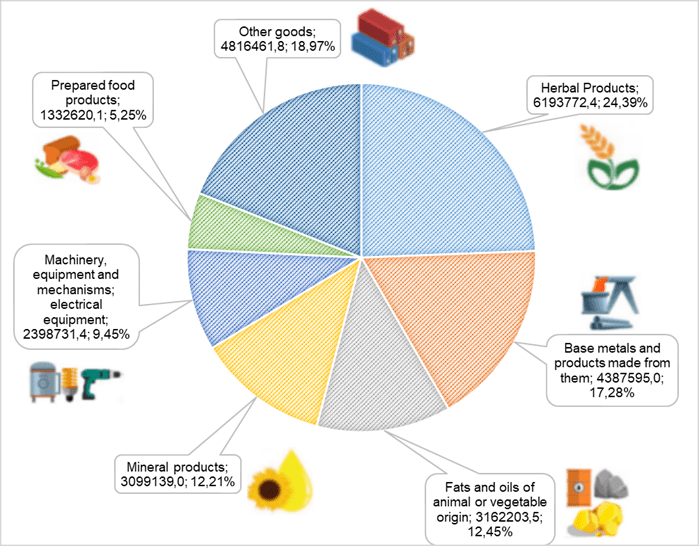

Foreign trade turnover by most important positions in Jan-Aug 2022 (export)

SSC of Ukraine , graphics of the Club of Experts

European stock indices are rising on Tuesday due to investors’ optimism about corporate profits, as well as the continued positive market sentiment after the UK’s fiscal policy reversal announced the day before.

The composite index of the largest enterprises in Europe Stoxx Europe 600 as of 12:50 CST rose by 0.23% to 399.4 points. Growth marks the fourth session in a row.

German DAX adds 0.84%, French CAC 40 – 0.32%, British FTSE 100 – 0.52%, Italian FTSE MIB – 1.22%, Spanish IBEX 35 – 0.55%.

Britain’s new Chancellor of the Exchequer, Jeremy Hunt, announced on Monday that he was phasing out much of the fiscal stimulus proposed by former British Treasury Secretary Quasi Kwarteng on 23 September.

In particular, the British government will return to plans to increase the corporate tax rate from 19% to 25% from April 2023, and will also refuse to reduce the tax on dividends, carry out wage reform, freeze alcohol duties and introduce a zero VAT rate. for foreign buyers.

In addition, the lowering of the base income tax rate to 19% from 20%, planned for April, will be postponed, and the program to subsidize homeowners’ electricity costs will be reduced.

Hunt’s proposals are expected to save the British authorities £32bn.

The Bank of England called “incorrect” the report of the Financial Times newspaper that the Central Bank will postpone the sale of government bonds from its portfolio until the market stabilizes.

Statistical data from Germany, published on Tuesday, showed some improvement in the mood of investors and analysts. The index of economic expectations for the next six months in October rose to minus 59.2 points from minus 61.9 points a month earlier. Experts polled by Trading Economics, on average, expected it to fall to minus 65.7 points.

Share quotes of European automakers are rising during trading on data from the European Automobile Manufacturers Association (ACEA), which showed an increase in car sales in the European Union in September by 9.6% compared to the same month in 2021. The increase in sales in the EU was noted in the second month, before that the figure had been declining for thirteen months in a row.

Shares of Volkswagen added 2.1%, Mercedes-Benz – 3.2%, Stellantis – 2.3%, BMW – 1.5%, Renault – 2%.

The value of shares of the French Publicis Groupe SA, one of the world’s largest advertising holdings, increased by 2.2%. Publicis has improved its 2022 organic revenue growth forecast to 8.5% from previously expected 6-7%, noting that it is yet to feel the impact of its customers’ spending cuts.

Swiss Re’s share price edged up 0.8% in trading. The Swiss reinsurer has a preliminary estimate of $1.3 billion in claims related to Hurricane Ian, and is therefore likely to post a net loss of $500 million in the third quarter.

Swiss pharmaceutical company Roche Holding AG shed 1.4%. Roche’s third-quarter revenue fell 8%, but the company reiterated its full-year guidance.

Rio Tinto, which lowered its full-year forecast for refined copper production, is down 1.2%. The company also said that iron ore shipments this year will be closer to the lower end of its forecast.

The US dollar is declining against other major currencies during Tuesday’s morning deals as investors’ risk appetite rebounds.

At the same time, the dollar continues to receive some support from expectations of further tightening of the monetary policy of the US Federal Reserve System (FRS) in the face of persistently high inflation, writes Trading Economics.

The ICE-calculated index showing the dynamics of the dollar against six currencies (the euro, the Swiss franc, the yen, the Canadian dollar, the pound sterling and the Swedish krona) is losing 0.13%, the broader WSJ Dollar Index – 0.22%.

The euro/dollar pair is trading at $0.9862 by 8:47 am CST, compared to $0.9844 at the close of the market on Monday. Euro rises in price by 0.18%.

The rate of the American currency against the yen is reduced by 0.13% and amounts to 148.84 yen against 149.04 yen following the results of the previous session.

The pound sterling rose to $1.1384 from $1.1359 in previous trading.

Britain’s new Chancellor of the Exchequer, Jeremy Hunt, has abandoned much of the fiscal stimulus proposed by former British Treasury Secretary Quasi Kwarteng on 23 September.

“The most important goal for our country now is stability,” Hunt said on Monday, speaking before Parliament.

Hunt’s proposals are expected to save the British authorities £32bn.

In particular, the government will return to plans to increase the corporate tax rate from 19% to 25% from April 2023, and also abandon plans to reduce the tax on dividends, carry out wage reform, freeze alcohol duties and introduce a zero VAT rate. for foreign buyers, writes the Financial Times newspaper. In addition, the lowering of the base income tax rate to 19% from 20%, which was planned for April, will be postponed.

Most of the stock indices of the largest countries in the Asia-Pacific region are growing on Tuesday following the rise of the US market a day earlier against the background of good quarterly reports of companies.

The only exception is the Chinese Shanghai Composite index, which fell 0.06% by 8:35 a.m. CET.

The Hong Kong Hang Seng added 1.2% by this time.

BYD Co. stock quotes. on the Hong Kong Stock Exchange jumped 6.4%. The leading manufacturer of vehicles powered by new energy sources in China expects net profit growth in the third quarter by almost 5 times (by 365%) – up to 5.5-5.9 billion yuan ($764-820 million), according to preliminary calculations.

Auto parts subsidiary BYD Electronic rose 7.5%.

Top gainers in Hong Kong on Tuesday also included solar panel maker Xinyi Solar Holdings (+5.7%), jewelry chain Chow Tai Fook Jewelery Group (+4.9%), chip maker Sunny Optical Technology Group Co. (+4.8%) and automaker Geely (+4%).

In addition, Internet retailers Alibaba Group and JD.com rose 3.8% and 2.7%, respectively, while Internet giant Tencent Holdings Ltd. – by 2.9%.

The value of the Japanese index Nikkei 225 increased by 1.5% by 8:31 am KSK.

The most significant increase in quotations is demonstrated by shares of medical services provider M3 Inc. (+5.5%), electronics manufacturer Sharp Corp. (+5%) and musical instrument manufacturer Yamaha Corp. (+4.9%).

The value of Recruit Holdings Co. jumped by 4.8%. The recruiting company announced the repurchase of its own shares in the amount of 150 billion yen ($1.01 billion), which is 2.5% of the capital. The program will run until March 14, 2023.

Also rising stock quotes financial group Mitsubishi UFJ (+1%), clothing retailer Fast Retailing (+1.3%) and consumer electronics manufacturer Sony Group (+1.2%).

The South Korean index Kospi rose by almost 1% by 8:26 am KSK.

Quotes of securities of one of the world’s largest manufacturers of chips and electronics Samsung Electronics Co. decline by 0.5%, while the cost of automaker Hyundai Motor rose by 0.3%.

The Australian S&P/ASX 200 gained 1.7%.

The capitalization of the world’s largest mining companies BHP and Rio Tinto increased by 1.4% and 0.1%, respectively.

Shares of technology companies are also going up: Block Inc (+7.2%), Xero (+3.4%), Life360 Inc (+3%), Seek (+3.6%) and Wisetech Global (+3.4%) ).

Oil prices are rising during trading on Tuesday after a moderate decline in the previous session.

The cost of December futures for Brent crude on the London ICE Futures exchange by 8:06 am CST on Tuesday is $92.37 per barrel, which is $0.75 (0.82%) higher than the closing price of the previous session. As a result of trading on Monday, these contracts fell by $0.01 (0.01%) to $91.62 per barrel.

The price of futures for WTI oil for November in electronic trading on the New York Mercantile Exchange (NYMEX) rose by this time by $0.82 (0.96%), to $86.28 per barrel. By the close of previous trading, the value of these contracts fell by $0.15 (0.2%) to $85.46 per barrel.

The market is supported, among other things, by the weakening of the dollar, which is depreciating against major currencies on Tuesday amid increased risk appetite, writes CNBC. Meanwhile, concerns about a potential recession in the global economy limit the growth of oil prices.

Downward pressure on oil prices continues to be exerted by concerns about the tightening of the monetary policy of many major central banks of the world, aimed at curbing inflation, writes Trading Economics.

Meanwhile, China is expected to maintain loose monetary policy to support the economy amid COVID-19-related restrictions.

Market participants are preparing to cut OPEC+ oil production. As reported, in early October, OPEC + decided to reduce oil production quotas from November by 2 million barrels per day.