The UN General Assembly adopted a resolution on respect for the territorial integrity of Ukraine, which also condemns the attempt of the Russian Federation to annex the temporarily occupied territories of Donetsk, Luhansk, Kherson and Zaporozhye regions of Ukraine.

The resolution calls on countries not to recognize Russia’s claims to the four regions of Ukraine claimed by Russia after the so-called referendums held late last month, and demands that Moscow change course from an “illegal annexation attempt,” according to a press release posted on the website. UN.

The resolution, “protecting the principles” of the UN Charter, notes that the Donetsk, Kherson, Lugansk and Zaporozhye regions are temporarily occupied by Russia as a result of aggression, violation of the territorial integrity, sovereignty and political independence of Ukraine.

The General Assembly automatically brought the resolution to the discussion caused by Russia’s use of the right of veto in the Security Council in connection with the attempted annexation.

The resolution adopted by the Assembly calls on all states, the UN and international organizations not to recognize any claims of Russia for annexation and demands the immediate cancellation of its application for annexation. The resolution welcomes and “expresses strong support” for the continued efforts of the Secretary-General and Member States to de-escalate the current situation in search of peace through dialogue, negotiation and mediation.

According to the broadcast from the General Assembly hall, 143 out of 193 participants voted in favor, 35 countries abstained (Algeria, Armenia, Bolivia, Burundi, Central African Republic, China, Congo, Cuba, Eritrea, Eswatini, Ethiopia, Guinea, Honduras, India, Kazakhstan, Kyrgyzstan, Laos, Lesotho, Mali, Mongolia, Mozambique, Namibia, Pakistan, South Africa, South Sudan, Sri Lanka, Sudan, Tajikistan, Thailand, Togo, Uganda, Tanzania, Uzbekistan, Vietnam, Zimbabwe), voted 5 against (Belarus, DPRK , Nicaragua, Russia and Syria).

U.S. chip makers are recalling employees from China’s leading memory chip maker, Yangtze Memory Technologies Co. (YMTC), writes The Wall Street Journal, citing informed sources.

In particular, we are talking about KLA Corp. and Lam Research Corp., which are suspending cooperation with a Chinese state-owned company after Washington imposed restrictions blocking the supply of high-tech semiconductor components and equipment for their production in China.

U.S. companies have suspended maintenance on existing equipment at the YMTC facility and have also stopped installing new equipment, sources said.

In total, dozens of employees of American companies are involved in the plant, who play a key role in maintaining the operation of the enterprise, having the expertise necessary for high-tech production, the sources say.

If these employees do not return to work, YMTC will not be able to modernize production in the future, and will also face difficulties when equipment needs to be repaired.

Under new export controls announced last Friday, high-performance computing, supercomputing and artificial intelligence (AI) chips made using US technology can only be sold to China with an export license.

Washington also banned US citizens and organizations from working with Chinese chipmakers without special permission.

In addition, the US-announced package severely restricts exports to China of chip manufacturing equipment and technologies that local companies could use to develop their own equipment.

According to Boston Consulting Group estimates, US companies account for 41% of global production of equipment for the production of chips, China – no more than 5%.

PJSC “Zaporozhkoks”, one of the largest producers of coke products in Ukraine, which is part of the “Metinvest” group, in January-September of this year reduced the production of blast-furnace coke by 17.7% compared to the same period last year – up to 527.9 thousand tons. tons.

According to the company, 61.3 thousand tons were produced in September.

“The decrease in production compared to the same period last year is associated with a shortage of raw materials caused by military operations,” the company explains.

As reported, in 2021, Zaporizhkoks reduced production by 1.9% compared to 2020, to 837.2 thousand tons.

“Zaporozhkoks” produces about 10% of coke produced in Ukraine, owns a full technological cycle for processing coke products. In addition, it produces coke oven gas and pitch coke.

Metinvest is a vertically integrated mining group of companies. Its main shareholders are SCM Group (71.24%) and Smart Holding (23.76%), which jointly manage the company.

Metinvest Holding LLC is the management company of the Metinvest group.

European stock markets continue to decline on Wednesday for the sixth session in a row on investor anxiety due to further economic growth and rising interest rates in the world.

Traders are waiting for the publication of data on changes in US consumer prices in September, which may indicate how effective the tightening policy of the US Federal Reserve System (FRS) is. The report of the Ministry of Labor of the country will be published on Thursday at 15:30 square meters. Analysts expect U.S. inflation to slow to 8.1% last month from 8.3% in August, according to Trading Economics.

The composite index of the largest enterprises in Europe Stoxx Europe 600 fell by 11:20 qoq by 0.4% to 386.39 points.

The German DAX is losing 0.4%, the French CAC 40 – 0.18%, the British FTSE 100 – 0.1%. The Italian FTSE MIB and the Spanish IBEX 35 are down 1% each.

UK GDP in August fell by 0.3% in monthly terms after rising by 0.1% in July, data from the country’s statistics agency ONS showed. Experts on average expected that the volume of the country’s economy in the month before last would not change compared to July, according to Trading Economics.

In annual terms, UK GDP growth slowed to 2% from 3.1% in July.

Industrial production in the UK fell 1.8% in August from July after falling 1.1% a month earlier, the ONS report also said. At the same time, the volume of production in the manufacturing industry fell by 1.6%, in the mining industry – by 8.2%, and in power generation – by 0.6%.

In annual terms, industrial production in the country in August fell by 5.2% compared with a decline of 3.2% a month earlier.

The UK trade deficit widened to £7.1bn ($7.8bn) last month from £5.4bn in July. Imports rose 4.3% m/m to a record £75.3bn, exports up 2.2% to £68.2bn.

Consumer goods and medical equipment maker Royal Philips NV shed 8.4%. The Dutch company said its third-quarter like-for-like sales were down about 5% due to stronger-than-expected problems in its electronics supply chains.

Among the decline leaders in the Stoxx 600 is also TAG Immobilien AG (-9.3%), which operates in residential real estate.

Meanwhile, LVMH Moet Hennessy Louis Vuitton SA, the world’s largest luxury goods maker, is up 2.2%. The company on Tuesday evening after the close of trading published a statement in which it said that its revenue in the third quarter of 2022 increased by 27%, surpassing market forecasts.

Danish biopharmaceutical company Chr. Hansen Holding AS surged 12.7% after posting strong third-quarter results and a promising full-year outlook.

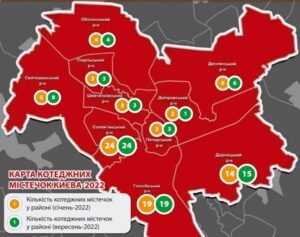

As of October 01, 2022, according to the RealExpo consulting company and the database of the suburban real estate portal www.zagorodna.com, there were 86 townships in Kyiv compared to 84 objects in January.

For the same period in 2021, 16 new projects appeared in Kyiv.

The number of cottage townships in Kyiv,

January-September-2022

(according to www.zagorodna.com)

Kyiv area January September

Goloseevsky 19 19

Darnitsky 14 15

Desnyansky 6 6

Dneprovskiy 2 1

Obolonsky 4 4

Pechersky 3 3

Podolsky 3 3

Svyatoshinsky 6 8

Solomensky 24 24

Shevchenkovskiy 3 3

TOTAL 84 86

According to the director of the RealExpo consulting company and the head of the www.zagorodna.com portal, Viktor Kovalenko, “2 new projects appeared on the cottage construction market in Kyiv during 9 months of 2022: 1 in Goloseevsky and 1 in Darnitsky districts. In the private sector above these areas, new projects have appeared on small plots from 10 to 20 acres. These are townhouses for 4-12 households. The adjacent plots to the townhouses are also small: from 0.7 to 2 acres. The area of households in new projects ranges from 85 to 194 sq.m. This is basically a comfort-class housing.

The first place in terms of the number of townships belongs to the Solomensky district – 24 townships.

The second place in terms of the number of towns is Goloseevsky district (19 towns).

The third place belongs to the Darnytsia region (15 towns).

Types of real estate in cottage townships in Kyiv

in 60 cottage villages the preferred type of real estate is townhouses against 50 in January. The proportion of townhouses is 69.76% of all townships. The leader is Solomensky district (23 projects);

in 2 towns – quadrexes against 2 in January. The proportion of quadrexes is 2.32% of all townships. There is one town with quadrexes each in the Solomensky and Goloseevsky districts;

in 8 towns – duplexes against 6 in January. The share of duplexes is 9.3% of all campuses. The leaders in duplexes are Goloseevsky and Darnitsky districts (2 towns each);

in 27 towns – cottages against 24 in January. The share of cottages is 31.39% of all campuses. The leader is the Darnitsky district (8 towns with cottages);

Types of real estate in cottage townships in Kyiv

(according to www.zagorodna.com ), January-September-2022

Type January September

Quadrex 2 2

Duplex 6 8

Cottage 24 27

Townhouse 50 60

Readiness in cottage townships in Kyiv

The leader in terms of readiness are built towns (65.11%), followed by towns under construction (25.58%) and projects account for 9.3%.

56 cottage villages built compared to 50 in January;

22 campuses under construction compared to 24 at the beginning of the year;

8 projected settlements against 10 in January;

Championship in built towns near the Solomensky district (17 towns).

Championship in towns under construction near Goloseevskogogor district (7 towns).

Goloseevo is ahead in terms of projects (4 campuses).

The degree of readiness in the cottage townships of Kyiv

(according to www.zagorodna.com ), January-September-2022

Status January September

Built 50 56

under construction 24 22

Project 10 8

“Frozen” cottage villages in Kyiv

Currently, construction has been halted in Kyiv at 9 sites: Karpatsky, Bolgarsky project, Townhouses on Trakhtemirovskaya, Nizhnie Sady, Villas on Grabovsky, Cottages on Osokorki, Townhouses on Metrological, Pushcha Residence”, trans. Pine 18-22.

This is 30% of the total number of cottage settlements under construction and projected.

Most of the frozen construction projects are located in the Goloseevsky district (4), 2 projects in the Darnitsky district and 1 construction site each in Desnyansky, Obolonsky and Solomensky districts.

Sold cottage settlements in Kyiv

In 40 cottage villages in Kyiv, construction has been completed and all households in the towns have been sold. This is 46.5% of the existing campuses.

What and where is being built in Kyiv? Cottages and townhouses in cottage towns in Kyiv have an area of 30 sq.m in townhouses “Bulgarian project” and reach 800 sq.m in villas in the “Italian quarter”; located on land plots ranging from 0.06 to 62 hectares and have adjacent plots from 0.1 to 50 acres, designed for 3-295 households.

They are built from gas blocks, bricks with insulation and connected communications.

Expert opinions

We asked developers how the demand in cottage towns has changed since the outbreak of hostilities and how prices have reacted to the war.

Vladimir, project manager of Sosnovy Bor duplexes, commented on the situation on the market of cottage townships in Kyiv:

“Compared to pre-war, the demand for duplexes in our project has fallen by 100%.

Buyers are waiting for the market to crash and prices to fall in order to invest profitably.

There is a lot of pent-up demand. People call and look at real estate. Until the end of the war, they postponed the purchase, but plan to return to this issue later. People are afraid to invest in houses during the war.

Since the beginning of hostilities, building materials have risen in price, and some of them, like glass, aerated concrete, metal of some brands, are in short supply.

Builders are also in short supply. Many went to the front.

In many projects, there will be a delay in the commissioning date of 3-5 months because of this.

The cost of construction in hryvnia increased, while in dollars it remained at the same level.

The cost we have before the war and is now declared in dollars at the exchange rate. The cost in dollars decreased by 10-15%.

The representative of the developer in the Happiness CG, Timofey, said: “in our project, demand fell by 90%. There’s just a lot of pent-up demand. The prices were denominated in dollars. Prices have decreased by 5-10%, but in each case, individual conditions are discussed.”

Sales manager of Montreux Townhouses Alexander reported that “demand in the project fell by 90%. Prices have dropped by 15%.

Andrey, a representative of the builder in OldStories townhouses, said: “In our project, demand fell by 60%. The prices were denominated in dollars. Prices have not changed.

Conclusions:

Demand in cottage townships in Kyiv, according to experts, has decreased by 60-100% since the beginning of the war, but it is gradually resuming.

It was military operations in Kyiv and its environs, “arrivals” that influenced and are still affecting the drop in demand for townhouses and cottages in Kyiv.

Growth or fall in demand depends on the distance from the center, readiness, type of real estate.

Buy and sell cottages and townhouses in Kyiv on the suburban real estate portal zagorodna.com

The capital’s museums that suffered from rocket fire are closed until approximately October 16, the liquidation of the consequences is underway, and fundraising for restoration work has been announced.

The Khanenko Museum, in particular, reported that the team was not injured, the collection has been safe since the beginning of Russia’s full-scale invasion of Ukraine.

“The work on assessing the damage is ongoing. You probably saw in numerous photos and videos from the scene that the windows of the museum were damaged. We have already blocked them and removed the broken glass. Thanks to the friends and volunteers of the museum for this!” on Facebook.

For those wishing to help financially, the accounts of the museum’s partners, the Mizhvukhami Fund charitable organization are published:

UA323052990000026001016208973 UAH/840

UA753052990000026001046225528 EUR/978

UA633052990000026006026228830 USD/840

In the appointment it is necessary to indicate “For the Khanenkiv Museum”.

The National Science and Natural Museum of the National Academy of Sciences of Ukraine reported that the windows of the courtyard of the museum in the exposition halls of the geological, paleontological and zoological departments were knocked out by the blast wave.

“We are forced to ask for help. We urgently need materials or funds to purchase materials for the prompt repair of broken windows,” the museum’s page says.

If you can help financially – charitable account of the National Science and Natural Museum:

UA 958201720313271001302009806

Code ЄDRPO19020229

Full name: National Science and Natural Museum of the National Academy of Sciences of Ukraine (abbreviated as NNPM NAS of Ukraine)

If there is an opportunity to help with materials – the phone number of the director for museum and scientific work Chervonenko Oksana Vladimirovna +380503113256.

The windows of the first and second floors were damaged at the Taras Shevchenko National Museum. According to the museum, the process of cleaning and assessing losses is underway. For those who want to help, the account is indicated:

UA 43 820172 0 3132 71001 30101 6007

EDRPOU 022 26 116

The building of the Kyiv Art Gallery (formerly the Museum of Russian Art) was left without a roof and windows due to the raid. Funds for the restoration are collected by the charitable foundation. Sholom Aleichem. Requisites:

EDRPOU code 41378964

p/r UA133052990000026009016711600 in JSC CB “PrivatBank”

Purpose of payment: “A charitable contribution to commemorate the National Museum “Kyiv Art Gallery” of the victim of a violent aggression, head of 10.10.2022.”

The rector of the Taras Shevchenko National University of Kyiv Volodymyr Bugrov called for support for the restoration of the damaged university buildings and published the details:

In Ukraine:

r/r UA188201720313271002301014095

bank code 820172

code ЄDRPOU 02070944

For assistance in foreign currency, accounts are opened in Oschadbank: https://bit.ly/3COMgC0

As reported, during a massive rocket attack on October 10, the buildings of the Taras Shevchenko National University of Kyiv (the Red Building and the building of the Institute of Philology), the Scientific Library named after M. Maksimovych, the Institute of Literature of the National Academy of Sciences of Ukraine, the Institute of Archeography of the National Academy of Sciences of Ukraine, the National Philharmonic, the House of the Central glad, which houses the Pedagogical Museum of Ukraine and the Museum of the Ukrainian Revolution of 1917-1921. Also, the National Museum of Arts named after B. and V. Khanenko, the National Museum of Taras Shevchenko, the Kyiv Art Gallery, the National Research and Restoration Center, the memorial museum-apartments of M. Bazhan and P. Tychyna, the National Science and Natural Museum of the National Academy of Sciences of Ukraine Ukraine, Museum of the history of the city of Kyiv.

https://www.facebook.com/khanenkomuseum/photos/a.10155621344004162/10161146499489162/

https://www.facebook.com/permalink.php?story_fbid=5550628474991631&id=100001335990722

https://www.facebook.com/photo/?fbid=8389957164378847&set=a.289508001090511

The Open4Business project is ready to process and post information about humanitarian requests from organizations in need of restoration free of charge.