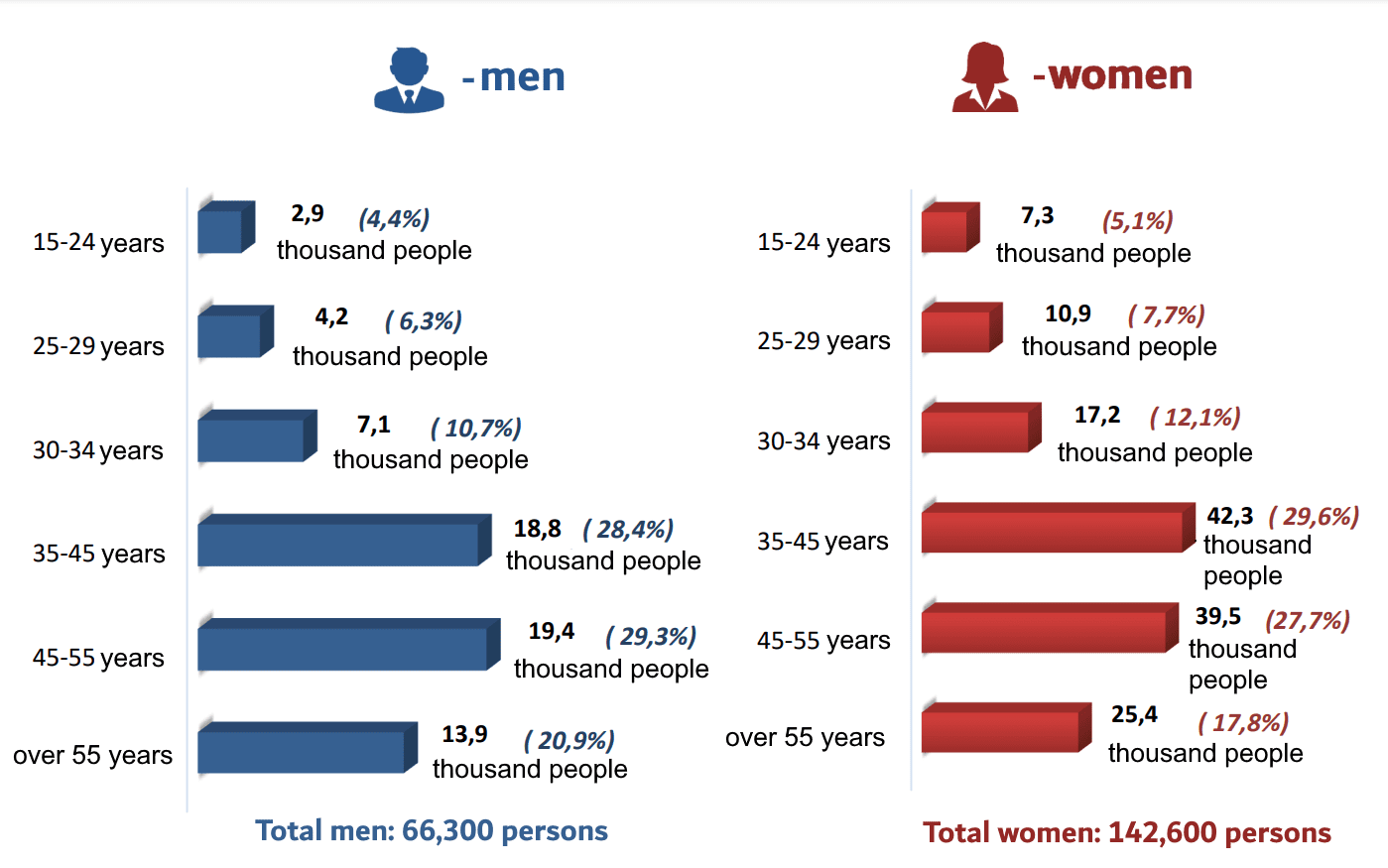

Structure of registered unemployed as of 12.01.2022 by age group

Source: Open4Business.com.ua and experts.news

Metinvest Mining and Metallurgical Group, as part of Rinat Akhmetov’s Steel Front militarized initiative, handed over four modern drones to scouts in the Avdiivka direction, continuing to support Ukraine’s defenders in the fight against the Russian aggressor.

The company’s press release specifies that the tactical equipment provided protects operators’ lives from enemy attacks, as specialists can control the drone from long distances without exposing themselves to direct danger.

“They (drones – IF) are effective for suppressing the enemy, artillery work and at night for infantry, because lately the enemy is very much making installation for night maneuvers, for night advancement,” explains Colonel Alexander Danilchenko of the AFU, quoted by the press service, noting the productive assistance of Metinvest, which it began to provide since March last year.

At the same time, it is noted that for eleven months Avdeevka has been subjected to hostile shelling. Stubborn battles are going on nearby every day, as the enemy is trying to expand the borders of the occupation. However, the AFU and defense forces are heroically defending the city and neighboring frontline territories.

“In Avdeevka we have not conceded a single step, even in some positions we have advanced,” Danilchenko stressed.

The press release reminds that Metinvest Group is one of the first companies in Ukraine to start supplying drones to the AFU.

“The company systematically supplies our military with body armor and helmets, burners and fuel, helps to equip defensive structures and transfers mobile shelters made of strong steel. Today we are making another contribution to the forthcoming common victory over the invaders. I am sure that the “birds” will be useful and will help our defenders to repulse the enemy”, noted Acting General Director of Avdiivka KHP Yuriy Ktsinenko.

It is also reported that Metinvest organizes the search and delivery of important tactical equipment and machinery to Ukraine in order to strengthen the army’s defense capabilities in different parts of the front. The company has already transferred approximately 1,700 thermal imaging cameras, 1,000 drones and quadcopters, and 312 vehicles, including ambulances, to the fighters. And 1 million liters of fuel have been provided to refuel the vehicles.

“Metinvest is a vertically integrated group of mining and metallurgical enterprises. Its enterprises are located in Ukraine – in Donetsk, Lugansk, Zaporizhzhia and Dnipropetrovsk regions, as well as in European countries.

The major shareholders of the holding are SCM Group (71.24%) and Smart Holding (23.76%) that manage it jointly.

Metinvest Holding LLC is the management company of Metinvest group.

DIM Group put into operation the first stage of Park Lake City after the war, postponed by a quarter the date of delivery of houses in Lucky Land, “Metropolis” and “New Autograph”, the managing partner of DIM Group Alexander Nasikovsky told “Interfax-Ukraine” agency.

“After the beginning of the war we commissioned two houses for 190 apartments, which is 18840 square meters of the first stage of the complex Park Lake City in Podgortsy. We were forced to postpone for a quarter the terms of delivery of houses in our projects: Lucky Land, “Metropolis” and “New Autograph”. We intend to do everything possible to speed up this process and give the keys in the first half of 2023. We thank our investors for their understanding and support”, – said Nasikovsky.

He added that the company has a number of projects in its project portfolio that were scheduled to start in the spring of 2022.

“The war has made its adjustments, now we are directing all efforts to the objects already under construction, and we are doing everything possible to put them into operation as soon as possible. After all, we see an increase in demand for finished housing among our potential buyers, “- said Nasikovsky.

In general, he estimated “dozens of times” decrease in demand compared to the prewar period.

“Our company until Feb. 24, 2022, had 100 to 150 transactions a month, depending on the month and seasonality. Now we’re frankly happy with numbers in the tens. Consumer activity isn’t just down by a factor of ten; it’s almost frozen for months. But people who associate their future only with Ukraine, and for whom the question of buying their own home was relevant before the war and remains so now, return to the choice of their home “- he said.

Nasikovsky recalled that the company had already resumed work on the sites of five projects by June. Among the difficulties he noted a shortage of labor (by his estimates, the number of employees at construction sites has decreased from 20 to 40%), an increase in prices of building materials (by 35%).

“Despite this, developers are trying to keep prices per square meter of housing at levels up to February 24, 2022. In dollars the prices are almost unchanged, but in hryvnia the cost has increased, primarily due to significant exchange rate fluctuations,” – said a representative of the building group.

According to his predictions, in 2023 the cost of primary real estate will grow. This is due not only to the impending growth of demand for new housing, but also the rise in price of construction materials, energy and related resources needed to build houses.

The expert believes that the biggest demand is and will be in the coming years for ready-made accommodation “turnkey”: apartments ready to move in, furnished and equipped.

“There will be a demand for residential complexes with developed infrastructure and everything necessary for comfortable living, so we are actively developing this direction in our projects – ReadyDIM”, – he said.

Another trend is energy-independent solutions not only for individual houses, but also for apartment buildings. In the DIM group of companies since 2022 are working on solutions for new houses of one of the projects on the energy-independent side with alternative solutions for water, electricity and heat.

“We hope to present these projects as early as this year,” Nasikovsky said.

Founded in 2014, the DIM Group consists of six companies that cover all phases of construction.

To date, the company has commissioned 12 houses in six residential complexes. Seven residential complexes of comfort+ and business class are under construction: “Novy Autograph”, “Metropolis”, Park Lake City, Lucky Land, etc.

The work on the transfer of Israeli technologies related to smart alerts for missiles and drones to Ukraine is in progress, said the Ambassador of Ukraine to Israel Yevgeniy Korniychuk.

“Regarding the official things that we can comment – there is work on the transfer of Israeli technology related to smart alerts concerning missiles and drones. This technology is officially being transferred by the Israeli side. And I think that in a certain time we will receive it completely,” he said at a briefing at the Media Center Ukraine.

The Ambassador added that Ukraine still needs more active military-technical cooperation. However, according to him, there are many projects that cannot be commented on publicly yet.

“In order to have specifics on Iranian drones, I think it will take a few weeks. Since the government has just started work, it needs to make a decision taking into account the position of the U.S. as a major strategic partner, and the interests of the public,” the ambassador said.

He explained that the gap between the right-wing bloc that came to power and the left-wing forces is very small – 40 thousand voters, and the agenda is very much related to domestic politics, as well as the Palestinian question.

“So the issue of Ukraine is not a priority. Although we are trying with all our might to make it so,” Korniychuk added.

At the same time, the Israeli Foreign Ministry said that the issue of the war in Ukraine is a priority, said the Ukrainian diplomat.

“The minister said that he would facilitate more aid to Ukraine, without specifying it,” the ambassador said.

The average rate of new hryvnia deposits for households in December was 10.6% per annum, which is by 0.6 percentage points (p.p.) higher than in November and by 4.9 p.p. than in May, when the historical minimum was reached.

According to the information from the National Bank of Ukraine (NBU) on its website, the rate on deposits in the national currency increased by 3.5 p.p. over 2022.

At the same time, the rate on loans in hryvnia to households in December remained at the level of November – 35.1% per annum, and for the year its growth was only 1.4 percentage points.

The rate on foreign currency deposits, which reached a historical low of 0.4% per annum in April, decreased from 0.7% to 0.6% in December, which may be associated with deposits for the purchase of foreign currency, the rate on which, as a rule, is close to zero.

As for the corporate sector, the rate on new hryvnia deposits in December increased by 0.8 p.p. – to 10.4%, while on foreign currency deposits it decreased by 0.1 p.p. – to 1.4% per annum.

The average rate of UAH loans to the corporate sector in December decreased by 0.7 p.p. – to 20.1%, whereas on foreign currency loans – by 0.2 p.p., to 5.2%.

During the year, hryvnia loans for corporate sector went up by 11 p.p., while currency loans went up by 1.1 p.p.

As earlier reported, on June 3, the NBU raised its key rate from 10% to 25%, in order to improve the attractiveness of the hryvnia, reduce pressure on international reserves and combat inflation, which totaled 26.6% for the year.

The National Bank expects that banks will also increase rates on deposits, and the Ministry of Finance – on OVGZ, while the increase in interest rates on loans will not be so significant. Since October, the Ministry of Finance raised rates on bonds with maturities of five to 24 months to 14-19.5% per annum, while in the secondary market they reach 20% per annum and higher.

Ukraine’s foreign trade deficit in goods in January-November 2022 increased 2.3 times compared to the same period in 2021, to $8.524 billion from $3.635 billion, the State Statistics Service said.

According to them, exports from Ukraine during this period compared to January-November 2021 decreased by 33.6% to $40.671 billion, imports – by 24.2% to $49.195 billion.

The State Statistics Committee specifies that seasonally adjusted exports decreased by 2.6% to $3.507 billion in November compared to October, while imports increased by 2.0% to $4.827 billion.

The seasonally adjusted foreign trade balance in November-2022 was negative at $1.319 billion, while in October-2022 it was also negative at $1.129 billion.

The coverage ratio of imports by exports in January-November 2022 was 0.83 (0.94 in January-November 2021).

The State Statistics Committee specified that foreign trade transactions were conducted with partners from 230 countries.