Ukraine in January-September this year reduced imports of aluminum ores and concentrate (bauxite) in physical terms by 75.6% compared to the same period last year – up to 945.311 thousand tons.

According to statistics released by the State Customs Service (STS), during this period, bauxite imports in monetary terms decreased by 72.8% to $48.106 million.

At the same time, imports were carried out mainly from Guinea (58.97% of supplies in monetary terms), Brazil (27.22%) and Ghana (7.49%).

Ukraine in January-September 2022 did not re-export bauxite.

As reported, Ukraine in 2021 reduced the import of aluminum ores and concentrate (bauxite) in physical terms by 0.1% compared to 2020, to 5 million 114.227 thousand tons. Bauxite imports in monetary terms increased by 4.2% to $236.638 million.

At the same time, imports were carried out mainly from Guinea (59.33% of supplies in monetary terms), Brazil (21.33%) and Ghana (16.8%).

Ukraine in 2021 re-exported bauxite in the amount of 277 tons worth $70 thousand to Belarus (48.57%), Poland (40%) and the Russian Federation (7.14%), while in 2020 255 tons of bauxite were re-exported to Poland for $41 thousand

Bauxites are aluminum ores used as a raw material for the production of alumina, and from it – aluminium. They are also used as fluxes in ferrous metallurgy.

Bauxites are imported to Ukraine by the Nikolaev Alumina Refinery (NGZ), which was affiliated with the United Company (OK) Russian Aluminum (RusAl, RF) before the war. Alumina is produced from bauxite.

RusAl also previously owned a stake in Zaporozhye Aluminum Plant (ZALK) in Ukraine, which stopped producing primary aluminum and alumina.

JSC “Ukrposhta” issued new postage stamps for the Day of Defenders of Ukraine “Glory to the Armed Forces of Ukraine!”, the press service of the postal operator reported on Friday.

“Today, Ukrposhta presented the first 6 branches and troops of the Armed Forces of Ukraine. In the future, we plan to expand this series. And in order to thank the military not in word, but in deed, 8 UAH from each stamp will be directed to support the army,” commented the Director General of Ukrposhta Igor Smelyansky.

According to the report, the block of stamps is made in a graphic style, where each postage stamp displays images of modern Ukrainian defenders from different units of the troops and contains their emblem.

The stamps represent the Airborne Assault Forces, the Ground Forces, the Naval Forces, the Air Force, the Special Operations Forces, and the Territorial Defense Forces.

The author of the postal issue dedicated to the defenders is Anton Khrupin, a Ukrainian designer from Kramatorsk.

According to the release, the circulation of the stamp sheet is 1 million copies, the cost of one sheet is UAH 120, of which UAH 48 is a charitable contribution.

An envelope “First Day” was also issued for the sheet, thematic artistic envelopes and leaflets, in addition to plots, also contain colors and emblems of each branch of the Armed Forces of Ukraine.

Buy postal issue “Glory to the Armed Forces of Ukraine!” You can start from October 14 in the city branches of Ukrposhta throughout the country, as well as in the official online store of the operator.

In addition, the new postal issue will be sold in the official online stores of Ukrposhta on the Prom, Kasta, Rozetka, eBay and Amazon marketplaces.

The company noted that there will be restrictions on the sale of the “First Day” envelope in branches – no more than two per order. It will be possible to order online up to 10 stamp sheets, 10 artistic envelopes and 10 postcards of the same type per order.

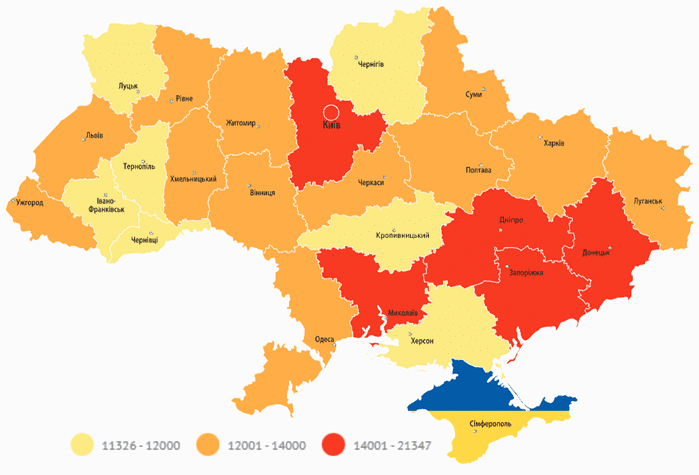

Average salary of staff employees be regions (UAH)

State employment center , graphics of the Club of Experts

Ukraine in January-September this year reduced imports of nickel ores and concentrate in kind by 63.9% compared to the same period last year – up to 328.936 thousand tons.

According to statistics released by the State Customs Service (STS), in monetary terms, imports of nickel ores decreased by 65.7% to $14.796 million.

At the same time, the import was carried out from Guatemala (100% of deliveries in terms of money).

For the nine months of 2022, as in January-September 2021, Ukraine did not export and re-export these products.

As reported, Ukraine in 2021 reduced the import of nickel ores and concentrate in physical terms by 20.6% compared to 2020 – to 1 million 235.533 thousand tons. In monetary terms, imports of nickel ores decreased by 22.2% to $58.929 million. Imports were carried out from Guatemala (100% of deliveries in monetary terms).

Last year, Ukraine did not export and re-export these products.

Nickel ore is imported to Ukraine by the Pobuzhsky ferronickel plant (PFC, part of the Solway group).

PFC processes about 1.2 million tons of ore per year.

Ukraine in January-September this year reduced the import of manganese ore and concentrate in kind by 54.1% compared to the same period last year – up to 135.044 thousand tons.

According to statistics published by the State Customs Service (STS), in monetary terms, imports of manganese ore and concentrate for the specified period decreased by 50.7% – to $17.972 million.

In August-September, manganese ore was practically not imported.

At the same time, for the nine months of 2022, imports were carried out from Ghana (99.86% of supplies in monetary terms) and Belgium (0.1%) and Brazil (0.02%).

For nine months of 2022, Ukraine did not supply manganese ore and concentrate for export.

As reported, Ukraine in 2021 reduced the import of manganese ore and concentrate in physical terms by 26.8% compared to 2020, to 425.279 thousand tons. In monetary terms, imports of manganese ore and concentrate over the specified period decreased by 29.6% to $53.917 million. At the same time, the main imports were from Ghana (99.87% of supplies in monetary terms), Brazil (0.07%) and Belgium ( 0.05%).

Last year, Ukraine supplied 770 tons of manganese ore and concentrate to Poland (94.38%) and the Russian Federation (5.62%) in the amount of $89 thousand, while in 2020 it exported 69.303 thousand tons of manganese ore and concentrate to $10.819 million

In Ukraine, manganese ore is mined and enriched by Pokrovsky (formerly Ordzhonikidzevsky) and Marganets mining and processing plants (both – Dnepropetrovsk region).

The consumers of manganese ore are ferroalloy enterprises.

Prices of precious metals continue to decline on inflation data in the US and against the background of the strengthening of the US national currency, as a result, gold may end the first week of the last three in the red, MarketWatch reports.

Gold and silver “continue to trade in a strong inverse relationship with the strong dollar index,” said Jim Wyckoff, senior analyst at Kitco.com. At the same time, market bulls are surprised that precious metals do not attract investors as a “safe harbor” in the face of increased geopolitical and market uncertainty, he said.

Quotes of December contracts for gold on the Comex during trading on Friday decreased by 1.3% – up to $1654.9 per troy ounce. Silver for December delivery fell 2.8% to $18.39 an ounce. Since the beginning of the week, the cost of these precious metals has fallen by 3.1% and 8.8%, respectively.

December palladium futures fell 3% on Friday to $2,053.5 an ounce.

Meanwhile, the DXY index, which shows the value of the US dollar against six major world currencies, rose by 0.7% to 113.14 points.

Consumer prices (CPI index) in the US in September rose by 8.2% compared to the same month last year, showed data published on Thursday by the country’s Ministry of Labor. Thus, inflation slowed down compared to 8.3% in August, but turned out to be higher than the 8.1% expected by analysts.

Meanwhile, consumer price growth before food and energy (Core CPI) accelerated to 6.6% year-on-year last month from 6.3% in August, renewing a record since 1982.

“Inflation data was terrible for the yellow metal as it cemented a 75 basis point Fed rate hike next month. And with inflation looking so unwavering, the Fed will likely have to go further than markets previously expected,” he said. Oanda Senior Market Analyst Craig Erlam “This does not bode well for gold in the near term. Yesterday’s lows of around $1,640 an ounce could soon be tested again.”