The construction of a building technology campus of Kingspan, an Irish manufacturer of energy-efficient insulation technology, is scheduled to start in 2024, and the company has already started looking for a site in the Lviv region because of its proximity to the border, according to a UkraineInvest press release on Thursday.

According to it, the campus will include six production areas, including the production of insulation materials and district heating solutions. The campus will produce construction products with high added value. The project includes a green, low-carbon manufacturing facility.

Kingspan is reportedly investing more than EUR200 million in the construction. Construction will take about five years. The implementation of the project will create 600-800 new jobs.

Kingspan was founded in 1965 in Ireland, specialized in production of building solutions for building envelopes (roofs, walls, facades), as well as protective walls, cold doors, high-tech solid urethane and solid phenolic thermal insulation for roofs, walls, floors and pipelines. It operates 200 production facilities around the world. The company came to Ukraine in 2005.

In April 2022, Kingspan announced the completion of its exit from the Russian business. Russia accounted for less than 1% of the company’s global operations. It also donated $750,000 to UNICEF to set up five Blue Dot centers to help refugees on the Ukrainian border.

UkraineInvest, the Investment Attraction and Support Office of the Cabinet of Ministers of Ukraine, provides organizational and advisory support for investors to prepare projects for implementation.

A 2007 smartphone with 8GB of memory that’s still sealed in the box could fetch its owner Karen Green quite a bit of money. The woman said the phone was a gift from her friends.

“In 2007, I got a new job, and my friends bought me the newest, first-generation iPhone. It had everything for the new job, like a calendar,” Green said.

But despite all the useful features of the new phone, she didn’t want to part with the old one. Green decided for herself that the iPhone would never get old.

Most likely, Greene’s friends bought the phone for $499 $599. At the LCG Auctions auction the starting price for the gadget was $2.5 thousand, but experts suggest that in the end the lot will go for $50 thousand.

This is not the first time, when the iPhone of the first generation goes under the hammer. In August, one such phone was sold for $35.4 thousand, and in October – for $39.3.

Anthony Marino was elected chairman of the supervisory board of Naftogaz of Ukraine at a meeting on Friday, Alexei Chernyshov, head of the company’s board, said on Facebook.

“Just now at a meeting of Naftogaz’s supervisory board, its chairman was elected. I salute Anthony Marino on his election!”, – wrote the head of NAC.

“Anthony (USA/Canada) has significant management experience. He is currently president and CEO of (Canadian – IF) energy company Tenaz Energy. Prior to that, he served as executive director, president and CEO of Vermilion Energy, an international hydrocarbon exploration and production company,” Chernyshov noted.

Morino served on the supervisory boards and boards of directors of six companies and organizations from 2002-2020.

“I am sure that his many years of experience in hydrocarbon exploration and production will help our group of companies to achieve the best results,” the head of Naftogaz stressed.

Chernyshov said the reinstatement of Naftogaz’s supervisory board at a time when Ukraine’s energy system is being tested through a full-scale war is an extremely important development.

“Anthony Marino is an upstream specialist with more than 38 years of experience in the oil and gas industry. He is a U.S. and Canadian citizen,” added Naftogaz in Telegram.

He has served as executive director, president and CEO of Vermilion Energy, an international hydrocarbon exploration and production company with a market capitalization of $4 billion.

Volumes of currency purchase by Ukrainian population in January 2023 exceeded volumes of its sale by $564 million as compared to $463.2 million in December last year, this figure is growing for the sixth month in a row, the National Bank of Ukraine (NBU) said.

According to its website, if earlier the “net” purchase was formed mainly in the cash market, in December – almost equally in the cash and non-cash markets, in January it is already mainly in the cash market.

At the end of September last year, the National Bank raised the limit on the purchase of non-cash currency by physical persons from 50 thousand UAH to 100 thousand UAH a month, under its placement on deposit for at least three months, which stimulates such operations: in January, non-cash currency purchases rose to $ 523.9 million from $ 450.5 million in December, $362.2 million – in November.

The sales of non-cash hard currency, by contrast, decreased to $153.4 million from $220.2 million in December and $211.1 million in November.

As for cash currency, its purchase and sale decreased compared to December: purchase – from $1.425 billion to $1.268 billion, while sale – from $1.191 billion to $1.075 billion.

According to these data of the NBU, the turnover of the official foreign currency cash market in January this year amounted to 71.9% of the turnover in pre-war January 2022, while non-cash currency transactions – 60.6%.

As reported, the population bought $880.1 million more currency than sold, including $1010.0 million more cash currency bought than sold, according to official statistics, for 2022 as a whole.

At the moment, the dollar exchange rate in the cash market is about 39.9 UAH/$1, while the National Bank set the official rate from July 21, 2022, at 36.5686 UAH/$1. The dollar is quoted at about 0.6 hryvnia cheaper than a month ago.

On February 9, Khmelnytskyi communal enterprise “Elektrotrans” announced a tender for voluntary civil liability insurance for owners of land transport and compulsory civil liability insurance for owners of land vehicles (MTPL), according to the electronic public procurement system Prozorro.

In addition, the lots were announced for compulsory insurance against accidents in transportation, compulsory insurance services for departmental and rural fire departments and members of volunteer fire brigades.

The expected cost of purchasing services is 690 thousand UAH.

The security of the tender offer is not required.

The deadline for submission of bids is February 17.

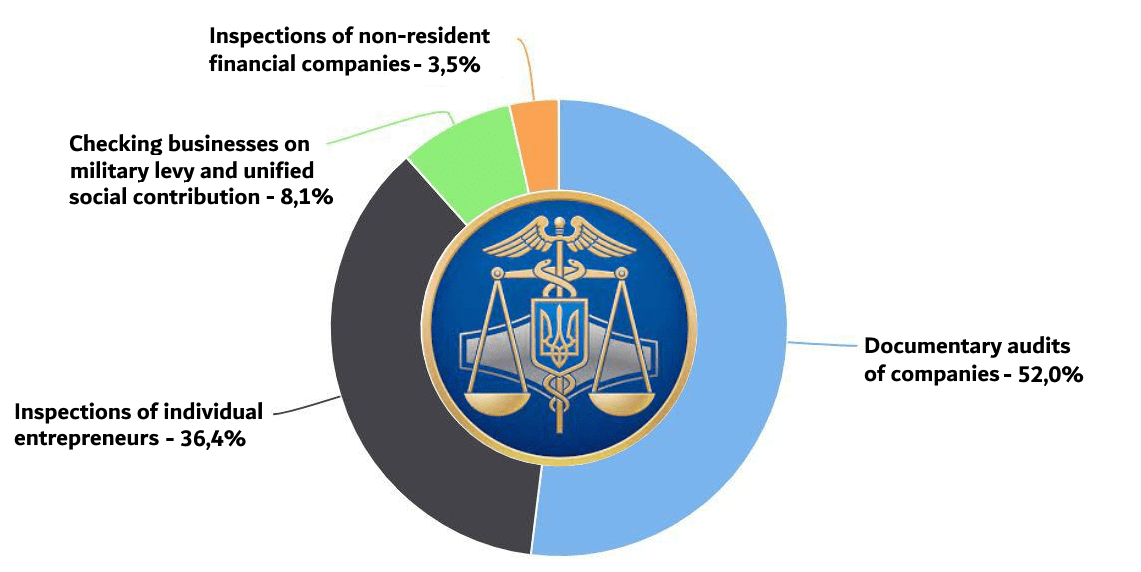

Scheduled business audits by state tax service in 2023

Source: Open4Business.com.ua and experts.news