Miller legal company, representing the interests of the ex-general director of Boryspil airport, Yevhen Dykhne, on Thursday filed an appeal against the decision of the High Anti-Corruption Court, which found Dykhne guilty of abuse of power and sentenced him to 5 years of imprisonment.

“An appeal is being filed today. We will insist on a full acquittal. There is not a single piece of evidence in the case that would allow us to find elements of a crime in it,” said Oleksiy Nosov, the partner of the Miller company, said at a briefing in Kyiv with the participation of Dykhne.

According to Nosov, the presence of a corruption component was not proved during the process.

“It is not even in the prosecution materials. They did not even try to attribute it to the fact that this was done in the interests of … or Yevhen Hryhorovych (Dykhne) received a kickback, for example. There was no such thing, it was not even proved, it was not even investigated,” the lawyer said.

Dykhne said that during the period when he was in charge of Boryspil airport, the task was to urgently solve the problem of the airport’s compliance with the requirements of international rules in terms of the level and quality of service.

“Under these conditions, of course, decisions were made that were not related to any possible restrictions,” the ex-general director said.

According to him, the charges brought against him and Olesia Levochko, the head of the airport’s rental relations service, who was recognized as his accomplice and sentenced by the court to four years in prison, may influence the decisions of other directors of state enterprises.

“How will the airport compete in the future? It will be exactly the same situation as in 2014. The war will end with our victory, it will be necessary to resume the operation of the airport, it will be even more empty. And where are the mechanisms?” said the ex-director.

He noted that over the three years of discussion of the problem in court, there have been no changes to the legislation, and the mechanisms for managing state property have remained the same.

Dykhne said that he had received two attractive job offers in public sector enterprises related to infrastructure, but he could not accept them before the court’s verdict of acquittal.

As reported, on March 1, the High Anti-Corruption Court found Dykhne guilty of abuse of power and sentenced him to five years in prison. The court also satisfied the civil claim of the regional branch of the State Property Fund (SPF) for recovering the damage in the amount of about UAH 10 million. Dykhne is accused of the fact that being in the position of acting general director of Boryspil airport, in April 2016 he entered into preliminary agreements with Arteria Group LLC and Coffee Bar Plus LLC, allegedly at a lower cost, without the consent of the airport’s governing body – the Ministry of Infrastructure – and without a competitive selection of the tenant. This allegedly led to losses in the amount of UAH 15.7 million: about UAH 10 million to the State Property Fund as a lessor and about UAH 5 million to Boryspil airport.

The materials of the case are available at the link: www.nojustice.com.ua

Yuria-Pharm, one of Ukraine’s leading pharmaceutical companies, has acquired the pharmaceutical company Reka-Med in Uzbekistan, using EUR10 million in financing from an existing loan from the European Bank for Reconstruction and Development (EBRD) after it changed its purpose.

“The EBRD loan will allow Yuria-Fram, which exports 30% of its products (of which 15% are to Uzbekistan), to produce pharmaceutical products locally for the Uzbek market and free up about 10% of its capacity in Ukraine to produce products more critical to the domestic market,” the EBRD said in a Thursday press release.

It noted that buying the Uzbek company to switch to local production was the best strategic response to Russia’s unleashed war in Ukraine, which has made exports more difficult and costly.

“This agreement will improve the availability and affordability of drugs in Ukraine and Uzbekistan. It will also improve Yuria-Pharm’s profitability and allow it to diversify its production risks by locating production outside Ukraine,” EBRD Managing Director for Eastern Europe and the Caucasus Matteo Patrone said in a statement.

Purchase of assets abroad and entering the international level of activity will make “Yuria-Pharm” more competitive, the banker concluded.

The EBRD recalled that Yuria-Pharm’s main operating company, Yuria-Pharm LLC, which produces drugs and medical devices, signed an initial loan agreement with the EBRD in May 2019. The document provided for the company to receive EUR25 million financing in two tranches: the first reserved tranche of EUR15 million was for upgrading packaging lines, launching the production of a cancer drug in affordable individual doses and implementing energy efficiency measures, while the second, unreserved tranche of EUR10 million was for production improvements. It was this tranche that, once reserved and reassigned, was used to acquire Réka-Med.

The EBRD is the largest institutional investor in Ukraine. The bank promised to invest at least EUR3 billion in the real sector of the Ukrainian economy in 2022-23. In 2022, the EBRD invested EUR 1.7 billion, with another EUR 200 million mobilized from partner financial institutions. The loan to Yuria-Pharm is backed by a EUR2.5 million first-loss guarantee from the EBRD’s Special Crisis Response Fund.

According to the EBRD, Yuria-Pharm is among the top five pharmaceutical producers in Ukraine and sells its products all over Ukraine and exports to more than 40 countries.

In 2021, the company increased its net profit by 30.2% to UAH 883.5 million while revenues increased by 36.1% to UAH 4 billion 562.9 million.

Yuria-Pharm LLC was founded in 1998; its statutory fund is UAH 44.1 mln. The final beneficiaries with equal shares are Natalia Derkach and Nikolai Gumenyuk.

Reka-Med Farm LLC (Tashkent) was commissioned in 2006 as a joint Uzbek-Russian-British venture. According to the information on its website, it produces infusion intravenous drugs. Now the company has one line, the maximum average annual capacity of which is 18.15 million vials

JSC Kyivmedpreparat (Kyiv) posted a net loss of UAH 213.825 million in 2022 after seeing a net income of UAH 30 million in 2021.

According to the company in the information disclosure system of the National Securities and Stock Market Commission, the shareholders will consider the results of its work at a remote meeting scheduled for April 26.

The manufacturer of antibiotics Kyivmedpreparat together with JSC Galychpharm are the main manufacturers of Arterium products (Kyiv).

Poznyaki-Zhyl-Bud PJSC (Kyiv) made net profit amounting to UAH 5.9 mln according to the results of 2022, while 2021 ended with a loss of UAH 6.5 mln.

According to the company announcement in the information disclosure system of the National Securities and Stock Market Commission (SSMSC) about the annual general meeting of shareholders on April 28, the net profit per share last year was UAH 1.68 ths.

Poznyaki-Zhyl-Bud’s uncovered loss in 2022 decreased by 25% compared to 2021, to UAH 17.6 mln. Total accounts receivable increased by 36.8% to UAH 642.1 mln.

Last year current liabilities of PJSC increased by 24.6% up to 2.24 billion UAH, and long-term liabilities decreased to 5.6 billion UAH.

In general, the value of assets of Poznyaki-Zhyl-Bud in 2022 increased by 11% to more than 2.23 billion hryvnias.

According to the agenda of the meeting, the shareholders intend not to distribute dividends for 2022 and also elect new members of the supervisory board for three years.

In 2023 the company plans to continue the organization of residential, hotel, office complexes construction in Kiev, including residential complex with non-residential premises and underground parking in 12, John Paul II Str., and multifunctional complex in 7-9, Lesya Ukrainka Str. in Pecherskiy district of the capital.

According to the data of the National Commission on Securities and Stock Market, as for the fourth quarter of 2022 the shareholder of “Poznyaki Zhil-Bud” is Ruzanna Kagramanian (100%).

Poznyaki-Zhil-Bud PJSC was founded in 2002, specializing in construction of elite residential real estate, commercial real estate and social infrastructure objects.

According to the company web-site, its portfolio of completed construction projects includes residential and office complexes over 1 million sq.m.

Poznyaki Zhil-Bud Corporation since December 2015 is a part of investment and development group of companies Taryan Group (Kiev), founded in 2011 by ex-president of Poznyaki Zhil-Bud PJSC Arthur Mkhitaryan.

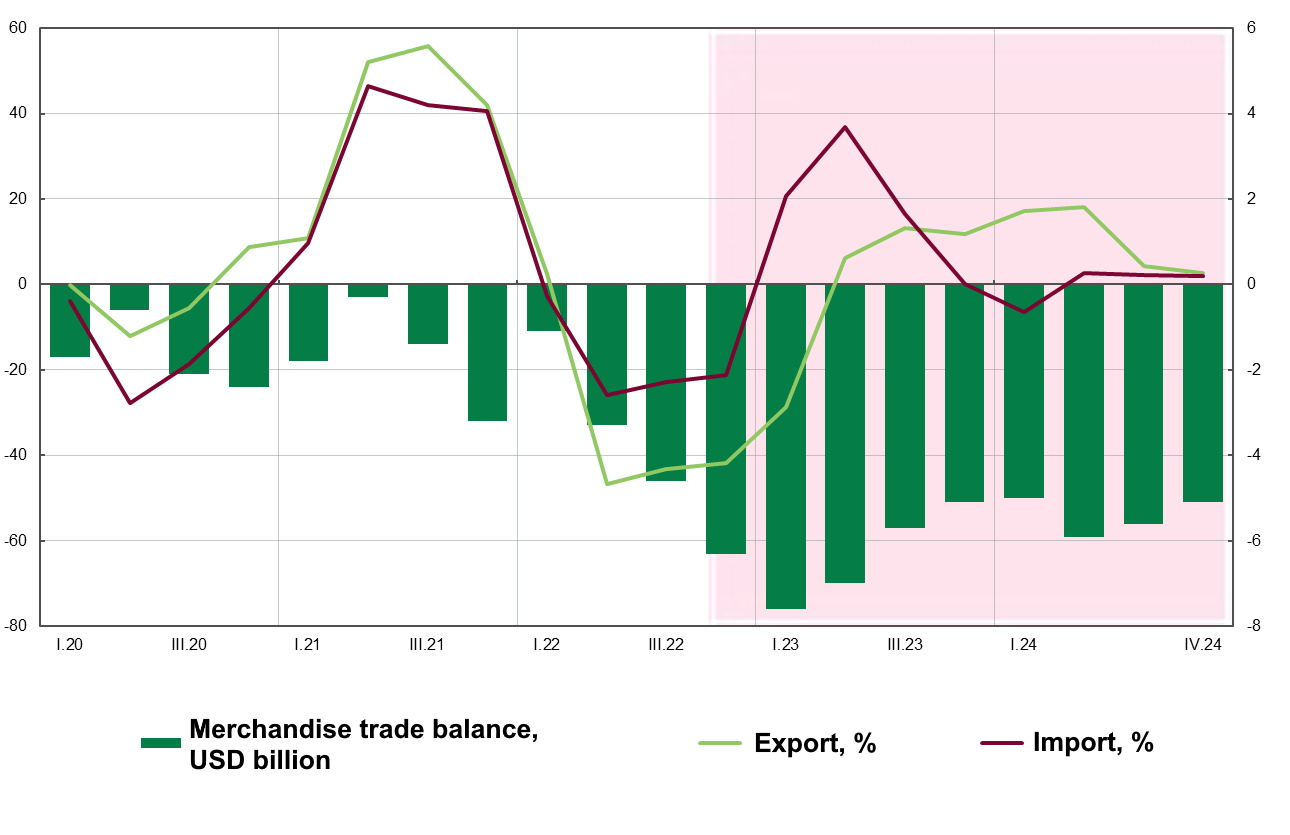

2022-2024 goods trade balance forecast (USD bln)

Source: Open4Business.com.ua and experts.news

The U.S. economy will enter recession in the coming months, Jeff Gundlach, head of investment company DoubleLine Capital, said on CNBC.

According to Gundlach, only a rise in unemployment is needed for a recession to begin under current conditions. The Federal Reserve (Fed) will need to take “very decisive” action, he believes, and expects the regulator to lower interest rates this year.

Since March 3, the two-year U.S. Treasury yield has fallen about 100 basis points to 4.078%. Until it recovers, the Fed won’t raise rates, Gundlach believes.

The Fed has been tightening monetary policy throughout the year. As Bloomberg notes, this forces investors to reallocate capital in favor of cash and instruments with yields higher than deposit rates, including Treasury bills and units of money market funds.