Florian Bollen, the new manager of the Tarantino Family restaurant chain, announced his intention to invest in the reconstruction of the Zhytniy Rynok (Zhytniy Market).

A new tenant is working on a reconstruction project in cooperation with Kyiv City State Administration and Zhytniy Rynok municipal enterprise, he said in an interview with Focus.

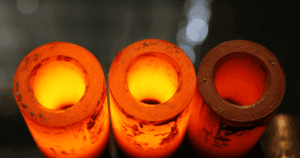

“The general idea is to make a comfortable public space with a place for Ukrainian producers and farmers, with platforms for public and social initiatives, with quality food at the food court, with comfortable places for trade. A craft brewery will be a highlight. Also in the plans are a cheese factory, a bakery, a children’s zone,” Bollen said.

According to him, reconstruction work can begin next year. At the same time, the businessman did not name the amount of planned investments.

“It is difficult to predict the final estimate amid war. The exchange rate is unstable, the logistics of construction materials is complicated. But I would like to start construction work next year. German Kraft Beer has a good reputation in the financial environment, we have the opportunity to receive affordable loans from European banks,” he emphasized.

Bollen explained that the building is on a long-term lease based on the results of tenders held by Kyiv City State Administration through the ProZorro e-procurement system.

As reported, the Tarantino Family restaurant chain in October 2022 came under the control of Florian Bollen, a German businessman and co-owner of German Kraft Beer craft breweries.

INVEST, KYIV, RECONSTRUCTION, RESTAURANT, Tarantino Family, Zhytniy Rynok

The Ministry for the Reintegration of Temporarily Occupied Territories reported that 6,570 places of compact residence for IDPs have been equipped in Ukraine at present.

“In Ukraine, 6,570 places of compact residence for IDPs (internally displaced persons) have been equipped, and the state continues to increase their number. It is easier for the authorities to provide educational, medical and other services for those living in them. The organization of work with our migrants is entrusted to local and regional authorities, however, in close cooperation with the central ones,” the press service of the ministry said in a statement.

It is noted that for people who were forced to move, modular cities were deployed in five regions, 25 of these towns were built by the Polish government.

“Of course, this is not enough, and therefore, negotiations are now underway with international donors and governments of other countries on the possible attraction of investments. On behalf of the President of Ukraine, a project is being developed to build such housing in the regions. investors, and this should be done before spring,” the message says.

Over the past two weeks on October 3-17, 4.05 thousand transactions were concluded in Ukraine with agricultural land plots with a total area of 7.33 thousand hectares, which is 2.9 times and 2.6 times, respectively, higher than the figures for the previous period September 19-October 3.

As reported on the website of the Ministry of Agrarian Policy and Food on Monday, in general, for the period from July 1, 2021 to October 17, 2022, during which the agricultural land market operates in the country, 126.21 thousand transactions took place on land plots with a total area of 289, 31 thousand hectares.

According to the agency, for the period October 3-17, an average of 289 transactions with agricultural land with a total area of 0.52 thousand hectares / day were concluded daily, while for two weeks September 19 – October 3, the daily indicators of the land market averaged 93 transactions per total area of 0.17 thousand ha/day, for the week of September 12-19 – 210 transactions with a total area of 0.4 thousand ha/day, for the week of August 22-29 – 164 transactions for 0.28 thousand ha/day, and for August 15-22 – 198 transactions on 0.69 thousand hectares.

This figure is still significantly lower than before the Russian invasion: according to the latest pre-war data from the Ministry of Agrarian Policy, during the period February 11-18, an average of 621 land transactions with a total area of 1.65 thousand hectares were concluded in Ukraine daily.

In terms of the total area of sold agricultural land plots, the Kharkiv region is in the lead with an indicator of 38.2 thousand hectares. It is followed by Dnepropetrovsk – 25.4 thousand hectares, Poltava – 23.3 thousand hectares, Kirovograd – 23.1 thousand hectares and Kherson – 21 thousand hectares of the region.

According to the Ministry of Agrarian Policy, since the beginning of the full-scale Russian invasion in Ukraine, 25.24 thousand transactions have been concluded with agricultural land with a total area of 44.78 thousand hectares. Most land plots sold during the war were in Khmelnitsky (4.92 thousand hectares), Poltava (4.89 thousand hectares), Vinnitsa (4.87 thousand hectares), Kirovograd (4.71 thousand hectares) and Dnipropetrovsk regions (4.08 thousand ha).

It is specified that over the past two weeks, the average price of 1 ha of agricultural land has not changed compared to the previous two-week reporting period and remained at the level of UAH 37.21 thousand / ha.

As reported, the agricultural land market, launched in Ukraine as part of the government’s land reform, began operating on July 1, 2021. At the first stage of the reform, only citizens of the country will be able to buy and sell land. One individual can have at his disposal no more than 100 hectares.

The right to acquire agricultural land on January 1, 2024 will be given to legal entities established in accordance with the legislation of Ukraine, while the final beneficiary of one or several legal entities will be able to consolidate through them a total of no more than 10 thousand hectares.

Futures for US stock indices are actively rising on Monday, signaling that the US stock market may start the week on a positive note, winning back the fall on Friday.

Investors are analyzing the latest financial statements of the largest Wall Street banks.

Bank of America Corp. in the third quarter increased revenue by 7.5%, which was better than analysts’ expectations. BofA shares are up 2.8%.

Bank of New York Mellon (SPB: BK), the world’s largest custodian bank, sharply cut its net income in July-September, with an adjusted per-share figure that beat analysts’ expectations. Paper BNY Mellon rise in price by 4.7%.

On Friday, JPMorgan Chase & Co also released its third-quarter financials. (SPB: JPM), Citigroup Inc. (SPB: C), Wells Fargo & Co. (SPB: WFC) and Morgan Stanley (SPB: MS).

JPMorgan and Citigroup delivered higher-than-market revenue and adjusted earnings, while Wells Fargo increased revenue by 4% and Morgan Stanley cut it by 12%.

The market capitalization of oil producer Continental Resources (SPB:CLR) jumped 8.2% in pre-trading. Company founder Harold Hamm has announced that he will buy all outstanding shares of Continental Resources through his Omega Acquisition Inc.

Shares of Archaea Energy Inc., one of the largest producers of renewable natural gas in the United States, jumped 1.5 times after the announcement that it was being bought by the British BP Plc (SPB:BP).

The cost of the manufacturer of diagnostic medical equipment PerkinElmer Inc. (SPB: PKI) does not change during pre-bidding. The company said it expects higher-than-expected third-quarter adjusted earnings, with revenue close to the upper forecast range.

Meanwhile, the Empire Manufacturing Index, calculated by the New York Fed, fell to minus 9.1 in October from minus 1.5 a month earlier, indicating a further decline in business activity in New York State. The indicator turned out to be negative for the third month in a row. Analysts had expected it at minus 4 points, writes Trading Economics.

Quotations of December futures for the Standard & Poor’s 500 index rose by 1.37% to 3646 points by 15:50 square meters, for the Dow Jones index – by 1.05%, to 30021 points. The price of contracts for December on the Nasdaq 100 index by this time increased by 1.73% – up to 10929.5 points.

PJSC Interpipe Novomoskovsky Pipe Plant (Interpipe NMTZ, Dnipropetrovsk region) increased its net profit by 2.2 times in 2021 compared to the previous year, to UAH 175.722 million.

According to the company’s annual report published on Monday, Interpipe NMPP increased its net income by 43.6% in 2021, to UAH 3 billion 871.695 million.

Retained earnings at the end of 2021 amounted to UAH 514.575 million.

As reported, Interpipe NMPP increased its net income by 25.1% in 2020 to UAH 3 billion 63.202 million, received a consolidated net profit of UAH 80.919 million, while it ended 2019 with a net loss of UAH 43.743 million.

Interpipe is a Ukrainian industrial company, a manufacturer of seamless pipes and railway wheels. The company’s products are supplied to more than 80 countries through a network of sales offices located in the key markets of the CIS, the Middle East, North America and Europe.

The structure of the company includes five industrial assets: Interpipe Nizhnedneprovsk Pipe Rolling Plant (NTZ), Interpipe Novomoskovsky Pipe Plant (NMTZ), Interpipe Niko-Tube, Dnepropetrovsk Vtormet and the Dneprostal electric steel-smelting complex under the Interpipe Steel brand .

The ultimate owner of Interpipe Limited is Ukrainian businessman Viktor Pinchuk and members of his family.

“Interpipe NMTZ” specializes in the production of welded pipes for the oil and gas industry, mechanical engineering, construction and other industries.

According to NDU data for the second quarter of 2021, Interpipe Limited (Cyprus) owns 89.8681% of the shares of the plant, while Lindsell Enterprises Limited (Cyprus) owns 6.2918%.

The authorized capital of PJSC Interpipe NMPP is UAH 50 million, the par value of a share is UAH 0.25.

The Western European stock market rises during trading on Monday.

The composite index of the largest companies in the Stoxx Europe 600 region increased by 0.27% by 11:32 a.m. and amounted to 392.35 points.

The British stock index FTSE 100 by this time increased by 0.33%, the German DAX – by 0.16%, the French CAC 40 – by 0.09%. The Italian FTSE MIB and the Spanish IBEX 35 added 0.15% and 0.95% respectively.

Market participants, among other things, are waiting for statements from the new British Chancellor of the Exchequer, Jeremy Hunt, who is due to address the House of Commons on Monday.

Meanwhile, three members of the British Parliament from the Conservative Party, as well as some leading businessmen, called on British Prime Minister Liz Truss to resign after a series of controversial economic decisions, reports The Financial Times.

Among the decisions that provoked criticism even from party members of Truss, the publication names, among other things, the appointment of Hunt as head of the Ministry of Finance. During the year, four finance ministers were replaced in the UK. His predecessor as finance minister, Kwazi Kwarteng, announced his decision to step down 38 days after his appointment.

In addition, concerns about the state of the global economy against the backdrop of the situation in Ukraine and rising interest rates in the world remain in the spotlight.

Estimates of the likelihood of a recession in the US economy have risen sharply against the backdrop of high inflation and rising interest rates in the US, according to a regular survey by The Wall Street Journal.

Respondents estimated the probability of a recession in the US in the next 12 months at 63% against 49% in July. The indicator exceeded 50% for the first time since July 2020.

MorphoSys AG, a pharmaceutical company, led the way in the Stoxx Europe 600 index components, climbing 8.6%.

The drop leaders were financial services provider Hargreaves Lansdown PLC, which dropped 6%.

Shares of Nokia Corp. grow by 1.6%. The Finnish telecommunications equipment manufacturer has announced that it has been selected by telecom operator Reliance Jio India as one of the largest equipment providers to support 5G networks.

Papers of Credit Suisse Group AG added 0.7%. A Swiss bank has agreed to pay $495 million to settle claims by the US state of New Jersey in connection with transactions relating to its mortgage-backed securities business.