Ministry of Education and Science has published an algorithm of actions for applicants with a foreign document on education.

“SE” Inforesurs “provides an algorithm of actions for applicants who received education abroad. If you apply on the basis of a foreign document of education, you can only apply in paper form directly to the university. For further education and obtaining a diploma, an applicant must go through the procedure for recognizing a foreign document in Ukraine,” the ministry’s press service said.

The Ministry of Education notes that for this it is necessary to apply to the ZVO after enrollment during the first month of study, and the institution must make a decision by the beginning of the second semester of the first year of study.

“If confirmed, a certificate of recognition of a foreign document of education is issued, information about which is entered in the Unified State Economic Educational Institution. Please note that such a certificate is valid only at the university that issued it,” the ministry said.

In addition, you can contact the State Enterprise “Information and Image Center” of the Ministry of Education, where, upon recognition of the document, a certificate is issued, information about which is entered in the Unified State Economic Education and Educational Institute, and which is accepted in all educational institutions, enterprises, institutions, organizations of any form of ownership.

“Certificates issued by both the university and the Ministry of Education and Science are valid only together with the original document and are valid indefinitely,” the ministry informs.

Among other things, the Ministry of Education reported that recognition procedures do not require documents on the education of citizens of the former USSR, issued before May 15, 1992, as well as documents issued on the basis of training before the start of the 1992/1993 academic year in educational institutions of the states of the former USSR.

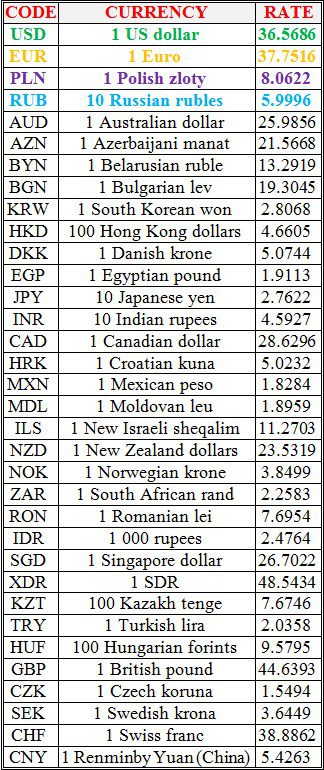

National bank of Ukraine’s official rates as of 12/08/22

Source: National Bank of Ukraine

The lowest corn harvest since 2007-2008 is expected in the countries of the European Union, which is caused by an abnormal drought that has gripped the main corn-producing countries in the past few weeks.

Against this background, the EU imports 13 million tons of corn from Ukraine to cover its needs, according to the website of the electronic grain exchange GrainTrade with reference to the report of the chief analyst of Argus Media (France) Nathan Cordier, which he announced during the meeting of grain traders “Trend and Hedge Club”.

According to him, Bulgaria, Romania and Hungary are the largest corn producers in the EU, and production performance in these countries will be disappointing in 2022.

“We expect Romania to harvest 8 million tons of corn, Hungary 4.5 million tons, and Bulgaria 15 million tons. These countries exported corn to Spain, Italy and Turkey, which were the main markets. low harvest in Brazil, exported grain to the Middle East and North Africa. This season, we expect that the supply of exports will be low,” GrainTrade quoted Cordier’s report as saying.

The expert noted that three heat waves have occurred in France since the beginning of corn sowing, so its harvest is expected at 11.2 million tons, and will be harvested from only 68% of the area. Thus, the yield of corn in France will be only 8 tons / ha, which is the worst result of the country in the last 20 years.

According to Cordier’s forecasts, Europe will be forced to import 23 million tons of corn to cover its needs, of which it will import 13 million tons from Ukraine, and another 5 million tons from Brazil.

As reported, the Minister of Agrarian Policy and Food Mykola Solsky in early August announced an increase in the forecast for the harvest of grain and oilseeds in Ukraine this season by approximately 5-7 million tons – up to 65-67 million tons from 60 million tons.

At the same time, in the July report, the US Department of Agriculture forecasts the harvest of Ukrainian wheat in the 2022/2023 marketing year (MY, July-June) at the level of 19.5 million tons, its export – 10 million tons, domestic consumption within the country – 10.2 million tons. The corn harvest is estimated at 25 million tons, export – 9 million tons, domestic consumption – 10.7 million tons.

In early July, the Ukrainian Grain Association (UGA) increased the forecast for the harvest of grain and oilseeds in Ukraine in 2022 by 4.4% compared to the May forecast – up to 69.4 million tons from 66.5 million tons.

According to her forecasts, in 2022, a wheat harvest is expected at the level of 20.8 million tons (+ 8.3% compared to the organization’s May forecast); 27.3 million tons of corn (+4.6%); 6.6 million tons of barley (forecast kept); 9 million tons of sunflower (forecast kept); 2.2 million tons of soybeans (+4.7%); 1.5 million tons of rapeseed (+13.3%).