Industrial production in Ukraine in 2022 fell by 36.9%, while in 2021 there was an increase of 1.9%, the State Statistics Service (Gosstat) said on Monday. The agency specified that industrial production in Ukraine decreased by 44.1% in December 2022 against December 2021, while in November the decline was 41.9% and in October – 41.6%.

Last year March was the worst month for the dynamics of industrial production, when after the Russian full-scale invasion it dropped by 53.7%, although in January the growth of 2.9% was recorded, and in February it was 10.1%.

In April the rate of decline decreased to 46.6%, and in May-June – to 40.9%-40.8%, respectively.

In the third quarter, before Russian shelling caused problems with energy supplies, this trend continued: after industrial production fell by 42.3% in July, in August and September it was 39.4% and 39.8%, respectively.

The State Statistics Service specifies that the data does not include the temporarily occupied territory of Crimea and Sevastopol, as well as part of the temporarily occupied territories in Donetsk and Luhansk regions.

By sectors, the statistics agency recorded the largest decline – 41.2% – in the processing industry, while in the extractive industry it was 30.1%, in the supply of electricity, gas and steam – 30.7%.

At the same time, in the extractive industry such indicator provided coal mining (down 7.7%) and gas and oil (down 8.4%), while in the mining of metal ores decline was 61.7% and other minerals and quarrying – 75.1%.

The crisis in the U.S. banking industry has led to a bubble in the segment of money market funds, writes MarketWatch referring to the report of Bank of America Corp.

According to analysts at the bank, over the past four weeks, assets under management of money market funds have grown by $300 billion – more than $5.1 trillion.

In addition, the bank’s experts point to the largest weekly inflows in money market investments since March 2020, the largest six-week inflows in US Treasuries in history and the largest outflows from the investment grade bond market since October 2022.

There was a surge in assets under money market funds in 2008 and 2020. However, at that time, the U.S. Federal Reserve (Fed) was lowering interest rates, not raising them. On March 22, the U.S. regulator reportedly raised the federal funds rate by 25 basis points.

“The stock and bond markets want too much of a rate cut and not enough of a recession,” BofA analysts said.

The Finnish manufacturer of telecommunications equipment Nokia in Ukraine has joined the country’s current legal and tax regime for IT companies Diia.City, the press service of the Ministry of Digital Transformation reported on Saturday.

“Residency will give the company the best legal and tax conditions, tools for attracting venture capital investments, and protection of intellectual property rights. Now, the company can develop more actively in Ukraine and contribute to the development of the digital economy,” Deputy Prime Minister for Innovation, Education, Science and Technology Development, Minister of Digital Transformation Mykhailo Fedorov wrote on his Telegram channel.

Soon Nokia plans to create a separate group of experts to restore the telecom infrastructure of Ukraine. The company is a partner of the Ministry of Digital Transformation in the development of the Internet and communications in Ukraine. Since the beginning of the full-scale invasion, Nokia has donated 5,000 routers to Ukraine, which are already providing Internet shelters in schools.

The total number of Diia.City residents has increased to 496 companies, the Ministry of Digital Transformation said.

Raiffeisen Bank is planning to send its profits for 2022 less dividends in the amount of UAH 1.572 billion to the bank’s reserve fund.

According to a report in the system of the National Securities and Stock Market Commission (NSSMC), the relevant decision will be considered at the remote gathering of the bank’s shareholders on April 28.

It is pointed out that the bank plans to deduct UAH 700 th from the profit for 2022 to pay dividends to the owners of the bank’s preferred shares before sending them to the reserve fund.

According to the National Bank of Ukraine, Raiffeisen Bank on the size of assets as of January 1, 2023, was in 5th place (187.26 billion UAH) among 67 operating Ukrainian banks.

The Federal Deposit Insurance Corporation (FDIC) has reached an agreement to sell the assets and deposits of Silicon Valley Bridge Bank to the American bank First-Citizens Bank & Trust Company, the FDIC said in a statement.

Silicon Valley Bridge Bank is a bailout bank created by the FDIC, which received the assets and deposits of Silicon Valley Bank (SVB), which closed in early March.

“Depositors of Silicon Valley Bridge Bank will automatically become depositors of First-Citizens Bank & Trust Company. All deposits transferred to First-Citizens Bank & Trust Company will continue to be FDIC insured up to the insurance limit,” according to the press release. The FDIC insurance covers deposits up to $250,000.

On Monday, March 27, all 17 Silicon Valley Bridge Bank branches will begin operating as part of First-Citizens Bank & Trust.

As of March 10, Silicon Valley Bridge Bank had estimated assets of about $167 billion and deposits of $119 billion.

As part of the deal, First-Citizens will receive $72 billion in assets at a discount of $16.5 billion, according to the FDIC. First-Citizens will also assume a $56 billion deposit service obligation.

The bank’s $90 billion in securities and other assets will remain under regulatory management. In addition, the FDIC received rights to shares of First Citizens BancShares Inc. for up to $500 million. The regulator and First-Citizens also entered into an agreement to share losses on Silicon Valley Bridge Bank loans.

First-Citizens, which is registered in North Carolina, is only the 30th largest U.S. bank by assets, a figure estimated at about $109 billion, but Bloomberg notes that the bank has extensive experience in acquiring troubled competitors – since 2009 it has bought more than 20 banks that were forced to ask for help from the FDIC.

Silicon Valley Bank (SVB), the 16th largest bank in the U.S., announced its closure on March 11. The bank had provided banking services to many U.S. startups. The withdrawal of funds from deposits by SVB corporate clients to cover costs amid falling revenues, superimposed on the declining value of the securities portfolio due to tightening Fed policies, eventually led to the fact that the bank had to be placed under the management of the FDIC.

The FDIC tentatively estimates the cost of the deposit insurance fund in connection with the closure of SVB at about $20 billion.

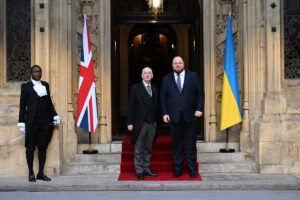

Chairman of the Verkhovna Rada Ruslan Stefanchuk will pay an official visit to the United Kingdom of Great Britain and Northern Ireland on 27-28 March.

According to the press service of the Verkhovna Rada, the program of the visit includes meetings with members of the British parliament. In particular, Stefanchuk will communicate with Speaker of the House of Commons Lindsey Goyle and Lord Speaker of the House of Lords D.F. McFaul, members of both Houses of Parliament, representatives of the UK-Ukraine Friendship Group and the Conservatives as Friends of Ukraine initiative group.

A number of bilateral meetings are also planned: with British Prime Minister Rishi Sunak and former British Prime Minister, MP Boris Johnson.

During the visit, a memorandum of understanding will be signed between the offices of the Verkhovna Rada and the House of Commons of the Parliament of the United Kingdom of Great Britain and Northern Ireland.