Beer production in Ukraine in January-July 2024 reached 84.4 million dal, up 6.9% compared to the same period in 2023, according to the website of the industry organization of brewers Ukrpyvo.

“The expert estimate of beer production in Ukraine for 7 months of 2024 is 84.4 million dal, or 106.9% compared to the same period in 2023. At the same time, this figure is only 80.9% of the production volume for 7 months of 2021,” the statement said.

Beer production in Ukraine in 2022 decreased by 27.9% compared to 2021 – to 122.8 million dal.

By the end of 2022, the brewing industry had partially recovered from a 50% drop in production in the first quarter due to the Russian invasion and the shutdown of some breweries.

Thus, in the first four months of the year, the decline amounted to 42.8% compared to the same period in 2021, January-May – 36.4%, January-June – 32%, January-July and January-August – 31.6% each, January-September – 30.5%, January-October – 28.6%, January-November – 28.1%, and 27.9% in the previous year.

“In January-July 2024, the Ukrainian Gas TSO purchased 128.1 million cubic meters at the Ukrainian Energy Exchange (UEEX), the company’s press service reports.

According to it, the operator concluded 82 agreements with 18 sellers, in particular, in July, GTSOU bought 29.9 million cubic meters at the UEEX, concluding 18 contracts with 10 sellers.

“The operator is interested in expanding the range of counterparties and building long-term mutually beneficial relations with the market. The company plans to actively offer participants a full list of procurement products, in particular to non-resident participants with the delivery of “border of Ukraine” and with the delivery of UGS “customs warehouse”,” the statement said.

GTSOU provides natural gas transportation to consumers in Ukraine and the European Union.

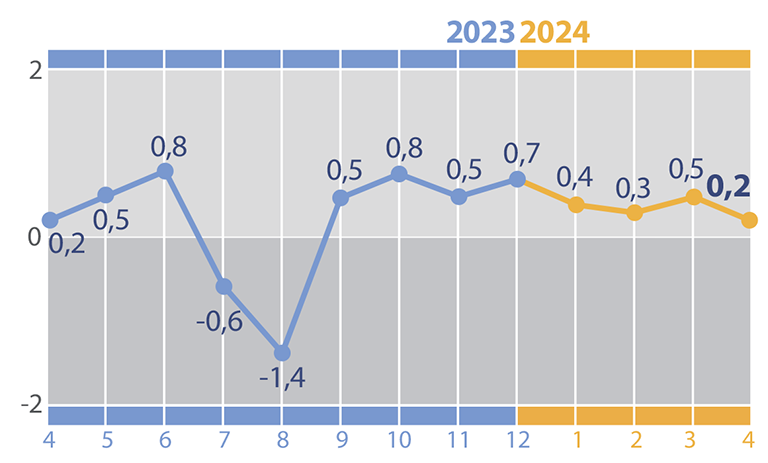

Change in consumer prices in 2023-2024

Source: Open4Business.com.ua

In the Kiev region they are completing the construction of an inclusive residential complex of 56 private houses for warriors with disabilities and their families, the head of the Kiev regional military administration Ruslan Kravchenko said.

“Handed 17 certificates for houses in the complex to veterans and their families. These are our heroes from the 3 assault brigade, 114 brigade TRO, 72 brigade im. Black Zaporozhtsy, 1 separate tank brigade. I had the honor on behalf of myself and all residents of Kyiv region to thank our military and the families of the fallen fighters for the fight against the Russian occupiers. Earlier 2 certificates were received by the GUR fighters”, – said the head of KOVA in Telegram.

It is reported that already at the end of August the military will receive the keys to the houses. Housing will be transferred to their ownership. Construction work is on the finish line. The houses will be repaired, kitchen furniture will be installed, bathrooms and bathrooms will be equipped.

It is reported that the large-scale project is financed by the charitable foundation of Andriy Zasukha and FC Kolos Kovalevka.

KYIV REGION, RESIDENTIAL COMPLEX, warriors with disabilities

Kyiv “Dynamo” defeated Scottish “Rangers” in the return match of Champions League qualification, the game ended with a score of 2:0 , reports Suspilnoe Sport.

It is noted that on the sum of the two meetings Kiev won 3:1.

Goals forgot: Dynamo -Pikhalenok at 82′, Voloshyn at 84′.

Dynamo’s opponent in the Champions League qualification playoffs will be Austrian Salzburg, which defeated Dutch FC Twente (5:4 on the sum of two games).