Since the beginning of the full-scale invasion of Russia, about 537 thousand citizens of Ukraine have returned to their homeland, the State Border Service of the country reports.

“Over the past week, 144,000 people left Ukraine. 88,000 arrived in Ukraine. In general, since the beginning of open aggression from the Russian Federation, about 537,000 of our compatriots have returned to Ukraine,” the Ministry of Internal Affairs said in a telegram message with reference to State Border Service data.

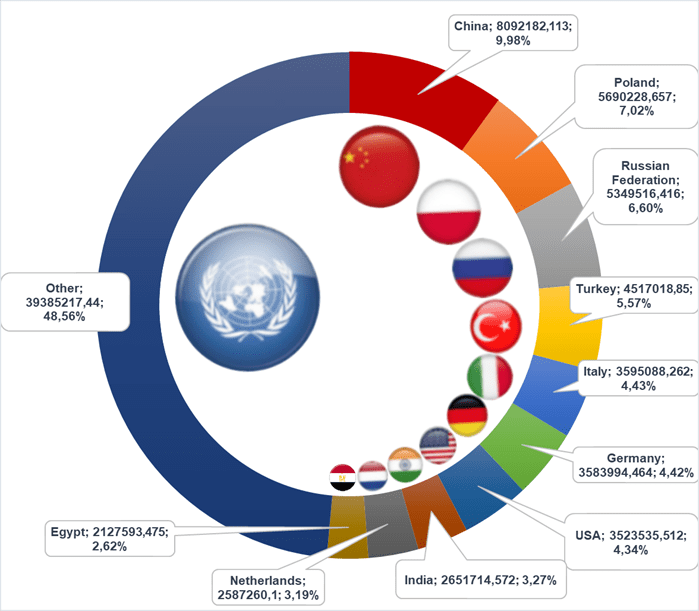

Main trade partners of Ukraine in % from total volume (export from Ukraine to other countries) in 2021

SSC of Ukraine

The humanitarian consequences of Russian aggression against Ukraine, as well as recommendations on spending on Ukraine in the EU budget, will be among the central topics of the plenary session of the European Parliament (EP), which will be held from April 4 to 7 in Strasbourg.

On Tuesday in Strasbourg, MEPs will discuss with the European Commission (EC) and the EU Council the possibilities of helping Ukrainian children fleeing military operations, in particular, protecting them from human trafficking and exploitation.

Following the launch on March 3 of a temporary protection mechanism for refugees from Ukraine, giving them the right to temporary EU residence, access to education and the labor market, the EC and the French Presidency of the Council of the EU are working on a 10-point plan that will “strengthen the common European response”. It will include the EU registration platform and the coordination of transport services for refugees, specific recommendations for the reception and support of children and adolescents from Ukraine. A corresponding resolution is expected to be adopted on Thursday.

According to UNICEF, almost half of Ukrainian refugees are minors who need enhanced protection as they are at greater risk of being trafficked and exploited.

The Ukrainian topic will also be in the parliamentary discussion on the priorities of the EU budget for 2023.

The MPs will call on the EU to “guarantee significant funding to address the geopolitical consequences of the current crisis, including support for humanitarian measures and ensuring preparedness for the reception of refugees in member states and in the countries of the Eastern Neighborhood.” On Tuesday, budget recommendations for 2023 will be put to a vote.

On Wednesday morning, the deputies will discuss the results of the March EU summit. The debate will be attended by European Council President Charles Michel and EC President Ursula von der Leyen, as well as High Representative for Foreign Affairs and Security Policy Josep Borrell.

At the March 24-25 summit, EU leaders had a wide-ranging discussion about the Russian war against Ukraine, international restrictions against Russia and the overall implications for the EU economy, with a focus on energy prices. US President Joe Biden attended the meeting in person, and Ukrainian President Volodymyr Zelensky remotely. A resolution will be adopted on the basis of the parliamentary debate on the results of the EU summit.

A separate debate on Tuesday evening will focus on the results of the EU-China Virtual Summit on Friday 1 April. It focused on the international consequences of Russian aggression in Ukraine and the position of China, as well as the future of bilateral relations between the EU and China, especially in the areas of trade and security.

On Tuesday, the session has time for questions and answers. The leaders of the European Council, the European Commission and the head of EU diplomacy will answer questions from European parliamentarians on a wide range of topics. Separately, the head of diplomacy Borrell will report. He will focus on the “Strategic Compass” – a project to strengthen the autonomy of the EU in the field of defense and security.

The agenda of the plenary session includes the traditional topics of the “green transition”, energy transformation, combating climate change, as well as human rights and the rule of law in Hungary and Poland and other issues.

On Wednesday, the EP will hold an urgent debate on human rights and on Thursday will adopt, respectively, three resolutions.

The German government calls for an investigation into the crimes of the Russian military and tougher sanctions against the Russian Federation, reports DW. “We must investigate these crimes of the Russian military with all severity,” said German Chancellor Olaf Scholz on Sunday, after the publication of evidence of war crimes committed by Russian invaders in the Kiev region. He noted that “criminals and those who gave them orders must be consistently held accountable.” Scholz also appealed to Moscow with a call to “finally agree to a ceasefire and stop hostilities.” At the same time, the German cabinet calls for tougher sanctions against the Russian Federation. “(…) We will tighten sanctions against Russia and support Ukraine even more strongly in its defense,” German Foreign Minister Annalena Berbock tweeted. The head of the Ministry of Economy and Vice-Chancellor of Germany, Robert Habek, also supports the tightening of sanctions against the Russian Federation. “This terrible war crime cannot go unanswered (the crimes of the Russian military in the Kiev region – IF),” he said in an interview with the German publication Bild. He also noted that “increased punitive measures against Russia are already under development” with partners in the EU.

Engineering and construction company Rauta has developed master plans for the construction of prefabricated camps for internally displaced persons, which provide for the construction of houses from sandwich panels.

“The concept of camps for migrants is based on the highest possible speed of construction, comfortable layouts and increased energy efficiency. The unification of production processes and ease of installation make it possible to ensure mass construction of camps in any region of Ukraine in a matter of months,” Andriy Ozeichuk, Director of Rauta, who was quoted by the press company service, said.

According to him, the master plans take into account various needs and funding opportunities. At the same time, houses made of sandwich panels can be effectively operated for several decades. Terms of implementation of small towns are 3-12 months, depending on building area.

In addition, if the need for settlements disappears over time, houses can be dismantled and moved to another location, as well as repurposed to perform new functions: recreation centers, administrative centers, outpatient clinics, small retail or office buildings, etc. Sandwich panels can also be efficiently disposed of.

Engineering and construction company Rauta is engaged in the design of buildings, supply, installation and maintenance of frames, sandwich panels, facades, prefabricated buildings, etc. The company acts as an exclusive supplier of products of the Finnish concern Ruuki to Ukraine.

German Chancellor Olaf Scholz promised that EU countries would impose new sanctions on Russia.

“In the coming days, we will take new measures,” he said on Sunday in Berlin.

According to him, the Russian president and those who support him will “feel the consequences” of these sanctions.