Investment banking firm Capital Times (Kyiv) has revised its macro forecast for 2024-2025, worsening its expectations of economic growth by 2.0 percentage points (pp) to 3.1% and inflation by 2.6 pp. – To 9.0%.

“We assume that the cooling economy will lead to negative real GDP in Ukraine in Q4 2024g and Q1 2025. Improvement of the forecast is possible subject to the implementation of mechanisms of budgetary stimulation of the economy, which was announced by representatives of the authorities,” the company said in a press release on Wednesday.

According to it, forecasts of GDP growth and inflation for next year are also worsened by 1.3 pp. – To 2.9% and 7.0% respectively.

It is indicated that Capital Times analysts record signs of economic slowdown and attribute them to a smaller flow of external financial assistance, as well as internal mobilization processes. Among other reasons were cited problems with electricity supply, strengthening trade and budget deficits.

The nominal GDP estimate was cut by 2.2% to $188.3 billion for this year and 1.8% to $205.7 billion for next year.

The company noted that while inflation reached its lowest levels in Q2 2024, there was a sharp acceleration in consumer and industrial inflation in June due to higher electricity prices.

“In the pre-war years, businesses gradually shifted the cost of utility bills to the consumer, but in wartime, there is not enough resource for businesses to cover the additional costs. Therefore, the business immediately lays the growth of production costs in the prices,” the analysts explained.

According to the updated forecast, Capital Times worsened expectations of the average official exchange rate for this year to UAH 40.5/$1 from UAH 39/$1 in the previous forecast, and for the end of the year – to UAH 42.5/$1 from the previously forecasted UAH 41/$1. Analysts are also more pessimistic about the possible trajectory of the hryvnia in 2025: the average annual official exchange rate is forecast at 43.7 UAH/$1, and 45.2 UAH/$1 at the end of the year, while earlier they expected the average exchange rate in 2025 at 42 UAH/$1.

“The accumulation of structural problems with budget financing and decreasing financial support from partners stipulate a gradual devaluation of the Ukrainian hryvnia during 2024. The devaluation trend is very strong and we anticipate hryvnia weakness in the second half of this year,” the release said.

At the same time, analysts improved their forecast for Ukraine’s foreign exchange reserves for this year from $38 bln to $41.5 bln, worsening it for next year from $42 bln to $40 bln.

A positive aspect of the updated macro forecast is the gradual narrowing of the negative trade balance from $37.7bn last year to $36.8bn this year and $35.4bn next year.

Analysts believe that agreement on a plan to restructure external debt, agreements with European partners on the Ukraine Facility program, implementation of the Extraordinary Revenue Acceleration Loans mechanism of providing Ukraine with $50bn, secured by future revenues from frozen Russian assets, and full IMF support are factors that will reduce Ukraine’s dependence on US aid in the coming years, offsetting the risks of the US election results.

“No significant changes on the front, despite a palpable excess of enemy forces. In the second half of the year, we assume more positive news for Ukraine, including progress in the liberation of territories. However, we see 2027-2028 as the base scenario for the end of the war,” Capital Times summarized.

Capital Times, GDP, Ukraine

On the fourth day of the XXXIII Olympic Games in Paris, representatives of the Ukrainian national team competed in 9 sports, the National Olympic Committee (NOC) of Ukraine reported on its Facebook page on Wednesday.

It is reported that Ukraine ranks 35th in the medal standings with one bronze medal.

According to the results of the tournament day, Ukrainian athletes showed the following results.

Table tennis (singles): in the 1/16 finals, Margarita Pesotska lost in 5 games to Bernardet Soch from Romania (1:4) and ended her performance at the Games.

Badminton (singles): In the second round of the group stage, Polina Bugrova defeated Czech Teresa Schwabikova 1-2 (21:19, 19:21, 21:18). However, this is not enough to get out of the group.

Swimming: Denys Kesil finished 24th in the 200-meter butterfly qualifying round and did not qualify for the semifinals.

Archery: In the 1/32 finals, Mykhailo Usach lost to world ranking leader Marcus D’Almeida of Brazil (2:6).

Fencing (epee, team): in the 1/4 finals, Joan Fabi Bejura, Daria Varfolomeieva, Olena Kryvitska and Vlada Kharkiv failed to defeat the team from China (41:45).

In the tournament for the 5th-8th places, the Ukrainian team defeated Egypt (45:31) and lost to the second place in the world ranking, the South Korean team (38:45). Ukrainian fencers finished in 6th place at the Games.

Tennis: In the third round, Marta Kostiuk and Elina Svitolina played grueling three-set matches. While Marta’s match with Greece’s Maria Sakkari ended in a victory for the Ukrainian (6:4, 6:7 (5:7), 4:6), Elina was defeated by Barbara Krejcikova of the Czech Republic (6:7(5), 6:2 (4:6)).

Marta Kostiuk and Diana Yastremska withdrew from the doubles tournament in favor of the singles tournament, in which Marta is participating.

Rowing slalom (women’s single): Viktoriya Us finished 9th in the qualifiers and advanced to the semifinals.

Football (3rd round): Ukraine lost to Argentina (0:2) and ended its participation in the Olympics.

Boxing (weight category up to 80 kg): in the 1/8 finals, Oleksandr Khyzhnyak defeated ex-Ukrainian Philip Akilov, representing Hungary, by a split decision of the judges.

On July 31, Ukrainians will compete in 8 sports

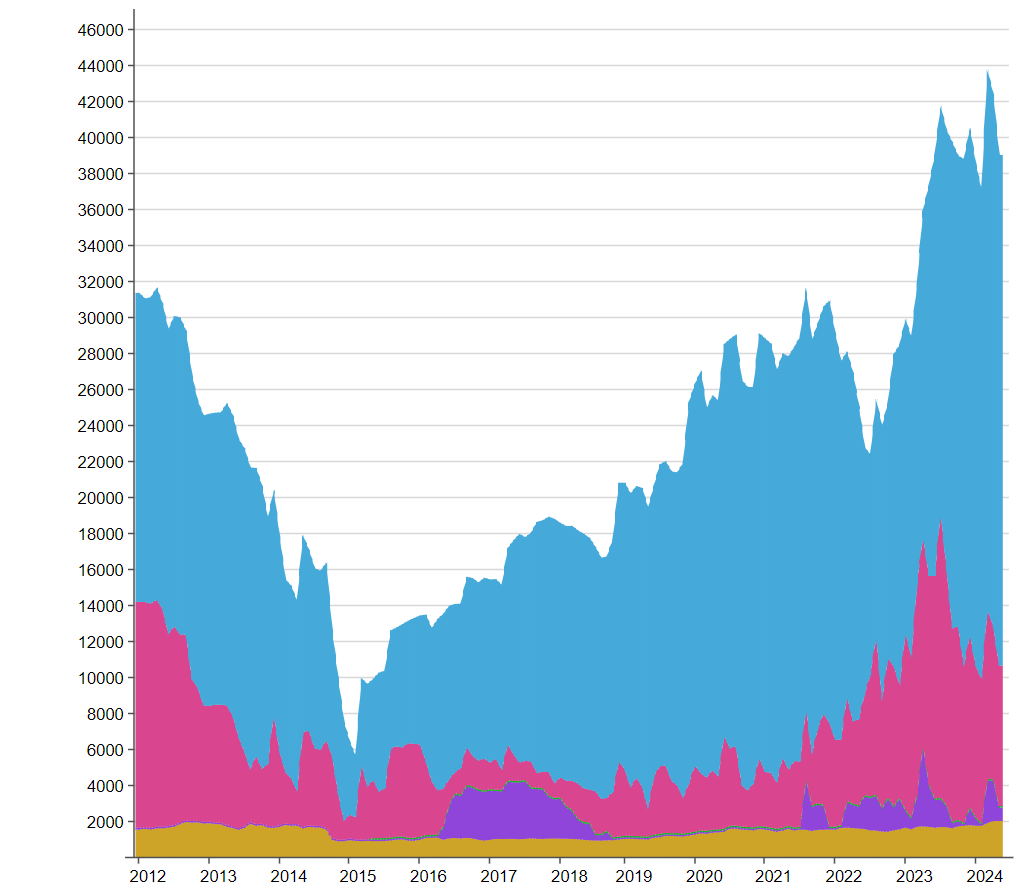

Dynamics of reserves of Ukraine from 2012 to 2024, million USD

Source: Open4Business.com.ua

The United States Agency for International Development (USAID) has launched a new GROW project to support Ukrainian credit unions, according to the USAID website.

“Through a partnership with the World Council of Credit Unions, USAID will expand support for Ukrainian credit unions, enabling them to provide more loans to businesses and individual entrepreneurs,” the report said.

The initiative begins this month and will last for the next four years. The initial investment of resources will be $5 million.

The GROW project will work closely with credit unions in Ukraine to create products and partnerships that will maximize credit union outreach to Ukrainians and positively impact local communities and local economies. The project will also increase access to finance for Ukrainians seeking to start their own businesses and businesses wishing to expand their operations, particularly for micro, small and medium enterprises, cooperatives and agro-producers in rural areas of the country.

In addition, the project will support Ukraine’s long-term priorities for further integration and EU accession, in particular harmonization of the regulatory framework for credit unions with relevant EU requirements.

Since the beginning of 2024, the clients of JSC OTP BANK – individuals – have purchased domestic government bonds for a total amount of UAH 3.1 billion.

The number of transactions in the first half of the year amounted to 1897, which is 137% more than in the same period of 2023.

Investments in domestic government bonds in 2024 were made in two ways: customers purchased bonds directly at auctions of the Ministry of Finance through the OTP Bank UA app or from the Bank’s own portfolio, also using the app.

During the first and second quarters, securities totaling UAH 2.8 billion in equivalent were purchased at the Ministry of Finance auctions.

Total sales from the Bank’s portfolio by the end of the second quarter amounted to UAH 305 million in equivalent.

We remind you that the service for purchasing government bonds from its own portfolio in the OTP Bank UA application was launched two months ago, at the end of May 2024.

“Investing in domestic government bonds is not only an opportunity to support Ukraine’s financial stability in times of war, but also a good opportunity to diversify your savings and earn additional income in both hryvnia and foreign currency. Moreover, the repayment of funds is fully guaranteed by the state, so it is also a guarantee of the safety of savings. We offer our customers different ways to invest – they can buy government bonds directly from the auction or at any convenient time from the Bank’s portfolio, with the best rate, maturity, in the chosen currency, 24/7,” said Valeria Ovcharuk, product owner of OTP BANK.

In total, since the beginning of the full-scale invasion, OTP Bank’s individual clients have invested more than UAH 11.5 billion in government bonds in equivalent.

To learn more about investing in government bonds through the OTP Bank UA app, please follow the link.

Commercial real estate restoration projects account for up to 20% of Ukraine’s construction market, Andriy Ozeychuk, director of Rauta engineering and construction company, told Interfax-Ukraine.

“Despite the military risks, the owners of most of the destroyed commercial real estate are investing in their restoration to restart their businesses, which allows companies to continue to operate efficiently. In particular, about 80% of commercial facilities destroyed during the full-scale invasion and located far from the war zone have already been rebuilt or are in the process of being rebuilt,” he said.

According to Mr. Ozeychuk, the figure is lower in the segment of industrial and warehouse buildings, at about 40%.

“For most of these facilities, the owners are looking for financing,” explained the Rauta director.

According to him, among the restoration projects Rauta was involved in were the Retroville shopping center (Kyiv), the production shop of the Chernihiv Automobile Plant, and the Novus supermarket in Bucha (Kyiv region).

Rauta’s experience in restoring commercial real estate shows that often an additional requirement of investors during the restoration of facilities is to improve their energy efficiency and architectural attractiveness, which allows them to optimize costs during the operation of buildings.

According to the World Bank, as of February 2024, Ukraine’s reconstruction needs were estimated at $486 billion, of which about 25% were commercial real estate.

Rauta is a leading provider of reliable construction solutions in Ukraine and the European Union.

According to Opendatabot, Rauta Group LLC was registered in Ukraine in 2014. Its authorized capital is UAH 388 thousand, and its revenue for 2022 is UAH 102.396 million.