TAS-Dniprovagonmash LLC (DVM, Kamianske, Dnipro region), a major Ukrainian railcar manufacturer controlled by businessman Sergiy Tigipko’s TAS Financial and Industrial Group, ended January-June 2024 with a net profit of UAH 18.85 million, three times less than in the same period in 2023.

According to the company’s interim reports, published on Tuesday in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), its net income in the first half of the year increased by 37.8% to UAH 796.47 million.

The company reduced its gross profit by 3% to UAH 78.4 million, earning UAH 26.44 million in operating profit (2.2 times less).

As reported, in the first quarter of this year, TAS Dneprovagonmash reduced its net profit by 5.2 times compared to the same period in 2023, to UAH 7.17 million, with a 4.4% decrease in revenue to UAH 379.24 million.

Thus, in the second quarter of 2014, the company reduced its net profit by 44% year-on-year to UAH 11.68 million, while net revenue increased by 30.4% to UAH 417.22 million.

In April-June, the plant’s production capacity was utilized by 22%, and the equipment utilization rate was 26%,

The report notes that in the second quarter of 2024, the plant produced 140 freight cars (177 units in the first quarter), which accounted for 23% of the total Ukrainian production (28% in the first quarter). Its main competitors include Kryukiv Carriage Works, Karpaty Railcar Plant, and Ukrzaliznytsia plants.

The average selling price of a freight car is UAH 2.215 million. Key customers: “TAS Poltavagon, MTB Bank, TAS Logistic, and Tecom Leasing.

According to the company, exports for this period amounted to UAH 3.4 million (0.8% of sales in the second quarter).

As noted in the report, TAS Dneprovagonmash’s annual budget for 2024 provides for the supply of 26 units of products to the European market.

“In the second quarter of 2024, the freight base of railway logistics in Ukraine showed an upward trend – +2%, or +0.9 million tons, compared to the first quarter of 2024 and +27.3%, or +9.8 million tons, compared to the same period in 2023. This, in turn, contributed to an increase in demand for newly built freight cars,” the statement said.

At the same time, the company continues to note the presence of factors restraining the dynamics of car building, in particular massive shelling, the abolition of restrictions on the maximum service life of cars in 2021, and an increase in the rolling stock turnover due to the lack of traction rolling stock at Ukrzaliznytsia.

“However, in general, in the second quarter, the production of freight rolling stock by Ukrainian enterprises tended to grow. The work of the Ukrainian Corridor (transport – IF-U), namely the Black Sea routes, remains a key factor in the growth of cargo turnover and the formation of demand for freight cars,” the document states.

As reported, at the beginning of 2023, TAS Group became a strategic investor in the TransAnt GmbH railcar building joint venture of Austrian Voestalpine and ÖBB Rail Cargo with a 40% stake, and in the spring of 2024 it became the majority owner of TransAnt, increasing its stake to 61%.

According to the company, in the second quarter of 2024, it shipped platform cars as part of the project.

This year, the company intends to invest UAH 100.2 million in the development of the European direction (for the purchase of equipment).

As reported, the company produced 378 freight cars in 2023 (including for the EU market), which is 34.8% less than in 2022, while sales decreased by 40.6% to 370 units. Revenue decreased by 2.8% to UAH 1 billion 77 million, while net profit increased slightly to UAH 49.2 million.

TAS Group was founded in 1998 by businessman Tigipko. Its business interests include the financial sector (banking and insurance) and pharmacy, as well as industry, real estate, and venture capital projects.

In January-June 2024, JSC Ukrgasvydobuvannya paid UAH 11.02 billion of rent payments to the consolidated budget of the country.

“Of this amount, 5%, or UAH 551.03 million, goes to the budgets of local and regional levels in the regions where the company produces hydrocarbons,” the company’s website said on Wednesday.

In particular, Kharkiv region will receive UAH 284.66 million, Poltava region – UAH 220.36 million, Lviv region – UAH 22.76 million, Dnipropetrovs’k region – UAH 10.76 million, and others – UAH 12.49 million.

As reported, in 2022, Ukrgasvydobuvannya produced 12.5 bcm of natural gas (commercial), which is 3% less than in 2021. At the end of 2023, commercial gas production amounted to 13.224 billion cubic meters, which is 0.679 billion cubic meters more than in 2022.

NJSC Naftogaz of Ukraine owns 100% of Ukrgasvydobuvannya shares.

The Ukrainian Grain Association (UGA) has lowered its estimate of the potential harvest of grains and oilseeds in 2024 by 2.8 million tons compared to the previous forecast, to 71.8 million tons, the association’s press service reports.

“The current forecast is based on the average weather conditions over the past five years, so the improvement or deterioration of these conditions in spring and summer make adjustments. Another decrease in the harvest forecast for the new season was caused by the hot and dry weather in Ukraine in July this year, which negatively affected the potential yield of late grains and oilseeds,” the report says.

According to experts, under such conditions, exports in the new season 2024/2025 will amount to 41 mln tons, which is 2.5 mln tons less than the previous forecast. Last season, which ended on June 30, according to the UGA, the export of grains and oilseeds amounted to 57.5 mln tons of grains and oilseeds. Thus, the drop in exports compared to the previous season could be more than 16 million tons.

The UGA estimates the wheat harvest in 2024 at 19.8 mln tons (22 mln tons in 2023). Potential exports of wheat in 2024/2025 MY may amount to about 13 mln tonnes, taking into account that at the beginning of the season carry-over stocks amounted to almost 1 mln tonnes.

The UGA pointed out that the consumption of wheat in Ukraine has decreased due to the war and significant outflow of population abroad. According to the Ministry of Agrarian Policy of Ukraine, wheat consumption decreased from 8 mln tons to just over 6 mln tons.

According to the UGA, the barley harvest in 2024 may reach 4.95 mln tonnes, which is 350 thsd tonnes more than the previous estimate (5.8 mln tonnes in 2023), and potential exports in 2024/2025 MY are expected to reach about 2 mln tonnes (last year barley exports amounted to almost 2.5 mln tonnes).

Expectations for the corn harvest in the new season are deteriorating due to the prolonged dry period in a number of regions. The UGA estimates the corn harvest at 23.4 million tons, which is 2.1 million tons lower than the previous estimate and 6.2 million tons less than last year’s harvest of 29.6 million tons. At the same time, potential exports may amount to about 18.5 mln tons (last season, exports amounted to 29.3 mln tons, in particular due to carry-over corn stocks).

The sunflower harvest in 2024 can be expected at 12.8 mln tons, which is 0.9 mln tons lower than the previous estimate (2023 – 14.2 mln tons). Potential exports could reach up to 250 thsd tonnes, while sunflower crushing for vegetable oil could reach 12.5 mln tonnes. Last season, the processing amounted to 13.5 mln tons.

In 2024, the UGA expects the rapeseed harvest to reach 4.3 mln tonnes (4.5 mln tonnes in 2023), while the exports in 2024/2025 MY will be 3.4 mln tonnes (3.7 mln tonnes in the current season).

As for soybeans, despite the fact that farmers have increased the area under the crop, unfavorable weather conditions will not allow to get a bigger harvest due to lower yields, experts believe. According to their estimates, the soybean harvest can be expected in 2024 at 4.8 mln tonnes, which is 0.7 mln tonnes less than the previous estimate (4.9 mln tonnes in 2023). Potential exports in 2024/2025 MY may reach 3.5 mln tonnes (last season – almost 3 mln tonnes).

As reported, in 2023, the UGA estimated the harvest at 82.8 mln tons of grains and oilseeds.

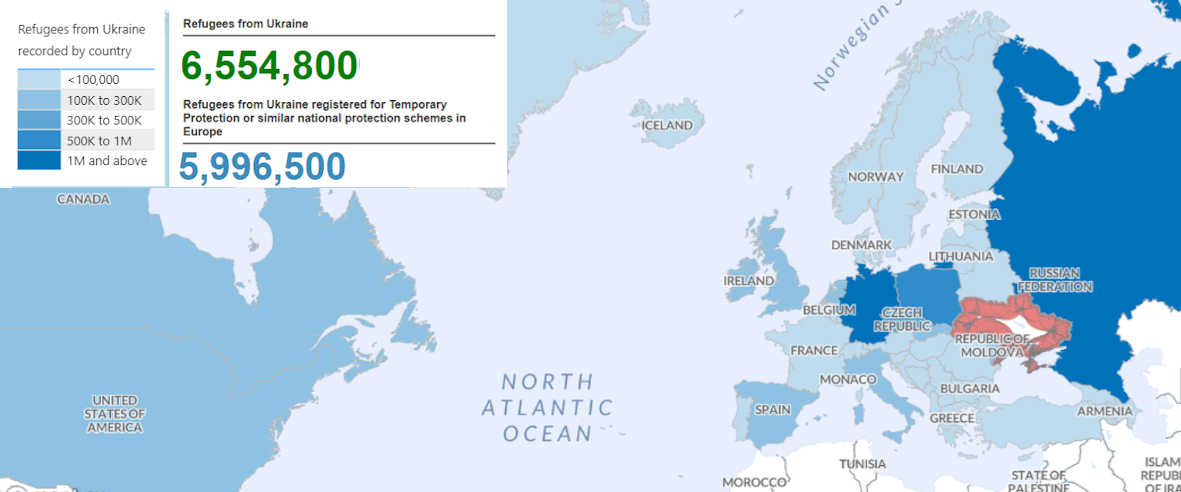

Number of refugees from Ukraine in selected countries as of 31.05.2024

Source: Open4Business.com.ua

The U.S. Agency for International Development (USAID) has raised more than $510 million from the private sector and international donors to support Ukrainian agricultural producers over two years as part of the Agricultural Resilience Initiative in Ukraine (AGRI-Ukraine), with the U.S. government contributing another $350 million to the program, the donor organization said.

“AGRI-Ukraine, founded in July 2022, has already helped more than 14 thousand Ukrainian farmers, which is 32% of registered agricultural producers in the country, to obtain the necessary resources, such as seeds, fertilizers, plant protection products, access to storage facilities and financial resources. This made it possible to harvest crops and provide additional income of more than $90 million due to an increase in corn and sunflower production by 430 thousand tons,” the statement said.

When Russia tried to block the export of Ukrainian agricultural products through the Black Sea ports, AGRI-Ukraine helped to prepare alternative export routes, in particular through ports on the Danube River and land border crossings.

Thanks to these measures, 62 million tons of agricultural products were exported, bringing more than $17 billion to the Ukrainian economy, USAID stated.

According to the donor organization, contributions of $510 million provided by the private sector and international donors tripled the original target set by USAID.

“In 2023, AGRI-Ukraine expanded its circle of partners to include 26 Ukrainian agricultural companies, the American seed company Gowan Seed, international financial institutions such as the European Bank for Reconstruction and Development, and the governments of the Republic of Korea and Japan.

“USAID and its partners remain committed to supporting Ukraine’s agricultural sector and the export of Ukrainian agricultural products, which will help mitigate the global food crisis that is deepening as a result of the war unleashed by Russia,” the donor organization assured.

Ferrexpo, a mining company with assets in Ukraine, increased its total sales of iron ore products by 85% year-on-year to 3.8 million tons in January-June this year.

According to the company’s interim report, out of 3.8 million tons, 1.8 million tons were exported through Ukrainian Black Sea ports.

Total commercial production in the first six months of 2024 increased by 75% to 3.7 million tons, including 3.3 million tons of pellets and 0.4 million tons of commercial concentrate.

C1’s production cost in 1H2024 increased to $79/tonne due to higher energy costs, expansion of mining activities, maintenance and repairs, partially offset by the positive effect of currency devaluation and cost-saving measures, the report explains.

It also notes that due to difficulties with electricity supply, the company is addressing this issue. At the same time, electricity costs in June increased by about $11/tonne at C1’s cost compared to the previous month. “C1 Group’s costs increased to $78.8/tonne in H1 2024 due to higher electricity prices offset by a slight devaluation of the hryvnia and the effect of a more favorable fixed exchange rate and increased production volumes,” the report explains.

Total distribution expenses in the reporting period increased to $148 million compared to $74 million in the first half of the previous year due to sales growth. And it is noted that maritime logistics routes are usually the cheapest and most efficient way to deliver the group’s products to its customers. As a result, sea sales increased by 1.7 million tons to 2.1 million tons in the first half of 2024 compared to 0.4 million tons in the same period of 2023.

In 1H2024, Ferrexpo reduced its capex by 5% year-on-year to $55 million from $58 million as a result of a 64.2% increase in revenue to $548.535 million from $334.010 million. EBITDA increased by 24.1% to $79.043 million from $63.685 million. Cash at the end of the first half of this year amounted to $115.131 million compared to $134.903 million at the end of June 2023.

In January-June 2024, Ferrexpo doubled its net profit compared to the same period last year to $55.490 million from $27.009 million. Pre-tax profit for the period amounted to $75.671 million, while in January-June 2023 it was $35.446 million.

In 2023, Ferrexpo reduced its capital investments by 37.1% to $101.247 million compared to $161.010 million in 2022 and $361 million in 2021.

Ferrexpo is an iron ore company with assets in Ukraine. Ferrexpo owns 100% of shares in Poltava Mining, 100% of shares in Yeristovo Mining and 99.9% of shares in Bilanivsky Mining.