Yuliya Tymoshenko, the leader of the All-Ukrainian Union Batkivschyna (Fatherland), has been on the top of presidential ratings in opinion polls, followed by President Petro Poroshenko and showman Volodymyr Zelensky.

According to the results of a recent poll conducted by Sociological Group Rating from September to October 2018, 17% of the people polled who said they had made their choice and were willing to go to vote said they have decided to vote for Tymoshenko as president. Poroshenko and Zelensky are supported by 10% of those polled each.

Anatoliy Hrytsenko, the leader of the Civil Position party, got 9% of the vote, Yuriy Boyko of the Opposition Platform — For Life received 8%, and Vadym Rabinovich of the same platform got 5%.

Some 5% of those polled said they would vote for Oleh Lyashko, the leader of the Radical Party, another 4% supported the singer and civil activist Sviatoslav Vakarchuk.

Among all the people polled, Tymoshenko received support from 14% of the people, Poroshenko and Zelensky got 8% each, and Hrytsenko received 7%.

The poll entitled “The Dynamics of Socio-Political Views in Ukraine” was conducted from September 28 to October 14, 2018, by Sociological Group Rating by order of the International Republican Institute (IRI.)

A total of 2,400 people aged 18 and above were polled across Ukraine in formal face-to-face interviews. The non-sampling error is no more than 2%.

The Lviv International Danylo Halytsky Airport in January-November 2018 increased passenger flow by 47.1% year-over-year, to 1.468 million people, the airport has reported on its official Facebook page.

At the same time, the number of flights in January-November 2018 increased 28.3%, to 14,148 (11,000 a year ago).

According to the results of the airport in November 2018, 124,900 passengers (109,100 international and 15,800 domestic) took advantage of the air traffic, which is 57.1% more than in November 2017 (79,500).

The number of flights serviced in November reached 1,235 (1,035 international and 200 domestic), which is 31.4% more than in November last year (940).

As reported, the Lviv airport in January-October 2018 increased passenger traffic by 46.3%, to 1.343 million people.

Lviv International Danylo Halytsky Airport is located 6 km south from the city center.

The main international routes serviced by the airport are Warsaw, Istanbul, Munich, Vienna, Baku, Thessaloniki, Madrid, Rome, Tel Aviv, Bologna, Radom, Iraklion, Minsk, and Burgas.

Ukrainian agricultural exports to the European Union countries in January-October 2018 grew by 1.3% year-over-year, to $4.7 billion, according to a posting on the website of the Agricultural Policy and Food Ministry of Ukraine.

According to the report, over the period foreign trade flow with agricultural goods and food between Ukraine and the EU countries rose by 7.15, to $6.9 billion.

“The EU countries are extremely important partners for Ukraine in terms of trade and economic relations in the agro-industrial sector. The pace of bilateral trade in agricultural and food products confirms this. The EU’s share of the regional structure of Ukrainian agricultural export in January-October 2018 is 31.6%,” Deputy Minister of Agrarian Policy and Food for European Integration Olha Trofimtseva said.

According to her, the Netherlands ($865,500), Spain ($713,600), Italy ($583,700) and Poland ($535,300) became the largest importers of Ukrainian agricultural products among the EU countries in January-October.

“During this period, Ukrainian producers increased exports of a number of products to EU markets. First of all, these are rapeseed, meat and edible poultry byproducts, wheat, corn, dried leguminous vegetables, nuts, confectionery goods made from sugar, rapeseed or mustard oil, chocolate and other products,” Trofimtseva said.

The deputy minister said that imports of European goods showed an increase over the specified period and amounted to almost $2.2 billion. In January-October 2018, Ukraine imported from the EU countries tobacco and products from it, chocolate and cocoa beans, animal feeding products, meat and byproducts, alcoholic beverages, grain products and cereals and other products.

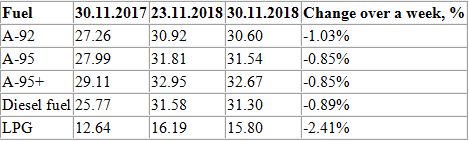

Average retail prices for petrol and diesel fuel in Ukraine in the period from November 23 to November 30, 2018 fell by 0.85-1.03%, while prices of LPG by 2.41%, according to data from the A-95 Consulting Group (Kyiv).

As reported, in 2017, average retail prices for petrol in Ukraine increased 19.2-20.1% (UAH 4.61-4.76 per liter), and for diesel fuel 22.6% (UAH 4.84 per liter). At the same time, average prices for liquefied petroleum gas (LPG), despite a sharp increase in August due to deficit, showed an increase of only 2.9% for the year (by UAH 0.36 per liter).

Changes in average retail fuel prices UAH per liter in Ukraine:

©Source: A-95 Consulting Company