Nova Poshta Group paid more than 5 billion hryvnias of taxes and duties to the budgets of all levels in 2022.

Vladimir Popershnyuk, co-owner of Nova Poshta, said this in his New Year’s greeting to the company.

He also noted that the company continues to develop and open international offices even during the active phase of the war.

For his part, the CEO of NovaBox, Alexander Lisovets, said that the company will soon present the company’s union postal terminals in Poland.

As it was reported, in 2021 Nova Poshta paid to the budget of all levels more than 6.4 billion UAH of taxes and duties, which is 26% more than in 2020.

Nova Poshta includes, in particular, Nova Poshta, NP Logistics, NovaPay and Nova Poshta Global.

The network includes about 10 thousand branches all over Ukraine.

German engineering company Krauss-Maffei Wegmann has begun production of RCH 155 self-propelled artillery units for Ukraine, Krauss-Maffei Wegmann advisor Nicholas Drummond said in a tweet.

“Sometimes combining two proven solutions into a new concept can be revolutionary, avoiding significant risk. Production of the Boxer RCH-155 for Ukraine has begun,” Drummond wrote.

In December, the German government officially confirmed that it was preparing 18 units of the latest RCH 155 wheeled units for Ukraine.

Ukrainian Defense Minister Oleksiy Reznikov made the request to Germany in July 2022.

The unit is operated by a two-man crew. The ammunition is 30 rounds. The manufacturer claims a range of 40 km and 52 km with V-LAP rounds.

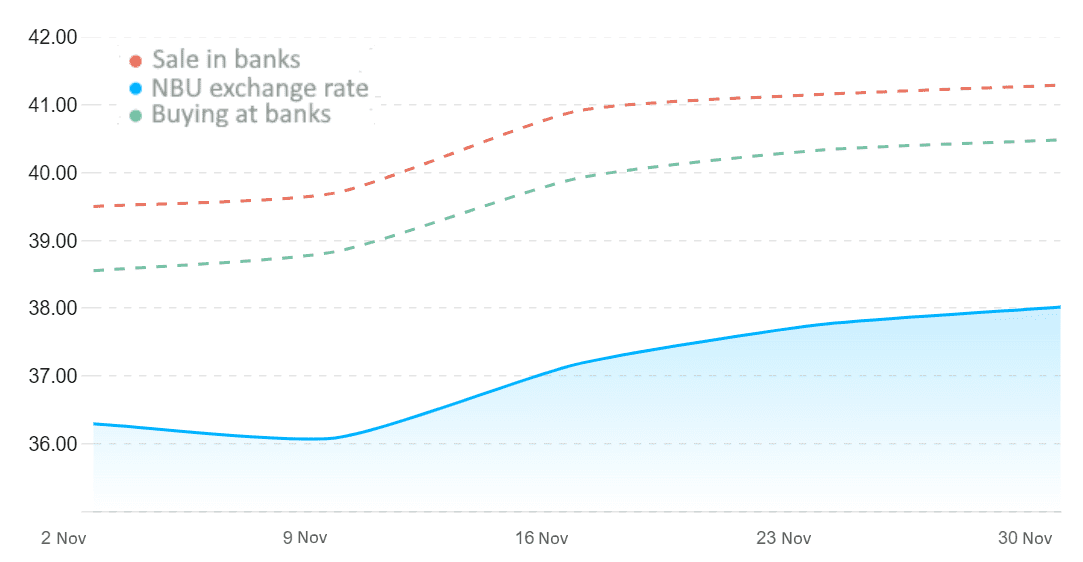

Quotes of interbank currency market of Ukraine (UAH for €1, in 01.11.2022-30.11.2022)

minfin.com.ua

Global equity markets are ending the year with the steepest declines in years, while for the bond market, 2022 will be the worst year in the 21st century.

Investors are cautiously optimistic about the year ahead, hoping for an end to the cycle of interest rate hikes, a Chinese economic recovery and a resolution of the conflict in Europe. However, their plans may be hampered by five key risks, according to Bloomberg.

INFLATION

“The bond market expects inflation to return to an acceptable range in the next 12 months,” said Matthew McLennan of First Eagle Investment Management.

But that outlook could be misleading, he cautioned, because rising wages and supply-side pressures, including energy prices, could lead to long-term increases in consumer prices.

If inflation proves more resilient than the market suggests, the Federal Reserve and the European Central Bank are unlikely to stop raising rates in the first half of the year, let alone lower them. In turn, this will cause further declines in stocks and bonds, a stronger dollar and difficulties for emerging markets. Rising borrowing costs could also trigger a recession.

“The Fed has failed to anticipate inflation and in its quest to beat inflation may miss the looming problem in the financial market,” McLennan warned. – It is quite possible that the Fed is underestimating the risks of financial disaster.”

CHINA’S PROBLEMS.

China’s stock index has jumped 35% from its October low on expectations of the removal of recent restrictions and lockdowns in the world’s second-largest economy.

But there is a danger of an uncontrolled rise in coronavirus diseases that China’s health care system cannot cope with, and then the country faces a collapse in business activity.

“The disease trajectory in China will rise and peak only a month or two after the Lunar New Year,” said JPMorgan Chase market strategist Marcella Chow.

China’s stock market recovery remains fragile and the prospect of declining economic activity could collapse demand for commodities, especially industrial metals and iron ore.

SITUATION IN UKRAINE

“If the situation worsens, NATO gets more involved in the fighting, and sanctions increase, that would be quite a negative,” said Nikko Asset Management senior strategist John Weil.

Secondary sanctions on Russia’s trading partners, mainly India and China, will only intensify the effect of existing bans at a very dangerous time for the global economy, he added.

“The world faces a supply crisis in terms of food, energy and other commodities, including fertilizers, some metals and chemical products,” the expert wrote.

COLLAPSE OF EMERGING MARKETS

Many investors expect a weaker dollar and lower fuel prices in 2023 to support emerging markets.

However, any difficulties in fighting inflation will keep the dollar down, and escalating hostilities in Ukraine is just one of many risks that could lead to another surge in fuel prices.

“It could very well turn out to be another tough year for emerging markets,” says Shane Oliver, head of investment strategy and economics at AMP Services Ltd. Shane Oliver. – “The still high likelihood of a rising dollar is a negative factor for them because many have dollar obligations.

A stronger dollar makes it difficult for countries to service U.S.-currency-denominated government debt.

THE RETURN OF THE CORONAVIRUS

The emergence of a more contagious or deadly strain of coronavirus, or even the spread of existing variants, could cause supply chain problems again, which in turn would cause inflation to rise and economic activity to slow.

“We think the impact on macroeconomics and growth will be felt mainly by large economies and countries that are more dependent on foreign trade,” JPMorgan’s Chow said.

However, her baseline scenario assumes that the coronavirus will continue to retreat, and the main negative factor for markets will be a possible recession in the U.S. and Europe.

Receipts of taxes and other charges to the general fund of the state budget in 2022 in terms of payments administered by the State Tax Service amounted to 694.4 billion UAH, which is 4.5 billion UAH, or 0.6% below the indicative indicators, the head of the parliamentary committee on finance, tax and customs policy Daniel Getmantsev said.

“More than last year the fact of January-December 2021 paid 80.0 billion UAH (+13.0%),” he wrote in a telegram on Saturday.

Hetmantsev said that in December 2022 the general fund of the state budget received 55.8 billion UAH, which is 12.6% or 6.2 billion UAH more than the indicator, and by 12.3% or 6.1 billion UAH more than the plan 2021.

According to him, such figures are largely due to an increase in revenues from the value added tax (VAT) on manufactured goods compared to last year by almost 1.4 times, or 58.1 billion UAH – up to 213.9 billion UAH. This is also by 19.1% or 34.3 billion UAH more than the indicative plan.

The head of the committee added, without specifying the amount of VAT refund, that in December the indicative indicators for this tax are exceeded by 22.5%, or 3.2 billion UAH, and amounted to 17.5 billion UAH, which is 13.4% or 2.1 billion UAH more than in December 2021

Hetmantsev also noted that the excise tax (made + imported) brought the budget 8.6 billion UAH, or 270 million more to the figure of the Ministry of Finance.

On the eve of the State Customs Service reported that in 2022 transferred 300.8 billion UAH of customs payments to the state budget, including 36.7 billion UAH in December compared to 33.4 billion UAH in November and 32.5 billion UAH in October.

The department recalled that in January and February of this year the receipts were 37.2 billion UAH and 39.6 billion UAH respectively, then collapsed in March and June to 7.7 billion UAH, 8.8 billion UAH, 9.5 billion UAH and 12.7 billion UAH respectively.

However, in the following months, including due to the abolition of import privileges introduced at the beginning of the war, they increased significantly, amounting already in July to 22.9 billion UAH and 30 billion UAH in August and September.

As it was reported with reference to the Ministry of Finance, the State Tax Service revenues to the general fund of the state budget in 2021 were 614.4 billion UAH, an increase of 3.1%, or 18.4 billion UAH above the budget.

Customs revenues last year brought 409.3 billion UAH to the general fund, and another 75.6 billion UAH to the special fund, which is 35% or 126.3 billion UAH more than in 2020. Including in December 2021 the total transfers of the State Customs Service amounted to 52.7 billion UAH, and during martial law in Ukraine (February 24) – 226.4 billion UAH of customs payments.

It should be noted that under martial law the functionality and positive dynamics of the increase of transfers of customs duties and other payments to the revenue part of the budget has been maintained.

Thus, the indicators of revenues increased from UAH 7.7 billion in March to UAH 36.7 billion in December this year.

The net outflow from Ukraine, which lasted five weeks and stopped in the week before the Catholic Christmas, was replaced by a net inflow of 33,000 people in the last week of the year, including 29,000 in the first three days, the State Border Service said on Facebook.

According to the Department, the flow on the way out of Ukraine from December 24-30 decreased in comparison with the previous week from 301 thousand to 279 thousand people, while on the way in – from 302 thousand to 312 thousand people.

Polish State Border Service also recorded a net inflow to Ukraine for the last seven days – 35 thousand people compared with 15 thousand people a week earlier.

According to the Polish Ministry, the weekly flow from Ukraine to Poland reduced from 184 thousand people to 179 thousand, while the return flow from Poland to Ukraine increased from 199 thousand to 214 thousand people.

As a whole from the beginning of the war 8,817 million people arrived in Poland from Ukraine, whereas in the opposite direction there were 7,028 million people.

According to the State Border Service of Ukraine, the number of cars crossing the western border of Ukraine declined from 139 thousand to 123 thousand, while 593 to 428 vehicles with humanitarian cargoes crossed the border.

As reported, since May 10, the flow to enter Ukraine through its western border every day for almost a month exceeded the flow to leave. The net inflow during this time was 188,000 people. In subsequent weeks there was no such unambiguous trend, except for the week of the new academic year, when net inflow was a record 47 thousand people.

In general, statistics showed a gradual return of Ukrainians to their homes: the net influx for the period from May 10 to September 23 was 409 thousand people.

For the first time since May 10, the number of those who left Ukraine in a week exceeded the number of those who entered at the end of September. At that time, the net outflow was 28 thousand people at once, and one of the possible reasons was a reaction to mobilization in Russia and “pseudo-referendums” in the occupied territories, and then the probable reason for the outflow was massive shelling of the energy infrastructure. In total, since then, the net outflow has been 84,000 people.

According to UNHCR data as of December 27, a total of 16.867 million people left Ukraine since the beginning of the war (not including the flow of people into the country), of which 8.507 million left for Poland, 2.852 million for Russia (data has not been updated since October 3), Hungary – 1.973 million, Romania – 1.738 million, Slovakia – 1.048 million, Moldova – 732.9 thousand people, Belarus – 16.7 thou

At the same time, according to the UN, from February 28 to December 27, 8.952 million people arrived in Ukraine (excluding Hungary, Russia and Belarus).