PrJSC United Mining and Chemical Company (UMCC), which has taken over management of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipro region) and Irshansk Mining and Processing Plant (IGOK, Zhytomyr region), has resumed mining titanium raw materials and the full operation of the open pits at Irshansk Mining and Processing Plant.

According to the company’s press release on Thursday, this branch was shut down in October 2022. This decision was made due to the lack of contracts for the sale of ilmenite concentrate and, at the same time, significant stocks of finished products in warehouses.

Currently, the management of UMCC has signed a large contract to sell the branch’s products to a strategic North American customer. Accordingly, there is a need to restore the plant’s full capacity.

“Back in April, we gradually started preparing for the full resumption of the branch’s operations, including the full resumption of production. We made all the necessary purchases and carried out as many repairs as possible. Now we have an active contract with an American end user for 70 thousand tons of ilmenite concentrate from Irshansk GOK,” said Yegor Perelygin, acting Chairman of the Board of UMCC.

According to him, another 25-40 thousand tons are currently under discussion. Additionally, the company is preparing to start negotiations for 30 thousand tons for a European end user, with a shipment plan for the fourth quarter of this year.

“Since we have almost sold the old stocks in our warehouses, which is good news, the resumption of quarrying is critical,” said Perelygin.

He specified that the company plans to produce 12 thousand tons of ilmenite concentrate per month by the end of this year.

“We understand that if there is an opportunity to increase production, we will definitely press the gas pedal. But there are several barriers and negative factors that constantly make adjustments to our production program. Everyone is well aware that we are in the active stage of the war and need to prepare for surprises or unplanned problems. In particular, it concerns the stabilization of electricity supplies to the plant,” added the CEO.

He also explained that UMCC has come a long way to qualify IGOK’s ilmenite concentrate for the North American market, and it is strategically important for the company to maintain this momentum until 2025, as then we can talk about long-term contracts and long-term product qualification.

“My personal dream is that 2/3 of IGOK’s products should be exported to the market that is strategic for us as a country and that our cooperation with the American chemical industry should only strengthen and the volumes should grow. This will allow us to move to planning horizons of 1-3 years, even during the war, and will have a good stabilizing effect,” Perelygin explained.

According to him, this will also allow us to move to a broader development of the local resource base, in particular by returning to the implementation of the capital investment program.

“Unfortunately, due to the lack of long-term money and a large number of unpredictable events, the last two years have been practically on hold,” summarized the acting chairman of the board of UMGC.

United Mining and Chemical Company started its actual operations in August 2014, when the Ukrainian government decided to transfer the property complexes of Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipropetrovska oblast) and Irshansk Mining and Processing Plant (IGOK, Zhytomyrska oblast) to its management. On December 8, 2016, the state-owned enterprise was transformed into PJSC UMCC, and on December 26, 2018, it was transformed from PJSC to PrJSC.

UMCC used to sell its products to more than 30 countries. The main sales markets were the EU, China, Turkey, as well as the USA and African countries.

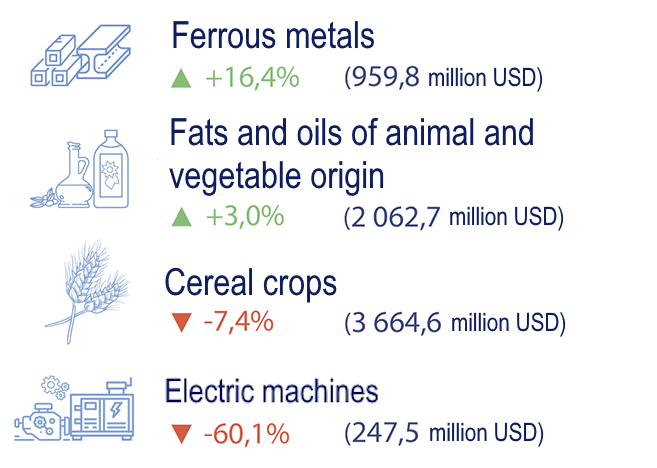

Dynamics of export of goods in Jan-Apr 2024 by the most important items in relation to the same period of 2023, %

Source: Open4Business.com.ua and experts.news

The official hryvnia exchange rate, after rising by 5 kopecks on Wednesday, dropped by 17 kopecks on Thursday to 40.8823 UAH/$1, a new all-time low.

According to market participants, the exchange rate came close to the level of 41 UAH/$1 near the end of interbank trading.

The reference value of the hryvnia exchange rate set by the National Bank of Ukraine (NBU) at 12:00 on Thursday fell by 16 kopecks to 40.8423 UAH/$1, while on the cash market the dollar rose by 12 kopecks to 41.10 UAH/$1.

A day earlier, the National Bank announced new easing of currency restrictions, in particular, it facilitated servicing of Eurobonds through dividends of guarantors and sureties. In addition, on July 11, the NBU expanded the list of defense goods available for purchase abroad for volunteers and allowed businesses to buy foreign currency to repay loans from international financial institutions (IFIs).

Since the beginning of 2024, the official hryvnia exchange rate has depreciated by 7.6%, or UAH 2.88, and since the NBU switched to managed flexibility on October 3, 2023, it has depreciated by 11.8%, or UAH 4.32.

In June, the official hryvnia exchange rate fell by 3 kopecks to 40.5374 UAH/$1, although in the middle of the month the exchange rate hit a record low of 40.6908 UAH/$1, while in May it fell by 90 kopecks.

The NBU attributed the weakening to increased government spending after receiving external financing in March-April, as well as the impact of the largest package of currency restrictions for businesses since the start of the full-scale war announced on May 3.

The NBU’s net sales of dollars in the first week of July decreased to $630.91 million from $670.41 million in the previous month. In June, it amounted to $2.99 billion compared to $3.07 billion in May.

Earlier, the Center for Economic Strategy (CES) released an updated consensus forecast of seven investment companies and think tanks. According to it, the forecast for the hryvnia exchange rate at the end of this year has been lowered from 40.5 UAH/$1 to about 42 UAH/$1, which generally correlates with the 42.1 UAH/$1 set in the state budget for the end of 2024. The forecast for the average annual exchange rate was also downgraded from 38.7 UAH/$1 to 40.1 UAH/$1, compared to the budgeted level of 40.7 UAH/$1.

The Norwegian government will allocate an additional NOK 1 billion to finance Ukraine’s air defense, the government’s press service reports.

“Ukrainians need more air defense to protect the population from Russian bombs and missiles. The brutal attacks we saw last week show why it is so important for Ukrainians to be protected from Russian air attacks. In the fall, together with Germany, Norway will deliver a complete IRIS-T anti-aircraft battery to Ukraine,” Prime Minister Jonas Gahr Støre commented on the decision.

Norwegian Foreign Minister Espen Barth Eide noted that support for air defense has long been one of Ukraine’s top priorities.

“Ukrainians know their needs best, and that is why we have close contact with Ukraine when we decide how to organize support for Ukraine,” he said.

It is noted that the allocated funds are part of the Norwegian Nansen program.

In the revised national budget, the government proposed to use up to NOK 4 billion from the Nansen program for air defense measures until 2024.

Most of these funds are earmarked for Germany’s Immediate Action for Air Defense initiative. The new measures are included in the funds identified through the RNB (revised national budget).

Dnipro Metallurgical Plant (DMZ), a part of DCH Steel of businessman Aleksandr Yaroslavsky’s DCH Group, cut rolled steel production by 40.5% year-on-year to 33.8 thousand tons in January-June this year.

According to a report in DCH Steel’s corporate newspaper on Thursday, coke production during this period increased by 1.1% to 143.5 thousand tons.

At the same time, in June 2014, DMZ reduced its rolled steel output by 83.2% compared to June 2013 and by 69.2% to 2.4 thousand tons compared to the previous month. Metallurgical coke production in June decreased by 26.9% compared to June 2023 and by 3.6% compared to the previous month to 24.4 thousand tons.

In addition, during the regular rolling campaign, which lasted 13 days in May and June, Rolling Shop No. 2 produced about 10 thousand tons of products, most of which have been sold to date. However, due to a lack of orders, the next rolling campaign was postponed. In turn, rolling shop No. 1 is scheduled to start rolling in the third decade of July.

As reported, in 2023, DMZ increased its rolled metal output by 86.2% compared to 2022, up to 105.6 thousand tons, and coke by 38.5%, up to 292.7 thousand tons.

In 2022, the plant reduced its rolled steel production by 74.2% compared to 2021, to 58.4 thousand tons, and coke production by 56.3%, to 211.3 thousand tons.

DMZ specializes in the production of steel, pig iron, rolled products and products made from them.

On March 1, 2018, DCH Group signed an agreement to buy Dnipro Metallurgical Plant from Evraz.

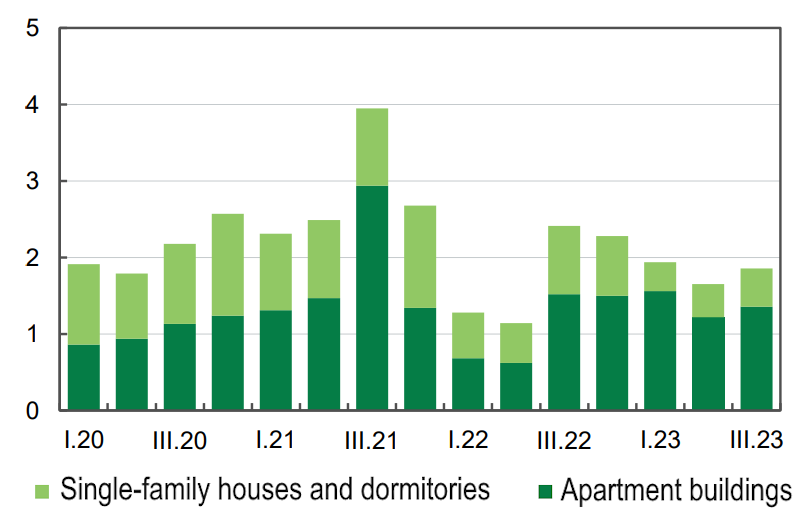

Commissioning of housing in Ukraine, mln sq m

Source: Open4Business.com.ua and experts.news