Ukrainian metallurgical enterprises in January-November this year increased production of general rolled products, according to recent data, by 5% compared to the same period last year, to 17.549 million tonnes.

According to the Ukrmetalurgprom association on Thursday, over 11 months, steel production also increased by 5%, to 19.639 million tonnes, and cast iron – by 4.6%, to 19.443 million tonnes.

In November, 1.563 million tonnes of rolled products, 1.736 million tonnes of steel, and 1.719 million tonnes of cast iron were produced, while in the previous month – 1.487 million tonnes of rolled products, 1.602 million tonnes of steel, and 1.564 million tons of cast iron.

The total amount of investments in new projects of industrial parks in Ukraine is UAH 884 million, Chairman of the Economic Affairs Parliamentary Committee Dmytro Natalukha has said.

“In less than three months, the creation of 24 industrial parks has started in Ukraine. Somewhere they are already being built, somewhere the documentation is being prepared, somewhere the city authorities have already allocated land, and somewhere the design is underway. In 13 regions of Ukraine. The total declared investment in these 24 projects is UAH 884 million. The area of these parks is 557 hectares,” he said during the third Forum of Industrial Parks held in Kyiv on Thursday.

According to him, up to 28,000 jobs can be created in these parks.

Natalukha noted that bills No. 5688 and No. 5689, establishing tax and customs incentives for participants of industrial parks, can be adopted at the first reading by the end of the year.

Currently, 52 industrial parks are already included in the register of industrial parks, management companies have been selected in 25 of them, but only eight have participants (15 participants in total).

Some 100 offline support centers are planned to be opened in Ukraine to provide assistance in receiving UAH 1,000 for vaccinations, head of the Servant of the People party Olena Shuliak said.

“The bill, which was adopted at the first reading on the allocation of UAH 3 billion this year for the so-called ‘UAH 1,000’ for vaccinated Ukrainians, now suggests that this amount will be increased to UAH 8 billion […]. In order to start a program to pay this UAH 1,000, some 100 offline support centers will operate, where assistance will be provided to citizens so that they could receive this UAH 1,000,” Shuliak told journalists on the sidelines of parliament on Thursday.

She also said that this UAH 1,000 is not taxed and does not affect the amount of the subsidy.

EU High Representative for Foreign Affairs and Security Policy Josep Borrell, during his talks with Ukrainian Foreign Minister Dmytro Kuleba, confirmed his intention to visit Ukraine in the near future, the Ministry of Foreign Affairs of Ukraine has said.

“Josep Borrell confirmed his intention to visit Ukraine in the near future at the invitation of Dmytro Kuleba, including a visit to Donbas,” the message posted on the website of the Ukrainian Foreign Ministry on Thursday says.

The minister informed the interlocutor in detail about the security situation in the temporarily occupied territories and along the state border of Ukraine, the threat of Russia’s preparation for a new wave of aggression against Ukraine.

Kuleba also called on the EU to accelerate work on the development of mechanisms for a comprehensive package of restraining the Russian Federation from further aggressive actions, including tough economic sanctions against Russia in the event of an expansion of aggression.

The Minister expressed gratitude to the EU for its long-term support of the sovereignty and territorial integrity of Ukraine, efforts to strengthen the stability of the Ukrainian economy and enhance the security of Ukraine.

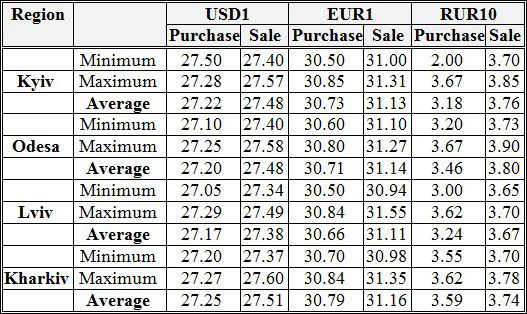

Ukrainian banks’ cash exchange rates on 02/12/21

Source: Interfax-Ukraine

The Cabinet of Ministers has introduced temporary restrictions on the entry into Ukraine of citizens of a number of South African countries to counter the spread of the Omicron coronavirus strain.

According to the decision adopted at a government meeting on Thursday, in particular, the entry into the country of citizens of South Africa, the Republic of Botswana, Zimbabwe, Namibia, the Kingdom of Lesotho, the Kingdom of Eswatini, the Republic of Mozambique, and the Republic of Malawi is limited.

In addition, citizens of Ukraine and other countries who have been in these countries for at least seven days in the last 14 days must go through mandatory self-isolation. The resolution comes into force from 24:00 on December 3.