Ukrainian President Volodymyr Zelenskyy has held a meeting with President of the Republic of Kenya William Ruto on the margins of the 78th session of the UN General Assembly in New York.

According to Zelensky’s press service, he thanked Kenya for supporting the sovereignty and territorial integrity of Ukraine.

“Thank you for supporting our people and our country. I would like to invite you and your team to visit Ukraine at a convenient time. We have many topics for discussion. Support in such a difficult time of war is important for us. To be strong and to hear your voices of support,” the President said.

The leaders discussed preparations for the next meeting on the implementation of the Ukrainian peace formula at the level of advisers.

Also during the talks they talked about preparations for the Global Peace Summit at the level of state leaders.

The sides discussed concrete steps to create grain hubs in Kenya. The Presidents emphasized the importance of stable supply of Ukrainian agricultural products to the region.

Zelensky also informed the President of Kenya about the functioning of an alternative route for exporting Ukrainian grain by the Black Sea, as well as about the work on the creation of other export routes.

In addition, the heads of state discussed security cooperation between Ukraine and Kenya.

Benchmark oil prices continue to decline on Wednesday morning after falling the day before.

The cost of November futures for Brent on the London ICE Futures exchange at 8:10 a.m. is $93.51 per barrel, which is 83 cents (0.88%) lower than at the close of the previous session. On Tuesday, these contracts fell by 9 cents (0.1%) to $94.34 per barrel.

Quotes for October futures for WTI in electronic trading on the New York Mercantile Exchange (NYMEX) by 8:04 a.m. fell by 82 cents (0.9%) to $90.38 per barrel. At the end of the previous session, they fell by 28 cents (0.3%) to $91.2 per barrel. October contracts for WTI will expire at the close of the market on Wednesday. Futures for November, which are more actively traded, are losing 74 cents (0.82%) to $89.74 per barrel.

By Tuesday, both brands had been rising in price for three consecutive sessions.

DTN Senior Market Analyst Troy Vincent believes that the main threat to the continuation of the oil rally is a change in fundamentals.

“At current prices, lower demand for imported crude from China and rising exports of its refined products will certainly help to curb this rally in the short term,” Vincent told MarketWatch. – “If that happens – and especially if demand elsewhere begins to weaken – Saudi Arabia could quickly change its mind about how far it is willing to go with voluntary production cuts.

Market participants are also awaiting the outcome of the September meeting of the Federal Reserve Board, which will be held on Wednesday at 21:00 p.m. Wall Street experts are almost certain that the US regulator will leave the interest rate at 5.25-5.5% per annum following this meeting.

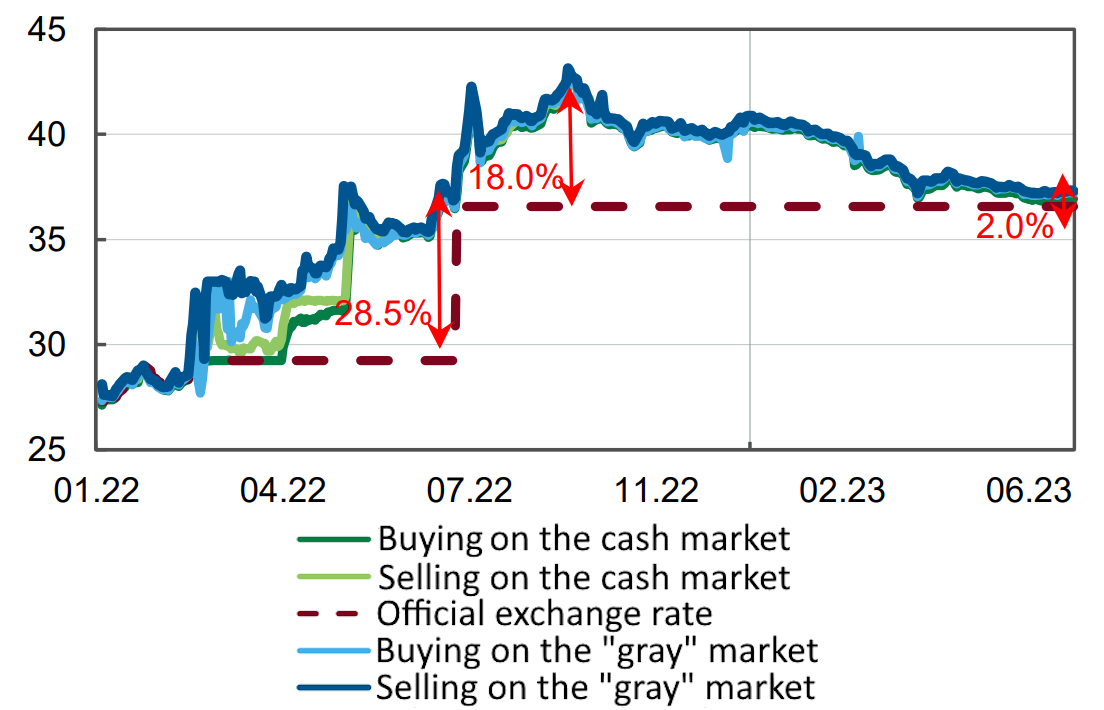

Dynamics of exchange rate of hryvnia to U.S. Dollar in 2022-2023

Source: Open4Business.com.ua and experts.news

President of Ukraine Volodymyr Zelenskyy has proposed creating grain hubs in African ports, the president’s website reports.

“Ukraine offers very clear actions. To prevent any shocks to the global food market, we can create hubs for millions of tons of grain per year in particularly sensitive areas, such as African ports,” the press service quoted Zelensky as saying during the Sustainable Development Goals summit.

According to him, negotiations have already begun on such opportunities. This will help prevent any shocks to the global food market.

He noted that Ukraine will never abandon its role as a guarantor of global food security: “No one expected us to be able to push the Russian fleet out of our Black Sea waters and give more space to the Black Sea Grain Initiative and the humanitarian initiative Grain from Ukraine. The results are really impressive.”

“Ukrainian food exports have reached the shores of Algeria, Djibouti, Egypt, Kenya, Libya, Lebanon, Morocco, Somalia, Tunisia, Bangladesh, China, India, Indonesia, Malaysia, Sri Lanka, Thailand, Vietnam, Oman, Pakistan, Turkey, Yemen and other countries. From transit ports, our products were delivered to Ethiopia and Sudan,” the President emphasized.

According to him, the total amount of food is 32 million tons. This is 32 million tons less chaos.

“I thank all those leaders who supported our export programs. Thank you, friends! We have done it. And nothing prevents us from achieving much more ambitious goals,” Zelensky added.

The State Property Fund (SPF) of Ukraine has put up for auction Zarubinsky distillery (Ternopil region), which is the most expensive lot in the history of small-scale privatization – the starting price is UAH 245.4 million, the Fund reported on Facebook.

“This is an operating enterprise in the alcohol industry that produces not only ethyl alcohol but also bioethanol and even exports it,” the SPF explained.

According to the report, the distillery includes 58 real estate objects with a total area of 28,804 thousand square meters, including workshops, warehouses, industrial buildings, an administrative complex and other facilities. The privatization lot also includes 27 vehicles and special equipment.

According to the SPF, in 2022-2023, the company was profitable – UAH 1.1 million and UAH 1.6 million, respectively. In 2020-2021, it showed significant losses – UAH 72.7 million and UAH 14.2 million, respectively. As a result, Zarubinsky Distillery has accumulated significant accounts payable – UAH 374 million, of which UAH 4.4 million are debts to the budget and UAH 732 thousand to employees. These liabilities will be transferred to the future investor.

The auction is scheduled for October 2.

According to the Fund, distilleries are among the most popular small-scale privatization assets. Since September 2022, the SPF has sold 14 distilleries and raised UAH 965 million to the state budget, with the average price of each property at auction tripling.

Global debt reached a record $307 trillion in the first half of 2023, the Financial Times reports, citing data from the Institute of International Finance (IIF).

Total debt, including liabilities of states, companies, and households, increased by $10 trillion in the first six months of the year, updating the previous maximum set in early 2022.

In January-June, global debt as a percentage of GDP increased by 2 percentage points to 336%. The record is 360% and was set during the coronavirus pandemic.