Last week, trading in August 2025, September 2025 and subsequent months continued. In total, 4 companies formed positions for the purchase and sale of natural gas: LTC Electrum, GTS Operator of Ukraine, D.Trading, and Ukrzaliznytsia.

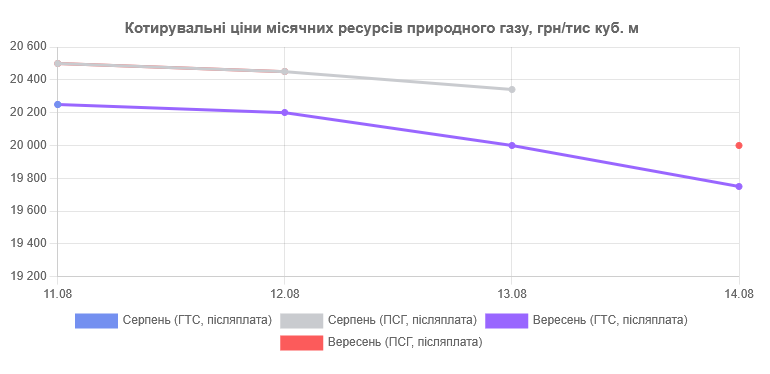

The starting prices of resources in the mid- and long-term market section varied widely. As a result, as of Friday, the average starting price of September resources in the GTS was 3.33% higher than on Monday. Last week, only buy positions were sold. In total, 20,700.00 thousand cubic meters of natural gas were sold, 17700 of which were purchased by the GTS Operator of Ukraine. Last week’s bidders formed the following quotation prices:

In the sections “Cross-border, customs warehouse” and “Imported natural gas”, the initiators formed starting positions, but no selling prices were formed in these sections last week.

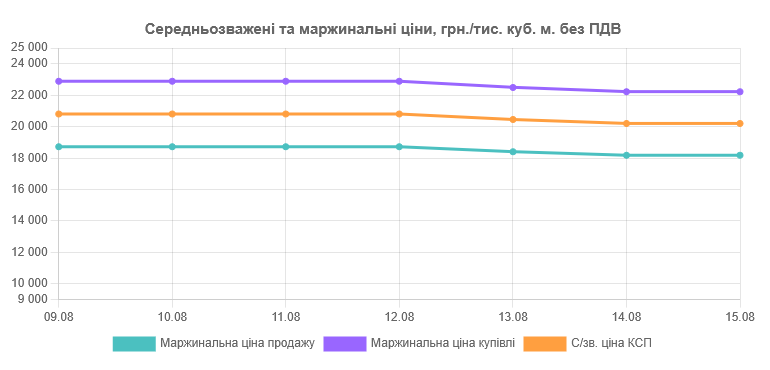

On the short-term natural gas market of the UEEX , participants placed bids on the intraday market. The deals were concluded for delivery to the Ukrainian gas transmission system. The weighted average price of the DAM on Friday, August 15, amounted to UAH 20200 excluding VAT.

European market

Gas prices declined last week. TTF futures dropped to around 32 euros/MWh. Gas stocks continue to grow, and geopolitical risks did not create a new shock in the short term. Steady gas supplies from Norway and high LNG imports offset some of the problems.

At the same time, the energy landscape was shaken by several strategic moves: Centrica and ECP (Energy Capital Partners) bought the Isle of Grain LNG terminal, Europe’s largest, for about €1.5 billion, sending a clear signal to the market about long-term dependence on imported gas, even as demand for its use in the power sector fell. In addition, Centrica has signed an agreement with the US-based Devon Energy to supply the equivalent of five LNG cargoes annually for a decade, another foundation that lays the groundwork for Europe’s energy security.

Month-ahead contracts at all analyzed hubs showed a different trend relative to spot prices, with an average increase of 1.64%. Quarter-ahead prices were higher than spot prices by an average of 4.68%. The season-ahead prices with an average value of 35.50 EUR/MWh tended to increase compared to the spot prices by an average of 5.77%.

September futures for LNG in Asia, the JKM Platts Future index, settled on August 14 at $426.38 per thousand cubic meters. US dollars per thousand cubic meters. The futures for LNG delivered to Northwest Europe (LNG North West Europe Marker) closed at $393.80 per mcm. US $/thousand cubic meters.

European LNG terminals operated on August 13 with an average capacity of 79.81%.

LNG stocks in the EU as of August 13, 2025 amounted to 4.336 million cubic meters, according to the Aggregated LNG Storage Inventors.

The storage level of the largest LNG exporter, the United States, according to the latest EIA data as of August 8, 2025, was 3.186 billion cubic feet, which is 6.6% higher than the average for the last five years.

This week, oil prices have declined – for example, Brent is trading in the range of $66-67 per barrel. OPEC+ has announced a significant increase in production (over 500 thousand barrels per day since September), and the imbalance between supply and demand is beginning to be smoothed out as the peak supply season gradually ends.

The meeting between Trump and Putin in Alaska is putting the market on edge. If sanctions against Russia are eased, prices could move downward, even to below $60 per barrel. On the other hand, if the opposite is true, the confrontation will escalate, and prices could jump up, approaching or even surpassing $80-90 per barrel.

Gas balance in Ukraine

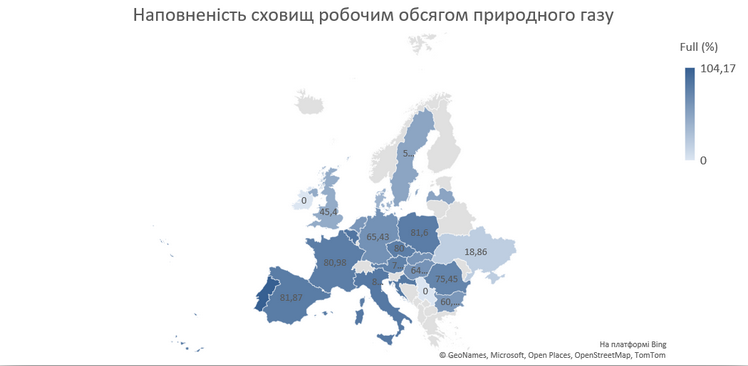

During the week, natural gas imports from Europe averaged 21 million cubic meters per day (1 million cubic meters higher than the previous week), from Hungary, Poland, Moldova, and Slovakia. The Hungarian direction was mainly used, although the share of other directions remained high. Ukraine’s storage facilities held about 10.4 bcm. There was virtually no withdrawal. Injection amounted to about 51 million cubic meters per day.

Interesting things for the week

For the first time, a €500 million loan for gas imports to Ukraine is provided under the EU’s UIF Hi-Bar program , which does not require a Ukrainian state guarantee, Gas United reports. The UIF – Ukraine Investment Framework – is the investment component of the Ukraine Facility program for the rehabilitation of energy infrastructure. The financing was launched at the URC-2024 in Berlin. The EBRD provided the funds for gas imports under the Hi-Bar facility, which aims to remove barriers to mobilizing the financing needed to accelerate the transition of the energy sector to net-zero, which involves the maximum possible reduction in greenhouse gas emissions.

The long-awaited revival in the construction of vegetable storage facilities has begun in Ukraine, with small and medium-sized facilities prevailing, Andriy Marushchak, Commercial Director of Van Dyke Techs, told SEEDS in an interview. According to him, this format allows farms to quickly meet local needs, but “storage is not everything”: without parallel development of processing, the effect will be limited.

According to the expert, construction is currently most active in Lviv, Khmelnytsky, Vinnytsia, Cherkasy, Odesa, Dnipro, and Chernihiv regions. The farmers’ decision was influenced by the high cost of logistics: “It is no longer as profitable to transport onions 400-800 km as it is to grow and store them closer to the market,” Marushchak said.

The most promising areas for a quick launch are French fries, dried mashed potatoes, peeled/ready-made potatoes; for onions, peeling, freezing and drying. In countries where processing is already in operation, farmers have gradually scaled up storage facilities from 3 to 30 thousand tons or more; it is logical for the Ukrainian market to follow the same trajectory, the expert emphasizes.

Vegetable consumption in Ukraine is less than 30% of WHO recommendations (≈150-200 g per day versus 600 g), which restrains demand beyond the “borscht set”. In a typical consumption structure, the share of potatoes is 50-60%, cabbage – ~10%, carrots – ~5%, and beets – “very little,” Marushchak said.

For the stable operation of storage and processing plants, it is important for farmers to form commodity lots and fulfill long-term contracts through professionally managed cooperatives, a model that has been successfully operating in the EU, the expert emphasizes.

https://www.seeds.org.ua/ovochesxovishh-v-ukraini-stane-bilshe-fermeri-pochali-aktivne-budivnictvo/

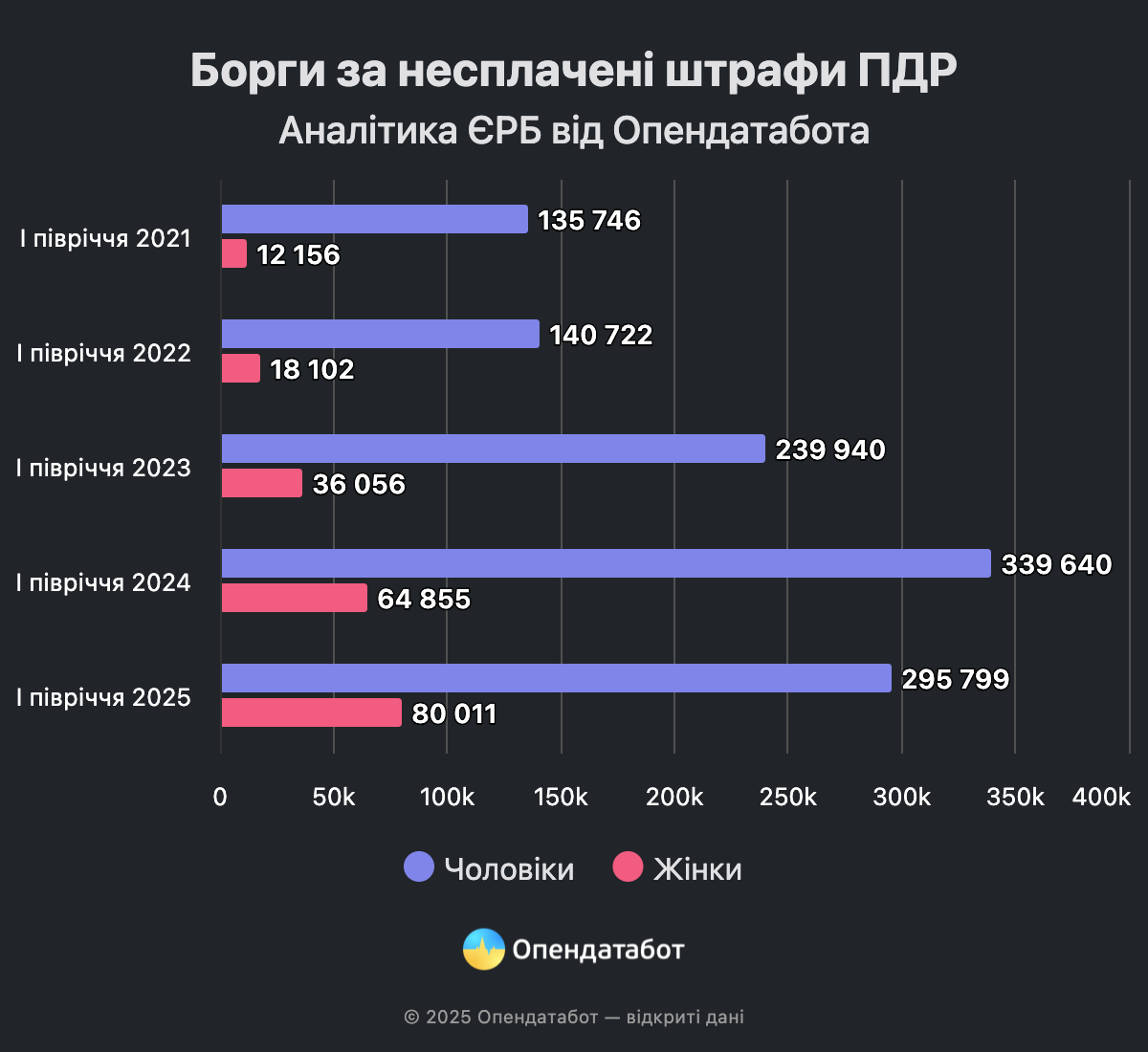

In the first half of 2025, the Unified Register of Debtors recorded 375,810 cases of non-payment of traffic fines. Although the figure has slightly decreased compared to last year, it remains significantly higher than the pre-war level. The capital ranks first in terms of the number of proceedings, and there are more and more women among the debtors. In 2025, they already account for 21% of all cases, up from 8% on the eve of the full-scale.

375,810 debts for non-payment of traffic fines – this is the number of cases recorded in the Unified Register of Debtors in the first half of 2025. This is less than last year, but still a third more than in 2023. Compared to the period before the outbreak of full-scale war, the number of debts and violations has increased most significantly, by as much as 2.5 times.

Since the start of the full-scale war, not only has the number of unpaid fines increased, but the gender distribution of drivers has also changed, both quantitatively and percentage-wise. The proportion of women who owe a traffic fine on time is growing year after year. If in the first half of 2021, women accounted for only 8% of proceedings, this year it is already 21%.

Men aged 25-45 are the most likely to violate and fail to pay fines in Ukraine, accounting for 41% of all proceedings.

Among the regions, Kyiv is the leader in traffic violations – 12% or 43,654 proceedings. It is followed by Dnipropetrovs’k region – 36,879 or 10% and Odesa region – 29,502 or 8%.

In total, the Unified Register of Debtors contains 1.8 million unpaid debts due to traffic violations. The vast majority – 1.7 million – are men.

It is worth noting that the URB is a non-static register, in which some debts are closed, while new ones may appear in their place. Therefore, these figures reflect the situation as of early July 2025.

In order to avoid being included in the Register of Debtors and the risk of card blocking, check and pay traffic fines in Opendatabot in a timely manner – or subscribe to free monitoring and get the information as soon as it appears in the registers. If the fine is not paid within 15 days, its amount increases by 2 times.

The total forecast for wheat production in Ukraine for the 2025-2026 marketing year (July-June) is about 21 million tons, of which 10.3 million tons will be food wheat, while the harvest of grade 1-2 grain, which is needed to produce bread-making flour, is forecast at 1.7 million tons, according to Rodion Rybchinsky, chairman of the Ukrainian Millers’ Union.

“We are already seeing growing competition between processors and exporters for high-quality wheat, while farmers, who have the opportunity to store grain for several years, are in no hurry to sell it. This creates risks for price stability and the availability of flour and bakery products for consumers,“ the association’s press service quoted him as saying at the ”Khleb.ua” conference on its Facebook page.

Rybchynsky drew attention to the situation with rye. Domestic production of this crop in Ukraine does not fully cover domestic demand. In 2025/26 MY, flour millers will have to import about 9,000 tons, while in the previous season this figure was 1,600 tons. The expert emphasized that such an increase in imports indicates the formation of a persistent shortage of raw materials.

“The current production structure and behavior of farmers may lead to further increases in flour prices. While the shortage of first- and second-class raw materials already determines the industry’s prospects, the issue of food grain availability poses risks to the country’s food security,” stressed the head of the Ukrainian Millers Association.

German newspaper Die Welt, citing EU diplomats, reports that Chinese authorities have confirmed their readiness to participate in a peacekeeping contingent for Ukraine.

However, it is emphasized that the government in Beijing will be ready to do so “if the peacekeepers are deployed on the basis of a United Nations mandate.”

“In Brussels, Beijing’s plan has met with a mixed reaction. On the one hand, it is said that the inclusion of countries from the Global South, such as China, could make the deployment of foreign troops for peace monitoring more acceptable,” Die Welt writes.

“However, on the other hand,” the publication continues, “there is also a danger that China will primarily want to spy on Ukraine and take a clearly pro-Russian position instead of a neutral one in the event of a conflict,” said a senior EU diplomat familiar with the ongoing discussions.

Venezuelan President Nicolás Maduro has announced the deployment (mobilization) of up to 4–4.5 million Bolivarian National Police officers in response to “threats from the US” and the build-up of American military presence in the Caribbean. This was reported by international media outlets, including El País, CBS News, and Al Jazeera.

According to the publications, Maduro’s statement came after the US decided to double the reward for information leading to his arrest and/or conviction to $50 million. The US State Department and the Associated Press/PBS agencies reported on the increase in the reward.

El País and other sources also note that Venezuela’s mobilization was a response to the deployment of US destroyers and other forces near the country’s coast, which has increased tensions in the region. Washington had previously accused Maduro of involvement in international drug trafficking and related crimes; the decision to increase the reward was announced this month.

American and international analytical publications note the growing military and political rhetoric on both sides and warn of the risks of further escalation. At the same time, there is no independent confirmation of the start of a “war” between the US and Venezuela; we are talking about mobilization steps and increased readiness against the backdrop of political confrontation.