Norwegian Defense Minister Bjørn Arild Gram on Wednesday announced Oslo’s intention to send German-made tanks to Ukraine, Norwegian broadcaster NRK reported.

“Norway will send German tanks to Ukraine as part of the Western countries’ decision to supply weapons,” NRK quoted the minister as saying.

The head of the Defense Ministry did not specify how many tanks he was talking about.

Earlier on Wednesday, US President Joe Biden announced the decision to send Ukraine 31 M1 Abrams tanks.

It also became known that the German authorities decided to transfer the first batch of 14 Leopard 2 tanks to Ukraine. At the same time, German authorities will give their allies permission to supply Leopard 2 tanks to Ukraine.

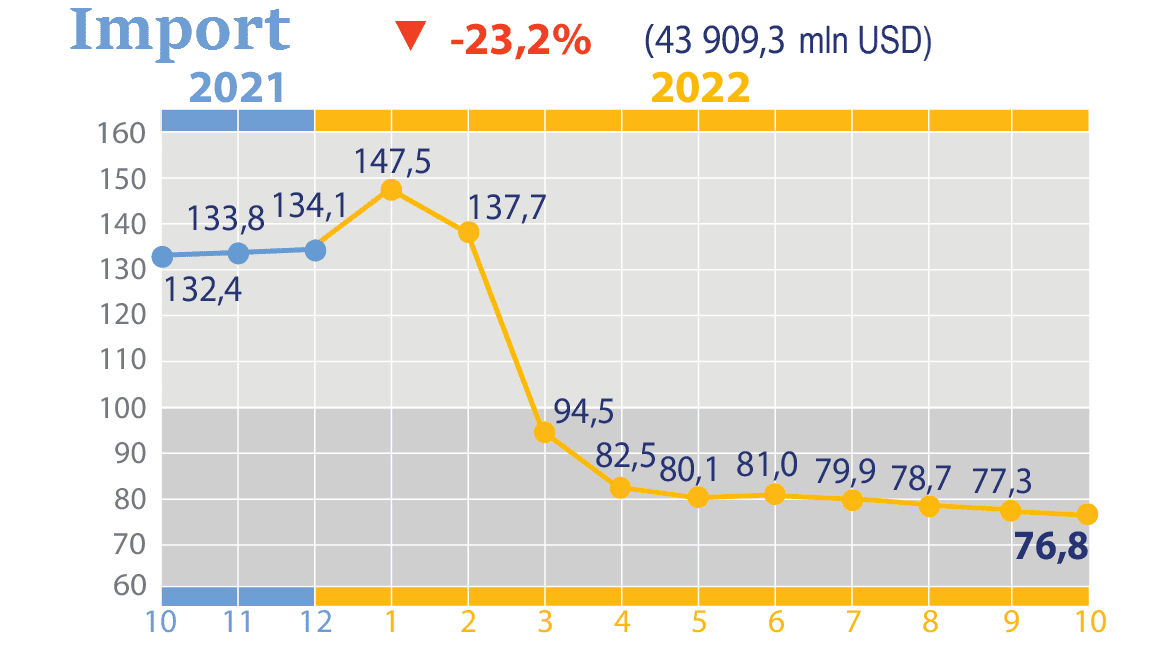

Import changes in % to previous period in 2021-2022

Source: Open4Business.com.ua and experts.news

The operator of Ukraine’s gas storages Ukrtransgas JSC planned to perform overhaul of 10 wells and also work on intensification of 20 more on one of the West Ukrainian underground gas storages (UGS) in 2023.

“Well workovers continue these days at one of the West Ukrainian UGS facilities. The overhaul crew has completed work on the facilities renewed since 2022 and has begun new work,” the company said in a telegram on Wednesday.

“Ukrtransgas”, in particular, started a thorough inspection of the systems at two wells of the gas storage facility and, if necessary, will replace its individual elements. The aim of the works is to restore the productivity of these wells to the designed indicators and increase safety of their further operation.

“It should be noted that in 2022 about 20% of the well stock of this subway well was repaired”, – informed the JSC.

Last year the specialists of the UGSF overhaul group replaced the system components such as stop valves, flowing valves, core heads, etc., tested the tightness of joints and conducted a complex of geophysical studies to ascertain the serviceability and reliability of the wells.

“The performed repair works allowed increasing the calculated productivity of the wells by 11%, improved safety and reliability of gas storage in UGSF, stability of its withdrawal and injection in the future”, – summed up in “Ukrtransgas”.

The European Bank for Reconstruction and Development (EBRD) has deployed €1.7 billion in Ukraine in 2022 and mobilised a further €200 million from partner banks. This represents more than 10 per cent of the Bank’s annual business volume.

This means the EBRD is on track to deliver on its commitment to invest €3 billion for Ukraine over the period 2022-23, with the exceptional support of shareholders and donors who share part of the risk of the investments that the EBRD has taken on its own books.

The results were achieved despite the extremely challenging global economic environment in the wake of Russia’s war on Ukraine and confirm the EBRD’s countercyclical role in supporting its countries of operations and clients.

“The Bank and its shareholders moved swiftly, following the beginning of the war, to provide adequate support,” said EBRD President Odile Renaud-Basso. “This impressive operational performance is testimony to our resilience and determination to support our countries of operations and clients.”

To support the real economy in Ukraine through investments in vital infrastructure, energy and food security, trade and support for the private sector, the EBRD deployed €1.7 billion. A further €200 million were mobilised from partner banks.

The Bank raised €1.4 billion of donor funds in 2022, including unfunded guarantees, which are dedicated to Ukraine and other countries most affected by the war in 2022 and 2023. The Bank bore 60 per cent of the risk related to the investments deployed in Ukraine in 2022.

Highlights of EBRD work in Ukraine in 2022 – which has successfully attracted further foreign grants – include providing Ukrzaliznytsia (Ukraine’s railway company) and Ukrenergo (the national power grid operator) with €150 million each of emergency liquidity last summer, to keep the country’s trains running and the lights on.

The Ukrzaliznytsia financing was supported by partial risk coverage from France and the European Union, and the financing for Ukrenergo by the European Union, United Kingdom, United States of America and The Netherlands.

A later financing package of €370 million to Ukrenergo in the autumn consisted of a €300 million EBRD loan and a €70 million grant from The Netherlands, for emergency repairs to the national power grid necessitated by Russia’s strikes on civilian infrastructure.

Likewise, the EBRD provided the gas company Naftogaz with a financing package of just under €500 million to compensate for the loss of natural gas production following the Russian invasion. Norway will provide a €190 million grant, which complements the €300 million financing line from the EBRD, which is supported by partial risk coverage by the USA, Canada, Germany and France.

The EBRD provided Ukraine with a total trade finance turnover of €459 million during 2022.

Together with partner financial institutions, it also supported food security by providing more than €280 million to the agribusiness value chain, and bolstered the resilience of other private-sector companies, including small and medium-sized enterprises, with €170 million.

Policy activity remains intense, via the Ukraine Reforms Architecture programme (a comprehensive technical assistance programme jointly managed by the EBRD and the European Union since 2016, following requests by the government of Ukraine for support with the implementation of key reforms), the promotion of good governance in state-owned enterprises with which the EBRD works, and support for human capital in partnership with Ukraine’s Ministry of Education.

The EBRD’s focus in 2022 has been on providing emergency liquidity to keep the lights and heating on and the trains running, supporting communities and sustaining companies. This is now shifting to providing finance for emergency repairs and the rebuilding of infrastructure that is coming under Russian attack.

“In the future, we also intend to expand our work with municipalities, including in de-occupied zones. For this, we foresee that we and our partners will need new financial instruments – a higher proportion of grants rather than loans. We have been requesting further support from shareholders or donors, either in the form of donor funds or guarantees, to continue sharing the risks of investing in Ukraine with us this year,” said President Renaud-Basso.

The EBRD President added: “We will remain agile in 2023, responding to changing circumstances and making adjustments according to the needs on the ground as we did last year.”

“When circumstances allow, we will help launch a reconstruction programme for Ukraine to rebuild livelihoods, jobs and businesses, vital infrastructure, good governance, and access to services. As the largest institutional investor in the country, one with an unrivalled presence on the ground, the EBRD is ready and willing to play a central role in reconstruction.”

The EBRD is a multilateral bank that promotes the development of the private sector and entrepreneurial initiative in 36 economies across three continents. The Bank is owned by 71 countries as well as the EU and the EIB. EBRD investments are aimed at making the economies in its regions competitive, inclusive, well-governed, green, resilient and integrated. Follow us on the web, Facebook, LinkedIn, Instagram, Twitter and YouTube.

At the end of 2022, Kernel Agro-Industrial Holding acquired a strategically important asset, the OilExport Terminal, from the Pivdennyi port in Odesa region for $19.8 million, as it reported in its financial report the day before.

As the company reported on Facebook on Wednesday, the terminal with silos with a total capacity of 49.4 thousand tons of simultaneous storage of the main types of vegetable oils can accept and separately store sunflower, soybean, and rapeseed oil.

At the same time, it is noted that the new asset is strategically important for Kernel given the current inability to transship vegetable oil through terminals in the port of Mykolaiv, which accounted for about half of the total transshipment of this product in Ukraine in 2019-2022 marketing years.

“Mykolaiv is of historical importance in this regard. Due to the full-scale war, the city’s port and terminals have been shut down, and they are currently outside the grain corridor. Therefore, we are compensating for temporary losses at the expense of OilExportTerminal in Pivdennyi,” explained Yevhen Osipov, CEO of the holding, as quoted by the press service.

As reported, Kernel said in its financial report that it acquired OilExportTerminal in December 2022.

The holding also clarified that in the first half of FY2023 (July-2022 – December-2022) it sold 546.8 thousand tons of sunflower and rapeseed oil (-14% compared to the same period in FY2022) and processed 1.11 million tons of oilseeds (-24%).

“Prior to the war, Kernel was the world’s largest producer of sunflower oil (approximately 7% of global production) and its exports (approximately 12%), and was the largest producer and seller of bottled sunflower oil in Ukraine. In addition, the company was engaged in the cultivation and sale of other agricultural products.

The largest co-owner of Kernel through Namsen Ltd. is Ukrainian businessman Andriy Verevsky with a 39.3% stake.

In fiscal year 2022 (FY, July-2021-June-2022), the holding made a net loss of $41 million against a net profit of $506 million in the previous year, its revenue decreased by 5% to $5.332 billion, and EBITDA decreased by 3.7 times to $220 million.

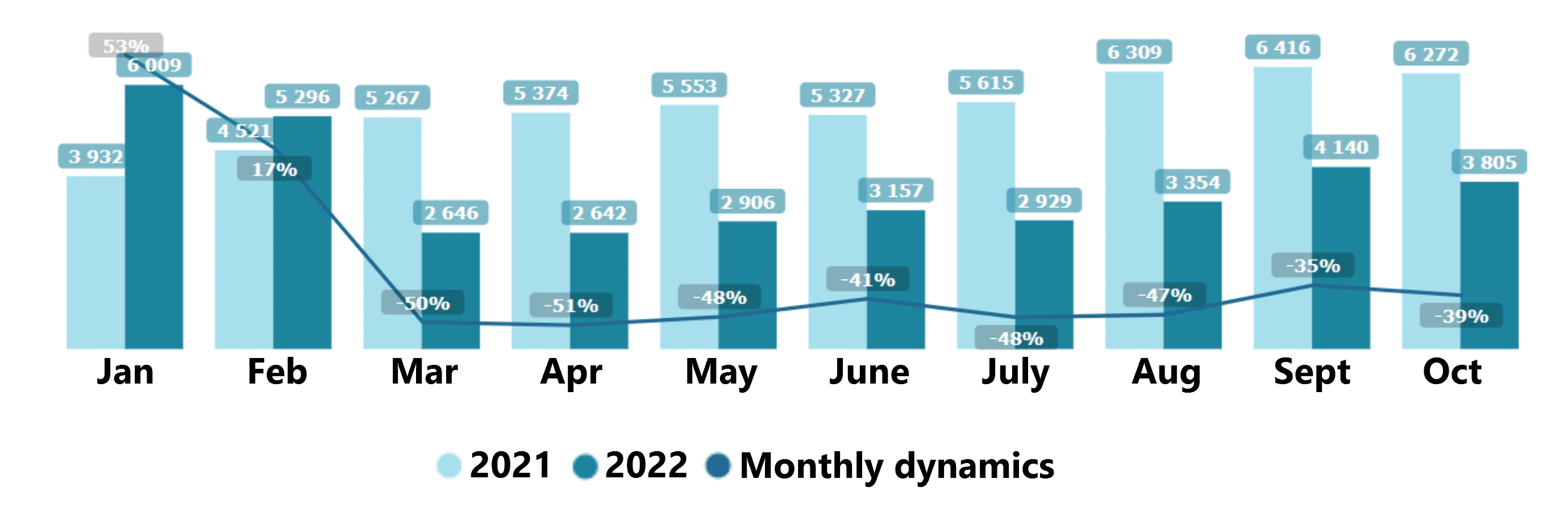

Dynamics of export of goods in 2021-2022

Source: Open4Business.com.ua and experts.news