Schneider Electric, a leader in digital transformation in the field of energy management and automation, and the OKKO filling station network have implemented a large-scale project for uninterrupted power supply and infrastructure reliability – 290 out of 410 filling stations of the network will be equipped with uninterruptible power supplies (UPS) with modern powerful batteries in 2022-2024, and in 2025 it is planned to equip another 50 filling stations of the network with the same UPS.

The equipment chosen by OKKO is designed to protect the power supply in the most unstable conditions. Schneider Electric lithium-ion UPS has a long service life without battery replacement (up to 12-15 years), long autonomy time with its compact dimensions and ease of maintenance.

“Even before the large-scale blackouts, OKKO started implementing a plan to modernize the corporate data network. We realized that we needed efficient equipment that would ensure the smooth operation of all vital filling station systems – cash registers, fuel dispensers, equipment providing Wi-Fi and other customer services. We started looking for the right powerful equipment, analyzing the world’s experience. The solution from Schneider Electric provided the result we needed. In fact, regardless of power outages at OKKO filling stations, customers will not face delays in payments or lack of Wi-Fi,” said Sergiy Lesko, CIO of OKKO.

“Schneider Electric has deep experience in technologies and practices that can improve energy efficiency and sustainability, understands and carefully studies the specific needs of each Ukrainian customer,” said Volodymyr Dokhlenko, Head of Secure Power at Schneider Electric in Ukraine, Czech Republic and Slovakia, ”As part of this project, our client received uninterrupted power supply to the filling station for up to 5 hours, as well as the preservation of critical data and round-the-clock monitoring of the UPS network.”

The UPS network monitoring system is provided by the equipment supplier. Thanks to predictive analytics of the UPS operation status and notifications about the need to replace it soon, service work is carried out in a timely manner, minimizing the risk of downtime.

About OKKO

The OKKO filling station network is one of the largest filling station networks in Ukraine (as of the beginning of 2025 – 410 filling stations). The company also has a network of on-the-go catering establishments, stationary and mobile laboratories for quality control of petroleum products, etc.

The company is one of the largest taxpayers in the fuel market. Based on the results of operations in 2024, the companies of OKKO Group paid a total of UAH 21.1 billion in taxes to the budget and state funds. This is UAH 5.6 billion, or 36%, more than in 2023.

About Schneider Electric

Schneider’s purpose is to create impact by empowering everyone to make the most of our energy and resources, ensuring progress and sustainability for all. We call it Life Is On.

Our mission is to be a trusted partner in sustainability and efficiency.

We are a global technology leader, bringing world-class expertise in electrification, automation and digitalization to smart industries, reliable infrastructure, future-proof data centers, smart buildings and intuitive homes. Drawing on our deep industry expertise, we provide integrated end-to-end AI-enabled industrial IoT solutions with connected products, automation, software and services, creating digital twins to drive profitable growth for our customers.

Ourmain resource is our 150,000 employees and more than a million partners operating in more than 100 countries to ensure proximity to our customers and stakeholders. We support diversity and inclusion in everything we do, guided by our meaningful purpose of a sustainable future for all.

KP “Vinnitsa transport company” on March 26 announced a tender for services on insurance of carrier’s liability for damage caused to the life and health of passengers and luggage during transportation by road transport (with more than 18 passengers) and on urban electric transport.

According to the message in the system of electronic public procurement Prozorro, the expected cost of the purchase of services is 2.960 million UAH.

The deadline for submission of proposals is April 3.

liability insurance, TENDER, Vinnytsia Transportation Company

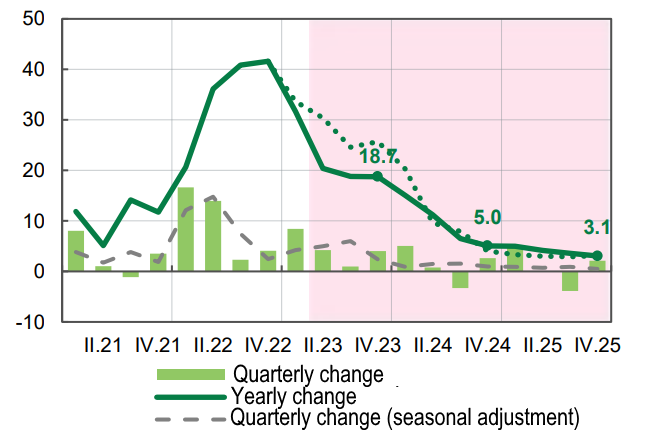

Change in prices of food raw materials from Ukraine (forecast up to 2025), %

On March, 22nd Kharkivoblenergo JSC has announced about the intention to conclude with IC VUSO (Kiev) the contract on purchase of services of compulsory insurance of civil liability of owners of land vehicles (OSAGO).

According to the message in the system of electronic public procurement Prozorro, the expected cost is UAH 5.424 million, the price offer of the company – the only bidder – UAH 4.989 million.

IC “VUSO” was founded in 2001. It is a member of ITSBU and NASU, a participant of the Agreement on direct settlement of losses and a member of the Nuclear Insurance Pool.

Ukraine’s imports of passenger cars, including cargo-passenger van cars and racing cars (UKT VED code 8703), in January-February 2025 in monetary terms decreased by 7.8% year-on-year to $719.92 million.

According to statistics released by the State Customs Service (SCS) of Ukraine, in February imports of passenger cars to Ukraine exceeded the February-2024 figure by 3% to $385.94 million, while in January there was a 17.8% drop compared to January-2023.

The top three largest suppliers of cars to Ukraine in January-February this year were Germany, the U.S. and Japan, while in the previous year it was the U.S., China and Germany.

In particular, the supply of cars from Germany increased by almost 40% – up to $152.15 million, and their share in the structure of car imports amounted to 21.13% against 13.94% a year earlier.

Cars worth $122.13 million (15% less) were imported from the USA to Ukraine. Japan, which last year was not among the top three countries with the largest car imports, this year imported $79 mln worth of cars in two months.

It is noteworthy that China, whose imports a year ago amounted to $114.88 mln (second place after the USA), has not yet entered the top three.

Overall, imports of passenger cars from other countries totaled $366.63 million during the period compared to $413.87 million in January-February last year.

At the same time, in January-February this year Ukraine exported such vehicles for only $1.9 million, in particular to the UAE (67% of exports), Czech Republic and Moldova, while a year earlier the country sold them to foreign markets for $3.8 million, mainly to Canada (47.7%), USA (26.8%) and Moldova.

According to the STS, in the total structure of imports of goods to Ukraine in January-February the share of passenger cars amounted to 6.37%, in the structure of exports – 0.03%.

As reported, in 2024 in Ukraine imported passenger cars for $4.385 billion – 8% more than a year earlier, exported $10.1 million (2.7 times less).