Spanish energy group Repsol, in collaboration with Enagas Renovable, has approved a project to build the first large-scale renewable hydrogen production plant in Cartagena (Murcia region, Spain).

According to Repsol’s press release, the electrolysis plant for producing hydrogen from oxygen and water will have a capacity of 100 MW, which will enable it to produce up to 15,000 tons of hydrogen and reduce carbon dioxide emissions by 167,000 tons annually.

The €300 million project has been designated a strategic project for the European Union (IPCEI) and has received support from the Spanish government. €155 million in funding will be provided through the Spanish Institute for Diversification and Energy Saving (IDAE).

According to Repsol, the implementation of the project in cooperation with Enagas Renovable, which owns 25% of the project’s shares, will create about 900 jobs. The facility is scheduled to be commissioned in 2029.

The company notes that renewable hydrogen production will be an important part of the Murcia Hydrogen Valley initiative and will enable the future integration of new capacity into the gas transmission network and the national hydrogen corridor.

Repsol is the largest hydrogen producer on the Iberian Peninsula, accounting for about 60% of national production and 4% of hydrogen consumption in Europe. Enagas Renovable operates as an independent energy producer specializing in renewable gases and decarbonization. The company’s portfolio in Spain includes around 20 projects in the hydrogen and biomethane sectors.

Search work in Odessa is completed, on more than 60 objects water pumped out, on about 30 more work continues, the victims of the disaster – 10, more than 380 people rescued, said the Minister of internal Affairs of Ukraine Igor Klymenko.

“In Odessa rescuers have completed search operations. Emergency recovery activities continue,” – wrote the Minister in the Telegram channel on Thursday.

He noted that the head of the state emergency service Andrey Danik is working on the site of liquidation of the consequences of the disaster.

“On more than 60 objects in the city specialists of the state emergency service have already fully pumped out water and prepared the infrastructure for further restoration. On about 30 – continue to work. The main thing that made sure: there are no more victims of the elements. There are 10 dead. More than 380 people have been rescued,” informed the head of the Interior Ministry.

According to him, all requests from the population have been processed.

Klimenko noted that the largest masses of water gathered in underground parking lots. “The elimination of waterlogging in these premises is the most difficult. Almost 130 motor pumps are at work, and also attracted attached forces from other regions. Only from the parking lots have already pumped out more than 15 thousand cubic meters of water,” – said the Minister.

As for shelters, according to Klimenko, out of 42 flooded in 40 have already pumped out water and prepared them for use. At 2 civil defense facilities, work is still ongoing.

“Professional training, availability of necessary equipment and experienced personnel were the key to such an effective result. Large areas of restoration work cleaned in such a short period of time – this is an eloquent indicator of the work of the State Emergency Service”, – summarized the head of the Ministry of Internal Affairs.

In addition, he said that throughout the night more than 50 rescuers worked in Slavutych, Kyiv region.

“Deployed 5 mobile points of indestructibility of the State emergency service, equipped with uninterrupted communication systems and devices for recharging gadgets. Prepared generators to support the work of the hospital and other social institutions”, – said the Minister.

American OpenAI, the developer of the chatbot GPT, has become the most expensive private company in the world after the completion of a deal on the secondary sale of shares to investors with an estimated value of $500 billion, CNBC writes. The opportunity to sell their shares was given to employees of the company, who owned them for more than two years. A total of $6.6 billion worth of securities were sold, while the authorization provided for the sale of up to $10.3 billion.

The buyer of the shares was a consortium of investors, including Thrive Capital, SoftBank, Dragoneer Investment Group, MGX and T. Rowe Price.

OpenAI was valued at $300 billion during the investment round completed in April of this year.

The current calculation of OpenAI’s value makes it the most expensive private company in the world. Previously, SpaceX, valued at $456 billion, was considered to be such.

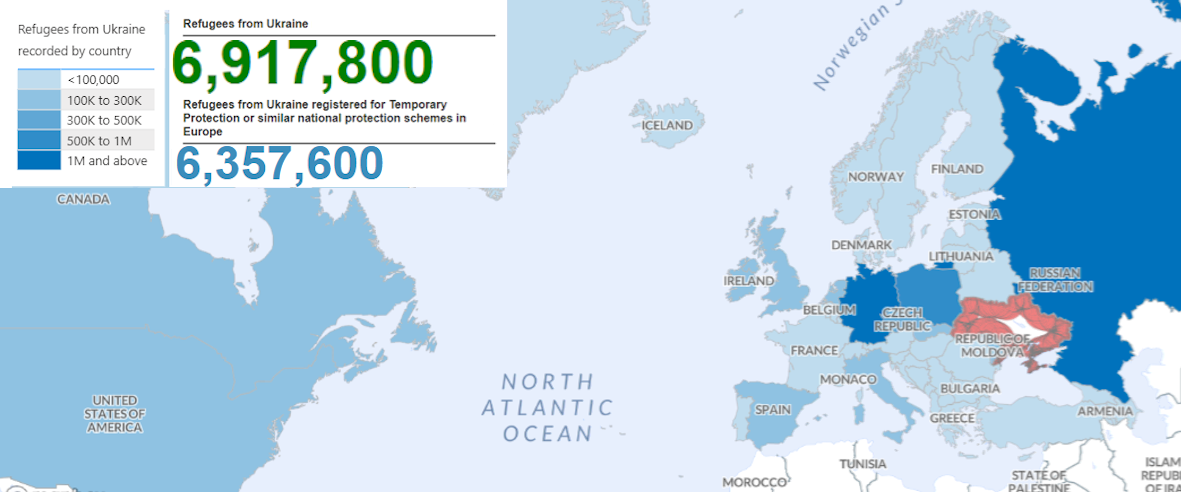

Number of refugees from Ukraine in selected countries as of 01.06.2025

Source: Open4Business.com.ua

The PRAVIO group of companies is investing in the construction and modernization of the recently acquired bankrupt cheese factory Gadyachsyru (Poltava region) to transform it into a modern export-oriented enterprise producing soft cheeses, sour milk cheese, and other products, said RAVIO founder and president Valentin Zaporoshchuk in a comment to BusinessCensor.

He noted that he acquired Gadyachsyir in February 2025.

“All of these products are in demand on the European market today. The plans include the construction of a plant with a processing capacity of up to 1,000 tons of milk per day, with an investment of EUR180 million. These will be funds raised from European banks. We have partners from Europe who are ready to join us in the project,” Zaporoshchuk said.

According to him, an audit is currently being conducted at the enterprise, which has been idle for almost five years. The company’s problems began in 2013–2014, when Gadyachsyir remained almost the only Ukrainian dairy plant that exported products to Russia and had no other stable partners. Later, the plant tried to participate in international exhibitions, but financial difficulties became inevitable.

Zaporoshchuk is convinced that the site and the region are promising for the development of a new enterprise.

“The Poltava region is one of the largest in terms of milk production and large farms. At its peak, the enterprise processed more than 2,000 tons of milk per day. And that’s not a bad volume. Of course, other enterprises have now taken over these volumes. But when we build a new enterprise with a strategic set of solutions on this site, it will be competitive, and milk producers will return to us,” added Zaporoshchuk.

The PRAVIO Group of Companies unites the Ichnia Milk Canning Plant, which specializes in milk processing and the production of canned dairy products, the Proviant Trading House, and has a raw materials division – the Mayak agricultural company, which specializes in crop production, and the Obmachivski Zirky company, which specializes in animal husbandry and crop production.

The group of companies owns the PRAVIO, MamaMilla, Milada, and Ichnia trademarks, whose products are exported to 40 countries worldwide and distributed in Ukraine through its trading house Proviant.