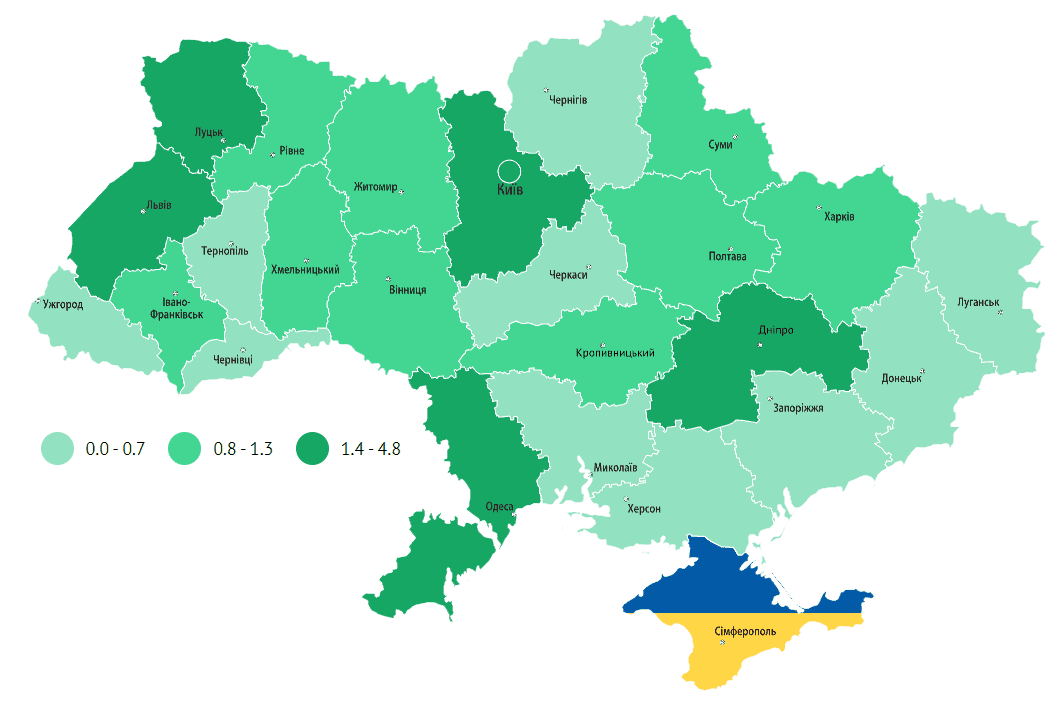

Anzahl der offenen stellen zum 01.12.2022 (ths. einheiten)

Source: Open4Business.com.ua and experts.news

Japan will hold an online G7 meeting on February 24, which will be joined by Ukrainian President Vladimir Zelensky, in addition, Tokyo will allocate $5.5 billion in aid to Ukraine, the Associated Press quotes the statement of Prime Minister of this country Fumio Kishida.

During his speech at a forum in Tokyo, Kishida said that his country will host the first summit of the G7, which will be held on February 24.

He also announced that Japan will provide assistance so that Ukraine can “rebuild daily life and infrastructure.

Large Ukrainian tomato paste producer Agrofusion (Agrofusion, Mykolayiv) intends to resume operations of its three tomato processing plants in Mykolayiv and Kherson regions, which were on the front line and were significantly damaged during the hostilities with Russian invaders.

The holding company is tasked with restoring the industry in the region, creating jobs and resuming exports of tomato paste from Ukraine, according to the EastFruit information and analysis platform’s website Monday.

“We built three tomato processing plants in the Mykolaiv region. These plants were among the best in Europe. Our plants are located in Zhovtnevyi (Vitovka – IF) district of Mykolaiv region and in Snegiriv region. These regions were on the front line and suffered a lot,” EastFruit quoted Agrofusion founder and director Sergei Sipko as saying.

He also clarified that now out of 2 thousand employees of the enterprises 400 people are ready to work.

“Agrofusion is a vertically integrated group of companies. Engaged in growing and processing of tomatoes for the producers of juices, ketchups and tomato sauces. Produces tomato paste under the Inagro brand that is represented in 45 countries around the world.

The group was founded in 2005 by businessman Sergei Sypko. It includes three plants (two in the Mykolaiv region, one in the Kherson region) producing tomato paste with a total production capacity of about 750 thousand tons of tomatoes per season, as well as agricultural farms in the Kherson and Mykolaiv regions cultivating over 30 thousand ha of land, and two greenhouse farms.

In 2019, the Group completed construction and put into operation a vegetable drying plant in Snegirevka (Mykolaiv region) and started production of tomato powder.

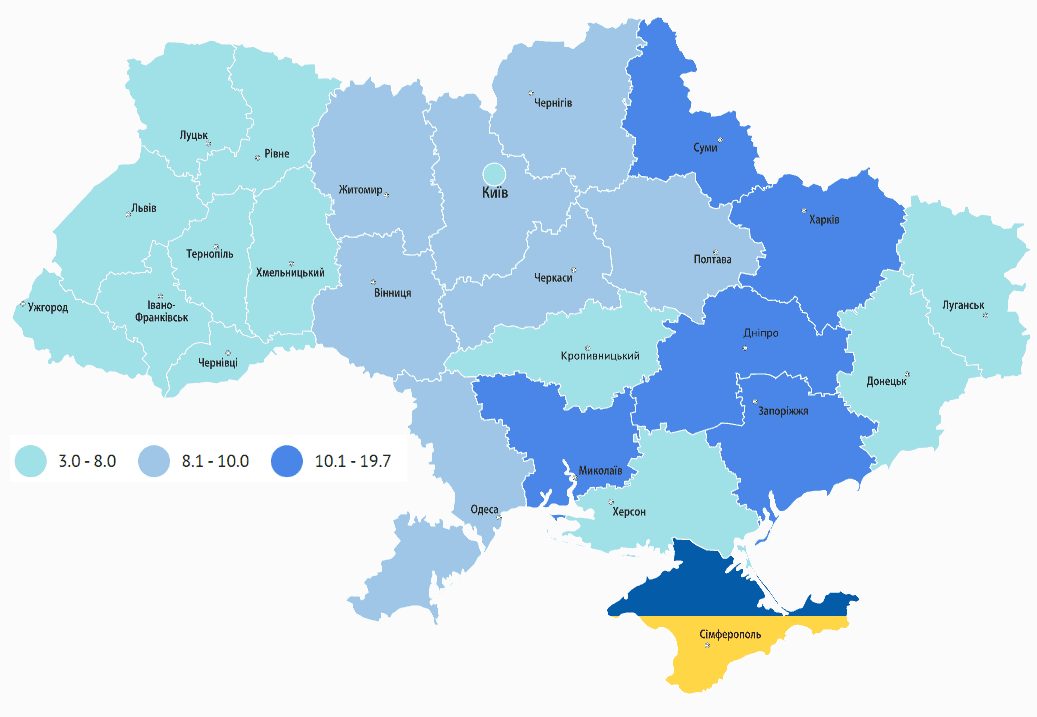

Number of unemployed people registered in public employment service as of 01.12.2022 (thush people)

Source: Open4Business.com.ua and experts.news

PJSC Yuzhkoks (Kamenskoye, Dnipropetrovsk Region) in 2022 reduced its output of metallurgical coke by 18.7% year-on-year, to 573,000 tonnes.

A company representative told Interfax-Ukraine that in December the company produced 46,000 tonnes of metallurgical coke.

He added that in 2022 the output of gross coke with 6% moisture was 662 thousand tons, including 53 thousand tons in December.

The plant produced 705 thousand tons of coke for 2021, including 60 thousand tons in December.

For 2022, the plant supplied a total of 924 thousand tons of coal, including 825 thousand tons of domestic production, 54 thousand tons from the Russian Federation (before the war) and 45 thousand tons from the United States. Including 77,000 tonnes of domestically mined coal concentrate was supplied in December.

As was reported, in 2022, the holding plants of Ukraine reduced the production of gross coke 6% moisture by 59% compared to the previous year – up to 3.91 million tons, including 3.354 million tons of metallurgical coke. In 2022, 4.594 million tons of coal concentrate was supplied to the domestic coke plants, including 3.158 million tons produced in Ukraine.

The registered capital of PJSC Yuzhkoks is UAH 171.918 mln, and the par value of the share is UAH 0.25.

EBRD will become the owner of the shareholder of 35% of M10 Lviv Industrial Park, investments will amount to $24,5 million, $5,5 million of which will be allocated for financing of the completion of the first stage of the project, the press service of the EBRD informed.

M10 Lviv Industrial Park, a multifunctional industrial park located 60 km from the Ukrainian-Polish border and being built by Dragon Capital Investment Limited, will provide new manufacturing and logistics facilities necessary for sustainable humanitarian and economic activities in Ukraine during the war and post-war reconstruction.

According to the release, the EBRD will invest up to $24.5 million in total to develop the $70 million project, of which up to $5.5 million will be used to complete the first stage of the project. Construction of the first phase was interrupted by Russia’s military invasion of Ukraine in February 2022, but resumed in the summer. The first 14,400-square-meter warehouse complex is expected to be completed in the second half of 2023.

“This is an especially important project for Ukraine in these difficult times and EBRD investment will be a strong signal to local and foreign investors. By increasing the availability of high-quality storage facilities, the project will increase Ukraine’s access to vital services and products,” Vlaho Kojakovic of the EBRD was quoted in the release.

The EBRD’s investment in M10 Lviv Industrial Park closes the financing gap caused by unfavorable market conditions and is also in line with the EBRD’s stance on Ukraine and the bank’s overall response to the crisis.

“We are pleased to welcome the EBRD as our partner in this important infrastructure development project for Ukraine. The M10 Lviv Industrial Park, located near the EU border, will create new logistics and manufacturing facilities in western Ukraine, which are in high demand after the start of the full-scale Russian invasion,” Dragon Capital CEO Tomasz Fiala was quoted in the release.

As emphasized in the release, the EBRD sees a special mission in overcoming the current crisis. After more than 30 years of promoting economic transformation in Ukraine, the bank’s emergency response to the war is focused on supporting the country’s economy and preparing for future recovery.

In addition to strengthening energy security, EBRD financing for Ukraine is used to finance trade to support the circulation of essential commodities, food security and vital infrastructure. EBRD financing is also used to help refugees in neighboring countries and to help host municipalities.

In October 2022, during a visit to Kiev to meet Ukrainian President Vladimir Zelensky, EBRD President Odile Reno-Basso informed the Ukrainian leader of the Bank’s strong intentions to support Ukraine in its defense against Russian aggression and promised that the EBRD would provide up to EUR2 billion to help Ukrainian business and economy continue to operate. In 2022, the EBRD allocated EUR1.7 billion for Ukraine and attracted another EUR200 million through partner banks.