The Motor (Transport) Insurance Bureau of Ukraine (MTSBU) raised tariffs on Green Card policies for traveling abroad by 3.15% starting April 21, its website says.

According to the MLSA, the last change of tariffs was on December 30, 2022, in the direction of increasing by 3.1%, before that they were also increased on November 17 by 6.9% after a decrease by 5.5% on October 3, before that, on July 26 of the same year, they were increased by almost a quarter (by 26.3%).

Green Card policies have been implemented since 2009 in two types: all Europe and Moldova. Also, since January 1, 2016, Ukrainian “Green Card” policies began to operate in the territory of Azerbaijan.

Thus, according to the MTSBU, the cost of “Green Card” in Ukraine for 15 days to travel in Europe for cars rises to UAH 982 (from UAH 952 previously), for buses – up to UAH 3.691 thousand (UAH 3.578 thousand), for trucks – up to UAH 2.317 thousand (UAH 2.246 thousand).

The cost of Green Card for one month for cars is now UAH 1.564 thousand (vs. UAH 1.516 thousand before), for buses – UAH 5.126 thousand (UAH 4.970 thousand), for trucks – UAH 3.075 thousand (UAH 2.982 thousand).

Semi-annual and annual Green Card policies for cars will now cost UAH 6.942 thousand and UAH 8.594 thousand respectively, for trucks – UAH 14.559 thousand and UAH 27.480 thousand, for buses – UAH 17.942 thousand and UAH 33.322 thousand.

Policies for trips to Azerbaijan and Moldova for passenger cars for 15 days will cost UAH 715 (UAH 694 previously), for one month – UAH 1.052 thousand (UAH 1.020 thousand), for six months – UAH 2.413 thousand (UAH 2.340 thousand), for a year – UAH 3.436 thousand (UAH 3.331 thousand).

The amounts of single insurance payments under the contracts of international compulsory insurance of civil liability of motor vehicles owners are set by the Decree of the Cabinet of Ministers as of January 6, 2005 and are defined in EUR.

“Green Card” is a system of insurance protection for victims of road accidents, regardless of their country of residence and country of registration of the vehicle. It covers the territory of 44 countries in Europe, Asia and Africa.

According to the decision of the General Assembly of the Bureau Council of the international motor insurance system “Green Card”, adopted in Luxembourg in May 2004, Ukraine since January 1, 2005 is a full member of the system.

Nova Posta group of companies has suspended acceptance of food products for shipment to all EU countries due to import restrictions imposed by the Polish customs, the company’s press service said.

“We are waiting for further clarification from the governments of Poland and Ukraine to clarify the possible terms of resumption of such shipments,” the statement said.

All branches of “Novaya Posta” temporarily do not accept any products in international parcels that are sent to the EU, due to the introduction of temporary restrictions on the import and transit of a number of food products from Ukraine – sugar, cereals, confectionery, fruits, vegetables and others.

Founded in 2001 Nova Posta is the leader of express-delivery market in Ukraine. Its network consists of more than 6 000 offices all over the country. The group “Nova Posta” provides customers with a full range of logistics and related services. The group consists of Ukrainian and foreign companies, including Nova Posta, NP Logistic, Post Finance (Forpost system) and Nova Posta Global.

A reminder that Poland, Slovakia, Hungary and Bulgaria imposed a ban on a number of agricultural products from Ukraine, but did not ban their transit through their territory.

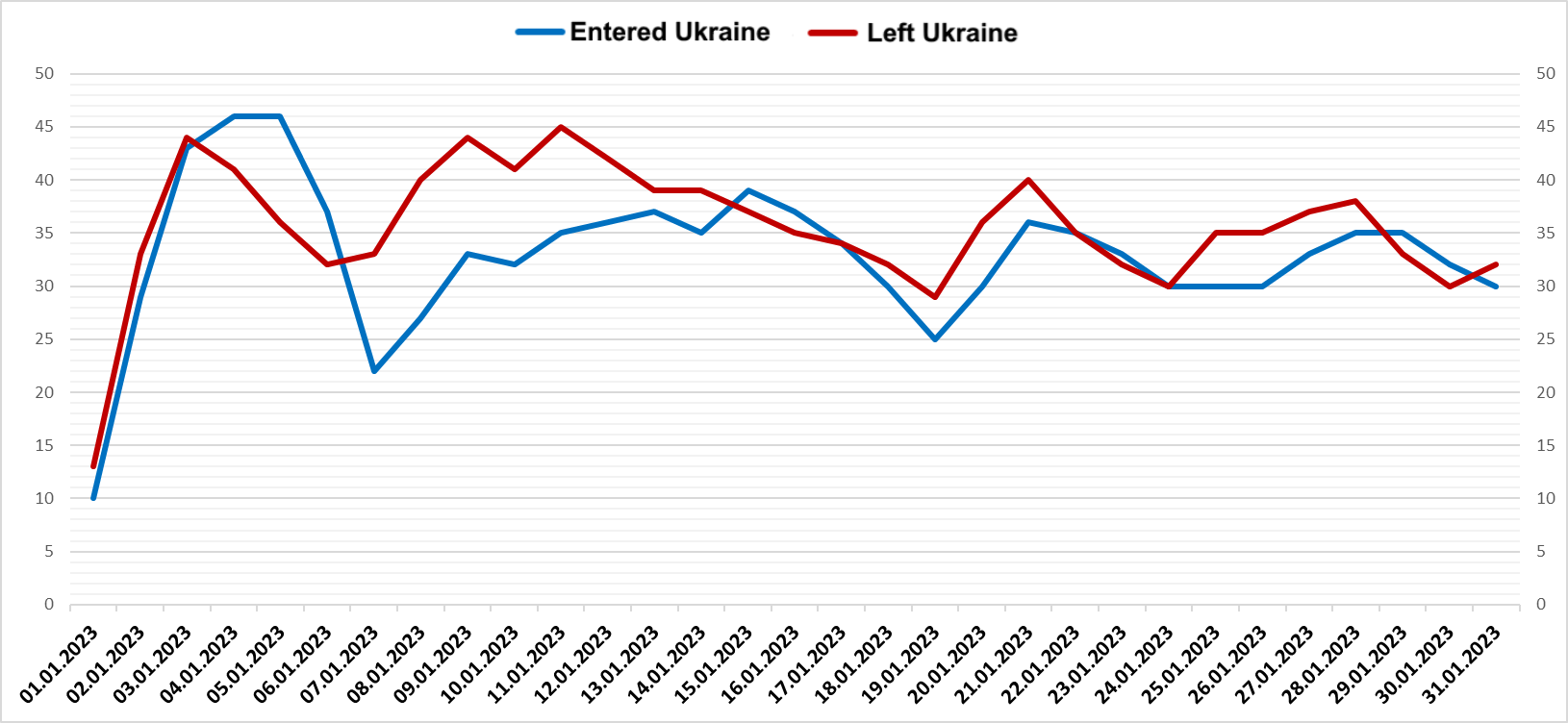

Motor transport provides third of passenger flow through western border of Ukraine in Jan 2023, thousand (graphically)

Source: Open4Business.com.ua and experts.news

Stock indices of the largest countries in the Asia-Pacific region on Friday declined after the negative dynamics of the U.S. stock market.

Consumer prices in Japan rose 3.2 percent year on year in March, according to the country’s Ministry of Internal Affairs and Communications. Thus, inflation slowed down from February’s 3.3% and was the lowest since September 2022.

Consumer prices in Japan, excluding fresh food (a key indicator tracked by the country’s central bank), rose 3.1% in March compared with the same month a year earlier. That matched both the February figure and analysts’ average forecast, Trading Economics reported.

Meanwhile, inflation excluding food and energy increased to 3.8% from 3.5%.

Japan’s Nikkei 225 index was down 0.25% by 8:30 a.m. ET.

Shares of carmakers Nissan Motor Co. (-3.3%) and Mazda Motor (-2.5%) and Internet company Rakuten (-2.6%) were among the leaders of the fall.

In addition, members of the financial industry are getting cheaper, including Mizuho Financial Group Inc. – by 2.3%, SoftBank Group, Dai-ichi Life Holdings Inc. and Mitsubishi UFJ Financial Group Inc. – by 2.1 percent.

Meanwhile, Tokyo Gas Co. (+5.3%), chip maker Advantest Corp. (+3.6%), transportation firm Kawasaki Kisen Kaisha Ltd. (+1.8%) and retailer J. Front Retailing Co. (+1.8%).

China’s Shanghai Composite had fallen 1.4 percent by 8:35 a.m. QE, marking its third straight negative session.

Hong Kong’s Hang Seng index is losing about 1.2%, also due to a decline in the technology sector.

Among them, shares of chipmakers Semiconductor Manufacturing International Corp. and Sunny Optical Technology Group Co. – by 4.1% and 2.9%, respectively, aluminum producer China Hongqiao Group by 4.5%, retailer Alibaba (SPB: BABA) by 3.5%, insurer Ping An Insurance by 3.2% and consumer electronics maker Xiaomi (SPB: 1810) by 2.8%.

South Korea’s Kospi index was down 0.75% by 8:31 a.m. ET.

Shares of steelmaker Posco plummeted 5.9%, automaker Hyundai Motor – 1.3%.

At the same time, the share price of Samsung Electronics Co., one of the world’s largest chip and electronics manufacturers, rose 0.3%.

Australia’s S&P/ASX 200 index was down 0.3 percent by 8:31 a.m. ET.

The capitalization of the world’s largest mining companies BHP and Rio Tinto are down 2.5% and 3.5%, respectively.

Rio Tinto in the first quarter decreased its iron ore shipments by 6% compared to the previous three months and diamond production by 28%. The company cut its 2023 copper output forecast to 590,000-640,000 tons from the previously expected 650,000-710,000 tons.

Oil prices of benchmark grades fell on Thursday to their lowest level since early April and continue their weak decline on Friday morning.

This could be the first week of losing territory in the last five weeks. Among the negative factors is a strengthening U.S. dollar, notes MarketWatch. In addition, traders fear that further tightening of monetary policy by the Federal Reserve and other major central banks could worsen the global economy and reduce the demand for fuel.

The quotations of June futures for Brent at London Stock Exchange ICE Futures made $81.07 per barrel by 8:02 a.m. which is $0.03 (0.04%) lower than the closing price of the previous session. The previous day those contracts fell by $2.02 (2.4%) to $81.1 per barrel.

The price of WTI futures for June oil at NYMEX fell by $0.03, to $77.34 per barrel. At the end of previous session the contracts value decreased by $1.87 (by 2.4%) to $77.37 per barrel.

According to Trading Economics, the decrease in WTI quotations since the beginning of the current week exceeds 6%.

Commercial banks will take into account not 100%, but 120% of the volume of non-cash currency purchases from the population starting April 21 when calculating the amount of cash foreign currency they can sell in the foreign exchange market, starting April 13, 2022.

“The National Bank has consistently taken steps to minimize the multiplicity of exchange rates. This contributes to the stability of the currency market and improves exchange rate expectations. For the same purpose, the NBU is expanding the ability of banks to carry out transactions for the sale of foreign currency in cash to the population,” the National Bank explained its decision on its website on Thursday evening.

He noted that the relevant changes are aimed at preserving favorable conditions in the foreign exchange market.

The NBU specified that the corresponding changes are stated in the decision № 53 as of April 20.

As reported, the volume of non-cash currency purchases by banks declined to $300.4 mln in March from $462.1 mln in February and $523.9 mln in January. Hryvnia appreciation at the cash market by 1.15 UAH in February, and in March by another 1.2 UAH – to 37.75 UAH/$1, with official rate 36.57 UAH/$1, reduced interest in buying non-cash currency by placing it on deposit for at least three months.

The volume of non-cash currency sales by population in March slightly increased – to $153.3 mln from $123.1 mln in February, returning to the level of January.

As for cash currency, its purchase and sale increased compared to February: purchase – from $1.185 billion to $1.512 billion, sale – from $1.082 billion to $1.235 billion.

At the cash market in April, the hryvnia, after strengthening to 37.2 UAH/$1, has weakened to 38 UAH/$1 by now.