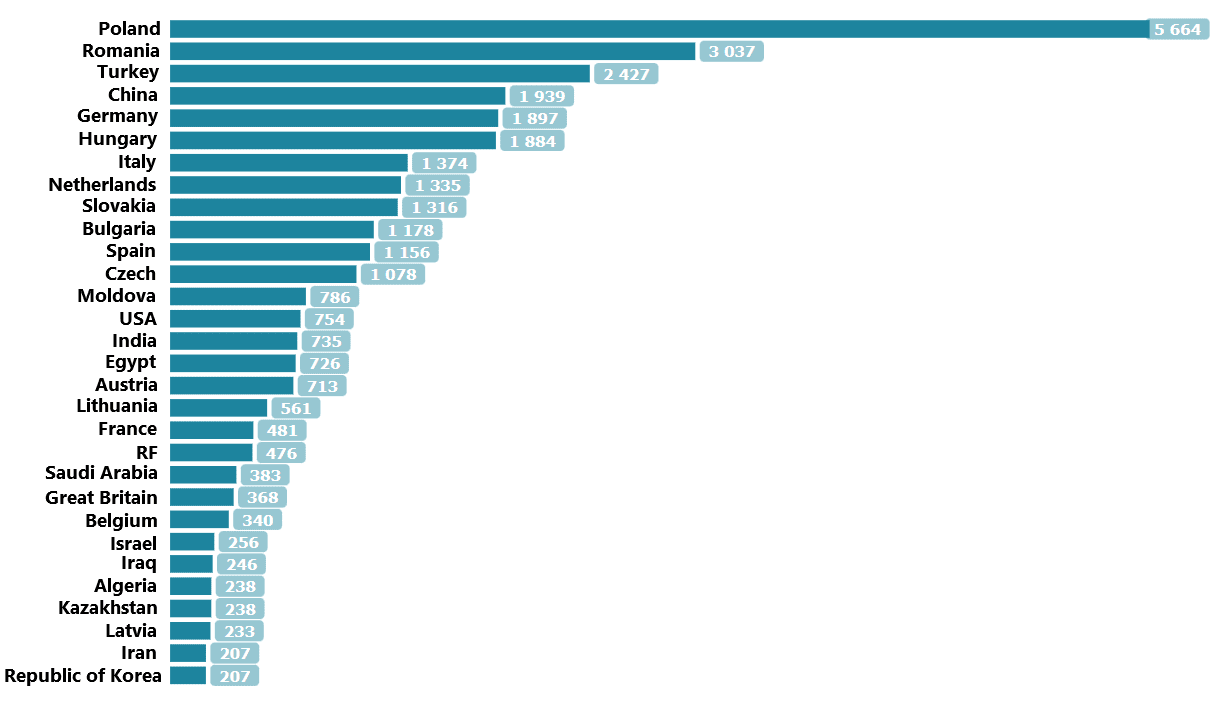

Export of Ukraine by countries in Jan-Oct 2022

Source: Open4Business.com.ua and experts.news

Stock indices of Asia-Pacific countries are changing differently on Wednesday morning because the dynamics of Wall Street the day before was also mixed and did not give direction to the Asian market.

At that trading activity remains below usual level as Chinese and Hong Kong stock exchanges are closed in connection with the celebration of the New Year according to the lunar calendar, MarketWatch notes.

Investors are assessing the statements of major companies over the past quarter and the statistical data from Australia.

As it became known on Wednesday, consumer prices in Australia rose by 8.4% year-over-year in December after climbing by 7.3% in November and well ahead of the forecast of 7.6%.

This sharp acceleration in inflation is largely due to higher real estate prices (new buildings jumped 16%) and motor fuel (10.8% after increasing by 8.4% in November), as well as recreation and cultural events (+14.4% vs. 5.8%).

Inflation was 7.8% in the fourth quarter, up from 7.3% the quarter before, a record high since 1990.

The jump in inflation raises the likelihood of another key interest rate hike by another 25 basis points by the Australian Central Bank in February, IG market analyst Yip June Rong said.

Australia’s S&P/ASX 200 index is down 0.15%.

Australia’s banking sector is mostly up on the prospect of higher interest rates, with Commonwealth Bank shares up 0.8%, ANZ Group up 0.1% and Macquarie Group up 0.7%.

Meanwhile, leading mining companies BHP Group and Fortescue Metals are down 0.8% and 0.4%, respectively, while Rio Tinto is down 0.6%.

The value of Japanese index Nikkei 225 increased by 0.5%.

Shares of Suzuki Motor Corp. (5.7%), Nippon Steel (4.5%) and Tokyo Electric Power Co. (3.3%) act as growth leaders among index components.

Nidec Corp.’s capitalization fell 5.7% after the electric motor maker sharply cut its full-year operating profit forecast due to shrinking demand and a slow recovery in the global auto industry.

South Korea’s Kospi Index jumped 1.3%.

The market value of Samsung Electronics Co. one of the world’s biggest chip makers rose 2.6 percent and automaker Hyundai Motor rose 0.7 percent.

The U.S. dollar is stable against the euro in trading on Wednesday, strengthening against the pound and the yen.

The ICE-calculated index showing the dollar’s dynamics against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona) is adding 0.02% in trading, while the broader WSJ Dollar Index is losing 0.04%.

The euro/dollar pair is trading at $1.0899 as of 8:00 a.m., up from $1.0888 at market close Tuesday.

The pound is down to $1.2319 from $1.2329 the day before. The dollar fell to 130.44 yen against 130.17 yen in previous trading.

This week traders will focus on preliminary data on US GDP for the fourth quarter to be published by the US Department of Commerce on January 26. The consensus-forecast of experts quoted by Trading Economics suggests that the American economy growth slowed down to 2.6% in October-December from 3.2% in the third quarter.

The data published the day before showed a continuing weakening of business activity in the states.

The composite Purchasing Managers Index (PMI) in the U.S., calculated by S&P Global, rose to 46.6 points in January from 45 points a month earlier. A reading below the 50-point mark indicates a contraction in business activity. The U.S. PMI has remained below that level for seven months in a row.

Business activity in January continued to fall in both the U.S. manufacturing and service sectors, preliminary data from S&P Global showed.

Experts expect the weakening economic recovery to prompt the Federal Reserve (Fed) to slow the pace of base interest rate hikes.

Oil prices are rising on Wednesday after falling the day before on weak statistical data from the U.S., which reduced investor optimism about global energy demand.

Traders’ attention is focused on the U.S. Department of Energy report on the country’s energy reserves, which will be released at 17:30.

The American Petroleum Institute (API) data released on Tuesday night showed an increase of 3.378 million barrels in U.S. oil inventories for the third week in a row. The previous two weeks, oil reserves in the country increased by more than 27 million barrels, reaching the highest since June 2021.

The value of March futures for Brent on the London Stock Exchange ICE Futures was $86.34 a barrel by 8:10 Moscow time on Wednesday, which was $0.21 (0.24%) higher than the price at the close of the previous session. Those contracts fell by $2.06 (2.3%) to $86.13 a barrel at the close of trading on Tuesday.

The price of WTI futures for March increased by $0.14 (0.17%) to $80.27 per barrel at electronic auctions of New York Mercantile Exchange (NYMEX). By the close of previous trading, those contracts had fallen $1.49 (1.8%) to $80.13 a barrel.

“Oil prices are trying to correct after falling the day before on weak data on business activity in the States,” – said an analyst at IG Asia Pte in Singapore Yeop June Rong. – But the pressure on the market remains, the risk appetite of investors remains subdued.

The composite purchasing managers index (PMI) in the United States, calculated by S & P Global, in January rose to 46.6 points from 45 points a month earlier. A reading below the 50-point mark indicates a contraction in business activity. The U.S. PMI has remained below that level for seven months in a row.

Business activity in January continued to fall in both the U.S. manufacturing and service sectors, preliminary data from S&P Global showed.

Agricultural holding “Astarta”, the largest sugar producer in Ukraine, in October-December 2022, reduced sales of the product by 27.7% compared to the same period in 2021 – up to 62.1 thousand tons, but its average selling price rose by 43.6% – to 25.62 thousand UAH per ton.

According to the agrarian group’s report on the Warsaw Stock Exchange on Tuesday evening, milk sales in the fourth quarter of 2022 increased 9% to 26,500 tons.

Soybean oil sales jumped 75.3% to 10,700 tons, wheat 2.9 times to 135,200 tons, and rapeseed more than 2.9 times to 12,400 tons,

At the same time, soybean meal sales fell by 8.2% to 26.5 thousand tons, sunflower seed – by 8.3% to 23.3 thousand tons, corn – 4 times to 82 thousand tons.

Agroholding specified that the average cost of soybean oil sold in October-December, 2022 increased by 28.1% up to 44.67 thousand UAH/ton, soybean meal – by 23.5% up to 17.54 thousand UAH/ton, milk – by 8.8% up to 13.73 thousand UAH/ton, corn – by 66.5% up to 9.6 thousand UAH/ton, wheat – by 25.3% up to 9.4 thousand UAH/ton.

Only sunflower seed went down in price – by 7.4%, to 15.94 thousand UAH/ton.

Thus, taking into account the volume of sold products and their average price, we can tentatively estimate the growth of Astarta’s revenues in the fourth quarter of last year compared to the fourth quarter before last year at 7.4% – up to UAH 5 billion 796.4 mln. In particular, sugar decreased by 3.7% to UAH 1 billion 589.5 million, wheat – 3.6 times to UAH 1 billion 270.3 million, rapeseed – almost 2.9 times to UAH 280.3 million, soybean oil – 2.2 times to UAH 488.6 million, soybean meal – by 13.4% to UAH 644.7 million and milk – 18.6% to UAH 363.2 million.

Meanwhile, sales of corn decreased 58.8% to UAH 787.7 mln, while sunflower sales decreased 15% to UAH 372.1 mln.

The company also reported that to date it has harvested corn from 90% of the area, its average yield is estimated at 9 tons per hectare.

“Astarta is a vertically integrated agro-industrial holding operating in eight regions of Ukraine. It consists of six sugar factories, farms with land bank of 220 thousand hectares and dairy farms with 22 thousand cattle, oil extraction plant in Globino (Poltava region), seven elevators and biogas complex.

In 9M2012, Agropromholding received EUR102.2 mln, which is 11.7% more than in 9M2012. 9M2012 Agroindustrial Holding received net profit amounting to EUR 102.2 mln, which is 39.3% less compared with the same period of the previous year, while its revenue increased by 13% – to EUR 341.3 mln.

In UAH terms Astarta’s net profit for 9M2012 decreased to EUR 341.3 mln. Astarta decreased its net profit by 38.6% – to UAH 2 bln 76.15 mln, while its revenue increased by 14.7% – to UAH 11 bln 268.54 mln.

Agro-industrial group of companies Ovostar Union, one of the leading producers of eggs and egg products in Ukraine, in 2022 reduced the production of shell eggs by 9% compared with 2021 – to 1.55 billion units, and sales – by 6%, to 1.08 billion units.

According to a group report posted on the Warsaw Stock Exchange website on Tuesday, Ovostar increased its egg exports by 27% to 290 million eggs last year, which pushed the share of foreign shipments in its sales up 4 p.p. – The company’s share of foreign sales rose four percentage points to 27%, up from 23%.

“Supply chain issues, additional export and import regulations, internal and external migration, temporary occupation of some territories in the first half of the year, and power outages in the second half of the year forced the company to cut investments in new stock and streamline other processes. Although by the end of 2022 the total flock was down 14%, the group was able to mitigate the impact of negative factors, resulting in a decline in production of only 9%,” the holding quotes its general director Boris Belikov in a report.

According to him, last year egg sales dropped only 6% down, which was partly due to a decrease in egg processing. In addition, the holding benefited from the dynamics of world prices of eggs and egg products in the shell.

Ovostar also processed 427 million eggs in 2022, which is 15% less than in 2021. At the same time, at the end of the first nine months of last year the lag was 10% against the nine months of 2021.

Ovostar Union’s bird population as of December 31, 2022 was 7.2 million birds (down 14.3% from the same date a year earlier), including 6 million laying hens (-14.3%).

Last year, Ovostar’s sales of dry egg products decreased by one-third compared to 2021, to 2,13 thousand tons, and their export share in total sales was 68%, while in 2021 it was 64%.

In turn, sales of liquid egg products during this period decreased by 26% to 10.62 thousand tons, their share of exports was 40% compared to 28% in 2021.

According to the report, 2.54 thousand tons of dry egg products were produced in 2022 (-6% compared to 2021), and liquid egg products – 10.79 thousand tons (-24%).

The average selling price of shell eggs last year increased by 34% in UAH terms against 2021 and reached 2.9 UAH/ piece, while in USD the increase was 13% – to $0.09/ piece. The average selling price for dry egg products doubled in UAH equivalent to 277.94 UAH/kg, and rose 71% in USD – to $8.59/kg, liquid egg products – 42% in UAH, to 66.79 UAH/kg, and 20% in USD – to $2.06/kg.

Ovostar Union is a vertically integrated public holding company, one of the leading producers of shell eggs and egg products in Europe. The producer has been a certified exporter to the EU since 2015.

The group’s holding company, Ovostar Union N.V., held a 25% IPO on the Warsaw Stock Exchange in mid-June 2011 and raised $33.2 million. The majority stake in the company is owned by Prime One Capital Limited, which is controlled by its CEO Boris Belikov and Chairman of the Board Vitaliy Veresenko.

“Ovostar reported $1.65 million in net income for 2021, down 38 percent from 2020. Its EBITDA was down 29% to $5.7 million, while revenue increased 35% to $133.3 million.