The State Tax Service will operate as a single legal entity from January 1, 2021.

“From January 1, 2021, the territorial bodies of the State Tax Service, created as its separate divisions, begin to exercise the powers and functions of the territorial bodies of the State Tax Office, which are liquidated as a legal entity,” the service said on its website on Thursday.

The corresponding order was signed by head of the department Oleksiy Liubchenko on Thursday.

According to him, this is the final step in the transition of the service to the format of a single legal entity.

Thus, from January 1, the service will consist of the central office and territorial bodies as separate units, the department added.

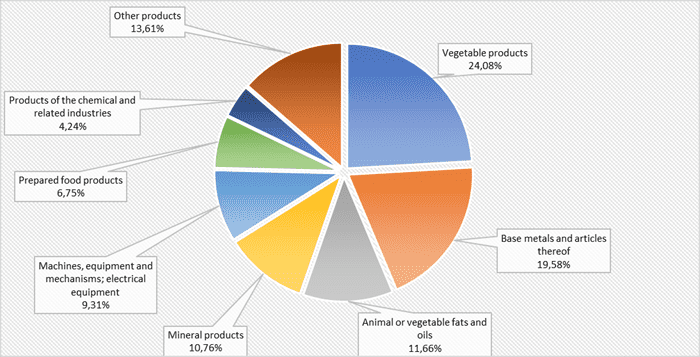

Foreign trade turnover by the most important positions in Jan-Sept 2020 (export).

Electricity consumption in Ukraine in January-November 2020, taking into account in-process losses, decreased by 3.6% (by 4.917 billion kWh) compared to the same period in 2019, to 131.305 billion kWh, the Ministry of Energy has told Interfax-Ukraine.

Excluding in-process losses, electricity consumption over 11 months decreased by 3.2% (by 3.456 billion kWh), to 105.864 billion kWh.

The country’s industry, excluding in-process losses, reduced electricity consumption by 4.6%, to 44.768 billion kWh. In particular, metallurgical industry consumed 24.767 billion kWh (6.4% less compared to January-November 2019), fuel industry 2.791 billion kWh (5.6% less), machine building industry – 2.791 billion kWh (16.5% less), chemical and petrochemical – 3.953 billion kWh (11.7% more), food and processing – 3.953 billion kWh (3.7% down), construction materials – 2.116 billion kWh (1.9% more), others – 4.422 billion kWh (4.1% more).

In addition, agricultural enterprises consumed 3.411 billion kWh (0.2% more), transport – 5.103 billion kWh (14.5% less), construction – 831.2 million kWh (4% less).

The population of the country consumed 32.583 billion kWh (2.4% more), household consumers – 12.719 billion kWh (6.7% less), other non-industrial consumers – 6.449 billion kWh (down by 3.9%).

According to the results of 11 months, the share of industry in the total volume of electricity consumption decreased from 42.9% to 42.3%, while the share of the population increased from 29.1% to 30.8%.

In the Novohrad-Volynsky region, law enforcement officers caught up and forcibly stopped a Nissan minibus, which contained 27 bags of amber, the police communication department of Zhytomyr region reports.

“At about 20:00 on 255 kilometer of the Kyiv-Chop highway, near Povchyno village, Novohrad-Volynsky district, the patrolmen forcibly stopped a Nissan car. Moving through the territory of Rivne region, the driver violated several traffic rules and did not stop at the request of the police, so they decided to catch up with him and check. As it turned out, the driver avoided talking to the police because of the cargo in the minibus,” a message on the police website says.

So, when inspecting the car, it turned out that the driver was transporting 27 bags of stones that looked like raw amber. However, in order to avoid administrative and criminal liability, the driver, 51-year-old resident of Chernivtsi region, offered the police EUR 1,000 of inappropriate benefits.

The discovered stones were seized and transferred for safekeeping at the State Directorate of the National Police in Zhytomyr region, an expert study was appointed.

The pretrial investigation is carried out in accordance with Article 240-1 (illegal extraction, sale, acquisition, transfer, shipment, transportation, processing of amber) of the Criminal Code of Ukraine. The police also documented the circumstances of improper benefits offer to the patrolmen. On this fact, criminal proceedings have been initiated under Article 369 of the Criminal Code of Ukraine.

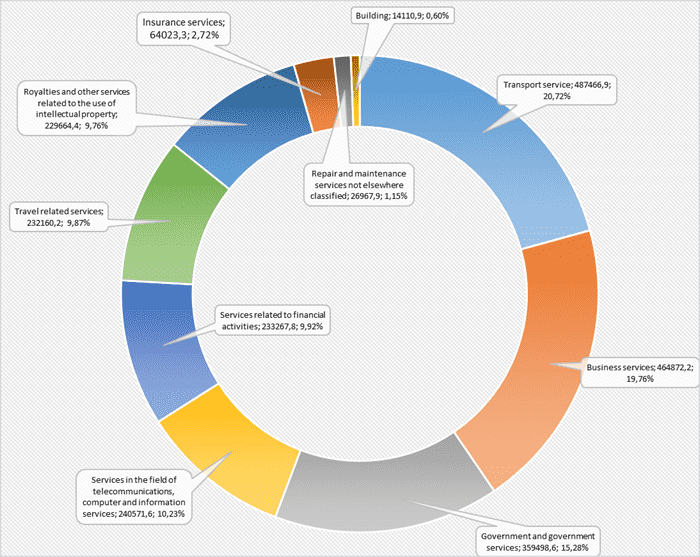

Structure of export of services in the first half of 2020 (graphically).

Caris Ukraine LLC (Kyiv), controlled by South Korean Caris, intends to buy out the shares of minority shareholders of Strila crane building company (Brovary, Kyiv region), in which it owns 89.837% of shares.

According to the public irrevocable demand published in the information disclosure system of the National Securities and Stock Market Commission of Ukraine, the shares from the minority shareholders will be redeemed at UAH 129.4 per share (with a par value of UAH 110).

The charter capital of JSC Strila is UAH 6.21 million.

At present, Strila plant, which employed ten people by the beginning of this year, does not carry out production activities (since 2015), and receives main income from the sale of materials and partial lease of premises.

Caris, according to its information, has enterprises in many countries of the world, construction, logistics companies, companies for the production of innovative materials and components for road construction and traffic safety, and also has an R&D center that owns patented innovative technologies for the production of polymer and superhard materials used in heat power engineering, industrial electronics and mechanical engineering.