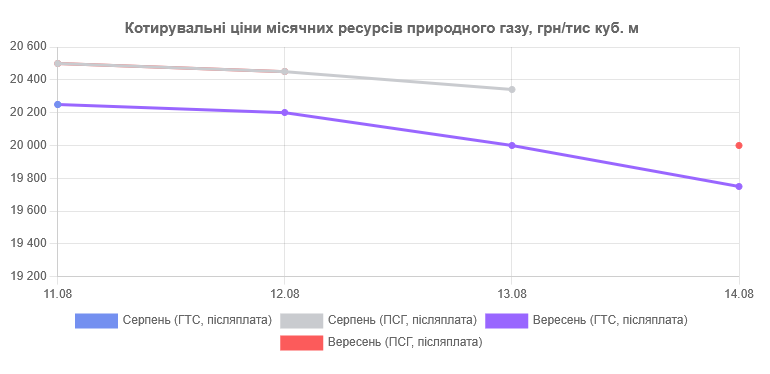

The starting prices of resources in the mid- and long-term market section varied widely. As a result, as of Friday, the average starting price of September resources in the GTS was 3.33% higher than on Monday. Last week, only buy positions were sold. In total, 20,700.00 thousand cubic meters of natural gas were sold, 17700 of which were purchased by the GTS Operator of Ukraine. Last week’s bidders formed the following quotation prices:

In the sections “Cross-border, customs warehouse” and “Imported natural gas”, the initiators formed starting positions, but no selling prices were formed in these sections last week.

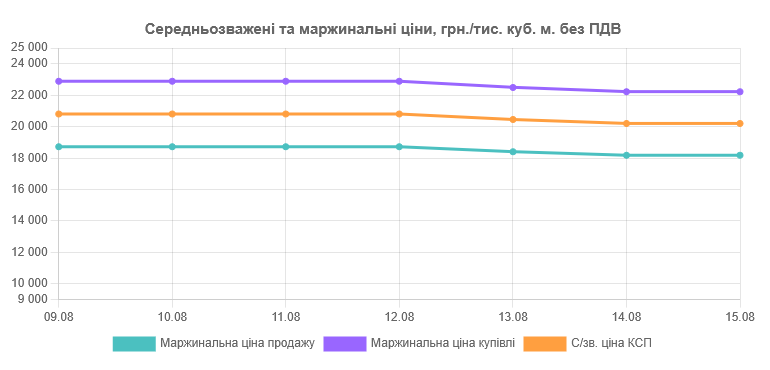

On the short-term natural gas market of the UEEX , participants placed bids on the intraday market. The deals were concluded for delivery to the Ukrainian gas transmission system. The weighted average price of the DAM on Friday, August 15, amounted to UAH 20200 excluding VAT.

European market

Gas prices declined last week. TTF futures dropped to around 32 euros/MWh. Gas stocks continue to grow, and geopolitical risks did not create a new shock in the short term. Steady gas supplies from Norway and high LNG imports offset some of the problems.

At the same time, the energy landscape was shaken by several strategic moves: Centrica and ECP (Energy Capital Partners) bought the Isle of Grain LNG terminal, Europe’s largest, for about €1.5 billion, sending a clear signal to the market about long-term dependence on imported gas, even as demand for its use in the power sector fell. In addition, Centrica has signed an agreement with the US-based Devon Energy to supply the equivalent of five LNG cargoes annually for a decade, another foundation that lays the groundwork for Europe’s energy security.

Month-ahead contracts at all analyzed hubs showed a different trend relative to spot prices, with an average increase of 1.64%. Quarter-ahead prices were higher than spot prices by an average of 4.68%. The season-ahead prices with an average value of 35.50 EUR/MWh tended to increase compared to the spot prices by an average of 5.77%.

September futures for LNG in Asia, the JKM Platts Future index, settled on August 14 at $426.38 per thousand cubic meters. US dollars per thousand cubic meters. The futures for LNG delivered to Northwest Europe (LNG North West Europe Marker) closed at $393.80 per mcm. US $/thousand cubic meters.

European LNG terminals operated on August 13 with an average capacity of 79.81%.

LNG stocks in the EU as of August 13, 2025 amounted to 4.336 million cubic meters, according to the Aggregated LNG Storage Inventors.

The storage level of the largest LNG exporter, the United States, according to the latest EIA data as of August 8, 2025, was 3.186 billion cubic feet, which is 6.6% higher than the average for the last five years.

This week, oil prices have declined – for example, Brent is trading in the range of $66-67 per barrel. OPEC+ has announced a significant increase in production (over 500 thousand barrels per day since September), and the imbalance between supply and demand is beginning to be smoothed out as the peak supply season gradually ends.

The meeting between Trump and Putin in Alaska is putting the market on edge. If sanctions against Russia are eased, prices could move downward, even to below $60 per barrel. On the other hand, if the opposite is true, the confrontation will escalate, and prices could jump up, approaching or even surpassing $80-90 per barrel.

Gas balance in Ukraine

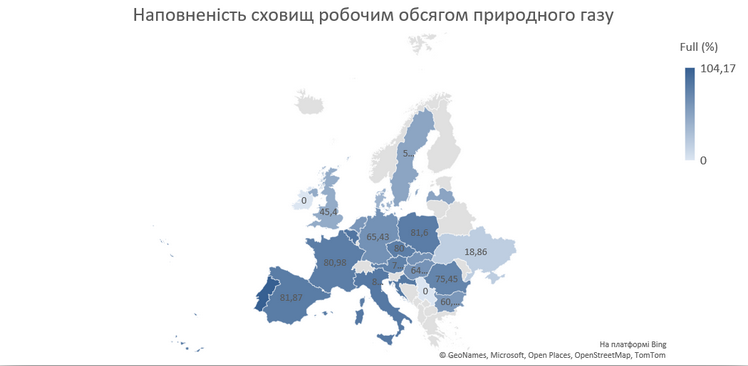

During the week, natural gas imports from Europe averaged 21 million cubic meters per day (1 million cubic meters higher than the previous week), from Hungary, Poland, Moldova, and Slovakia. The Hungarian direction was mainly used, although the share of other directions remained high. Ukraine’s storage facilities held about 10.4 bcm. There was virtually no withdrawal. Injection amounted to about 51 million cubic meters per day.

Interesting things for the week

For the first time, a €500 million loan for gas imports to Ukraine is provided under the EU’s UIF Hi-Bar program , which does not require a Ukrainian state guarantee, Gas United reports. The UIF – Ukraine Investment Framework – is the investment component of the Ukraine Facility program for the rehabilitation of energy infrastructure. The financing was launched at the URC-2024 in Berlin. The EBRD provided the funds for gas imports under the Hi-Bar facility, which aims to remove barriers to mobilizing the financing needed to accelerate the transition of the energy sector to net-zero, which involves the maximum possible reduction in greenhouse gas emissions.