Dobrobut Medical Network with the support of Direct Relief International Charitable Foundation launches free chemotherapy treatment program for breast cancer patients.

According to a press release from the nurse, as part of the first phase of the program, patients can receive Tamoxifen Citrate 10 mg for a three-month course of treatment free of charge.

“Dobrobut” is one of the largest private medical networks in Ukraine. It includes 17 medical centers in Kiev and Kiev region, emergency service, dentistry and pharmacies. Medical centers of network provide services for children and adults in more than 75 medical directions. Annually experts of “Dobrobut” carry out more than 7000 operations. The network has over 2,800 employees.

Collaborates with a number of international charities Direct Relief International, Children of War Foundation, International Medical Corps and the University of Miami Global Institute, as well as the Dobrobut Foundation, a charitable foundation founded by the clinic.

According to the results of 2022 Lekhkim-Kharkiv Pharmaceutical Company (Kharkiv) increased its net profit by 5.92% in comparison with 2021 – up to UAH 105.279 million.

As the company announced in the information disclosure system of the National Securities and Stock Market Commission, its shareholders will consider the results of its work at a general meeting on April 20.

It is planned to make a decision that the net profit for 2022 will be used for the development and financing of the company’s activity.

Earlier it was reported that in 2021 Lekhkim-Kharkiv increased net profits by 25% compared to 2020 – up to 99.9396 million UAH.

According to the NCSSM information disclosure system, 98% of Lekhkim-Kharkiv PJSC shares are owned by Lekhim PJSC (Kiev), the beneficiary of which is Valery Pechav.

“Lekhkim-Kharkiv” produces medicines in different dosage forms: tablets, ampoules, suppositories, solutions for infusion, solutions for injections, powders for injection solution, sachets. It is part of the Lekhim group of companies.

The National Bank of Ukraine (NBU) cancelled licenses of six non-banking institutions and removed four non-banking financial institutions from the State Register of Financial Institutions and one non-banking institution from the Register of Persons who are not financial institutions but are entitled to provide certain financial services.

As reported on the website of the regulator, all existing licenses were revoked and excluded from the State Register on the basis of their own applications: PO “Lombard “Express-Gotivka”, LLC “The World of Financial Solutions and Company”, LLC “Astra.Finance”, CC “Zalogy House”, CC “Crez-Capital” and LLC “Navia Invest” from the Register of persons who are not financial institutions, but have the right to provide certain financial services. Sovremennaya Finansovaya Kompaniya LLC had its licenses revoked on the basis of an application.

The Committee for the Supervision and Regulation of the Non-banking Financial Services Markets adopted these decisions on March 16, 2023.

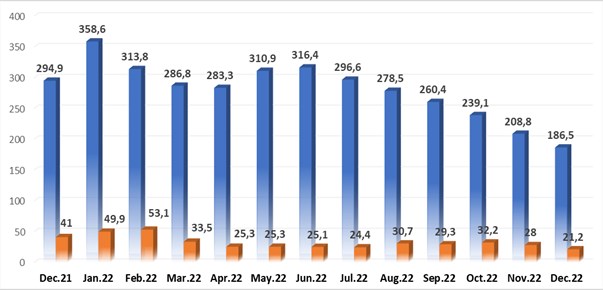

Number of unemployed in Ukraine and job opportunities, Dec 21 – Dec 22

Source: Open4Business.com.ua and experts.news

The Verkhovna Rada has supported the resignation of Deputy Prime Minister and Minister of Digital Transformation Mikhail Fedorov, a member of the European Solidarity faction, Oleksiy Honcharenko, said.

“Fedorov will be appointed to a new position. Preliminarily, he will become Deputy Prime Minister for Innovation, Development of Education, Science and Technology – Minister of Digital Transformation of Ukraine. His candidacy for the new position will be submitted to the Rada at the next meeting,” the parliamentarian wrote in the Telegram channel on Monday.

At the same time, a member of the faction “Golos” Yaroslav Zheleznyak specified that the decision to resign Fedorov supported 298 people’s deputies at the plenary session on March 20.

Fedorov held the post of Deputy Prime Minister – Minister of Digital Transformation of Ukraine since March 4, 2020.

As previously reported by Prime Minister Denis Shmygal, Fedorov will be engaged in a number of other areas, in addition to digitalization. “His future position is Deputy Prime Minister for innovation, development of education, science and technology – Minister of digital transformation of Ukraine,” he wrote in his Telegram channel.

The stock indices of the largest Western European countries are declining at the beginning of trading on Monday, followed by bank stocks.

The Stoxx Europe 600 composite index of Europe’s largest companies was down 0.6 percent at 11:18 a.m. and stood at 433.8 points.

Germany’s DAX indicator fell 0.4% from market opening, Britain’s FTSE 100 – 0.8%, France’s CAC 40 – 0.3%. Spain’s IBEX 35 lost 1%, Italy’s FTSE MIB – 0.7%.

It was announced Sunday that Swiss bank UBS is buying struggling Credit Suisse for 3 billion Swiss francs ($3.25 billion). UBS will pay 0.76 francs per Credit Suisse share. The deal will be paid in full in cash.

In the course of trading on Monday quotations of Credit Suisse shares collapsed by almost 60% – down to 0.78 francs. Price of UBS securities fell by 9.9%. The UBS shares are the leaders of the decrease among the companies included in the calculation of the Stoxx 600.

Shares of other European banks are also getting cheaper: ING down 6.6%, Deutsche Bank down 6.4%, Intermediate Capital Group down 4.8%, Barclays down 4.7%, Standard Chartered down 4.1%, HSBC down 3.1%, NatWest down 3% and Commerzbank down 3.7%, Societe Generale – 4.4%, Credit Agricole – 1.9%, BPER Banca – 3.8%, UniCredit – 2.3%, Banco de Sabadell – 3.7%, Unicaja Banco – 3.3%, CaixaBank – 2%, Banco Santander – 1.7%.

Oil prices were followed by declines in fuel producers, including Repsol down 1.9%, BP Plc (SPB: BP) down 0.5%, Shell (SPB: RDS.A) down 1.4%, TotalEnergies (SPB: TOT) down 1.1%.

The price of Electrolux securities is increasing by 2.7%. The Swedish household appliances maker said its financial targets remain unchanged. In particular, the company is going to reach 6% operating profit margin in the mid-term.

Meanwhile, the growth rate of producer prices (PPI) in Germany slowed to its lowest in seventeen months in February, according to the country’s statistical office. The index rose 15.8% compared to the same month last year thanks to a less significant increase in energy costs.

Analysts had expected a 14.5% increase, according to Trading Economics.

The PPI index in February relative to the previous month decreased by 0.3%. Thus, it declined for the fifth month in a row.