The attitude of Ukrainians toward China remains complex and controversial: a neutral position prevails, but among those who have decided, negative assessments significantly outweigh positive ones. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 44.7% of Ukrainian citizens expressed a neutral attitude toward China. At the same time, 40.7% of respondents indicated that their assessment was negative (30.0% – mostly negative, 10.7% – completely negative). Only 12.0% of Ukrainians have a positive attitude toward China (8.3% – mostly positive, 3.7% – completely positive). Another 3.0% of respondents admitted that they did not know enough about the country to express their own opinion.

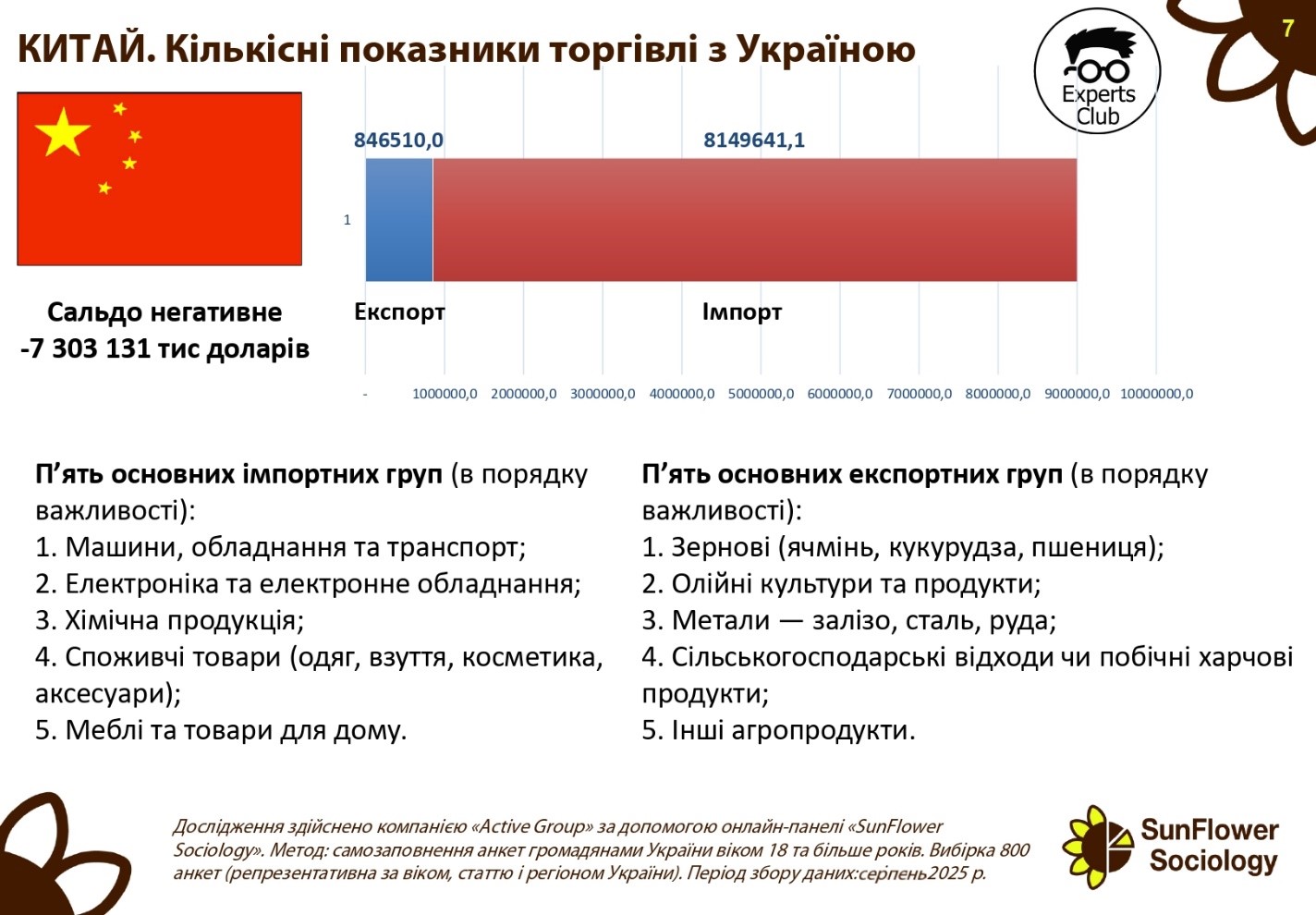

“Negative attitudes toward China among Ukrainians are primarily related to its foreign policy stance, which many people find ambiguous in the context of global events. However, the economic factor is extremely important: in the first half of 2025, China remained Ukraine’s No. 1 trading partner. Our exports to China amounted to more than $846 million, while imports exceeded $8.1 billion. This means that China’s influence on the Ukrainian economy is extremely significant, and it is simply impossible to ignore it,” said Maksym Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, drew attention to the importance of separating economic interests from public perception.

“The survey shows that Ukrainians are not ready to unequivocally perceive China as an ally. For many, it remains an alienated state, and a significant share of negative assessments is explained by the global political context and lack of trust. At the same time, economic cooperation is so extensive that it could become the basis for a gradual change in public opinion in the future,” he added.

The poll is part of a broader study that analyzes international sympathies and antipathies of Ukrainians in the current geopolitical environment.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, CHINA, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, URAKIN

Turkey remains one of the most positively perceived countries in the region for Ukrainians, driven by both political and economic factors. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

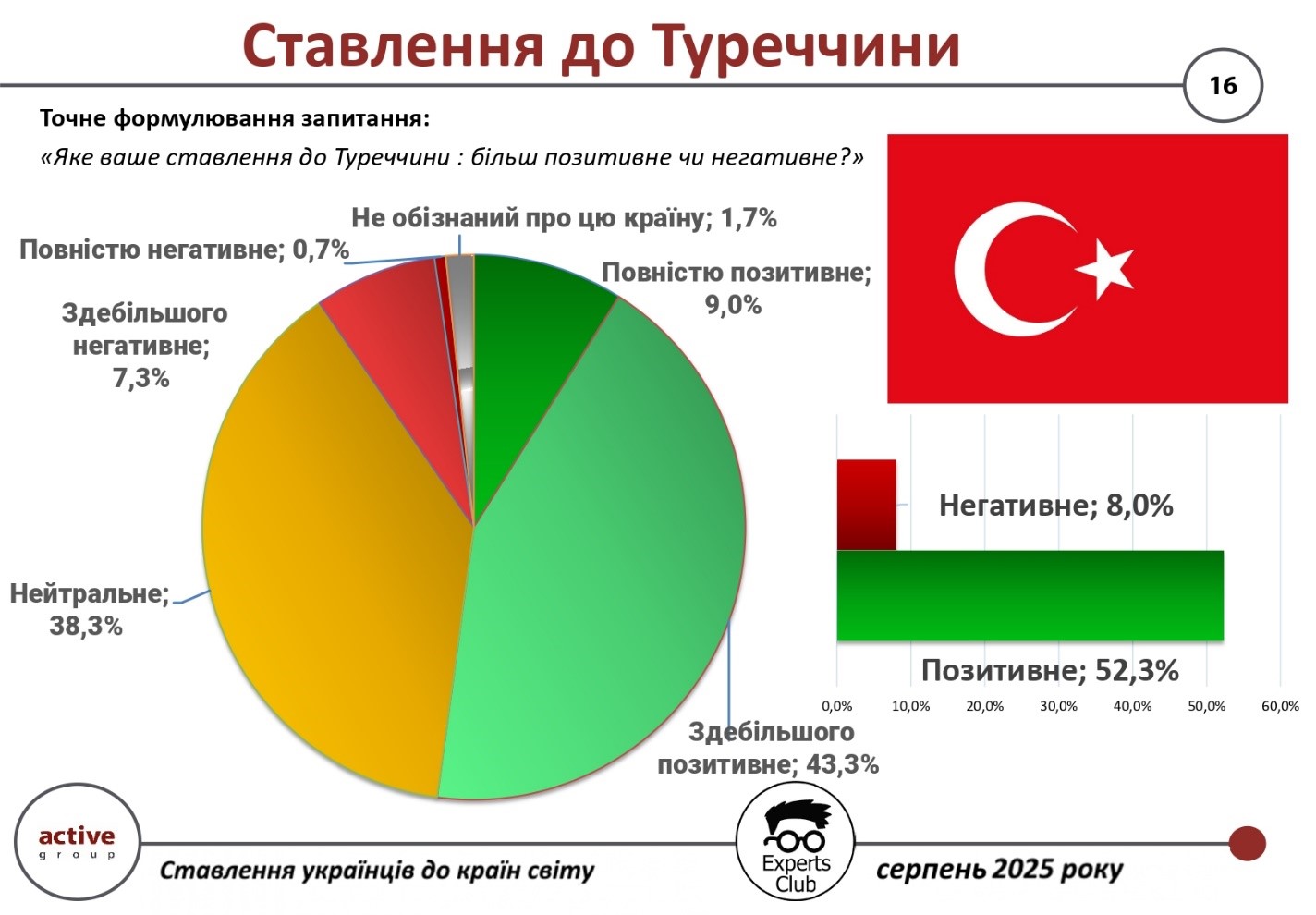

According to the survey, 52.3% of Ukrainian citizens have a positive attitude towards Turkey (43.3% – mostly positive, 9.0% – completely positive). Only 8.0% of respondents expressed a negative attitude (7.3% – mostly negative, 0.7% – completely negative). Another 38.3% of Ukrainians are neutral, and 1.7% admitted that they do not know enough about this country.

“For Ukraine, Turkey is not just a neighbor across the Black Sea, but a strategic partner with whom we have established close trade and economic ties. In the first half of 2025, the volume of bilateral trade exceeded $4.66 billion, of which exports from Ukraine amounted to more than $2.58 billion and imports from Turkey amounted to about $2.08 billion. The positive balance of more than $500 million shows that these relations are beneficial for the Ukrainian economy,” said Maksym Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, noted that the high level of positive assessments is explained not only by economic factors.

“Turkey is actively supporting Ukraine, which cannot be ignored by society. At the same time, the tourist destination, cultural contacts, and historical proximity through the Black Sea region create an additional level of sympathy among Ukrainians. This allows Turkey to occupy a consistently high position among the countries friendly to Ukraine,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, TURKEY, URAKIN

Poland remains one of the most positively perceived countries by Ukrainians, despite some controversies in bilateral relations. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 56.7% of Ukrainian citizens have a positive attitude towards Poland (44.3% – mostly positive, 12.3% – completely positive). Only 12.7% of respondents expressed a negative attitude (11.3% – mostly negative, 1.3% – completely negative). Another 30.0% of Ukrainians are neutral, and 1.0% said they are not sufficiently aware of this country.

“For Ukrainians, Poland is not only a neighbor, but also one of their key economic partners. In the first half of 2025, total trade between Ukraine and Poland exceeded $6.66 billion. At the same time, exports from Ukraine amounted to $3.03 billion, and imports from Poland exceeded $3.62 billion. The negative balance of $591 million does not seem critical, given the scale and strategic nature of cooperation,” said Maksym Urakin, founder of Experts Club.

In turn, co-founder of Active Group Oleksandr Poznyi emphasized that the positive attitude of Ukrainians towards Poland has deeper reasons than just the economy.

“We are talking about historical proximity, support for Ukrainian refugees, and Warsaw’s political solidarity in important international issues. At the same time, the economic dimension only strengthens these relations, making Poland one of Ukraine’s leading partners both in the EU and globally. It is the combination of political, humanitarian and economic components that explains the high level of sympathy in society,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, POLAND, Posniy, SOCIOLOGY, TRADE, URAKIN

Ukraine has announced a tender to conclude a production sharing agreement (PSA) for the Dobra lithium deposit (Kirovohrad region) to prospect, extract and enrich lithium, niobium, rubidium, tantalum, cesium, beryllium, tungsten and gold for a period of 50 years.

According to a report in the Uriadovyi Kurier newspaper and on the website of the Ministry of Economy, the minimum investment for exploration is the equivalent of $12 million, and for the organization of mining and processing of lithium-containing minerals and other metallic minerals – $167 million, but the final obligations are determined by the results of the tender. The total area of the site is 17.07 square kilometers, the deadline for submitting applications for participation in the tender is December 12, 2025, and the participation fee is UAH 0.5 million.

According to the terms, the maximum share of compensation products that will reimburse the investor for its costs is 70% of the total output until the investor’s costs are fully reimbursed, while the state’s share in profitable products should be at least 4-6%.

The Ministry of Economy clarified to Interfax-Ukraine that comparing such a share of the state in profitable products with a similar indicator for oil and gas PSAs, where it is significantly higher, is not correct, as this is the first PSA in the history of Ukraine for metal ores.

It is noted that the reserves and resources of lithium ores at the site were approved by decisions at the end of 2017 and in 2018 in the amount of C2 and P1 categories – 1 million 218.14 thousand tons (average Li2O content of 1.37%) and P2 – 70.6 thousand tons (average Li2O content of 1.43%).

Separately, the State Commission of Ukraine for Mineral Resources (SCR) noted the presence of prospective and inferred resources of associated mineral components (P1+P2) in lithium ores at Dobra: Ta2O5 – 4.75 thousand tons; Nb2O5 – 8.24 thousand tons; Rb2O5 – 104.07 thousand tons; BeO – 22.08 thousand tons; SnO2 – 4.46 thousand tons and Cs2O – 7.97 thousand tons.

“In addition, by the protocol dated 31.07.2002 No. 35, the resources of cat. P2 for the Novostankuvatske manifestation were estimated: Ta2O5 – 1414.22 tons (0.0127-0.0134%); Nb2O5 – 1734.5 tons (0.0163%); Li2O – 85196.1 tons (0.7541%); Rb2O5 – 9859.3 tons; Cs2O – 1493.6 tons; BeO – 3588.9 tons; SnO2 – 447.9 tons; WO3 – 8862.3 tons (cat. P3; 0.177%); at the Tashlykskoye ore occurrence: Ta2O5 – 480.32 tons (0.0106-0.0854%); Li2O – 13,596.4 tons (0.6291%); Rb2O5 – 1371.9 tons; Cs2O – 345.4 tons; BeO – 447.4 tons; SnO2 – 106.9 tons; Nb2O5 – 903.0 tons (0.0244%); Lutkivske deposit: WO3 – 2292.4 t (cat. P3; 0.101-0.378%); Kontaktovoye ore occurrence: Au – 2.05 t (4.08 g/ton); on the Stankuvatskoye ore occurrence: Au – 1.78 tons (1.3-2.5 g/t). For the Severostankuvatskoye ore occurrence, the operationally estimated Li2O resources are: cat. P1 – 269.93 thousand tons and cat. P2 – 140.82 thousand tons with an average Li2O grade of 1.3548%,” the announcement reads.

The winner of the tender must ensure geological exploration of the subsoil and international audit of reserves at the site within two and a half years and submit materials on the assessment of lithium and other metal minerals reserves to the State Committee for the approval of such reserves.

After the conclusion of the PSA, the investor is obliged, among other things, to prospect, extract and enrich (primary processing) lithium and possibly other metal minerals, and to ensure the comprehensive development and mining of the metal mineral deposit.

In addition, the PSA tender documentation for the first time includes obligations for the investor related to the agreement signed at the end of April this year to establish the US-Ukraine Reconstruction Investment Fund, which has the priority right to invest in new projects for the extraction of rare earth materials and purchase their products.

In mid-June, the head of the President’s Office, Andriy Yermak, said that the development of the Dobra lithium deposit could become the first pilot project in cooperation with the United States.

In early July, the mining investment company TechMet (Dublin), one of the largest investors of which is the US government through DFC, announced its interest in participating in the first PSA tender for lithium mining in Ukraine and, if it wins, building processing facilities with investments of more than $0.5 billion. Recently, a delegation of DFC accompanied by the heads of the Ministry of Economy of Ukraine visited Kirovohrad region.

At the same time, the US-based Critical Metals Corp also claims its rights to the Dobra site, linking them to the transfer of assets from Australia’s European Lithium, which, in turn, received these rights from Ukraine’s Petro-Consulting LLC.

Issue No. 1 – September 2025

The purpose of this review is to provide an analysis of the current situation on the Ukrainian currency market and forecast the hryvnia exchange rate against key currencies based on the latest data. We analyze current conditions, market dynamics, key influencing factors, and likely scenarios.

Analysis of the current situation on the currency market

International context

The first half of September in the global financial markets, as well as in the Ukrainian one, was marked by the expectation of a key decision by the US Federal Reserve. The Fed chairman made it clear that policy would have to be adjusted in order not to “overstretch” the economy, which is already showing signs of cooling. Inflation rose slightly again in August, but not critically, and the labor market is gradually weakening. This has put investors on hold: whether the Fed will cut rates in September or take a break. This answer will affect not only the dollar, but also the dynamics of the euro and hryvnia, as well as gold, stock, and even cryptocurrency prices.

Against this background, Europe looks quite calm. Inflation is hovering around 2%, which is the level that the European Central Bank is targeting. There are no new reasons to raise rates, so the regulator decided not to change anything. The eurozone economy is growing very slowly, and this does not give the euro strong arguments for strengthening.

Oil and gas prices did not add to the intrigue in August and September: prices remained more or less stable, with no new peak fluctuations. This is even a disadvantage for the euro, as the absence of energy pressure removes the need for the ECB to act more firmly.

The actual Fed rate cut has not yet occurred, but the market is already living in anticipation of this step, which analysts believe is most likely. Both globally and in Ukraine, the dollar is gradually weakening precisely because investors are pricing in the high probability of a policy easing by the US central bank.

In the euro/dollar pair, the euro is recovering without any drivers of its own, thanks solely to the dollar’s weakening. In Ukraine, the dollar is also drifting downward. This means that the “cheaper” dollar is actually already taken into account in quotes. At the same time, if the Fed does cut the rate in September, the reaction may be short and moderate, as the market has already played out most of the potential impact of this scenario. But if the Fed surprises by keeping the rate unchanged, the dollar will have a chance for a short-term pullback, and the market will have to quickly revise its estimates and expectations.

Domestic Ukrainian context

In Ukraine, the situation remains under control. The National Bank has record reserves and can smooth out any surges in demand or supply of currency. The official hryvnia exchange rate is gradually strengthening, and the cash market is moving in the same direction, without sharp deviations. Spreads – the difference between buying and selling – remain stable, indicating a consensus between the regulator and the market.

The key question for the coming weeks is how the dollar will react to the Fed’s decision. If the rate is cut, the hryvnia may receive additional support, and the euro may rise slightly higher. If the rate is left unchanged, the dollar will retain its advantage, and the Ukrainian market will feel it.

The main news of the first half of September was the government’s benchmark for the dollar exchange rate included in the draft budget for 2026 – an average annual rate of 45.6 UAH/$. It is close to the expectations of the business community: according to a survey by the European Business Association, member companies include UAH 46/$ in their financial plans for 2026, which is higher than the expected exchange rate for 2025 – UAH 44/$. In general, we see a devaluation consensus in the forecasts of the Ukrainian government and business, as there are no prerequisites for a reversal.

US dollar exchange rate: dynamics and analysis

General characteristics of market behavior

September for the dollar is in a mode of smooth fluctuations with an almost flat downward trend. On global markets, the dollar has already played down most of the expectations of a possible Federal Reserve rate cut in September, and this has been reflected in the domestic Ukrainian market.

Over the past 30 days, the exchange rate has been gradually slipping downward: the average buying rate dropped from UAH 41.20 to UAH 41.05, the selling rate from UAH 41.65 to UAH 41.50, and the official NBU rate from UAH 41.35 to UAH 41.25. It was a steady and controlled decline, with no sharp impulses. In the second decade of September, the dollar remained in a narrow range of 41.00-41.30 UAH/$ on the cash market, while sales remained in the range of 41.45-41.60 UAH/$.

The NBU’s official exchange rate moves in sync with the market, anchoring the market. Bid and ask spreads remained in a narrow range of UAH 0.40-0.50, while market rates remained equidistant from the official rate, indicating that there is a “rate consensus” between the market and the regulator.

Key factors of influence

Forecast.

We advise you to pay attention to our scenario modeling of exchange rates for different actions of the Fed, which was published in the previous forecast and is available at this link.

Euro exchange rate: dynamics and analysis

General characteristics of market behavior

In the first half of September, the euro on the Ukrainian market showed restrained dynamics with a gradual shift to the upper limits of the range. During the week, bidding quotes remained in the range of 48.00-48.10 UAH/€, while asking prices were 48.65-48.75 UAH/€. On the 30-day horizon, we can see an undulating trend: a decline in late August, stabilization in early September, and a new attempt to rise closer to the middle of the month.

Specifics of the course location

A characteristic change in the “geometry” is noteworthy: the buying rate during the previous week was clearly “pressing” against the official NBU rate, while the selling rate was gradually moving away from it. At the same time, the spread between buying and selling (0.50-0.60 UAH/€) remains relatively stable. This may indicate that:

Key influencing factors

Forecast.

We advise you to pay attention to our scenario modeling of exchange rates for different actions of the Fed, which was published in the previous forecast and is available here.

Recommendations: dollar or euro – buy, sell, or wait?

USD/UAH

The dollar has already priced in a high probability of a September Fed rate cut in the domestic market. This means that there is limited room for further decline.

It makes little sense to buy at the bottom; it is better to distribute purchases in tranches without trying to catch the perfect moment.

If the Fed unexpectedly leaves the rate unchanged, the dollar may briefly play up, and this will be an opportunity for those who hold reserves to sell some of them at a profit.

For medium-term plans, the dollar remains the “anchor” of the portfolio, but now is not the time for large one-time transactions – liquidity and flexibility are more important.

EUR/UAH

The euro is showing an interesting “geometry”: the buying rate is approaching the official rate, while the selling rate is moving up. This signals a lower demand for the euro from the population, but also the caution of operators who are hedging against the risk of its growth.

It is now possible to buy euros in small tranches, especially for those who are diversifying their savings or preparing future payments to the EU.

If the Fed does cut the rate, the euro will get a boost and could quickly approach 49-50 UAH/€.

There is little point in selling the euro now, as the upside potential is higher than the downside risk.

It’s better to wait for pullbacks or new peaks to optimize the euro’s share of the portfolio.

Overall strategy

On a short-term horizon, it is worth keeping a balance: the dollar as a stable base, the euro as a flexible instrument with the potential for rebounds.

It is better to buy in installments rather than in one go.

Sell only when the market shows a tangible upward movement.

And most importantly, plan in ranges, not points: the Ukrainian market is currently reacting to external signals rather than internal events.

Given the consensus between the government and business on a managed devaluation trend, the hryvnia is the best choice for saving money in the medium and long term.

If the Fed does lower the rate, it is worth considering diversifying your investment portfolio with crypto: the global market will be attracted to risk when it gets cheaper money.

This material has been prepared by analysts of the international multiservice product FinTech platform KYT Group and reflects their expert, analytical professional judgment. The information presented in this review is for informational purposes only and cannot be considered as a recommendation for action.

The Company and its analysts make no representations and assume no liability for any consequences arising from the use of this information. All information is provided “as is” without any additional warranties of completeness, obligations of timeliness or to update or supplement.

Users of this material should make their own risk assessment and informed decisions based on their own evaluation and analysis of the situation from various available sources that they consider to be sufficiently qualified. We recommend that you consult an independent financial advisor before making any investment decisions.

REFERENCE

KYT Group is an international multi-service product FinTech platform that has been successfully operating in the non-banking financial services market for 16 years. One of the company’s flagship activities is currency exchange. KYT Group is one of the largest operators in this segment of the financial market of Ukraine, is included in the list of the largest taxpayers, and is one of the industry leaders in terms of asset growth and equity.

More than 90 branches in 16 major cities of Ukraine are located in convenient locations for customers and have modern equipment for the convenience, security and confidentiality of each transaction.

The company’s activities comply with the regulatory requirements of the NBU. KYT Group adheres to EU standards, having a branch in Poland and planning cross-border expansion to European countries.

JSC OTP BANK plans to continue active lending to corporate business next year, in particular, to increase the volume of financing for renewable energy. This was stated by Alla Biniashvili, Member of the Management Board of OTP Bank responsible for corporate business development, during the event “Global Outlook: Strategic Momentum”.

“What, in our opinion, will be the driver in 2026? Of course, renewable energy. It is already financed mostly by state-owned banks, but all other institutions also prioritize financing energy security and renewable energy. And we at OTP Bank expect a significant increase in its share in our portfolio and in the portfolios of other banks next year,” said A. Biniashvili.

According to her, the banking sector is characterized by a high level of liquidity, and banks are determined to continue to finance businesses. In 2025, the top 3 lending areas include agriculture, food industry, and trade, both wholesale and retail. Financial institutions support Ukrainian companies by competing for customers and offering them optimal rates and conditions. “They do this, they successfully lend. But banks also finance companies. When we look at the balance sheets of banking institutions, we see that liabilities, i.e. deposits and account balances, are twice as high as assets. The reason for this is uncertainty: most companies are afraid to invest in projects because of the war and the risks associated with it. However, we are growing, and the banking sector is developing. If we talk about OTP Bank, we have grown by 35% in hryvnia over six months, i.e. plus UAH 6 billion to the beginning of the year,” emphasized the Board member.

According to Alla Biniashvili, despite all the challenges, including the geopolitical situation, inflation, deterioration of the trade balance due to the need for imports for energy security, lower harvests, and staff shortages, financial institutions are optimistic about the future. “We shouldn’t give up, because when the war is over, everyone will lend, and it will be a boom. And now we are working based on the situation we have and doing everything to effectively support business and the country’s economy,” emphasized the member of the Board of OTP Bank.

The event “Global Outlook: Strategic Momentum” event was attended by Andriy Pyshnyi, Governor of the National Bank of Ukraine, Olena Voloshyna, Country Manager of the International Finance Corporation (IFC) in Ukraine, and representatives of the business community. The participants focused on the following key areas: financial stability and the role of business in Ukraine’s recovery. They discussed the practical contribution of companies to rebuilding the country’s infrastructure, as well as the innovations and support needed to overcome current challenges. In total, the event was attended by about 350 guests, with another 200 joining the conference online.