Turkish President Recep Tayyip Erdogan discussed the war in Ukraine in a telephone conversation with Ukrainian President Volodymyr Zelensky, the office of the Turkish head of state said.

According to the report, Erdogan proposed to create a commission with the participation of “experts from the warring parties, the UN and the international community, in particular Turkey, for a detailed investigation of the explosion at the Kakhovska hydroelectric dam.”

The Turkish leader also promised to do everything possible in this matter and said that it is possible to use the method of negotiations, as in the “grain corridor.”

“Stressing that it will not be possible to prevent humanitarian losses on a daily basis as long as conflicts continue, the idea of returning to negotiations must therefore dominate, and said he would resolutely continue his efforts to establish a just peace,” the report said.

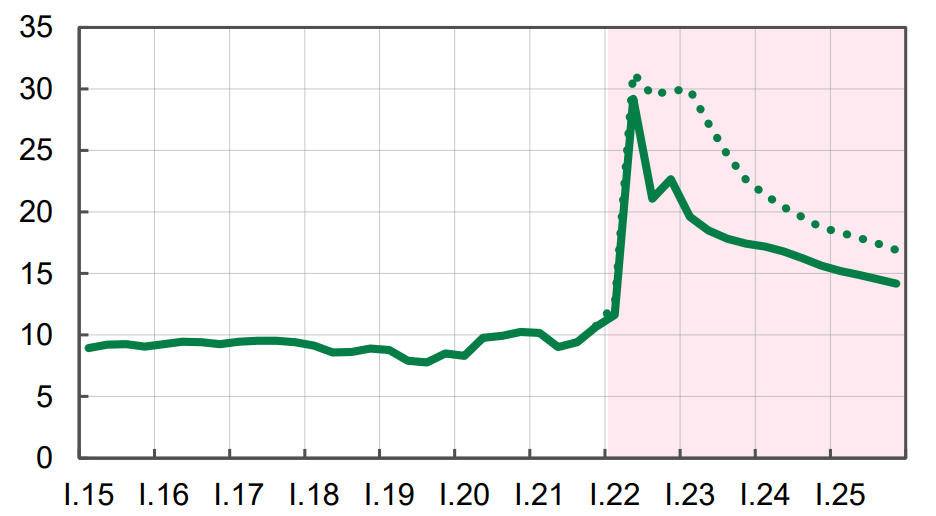

Forecast of unemployment rate in Ukraine according to methodology of international labor organization until 2025

Source: Open4Business.com.ua and experts.news

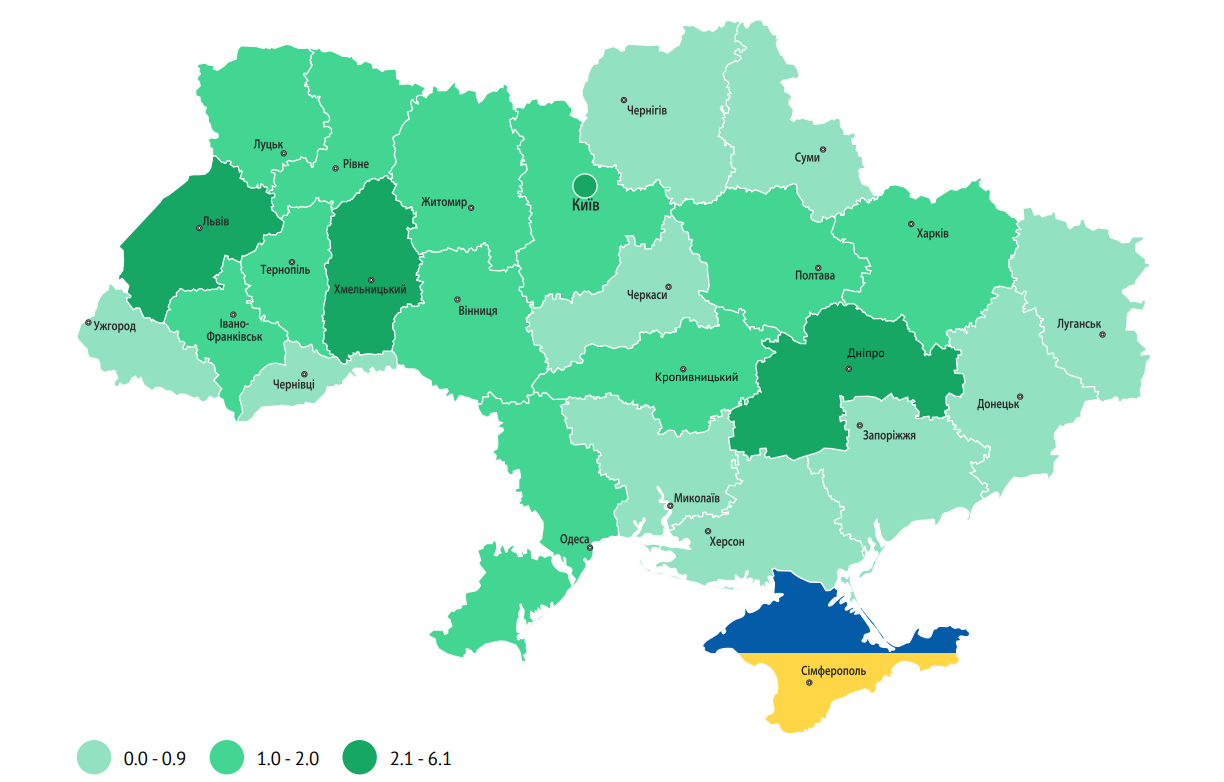

Number of vacancies as of 01.05.2023 (ths. Units)

Source: Open4Business.com.ua and experts.news

Primary registrations of electric cars in Ukraine in May increased by almost 15% compared to April this year – up to 2,451, while demand for new ones increased by 23% – to 559, and for used ones – by 13% – to 1,892, Ukravtoprom reports in Telegram channel.

Thus, the share of new cars in the total registrations of electric cars last month rose to 23% compared to 21% in April.

Earlier it was reported that in April 2023 there was a decline in demand for new electric cars by 14% compared to March, while demand for used cars increased by 21%.

The top five new electric cars in May formed Volkswagen ID.4 (168 vs. 129 in April), DongFeng/Honda M-NV (107 vs. 53), Volkswagen ID.6 (23 vs. 36), Honda e (23 as in April) and BMW iX – 18.

In the used segment, the Nissan Leaf consistently leads (388 vs. 366 in April). Next are Volkswagen e-Golf (259 vs. 145), Tesla Model 3 (144 vs. 156), Renault Zoe (123 vs. 113 units) and Tesla Model Y – 119.

According to the Association, a total of about 9.5 thousand vehicles were first registered in Ukraine in January-May 2023, of which 24% are new and 76% used.

As reported, Ukrainians in 2022 bought 13.6 thousand electric cars – 1.5 times more than a year earlier, with the share of new cars rose to 17% from 14%.

VESCO, one of the world’s leading producers and exporters of white plastic clay, has acquired quarries in Spain, Poland, Romania, Serbia and Bosnia in addition to its Ukrainian assets to maintain its competitive position in the market, said Andriy Gorokhov, CEO of umgi, an investment company whose assets include VESCO.

“We have already made investments, in particular in the extraction of minerals that are in demand for ceramics production, in five countries: … Spain is the key one … and now we have added Poland, Romania, Serbia and Bosnia and are looking at Turkey,” he said at a recent Ukrainian-Swiss business forum held in Lugano.

Gorokhov reminded that the asset in Ukraine produces a product of unique quality, and before the war it was No. 2 in its niche and was valued at more than $700 million.

According to the umgi CEO, VESCO had a strategy to expand, in particular abroad, and UMGI helps the team with the strategy and its implementation.

Gorokhov explained that the war accelerated the process of entering foreign markets, as Ukrainian raw materials became more expensive due to logistics, so it became necessary to have raw material production facilities in other countries to maintain competitiveness and existing customers.

He clarified that in addition to quarries, VESCO has production facilities in two key locations: Port Ravenna in Italy and Port Castellon in Spain, where the team mixes raw materials and receives the final product, guaranteeing timely delivery to the client.

“Thus, as a company that has extensive experience, primarily in the field of investment in Ukraine, we are trying to combine business models in the right way, where Ukraine always has a place and there is something that could strengthen these business models through investment abroad,” said umgi’s CEO.

According to him, clay is just an example of this approach, and creating something bigger and more efficient benefits both customers and investors and increases the value of the asset.

In general, representing the investment company, which changed its name from UMG Investments to umgi in March this year, he noted that it has been in the mining business for 17 years, has invested more than $100 million in it and has achieved good results.

“The return rate is five to one for our investors. For the mining business, this is more than a good result, (which) proves that it is possible to make money in this area in Ukraine. You just have to know what you’re doing and be a professional player, which is the standard for the whole world,” Gorokhov emphasized.

According to him, mining assets are one of the three in umgi’s portfolio, but they are significant: before the war, their value exceeded $800 million.

“When the war broke out, we continued to look for projects, and now we have about 10 projects that we are considering in Ukraine, plus we have started developing additional projects in Europe,” Gorokhov added.

According to him, umgi is now offering European investors to invest in Ukraine on a partnership basis.

The head of the investment company noted that over 17 years of work in Ukraine, the situation with laws and regulations and market transparency has improved significantly, an investment map has been created, access to databases has been provided, and liberalization is underway, in particular, in 2023, with the adoption of legislation, access to the purchase of licenses was greatly facilitated. Gorokhov added that, for example, in Ukraine, obtaining a license is easier than in Romania or Poland, although it can take up to two years to prepare a field for operations.

At the same time, there are still issues with connecting to the energy and transportation infrastructure, Gorokhov admitted.

According to the website, VESCO Limited is a company that is a 100% owner of shares in the VESCO clay mining group.

VESCO is a portfolio company of umgi, which is part of Rinat Akhmetov’s SCM, the largest investment group in Ukraine.

VESCO’s Ukrainian assets include VESCO PrJSC, Druzhkovka Ore Mining, Vogneftebrud and Chasovoyarsk Refractory Plant.

According to the data on the site, the production capacity of VESCO exceeds 3 million tons of clay per year, the products are delivered to more than 25 countries, more than 60 types of products are made for the companies of ceramic and refractory industries. It is noted that more than 900 thousand tons of products are kept in warehouses to ensure stability of supply.

At the end of August 2022 VESCO announced that it had restored the delivery of products to Spain, Italy and Turkey. It was pointed out that after the start of full-scale war on the part of Russia, the group suspended the production for several months, evacuating people and some equipment, but the accumulated stocks were sufficient. At that time, the group had reached a shipment volume of 100,000 tons per month.

As umgi pointed out in March of this year, in addition to the brand, the corporate identity was also redesigned.

“Since its founding, umgi has transformed from a non-core asset management company that was part of an industrial conglomerate to a captive private equity firm with a diversified portfolio of assets located first only in Ukraine and now also in the EU and Turkey,” the release noted.

As of March this year, umgi has a track record of investing in start-ups and developing operating companies in the green economy, industrial services and natural resources sectors. Umgi’s assets are located in Ukraine, Spain, Romania, Poland, Italy and Turkey and were worth more than $1 billion as of January 1, 2022.

The National Energy Regulatory Agency (ANRE) of Moldova has decided to reduce the gas tariff for final consumers to 18.06 lei per 1 cubic meter (including VAT).

The National Agency has urgently examined the request of Moldovagaz company at a meeting on Wednesday.

As earlier reported, on June 5, Moldovagaz submitted a request for gas tariff decrease to ANRE. The company explained its request by the decrease in purchase prices of natural gas. The distributor asked to reduce the weighted average tariff by 36.8% – down to 16,492 thousand Moldovan lei per 1,000 cubic meters. It was proposed to reduce the final tariff for residential consumers, including VAT, by 31.9% – from MDL 29.27 to MDL 19.93 per 1 cubic meter.

Thus, the tariff was reduced by 38%.

The last time the gas prices in Moldova were reviewed in autumn 2022, the prices for households rose by 27.3% – from MDL 23 to MDL 29.27 per 1 cubic meter.

Natural gas tariffs in Moldova are set by ANRE upon request of suppliers.

The official exchange rate as of June 7 – 17.82 lei/$1.