ASUS (Taiwan), a company specializing in computer electronics, has appointed former business development director Valeriy Bazilenko as director (ASUS Ukraine LLC).

Mikhail Lukashevich, who previously served as director of ASUS Ukraine for 17 years, has decided to step down as director of the company effective December 1, 2022.

ASUS Ukraine in 2021 had about 50 employees in Ukraine, and the share of ASUS in laptops in Ukraine, according to the data for 2021 was about 25%.

The Corum Group (DTEK Energy) engineering company intends to launch production of a new model of roadheader for uninterrupted extraction of coal from especially hard rocks in January 2023, the company said on Facebook.

“Mechanical engineers, no matter what, continue to improve the equipment for stable operation of coal-mining enterprises. Right now, our specialists are working on the development of the RH110 roadheader with a new technical level,” the company said in a statement on Wednesday.

According to Corum, the combine weighing about 53 tons in addition to all the basic technical solutions of the RH series will be the most versatile, powerful and reliable equipment of its direction.

“In the development of the giant, machine builders use modern European components for better diagnostics of equipment parameters and operational reliability,” the report said.

Design work is currently underway.

Corum Group, a leading manufacturer of mining equipment in Ukraine, is part of the energy company DTEK Energo, an operating company responsible for coal mining and electricity generation from coal in the structure of Rinat Akhmetov’s DTEK holding.

As previously reported, as part of the relocation of Corum’s Druzhkivska Machine-Building Plant (Donetsk Region) and Svet Shakhtyora Plant (Kharkiv), production sites were created in Dnipropetrovsk, Volynsk and Khmelnytskyi Regions.

In May of this year at the combine assembly plant in Dnipropetrovsk, the company has put out its first Roadheader RH220 combine after relocation, and in July – a Roadheader of KPD series.

In October, the company announced the release of another heavy-duty roadheader KPD for destroying the rock mass in mines, hazardous for gas and dust.

U.S. authorities have charged one of the most notorious figures in the crypto industry, FTX Group founder Sam Bankman-Friede. He faces up to 115 years in prison for what prosecutors classify as “the largest financial fraud in American history.”

Another U.S. official compared FTX to a house of cards, which investors managed to present as “one of the safest buildings in the cryptocurrency market.” What Bankman-Fried, who was detained in the Bahamas, will say about this in court is a matter for the future, but for now his position is that he was not aware of the asset diversion operations.

On Nov. 8, 2022, when the cryptocurrency exchange Binance announced its intention to buy the assets of rival FTX outside of the U.S., it seemed like the deal could be a game changer for the industry and one of the most important events in its history. Shares of another crypto platform, Coinbase Global, plummeted 11 percent on news of the merger. “This is a big deal,” Bernstein analyst Harshita Rawat wrote. – While Binance and FTX do not directly compete with Coinbase, we believe this merger marks a tectonic shift in the competitive landscape.”

As early as Nov. 10, a tectonic shift was indeed emerging, but of a very different nature. “As a result of corporate due diligence, as well as in light of recent news about mismanagement of customer funds and reports of an investigation by US authorities, we have decided to abandon plans to acquire FTX.com,” Binance reported. In turn, Bankman-Fried told investors that the exchange needs funding of up to $ 8 billion amid the massive withdrawal of clients from the site, wrote the Financial Times, citing its sources.

Investors who invested in FTX, all understood. Investment firm Sequoia Capital said it now considers the value of its investment in the crypto platform to be zero. Sequoia bought a stake in FTX for $213 million in 2021, when the exchange was valued at $25 billion.

Another day later, on November 11, FTX initiated its own bankruptcy. Bankman-Fried resigned. By court order the company was headed by John Ray III.

FTX had been issuing its own tokens, trading under the ticker symbol FTT. They had a combined value of $9.6 billion at their peak in 2021 and $3.5 billion on the eve of bankruptcy, Forbes wrote. Their buyers received certain financial preferences in FTX transactions, and within the Bankman-Frieda group of companies, it now appears, they could be used as collateral for lending. The exchange, which attracted customer funds, made loans under such a scheme to another Bankman-Frieda company, Alameda.

The U.S. Commodity Futures Trading Commission (CFTC) considers that these transactions represented “a limitless line of credit that allowed Alameda to take billions of dollars out of customer assets at FTX.” According to the SEC, client money was used to make “venture capital investments, luxury real estate purchases and large political donations.” To whom the latter were intended, the SEC report did not specify.

Another claim is that investors were defrauded. According to the SEC filing, FTX had raised more than $1.8 billion (including $1.1 billion in the U.S.) from them since May 2019 in exchange for an equity stake in the exchange. FTX investors included BlackRock, Sequoia Capital and Ontario Teachers’ Pension Plan, among others.

Now these actions formed the basis of the charges brought against Bankman-Fried by the U.S. Justice Department. Among other things, he is charged with conspiracy to commit fraud, misappropriation of funds of FTX exchange customers, including for personal use, writes the Financial Times. The implementation of the fraud scheme Bankman-Frieda began in 2019, since the founding of FTX, and continued until its collapse in November 2022, according to the text of the indictment. Collectively, he faces up to 115 years in prison.

In addition to the agencies mentioned, the Bankman-Fried case is being handled by the Federal Bureau of Investigation and the prosecutor’s office. According to Manhattan prosecutor Damian Williams, they are all working “around the clock” to get to the bottom of what happened in “one of the biggest financial frauds in American history.”

For his part, Ray, now dealing with FTX as a court-appointed receiver, said the scheme carried out was not “sophisticated.” He said it was a “routine embezzlement” of funds.

“We suspect that Sam Bankman-Fried built a house of cards based on deception, telling investors that it was one of the safest buildings in the cryptocurrency market,” SEC Chief Gary Gensler said.

Bankman-Fried, on the other hand, has insisted in recent weeks that he was unaware of the details of what Alameda was doing. It had its own chief executive, Caroline Allison, the FTX founder said.

The collapse of FTX had many implications for the cryptocurrency industry. As reported by The Wall Street Journal, citing data from research firm CryptoCompare, global funds investing in cryptocurrency assets in November recorded an outflow of $19.6 billion. From Binance, according to the Financial Times, investors withdrew more than $1 billion. Bitcoin – the most popular cryptocurrency – fell to a 2-year low.

Bankman-Fried was watching from the Bahamas, where FTX was also registered. Here, according to Reuters, luxury real estate was bought for the exchange’s founder himself, his parents, Stanford law professors, and other top executives in the group. Attorney James Bromley said that almost $300 million was spent for this purpose, Kommersant wrote.

Now Bankman-Fried is detained in the Bahamas at the request of the United States authorities. A local court denied his request for bail, saying that he could abscond and therefore must remain in custody. The judge scheduled a hearing on his potential extradition to the United States for Feb. 8, Bloomberg reported.

Meanwhile, Ray, who now manages what’s left of FTX, says it will take months to trace the fate of the withdrawn assets, and he is skeptical about the outcome of the search. “We won’t be able to recover all the losses,” Rey says.

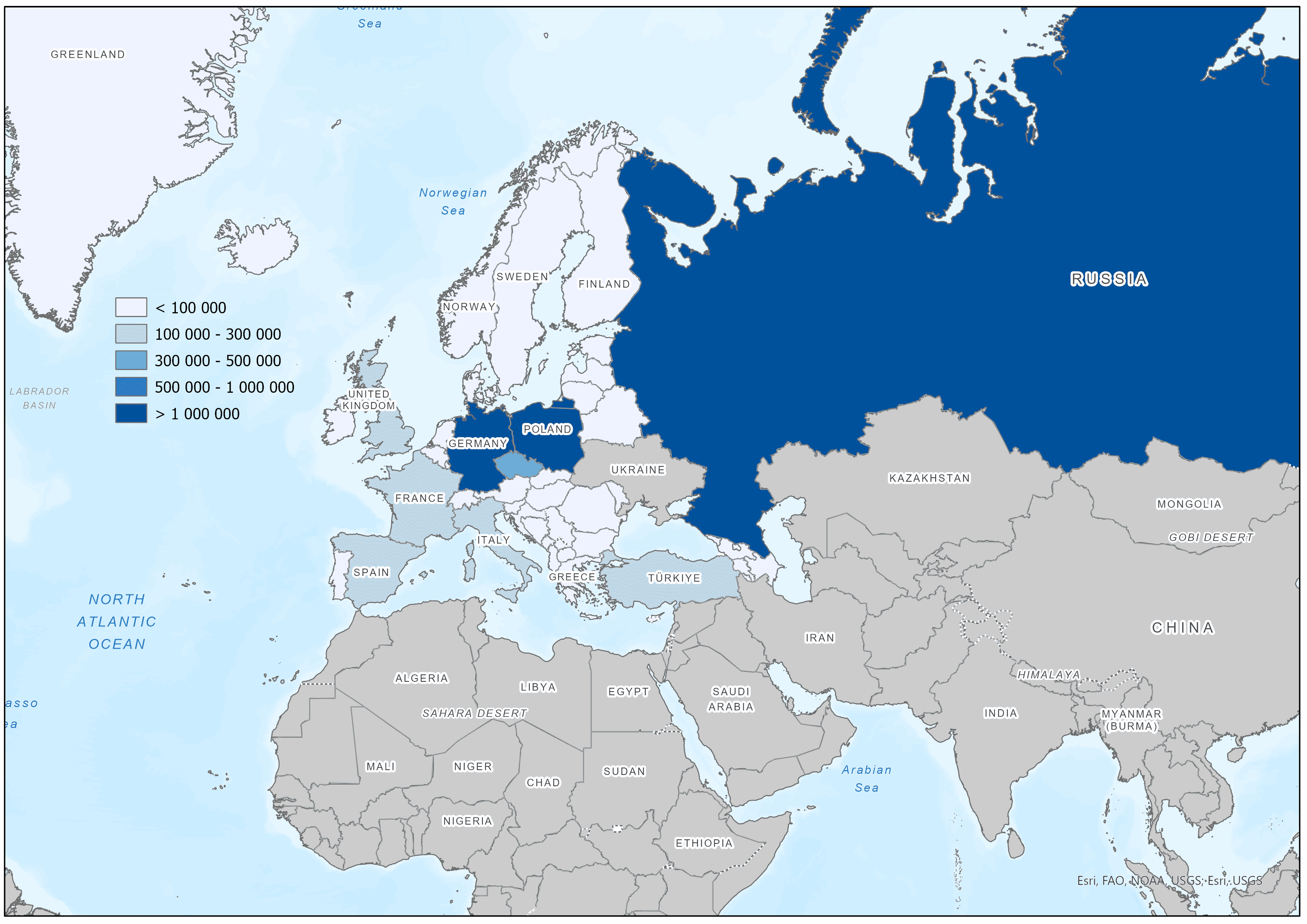

Number of refugees from Ukraine in selected countries as of 30.10.2022

UNHCR

Canada will provide CAD115 million (about $84.9 million at current exchange rates) to urgently restore Ukraine’s energy system, Canadian Deputy Prime Minister and Finance Minister Chrystia Freeland said.

“As the people of Ukraine continue their heroic resistance, we must all do even more to enable them to endure this struggle. That’s why Canada will provide $115 million from tariff revenues from imports from Russia and Belarus to urgently restore Kiev’s energy system,” she wrote on Twitter.

Canada’s Finance Ministry recalled in a press release Tuesday that on March 2, Canada became the first country to remove most-favoured-nation status for imports from Russia and Belarus, resulting in a 35% tariff on virtually all goods entering Canada from those two countries.

In June, G7 leaders pledged to explore ways to use revenues generated by tariff measures against Russia to help Ukraine. “As the first G7 country to fulfill this commitment, Canada will provide Ukraine with $115 million (Canadian) – the amount of expected tariff revenues from Russian and Belarusian goods – as part of the World Bank’s Re-PoWER Ukraine Project,” the Canadian Treasury said.

It recalled that this fund was recently established to facilitate grants from international partners to restore basic energy services in Ukraine.

Since Russia’s brutal and illegal invasion, Canada has already provided Ukraine with a total of CAD2 billion in direct financial assistance in 2022 and an additional CAD500 million in bonds in support of Ukrainian sovereignty earlier this month. This year, Canada has also provided over CAD2.5 billion in military, humanitarian and other assistance to Ukraine.

A petition demanding to veto the draft law No.5655 on reforming the sphere of urban planning, posted on the website of the President of Ukraine, has collected more than 25 thousand votes on the day of its adoption by the Parliament.

Now the petition should be considered by the head of state.

“New town-planning regulations under the guise of liberalizing the urban planning sphere and accelerating the construction actually untie the hands of large developers, who now do not have to go through checks from local authorities. Checks of construction and documentation of the project can be carried out by private firms, and the role of chief architects of the cities in this process is greatly restricted. If the law is adopted by the majority of deputies of the Verkhovna Rada at the next session, the process of chaotic development of our cities and the desecration of historical monuments will be accelerated,” – says the text of the petition.

As it was reported, on December 13, the Verkhovna Rada passed the bill as a whole #5655. It was voted for by 228 deputies.

Earlier, on December 1, 2022, the bill was withdrawn from consideration by Parliament. The Association of Ukrainian Cities, mayors, the National Agency for the Prevention of Corruption (NAPC), the Ministry of Culture and Information Policy, and the National Union of Architects of Ukraine insisted on its revision.