Energy Company of Ukraine” (“EKU”) has transferred about UAH 17 mln to pay dividends for 2022.

As noted in the release of the company on July 4, this is the first dividends received by the state from the new energy trading company, which began its commercial activities in August last year.

It is indicated that the net profit of EKU for the five months of 2022 amounted to 33.9 million UAH.

According to the decisions of the government and the State Property Fund (SPF) of Ukraine, to which the state company is subordinated, 50% of this amount shall be used to pay dividends, 30% – to counteract the armed aggression of the Russian Federation, and 20% – for the costs provided for by the financial plan of the company for 2023, the company explained.

Thus, in total, “EKU” will allocate 27 million UAH to the budget and to the fight against the Russian Federation.

“In a short time we managed to build a capable company from scratch and reach the planned level of profit. The state has strengthened its position in the energy market and began to earn in highly competitive segments, where it was almost not present before”, – commented the general director of “EKU” Vitaly Butenko, whose words are given in the release.

As Ukrainian News earlier reported, JSC Energy Company of Ukraine (EKU) is a diversified energy supplying company, which deals with buying, selling and supplying energy resources to commercial customers, including import and export operations. 100% of the company’s shares are owned by the state.

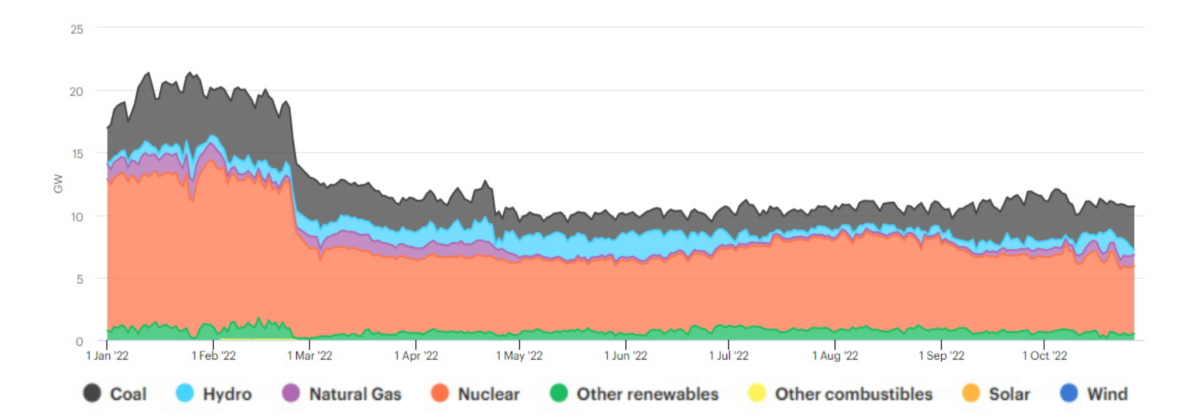

Generation distribution in power system of Ukraine in 2022

Source: Open4Business.com.ua and experts.news

Registrations in Ukraine of new commercial vehicles (trucks and special vehicles) in June amounted to 1,068 units, which is 12% more than in May this year and 2.5 times more than in June 2022, “Ukravtoprom” reported in Telegram channel.

“This is the best result in the last 17 months,” stated in the message.

At the same time, compared to the pre-war June-2021 registrations of commercial cars decreased by 26%.

The top five commercial vehicles on the market in June were: Renault – 356 units; Scania – 127 units; Volkswagen – 67 units; Peugeot – 60 units and Mercedes-Benz – 53 units.

Total, according to the Association, in the first half of the year 5,190 new trucks were added to the Ukrainian park of trucks and special vehicles, which is 61% more than during the same period last year.

In its turn, analytical group Auto-Consulting, analyzing the segment of trucks on its web-site on Tuesday, points out that in June there is again a record of their delivery to the Ukrainian market – 440 units, which is 2.2 times more than in June last year.

“And it is not a situational jump, because according to the results of six months we record the growth of the market by 89%”, – the experts state.

According to the group’s data, in June this segment of the market was headed by Scania, which managed to take 29% of the market, the second result was gained by DAF with 9%. IVECO, Renault, Volvo and Mercedes-Benz also increase their sales.

“There is a segment of trucks of 3.6-8 tons with a gross weight which is developing powerfully, where European producers are more and more present. But Chinese brands have started to actively develop the segment of communal machinery and have already achieved certain success. Now any tender on this theme consists of at least three or four proposals on the chassis of Chinese manufacturers”, – is noted in the report.

According to analysts, the high rate of recovery of the truck market is primarily due to the fact that businesses are trying to increase their own fleets to transport goods through the new logistics corridors.

As it was reported with reference to Ukravtoprom, in 2022 the market of new commercial vehicles was added 6.9 thousand new cars – 2.3 times less than in 2021.

Oil is moderately expensive on Tuesday morning.

The price of September Brent futures on London’s ICE Futures Exchange stands at $75.02 a barrel by 8:11 a.m., $0.37 (0.5%) above the previous session’s closing price. Those contracts fell $0.76 (1%) to $74.65 a barrel on Monday.

WTI futures for August crude oil grew by $0.36 (0.52%) to $70.15 per barrel at electronic trades on NYMEX. The day before these contracts went down by $0.85 (1.2%) to $69.79 per barrel.

On Monday, Saudi Arabia announced that it was extending its voluntary cut of oil production by 1 mln bpd for August. Thus, Saudi Arabia’s oil production will remain at around 9 million bpd in August.

Meanwhile, Russia, in an effort to balance the market, will voluntarily reduce supplies to oil markets by 500,000 bpd in August by reducing exports by a specified amount, Russian Deputy Prime Minister Alexander Novak told reporters.

Oil initially reacted to the news with moderate positivity, but it was not enough for a significant rally, Sevens Report Research analysts said.

A negative factor for the market was the news that the index of business activity in the U.S. manufacturing sector (ISM Manufacturing) fell to 46 points in June from 46.9 points a month earlier. Experts, the consensus forecast of which was quoted by Trading Economic, had expected the growth up to 47 points.

Meanwhile, the euro area manufacturing purchasing managers’ index (PMI) fell to 43.4 points this month, down from 44.8 points in May, according to final data from Hamburg Commercial Bank (HCOB) and S&P Global. Previously, it had reported a decline to 43.6 points. The final result indicates the sharpest deterioration in the sector since May 2020, Trading Economics wrote.

Ukraine’s State Budget General Fund on Monday received the second tranche of the International Monetary Fund’s (IMF) $890 million Extended Fund Facility (EFF), the Ministry of Finance of Ukraine said.

“The funding received is the result of effective and coordinated cooperation of the government, the Ministry of Finance, the National Bank of Ukraine with experts and IMF management under the extended financing program,” Finance Minister Sergei Marchenko said in a statement.

The Ministry of Finance specified that by now Ukraine has already received $3.59 billion from the IMF out of the total volume of this four-year program of $15.6 billion (11.6 billion SDR), opened at the end of March this year.

During the first review of the EFF program, which resulted in the allocation of the second tranche, experts and IMF management noted the significant progress of the Ukrainian side in the implementation of structural measures and quantitative performance criteria defined in the program, the Ministry of Finance pointed out.

“Thanks to the funds provided, we are able to continue to maintain economic stability in Ukraine and ensure priority spending of the state budget,” Marchenko noted.

Representatives of the IMF said after the first review that the second review is expected in late November and early December.

Dobrobut” medical network in 100 days from the moment of start of the voluntary health insurance project “Dobropolis” which is realized in partnership with “INGO” insurance company, sold 378 insurances or almost four insurances daily.

As Dmytro Grosu, director on corporate sales of “Dobrobut” medical network, informed “Interfax-Ukraine” agency, “Premium” packages are the most popular within the project, they occupy more than 50 % in sales structure of this product (cost of “Premium” package makes 4.6 thousand UAH per year, cost of “Standard” package is 1.9 thousand UAH).

“Among those who buy the product, 52% are men and 48% are women. Most often (90%) adults are insured, 10% of children under 18 years old,” he said.

The insurance company INGO, in turn, noted that the program “Dobropolis” “is not only successful, but also important at this time, because it allows getting insurance protection to the amount of 200 thousand UAH for expensive hospital treatment”.

At the same time, the insurance company noted that Dobropolis is a new product and should not be compared to classic VHI programs.

“Dobropolis” is quite a successful example of a joint product of a professional nurse and a reliable insurance company. Many people who have had experience with inpatient treatment understand how important it is to have the financial ability to get treatment from the best doctors in an emergency/complicated situation. This is why we have received so much positive feedback from clients, “- said the director of sales of personal insurance INGO Marina Zvarich.

At the same time, INgO specified that during the year the company plans to issue additional products, making it possible to expand the capacity of the existing “Dobropolis” program.

As reported, in March “Dobrobut” and INGO launched VHI program “Dobropolis”, which operates in acute conditions and covers among other things stroke, acute myocardial infarction, acute coronary syndrome, acute inflammation of the gall bladder, acute inflammation of the pancreas, injuries and fractures, appendicitis, renal and liver colic, exacerbation of several chronic diseases.

Dobrobut Medical Network is one of the largest private medical networks in Ukraine. The network includes 17 medical centers in Kiev and Kiev region, an emergency service, dentistry and pharmacy. Network medical centers provide services to children and adults in more than 75 medical fields. Annually experts of “Dobrobut” carry out more than 7 thousand operations. The network has over 2,700 employees.

The network collaborates with a number of international charities Direct Relief International, International Medical Corps and the University of Miami Global Institute as well as the Dobrobut Charitable Foundation founded by the clinic.

Since the start of the full-scale war, the Dobrobut Foundation has provided more than 16 million hryvnias worth of medical assistance to Ukrainians.

JSC “Insurance company “INGO” has more than 25 years of experience in the market. Since 2017, the main shareholder of the company is the Ukrainian business group DCH Oleksandr Iaroslavskyi.

The company enters the list of the largest insurance organizations in Ukraine in terms of premiums, the size of its own assets and the amount of claims paid. It has 29 licenses for different types of compulsory and voluntary insurance and provides insurance services to corporate and retail clients.

It is a full member of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU), a member of the American Chamber of Commerce (ACC), the European Business Association (EBA), the National Association of Insurers of Ukraine (NASU) and the International Chamber of Commerce (ICC).