Ukrainian banks’ profits in January 2023 amounted to 14.694 billion UAH, which is 2.1 times more than during the same month in 2022 (7.145 billion UAH), the press service of the National Bank of Ukraine (NBU) said Wednesday.

The regulator noted that banks’ revenues in January increased by 55% to UAH 38.65 billion, and expenses – by 35%, to UAH 23.956 billion.

At the same time, the fee and commission income rose by 4.6% – to UAH 8.3 billion.

At the same time the result of revaluation and from purchase and sale operations was positive and amounted to UAH 5.9 billion, while in the same period last year it was negative and amounted to UAH 42 million.

At the same time, deductions to the reserves rose by 58%, to 2.488 billion UAH, and the commission expenses increased by 31%, to 3.985 billion UAH,

As reported, the Ukrainian banks in 2022, net profit decreased by 3.1 times – to 24.716 billion UAH compared with 77.376 billion UAH in 2021.

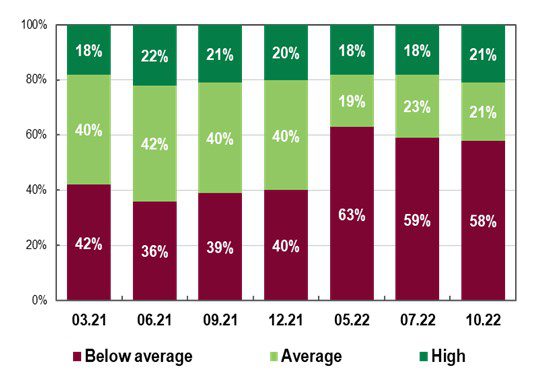

People’s assessment of their well-being in 2021-2022

Source: open4business.com.ua and experts.news

Oil continues to fall on Wednesday after a decline in previous trading.

Investors are evaluating the forecasts of global demand for fuel amid uncertainty about the global economy, writes MarketWatch.

At 8:05 Moscow time, quotations of April futures for Brent oil fell by $0.27 (0.33%) and totaled $82.78 per barrel at ICE Futures Exchange in London. Those contracts fell by $1.02 (1.2%) to $83.05 per barrel on Tuesday.

The price of WTI April futures on NYMEX fell by $0.27 (0.35%) to $76.09 per barrel. At the end of previous trading the value of contracts went down by $0.19 (0.3%) to $76.36.

The market’s attention is focused on the publication of the Federal Reserve’s meeting minutes on Wednesday, Bloomberg notes.

“Expectations of a more hawkish position by the Fed continue to grow, which puts strong pressure on the oil market,” Warren Patterson, head of commodity markets strategy at ING Groep NV in Singapore, believes.

The European Bank for Reconstruction and Development (EBRD) and Multilateral Investment Guarantee Agency (MIGA) signed the first co-financing agreement in their history, under which MIGA provides guarantees for up to $200 million of trade finance risks to EBRD under its Trade Facilitation Program (TFP).

“The first country to benefit from this agreement will be Ukraine…The guarantee will cover EBRD trade finance in selected state banks, primarily in Ukraine,” the bank said in a press release Tuesday.

According to it, the MIGA guarantee was signed by the agency’s executive vice president, Hiroshi Matano, during a visit to EBRD President Odile Reno-Basso.

The EBRD recalled that it had sent EUR1.7 billion to Ukraine in 2022 and promised to increase this amount to at least EUR3 billion by the end of 2023, and had established an international partnership to help Ukraine and its financing with shareholders and donors.

“The MIGA and EBRD partnership will facilitate needed trade finance in Ukraine and other countries supported by MIGA and EBRD at a time of growing economic pressures and heightened geopolitical risks affecting trade, supply chains and critical imports,” Matano said in the release.

“This guarantee will be important in helping us expand our trade finance business in Ukraine, which is one of our strategic priorities in working in the country,” Reno-Basso said in turn.

The EBRD pointed out that since the outbreak of the war in Ukraine in February 2022, trade flows and supply chains in Ukraine have been seriously disrupted. In particular, the agricultural sector, which accounts for 11 percent of the country’s GDP, nearly 20 percent of the labor force, and nearly 40 percent of all exports, has been affected.

In addition to the physical disruption of transportation routes, financial intermediation has been a significant problem, as foreign commercial banks have stopped taking any direct risk on trade finance transactions in Ukraine. To address this problem, the EBRD’s TFP Program significantly increased the provision for Ukrainian banks to cover some of the increased demand.

Since February 2022, TFP has supported more than EUR400 million in trade transactions involving critical commodities for the Ukrainian economy. TFP also supports the entire supply chain to address food security issues: facilitating imports of seeds, fertilizers, fuel, tractors and combines into Ukraine, as well as exports of grain, oilseeds and vegetable oils to other EBRD countries of operations, including Egypt, Morocco, Turkey and Tunisia.

The EBRD has developed its Trade Facilitation Program to promote and facilitate international trade with and within Central and Eastern Europe, the CIS and Southern and Eastern Mediterranean countries (SEMED). TFP provides guarantees to international commercial banks to cover political and commercial payment risk on transactions made by issuing banks in the EBRD’s countries of operations.

More than 100 issuing banks in 26 countries participate in the program, working with more than 800 confirming banks and their subsidiaries worldwide.

Since the program’s launch in 1999, TFP has supported over 30,000 trade finance transactions totaling over EUR30 billion, including 3,000 foreign trade transactions of Ukraine totaling over EUR4 billion.

Italy will organize a conference involving its own business companies on Ukraine’s reconstruction in April this year, Italian Prime Minister Giorgi Meloni said.

“We talked today about the post-war reconstruction of Ukraine and about the Fast Recovery Plan, that is, the reconstruction now … In Italy a conference will be organized about the reconstruction in April of this year. We will work on its organization. Italian companies have the know-how and the competence to provide, because Italy wants to play a significant role in the reconstruction of Ukraine – starting now,” Meloni said at a press conference with the President of Ukraine in Kyiv.

She stressed that Italy can do a lot in this context because it has tremendous experience in many strategic areas like infrastructure, transportation, energy, agriculture, food, etc.

“Our know-how will be able to give an opportunity and the right signal: what was destroyed will be restored,” said the Italian prime minister.

In addition, she said, holding the international exhibition Expo 2030 in Odessa, where Ukraine has applied, would be a special signal to Europe, namely: “Belief that everything will be fine in Ukraine.”

Also, as Meloni noted, Italy already provides support and assistance to Ukraine in the field of protection of cultural heritage.

Ukraine in January this year increased the export of ferroalloys in kind by 33.6% compared to the same period last year, to 55,900 tonnes.

According to statistics released by the State Customs Service, in monetary terms, the export of ferroalloys dropped by 35.5% to $51.573 million.

At the same time, the major exports were to Poland (57.25% of supplies in monetary terms), China (10.39%) and Turkey (7.37%).

In addition, in January, Ukraine imported 402 tonnes of these products, which is 96.3% less compared to January 2022. In monetary terms, imports fell by 84.6% to $1.657 million.

Ferroalloys were mainly imported from China (27.68%), Armenia (18.03%) and Slovakia (14.54%).