At night on May 9, frosts of 0-5° (danger level I, yellow) are expected on soil surfaces in northern and most central regions of Ukraine, according to Ukrhydrometecenter.

During the night of May 10 and 11, strong air frosts of 0-5° (danger level II, orange) are expected in western, Zhytomyr and Vinnitsa regions, while in Kyiv, Chernihiv, Cherkasy, Kirovograd, Odessa and Mykolaiv regions frosts of 0-5° (danger level I, yellow) on soil surfaces are expected.

INGo Insurance Company (Kiev) expanded its possibilities for apartment insurance by increasing the range of dangerous situations, such as damage to windows, balconies and loggias as well as military risks that were traditionally not included in property insurance programs for citizens, according to a press release from the insurer.

As noted, individuals who buy a property insurance policy can now be confident in protecting their property even in difficult wartime conditions.

“Such causes of destruction of buildings as shells, missiles, mines, balloons, etc., and consequences of explosions – broken glass and other damage to real estate – have always belonged to the list of exceptions, which exempted insurers from paying compensation to victims. However, now that the country is in martial law, we have decided to give people the opportunity to protect their property from these risks as well,” says director of retail business of the company Nikolai Matika, who is quoted by the press service.

It is specified that insurance coverage applies to both movable and immovable property of the apartment (decoration, repairs, engineering and other communications, furniture, appliances and other equipment, etc.), and liability to neighbors (or other persons).

It is possible to insure apartments that are located in a residential building that has been commissioned, upon completion of repair and reconstruction works in the premises. The insurance amount can be chosen at your discretion and varies from UAH 250 thousand up to UAH 2 mln. Besides, losses, which are the result of “war risks”, will be compensated according to the terms of the contract within the insured sum without additional sublimits.

According to the press service, you can get an insurance policy “Apartment Express” for a short term from one month – or for a standard period of one year. Insured can be individuals and legal entities – owners or tenants. There is no need to carry out a preliminary inspection to conclude an agreement and insignificant losses – up to 30 thousand UAH – are regulated by a simplified procedure that requires minimum documents.

JSC “Insurance company “INGO” has more than 25 years of experience in the market.

Since 2017, the main shareholder of the company is the Ukrainian business group DCH Oleksandr Iaroslavskyi.

The company is included in the list of the largest insurance organizations of Ukraine in terms of premiums, the size of its own assets and the amount of claims paid. It has 29 licenses for different types of compulsory and voluntary insurance and provides insurance services to corporate and retail clients. INGo is a full member of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU), a member of the American Chamber of Commerce (ACC), the European Business Association (EBA) of the National Association of Insurers of Ukraine (NASU) and the International Chamber of Commerce (ICC).

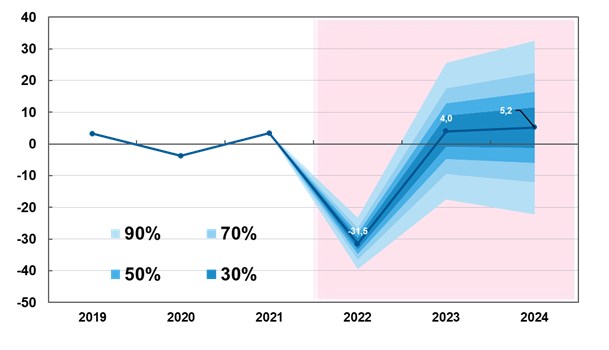

Forecast of dynamics of changes in GDP in % for 2022-2024 in relation to previous period

Source: Open4Business.com.ua and experts.news

Naftogaz group has paid more than UAH 30 billion of taxes to the state budget of Ukraine in the four months of 2023, which is 15% of all tax revenues to it during this time.

According to a report on the group’s website on Monday, Naftogaz Group paid a total of nearly 33 billion hryvnias to the state and local budgets as of May 1, 2023.

“Despite the war and the consequences it caused, Naftogaz Group remains one of the largest taxpayers in Ukraine and a reliable support for the treasury. Only in April we accumulated 6.2 billion UAH of taxes, which is almost 13% of all tax revenues of the state budget of the country”, – Chairman of the Board of Naftogaz of Ukraine Alexei Chernyshov was quoted in the message.

As Ukrainian News earlier reported, Ukrhazvydobuvannia (UHV), 100% owned by Naftohaz Ukrainy, transferred UAH 6.32 billion of rent payments to the country’s consolidated budget based on its activities in January-March 2023.

Primary registrations of used cars imported from abroad in April 2023 increased by almost 8% compared to March 2023 – up to 15.3 thousand units, which was the highest number of registrations per month since the beginning of the year, said the association “Ukravtoprom” in Telegram-channel.

The largest share in this segment of the car market belongs to gasoline cars – 45%, followed by diesel cars – 36%, electric cars – 11%, cars with HFO – 5% and hybrids – 3%.

The average age of used cars that switched to Ukrainian plates in April is 11 years.

According to the Association, the top five of the market of used cars compared to March has not changed: the most popular is still Renault Megane – 1273 units, the second result has Volkswagen Golf – 1180 units, the third – Skoda Octavia – 794 units. Volkswagen Passat (694 units) and Ford Focus (377 units) are at the end of the leading five.

Besides, the TOP-10 of the month includes: Nissan Leaf – 366 units; Nissan Qashqai – 337 units; VW Touran – 320 units; Skoda Fabia – 277 units; AUDI A4 – 270 units.

As reported with reference to Ukravtoprom, 5.16 thousand new cars were registered in Ukraine in April, i.e. almost three times less.

“Ukravtoprom” informs that in January-April, 54.5 thousand used cars, imported from abroad, got the first registration in Ukraine, which is 3.3 times more than the sales of new cars during the same period.

Ukrainians in 2022 registered 388.5 thousand imported used foreign cars, which is nearly a quarter less than a year earlier, but more than 10 times more than the market of new cars.

Oil prices are rising on Monday thanks to some easing of concerns over a possible recession.

A positive factor for the market was Friday’s data on the U.S. labor market, which showed that it remains strong despite a significant tightening of monetary policy by the Federal Reserve (Fed).

“Oil prices have been falling lately because of fears of a global recession, but strong labor market data and positive comments from central bank governors offer hope that a recession can be avoided this year,” said Jamil Ahmad, chief analyst at CompareBroker.io, cited by Market Watch.

Federal Reserve Chairman Jerome Powell said last week that the U.S. economy is likely to continue growing at a moderate pace this year and avoid a recession.

In addition, traders note that China is increasing its oil purchases and demand is likely to remain strong in the next few months due to increased tourist activity in the country.

At the same time, global oil inventories are shrinking and the problem will be exacerbated by OPEC+ production cuts.

July Brent crude futures on London’s ICE Futures exchange stood at $75.7 a barrel by 8:10 a.m. Monday, up $0.4 (0.53%) from the previous session’s closing price. Those contracts rose $2.8 (3.9%) to $75.3 a barrel on Friday.

The price of WTI crude futures for June grew by $0.43 (0.6%) to $71.77 per barrel at electronic auctions of New York Mercantile Exchange (NYMEX) by that time. The contract value grew by $2.78 (4.1%) to $71.34 per barrel at the end of previous session.

Brent was down 6.3% and WTI was down 7.1% at the end of last week.

“The market decline last week was much more significant than one would have expected, judging by the supply-demand balance in the market,” said Citigroup Inc. analyst Ed Morse. Ed Morse. – We can expect oil inventories to decline, given the approach of the summer season, during which demand will rise.”